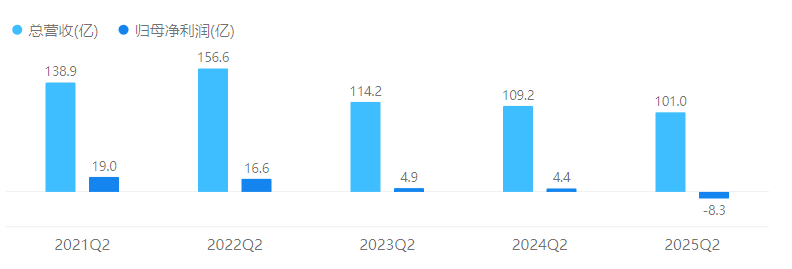

Dow Chemical Posts a Loss of 7.8 Billion Yuan

According to DT New Materials, on July 24, Dow Chemical released its second-quarter performance data, showing a decline in all departments' performance and an expanded loss. This follows BASF, the world's number one company, announcing an 81% drop in its second-quarter net profit, marking another (world's third) giant demonstrating market chill and helplessness.

Overall, looking at the data:

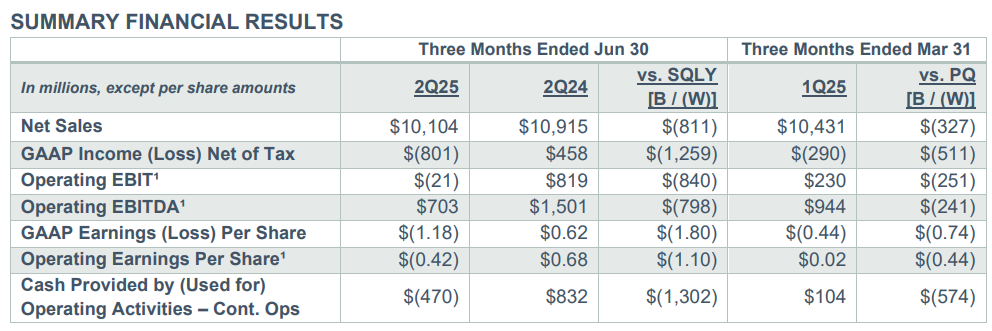

Net sales: 10.1 billion USD, down 7% year-on-year, with declines across all operating segments. Down 3% quarter-on-quarter (1Q25 was 10.4 billion USD).

(2) Sales: decreased by 1% year-on-year and 2% month-on-month. Although there was growth in the United States and Canada, it was offset by declines in Europe, the Middle East, Africa, and India.

(3) Price: A year-on-year decrease of 7% and a month-on-month decrease of 3%, mainly due to the pressure on global chemical product prices.

(4) GAAP net profit: a loss of $801 million. In the first quarter of 2025, this figure was -$290 million, meaning the company's total loss for the first half of the year reached $1.091 billion, approximately 7.8 billion RMB!

(5) Operating EBIT: a loss of USD 21 million, a year-on-year decrease of USD 840 million, mainly due to price declines and reduced equity earnings. A quarter-on-quarter decrease of USD 251 million, although supported by favorable currency exchange rates and company cost-cutting plans, was offset by declines in the packaging and specialty plastics segments.

(6) Cash flow from operating activities: -$470 million, a year-on-year decrease of $1.3 billion, and a quarter-on-quarter decrease of $574 million, primarily due to compressed profit margins.

Dow recently won a lawsuit against Nova Chemicals and will receive an additional CAD 1.62 billion (approximately RMB 8.5274 billion) in compensation, which is expected to be paid in the fourth quarter of 2025. This will significantly improve the company's overall financial data for this year.

By department

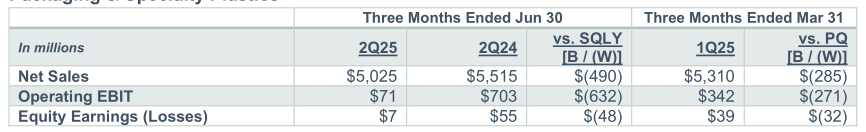

Packaging and Specialty Plastics Department

(1) Net sales: $5 billion, down 9% year-on-year, mainly due to a decline in polymer prices and reduced ethylene sales, as a result of the commissioning of Poly-7, which will bring the ethylene supply and demand in the US Gulf Coast into balance.

(2) Operating EBIT: USD 71 million, a year-on-year decrease of 89%, and a quarter-on-quarter decrease of USD 271 million.

In the two major segments, net sales of the packaging and specialty plastics business decreased year-on-year, mainly driven by a decline in downstream polymer prices, the divestiture of the lamination adhesive business, and a decrease in demand for infrastructure applications. Net sales of the hydrocarbons and energy business decreased year-on-year, primarily due to a decline in aromatics prices, partially offset by an increase in energy sales.

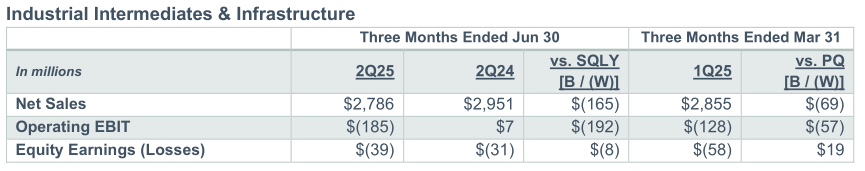

Industrial Intermediates and Infrastructure Sector

Net sales: $2.8 billion, down 6% year-on-year and 2% quarter-on-quarter, mainly due to a decrease in both price and volume.

(2) Sales volume: Decreased by 2% year-on-year, mainly due to a decline in sales of polyurethanes and construction chemicals, partially offset by growth in sales of industrial solutions.

(3) Operating Earnings Before Interest and Taxes (Op. EBIT): Loss of $185 million (compared to a profit in the previous year).

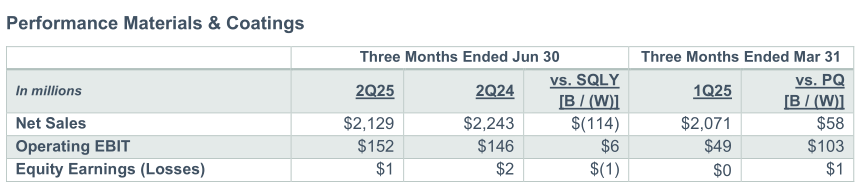

High Performance Materials and Coatings Department

(1) Net sales: $2.1 billion, down 5% year-over-year. Sequential growth of 3%, primarily driven by seasonal demand increase in architectural coatings and growth in downstream silicone sales, with both businesses achieving growth.

(2) Sales: down 3% year-on-year.

(3) Operating EBIT: increased by USD 6 million year-over-year and USD 103 million quarter-over-quarter.

From the perspective of the two major segments: the net sales of the consumer solutions business declined year-on-year, as the increase in downstream silicone sales was offset by price declines and a decrease in upstream siloxane sales. The quarter-on-quarter growth was driven by increased downstream silicone demand, mainly from transportation, personal care, and industrial applications. The net sales of the coatings and performance monomers business decreased year-on-year, primarily due to the continued pressure on the real estate market and the resulting decline in coatings demand. Quarter-on-quarter growth was driven by the seasonal increase in demand for architectural coatings, partially offset by a decline in acrylic monomer sales.

Looking ahead, Dow Chemical stated that the commissioning of recent growth projects (all of which will be put into operation in the third quarter), together with long-term strategic investments, will enhance Dow’s position in higher-value applications and attractive end markets. In addition, structural improvements to the cost base, optimization of the global asset footprint, and a track record of operational excellence will strengthen its competitive advantage.

Recently, Dow Chemical announced the closure of three upstream assets in Europe as part of its asset optimization efforts. These include the ethylene cracker in Böhlen, Germany, the chlor-alkali and vinyl (CAV) assets in Schkopau, Germany, and the basic silicones plant in Barry, UK. Additionally, in June, Dow announced the sale of its 50% stake in the joint venture DowAksa, a global leader in industrial-grade carbon fiber manufacturing, to its joint venture partner, Turkey's Aksa.

This move is a continuation of more than 20 “asset actions” initiated by Dow since 2023. Previously, Dow had closed the polyether polyols plant in San Lorenzo, Argentina, the alkoxylation plant in the Nangang Industrial Zone, Taiwan, and sold non-core assets such as its flexible packaging adhesives business.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track