Down 79%! After Shutting Down 5 Factories, the Giant Delays Again

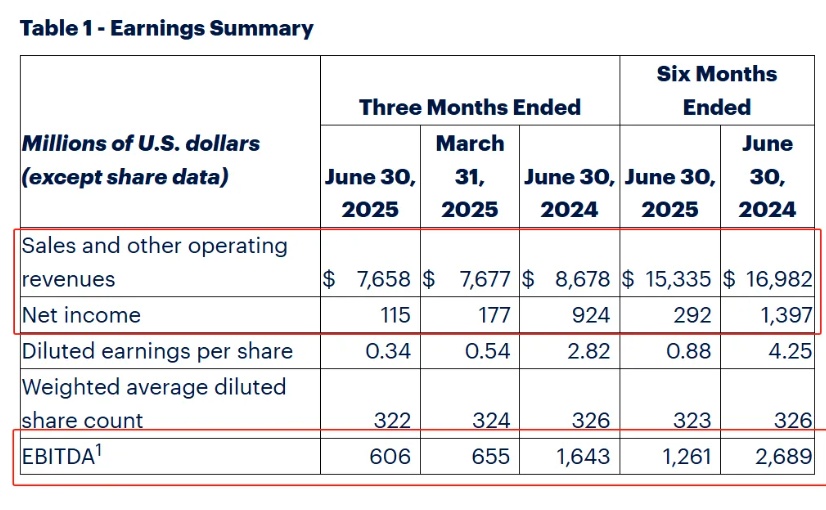

On August 1st, LyondellBasell (LYB) released its performance report for the first half and the second quarter of 2025. In the first half of 2025, the company achieved revenue of $15.335 billion, a year-on-year decrease of 9.7%; net income was $292 million, down 79.1% year-on-year; and EBITDA was $1.261 billion, down 53.1% year-on-year.

In the second quarter, revenue was $7.658 billion, a slight decrease year-on-year; net income was $115 million, down 35% year-on-year; EBITDA was $606 million, down 7.5% year-on-year.

Continue to implement the three-pillar strategy.

LYB stated that it will continue to implement its three-pillar strategy, taking decisive actions to reshape its asset base and enhance long-term value creation.

The plan to sell four European assets (olefins and polyolefins assets and related businesses) was announced on June 5th this year, with an agreement reached with AEQUITA and exclusive negotiations underway. The transaction is expected to be completed in the first half of 2026. In 2024, LYB had announced a strategic review of certain European assets, focusing on five plants in the O&P-EAI division located in France, Germany, the United Kingdom, Spain, and Italy, which account for about 30% of the division's capacity. The current sale includes four of these plants: located in Berre, France; Münchsmünster, Germany; Carrington, United Kingdom; and Tarragona, Spain.

Postpone the construction of the Flex-2 dedicated propylene project in Channelview, Texas: The project was approved in March this year and was originally scheduled to start construction in the third quarter of 2025 and be commissioned at the end of 2028. The facility will have an annual propylene production capacity of approximately 400,000 tons, employ 750 workers at the peak of construction, and is expected to add 25 permanent positions.

The final investment decision for its second pyrolysis-based advanced recycling project, MoReTec-2, has been postponed: The FID for MoReTec-2 is postponed to align with market developments and prudent capital allocation, and front-end engineering and design will be completed by the end of the year. The project will continue to advance based on market conditions and brand owners' commitments. Its MoReTec-1 project is progressing smoothly.

Expand the cash improvement plan: The plan is expected to achieve an incremental run rate of $600 million in 2025 and an additional incremental target of $500 million in 2026, totaling at least $1.1 billion in cash improvements to safeguard the balance sheet and support shareholder returns.

It is worth mentioning that in March of this year, it permanently closed the propylene oxide/styrene monomer production facility at the Maasvlakte plant in the Netherlands, a joint venture with Covestro. In February, it ceased operations at the Houston refinery.

For the future, LYB stated that it expects the integrated North American polyethylene profit margins to improve in the third quarter due to the completion of planned maintenance in April, strong domestic demand, increased export volumes, and rising prices. In Europe, stable seasonal demand and favorable feedstock costs are expected to continue. Ongoing capacity rationalization adjustments in the region will help balance regional supply and demand. Oxygenate fuel margins are expected to remain low for the remainder of the summer. LYB will continue to cautiously assess potential risks and opportunities related to tariff changes and global trade flows.

Peter Vanacker, CEO of LYB, stated: "We are encouraged by the recent improvement in polyolefin prices and demand. We remain cautiously optimistic about policy developments addressing China's overcapacity and revitalizing the European chemical industry. LYB is well-prepared to seize these market opportunities and create enduring long-term value for shareholders through the continued execution of our strategy."

Explanation of the Business Situation in the Second Quarter

For the second quarter performance, LYB stated that in North America, the company successfully completed the maintenance of the Channelview integrated plant, increasing the operating load of the facility, which led to an improvement in the sales and profit of the polyethylene integrated business compared to the previous quarter. Domestic demand for polyethylene and polypropylene strengthened due to seasonal factors, primarily driven by robust demand from industries such as consumer packaging, healthcare, construction, and infrastructure. The rise in polyethylene contract prices in June provided momentum for third-quarter earnings.

In Europe, the decline in raw material costs has driven an improvement in integrated polyethylene profits, and polyolefin sales have also benefited from seasonal demand increases.

In terms of intermediate chemicals, the profit of styrene has increased, mainly due to the decrease in the cost of benzene raw materials and price support brought by industry shutdowns in the second quarter. The profit of the oxygenated fuel business declined as lower crude oil prices suppressed the seasonal benefits usually brought by the peak travel season in summer.

During the second quarter, global markets began to adapt to trade fluctuations, and the operating environment for multiple product chains tended to stabilize.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track