Downstream Operating Rate Increase Expected to Ease Fundamental Pressure, Polyethylene May Rise Slightly in August

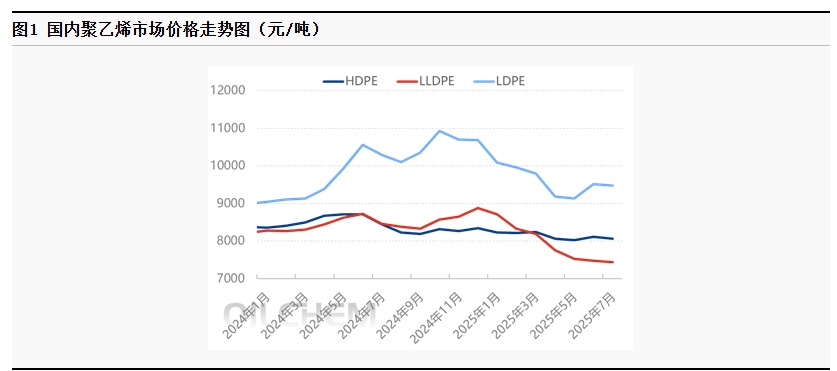

[Introduction]: 7 Under the dual constraints of monthly supply and demand contradictions, and with some relief in market pressure from the macro side, polyethylene prices experienced a slight decline. The average monthly price of mainstream LLDPE film in North China was 7,205 yuan/ton, down 0.22% month-on-month.In August, the polyethylene market is expected to see a slight price increase as the fundamental pressure eases amid improved downstream operating rate expectations.

One, The supply side continues to exert pressure and downstream operation rates are declining, leading to a narrow downward trend in polyethylene prices.

7 Domestic polyethylene prices fell in the month.

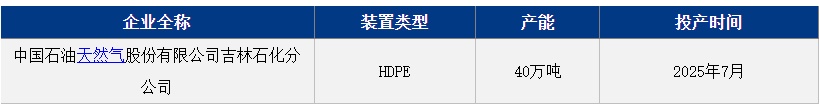

In July, with the commissioning of Jilin Petrochemical's new 400,000-ton/year plant, polyethylene production capacity reached 39.14 million tons. In terms of output, it increased by 4.48% month-on-month to 2.7264 million tons in July. The inventory of social sample warehouses rose by 10.77% to 561,700 tons, exerting pressure on the polyethylene market from the upstream supply side.

On the downstream side, by the end of July, the overall average operating rate of downstream PE industries dropped to 38.3%, down 0.4% from the previous month and 2.76 percentage points year-on-year, setting a record low for the same period in history.

However, on the macro level, the new round of policies for eliminating outdated production capacity released in mid-month offset part of the impact from fundamentals. Overall, under the dual constraints of supply and demand contradictions in July, and with some alleviation of market pressure from the macro side, polyethylene prices declined within a narrow range. By the end of the month, the average monthly price of mainstream LLDPE film in North China was 7,205 yuan/ton, down 0.22% month-on-month.

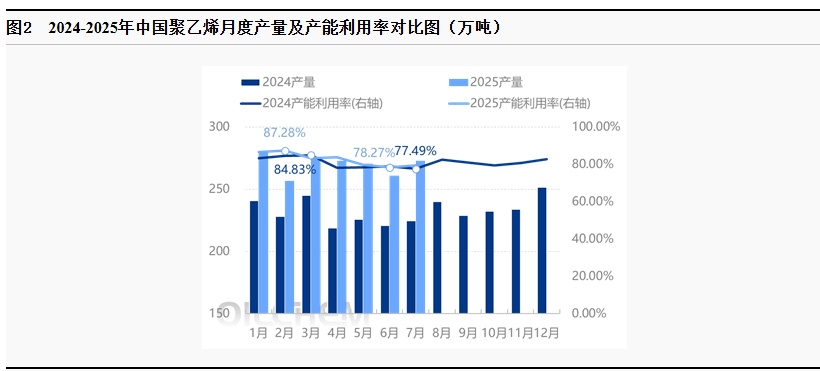

2. Newly commissioned enterprises within the month led to a 4.48% month-on-month increase in output.

In July, the domestic maintenance loss volume increased, with the loss volume month-on-month at -2.03% to 506,700 tons. Among them, the maintenance volume of low-voltage varieties decreased by 5.6% month-on-month, the maintenance volume of high-voltage varieties decreased by 1.84% month-on-month, and the maintenance volume of linear varieties increased by 5.04% month-on-month. The maintenance impact volume of low-voltage was 278,000 tons; the maintenance impact volume of high-voltage was 74,500 tons; and the maintenance impact volume of linear types was 154,200 tons.

7 Monthly New Polyethylene Production Units

In July, domestic polyethylene production reached 2.7264 million tons, a month-on-month increase of 4.48%. The capacity utilization rate rose by 1.16 percentage points month-on-month to 79.43%.

3.The operating rate downstream fell to 38.3% on a week-on-week basis.

In July, the operating rate of domestic downstream polyethylene was 38.3%, a month-on-month decrease of 0.4%.

In July, the overall operating rate of agricultural film increased by 0.1% month-on-month. The agricultural film industry continued to exhibit typical off-season characteristics in July, with overall performance remaining sluggish. Although the demand for greenhouse films slowly started to pick up, the increase in orders was less than that of the same period in previous years. Only a few large-scale enterprises saw a slight rise in operating rates, while small and medium-sized enterprises mainly engaged in intermittent production. The traditional off-season for mulch films saw most enterprises choosing to halt production for maintenance, except for a few that maintained sporadic order-based production.

Overall, the current agricultural film market exhibits clear seasonal characteristics. In July, the operating rate of agricultural film saw only a slight increase compared to June, and the market's recovery still awaits a seasonal demand turning point. The average operating rate of PE packaging film in July decreased by 0.23% month-on-month. This month's operating level mainly experienced slight and temporary fluctuations. Affected by demand, most companies supplemented with short-term orders, concentrating production on already received orders, with limited new orders coming in. 。

Section Four Translate the above content into English and output the translated result directly without any explanation.Polyethylene prices are expected to rise slightly in August.

Domestic PE market prices in August are expected to rise within a narrow range.

The polyethylene capacity utilization rate in August is expected to decrease by 0.79% to 78.64%. Despite the ramp-up of newly commissioned enterprises, output is only expected to increase slightly by 0.03% to 2.7271 million tons, showing little change compared to July. Exports are expected to decrease by 4.4% to 87,000 tons, while the total domestic market supply is projected to increase by 0.34% compared to July.

In terms of demand, it is expected that the overall average operating rate of downstream industries will increase by 2% to 40.3% in August. For agricultural films, the mid-to-late period will enter the "Golden September and Silver October" stocking season. This year, coupled with macro policy stimulus, the timing and strength of demand initiation are particularly crucial. The operating rate of agricultural films is expected to increase by 5.5%, while packaging films are expected to rise by 2.5%.

Overall, with the expectation of improved downstream operating rates in August, the fundamental pressures on the polyethylene market are expected to ease, and prices may rise within a narrow range. It is estimated that the average price of LLDPE in the North China market will be around 7,290 yuan/ton in August, 7,450 yuan/ton in September, and 7,520 yuan/ton in October. 。

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track