Double star new materials releases q3 report, bopet leader accelerates breakthrough in high-end materials, can general manager wu di turn losses into profits?

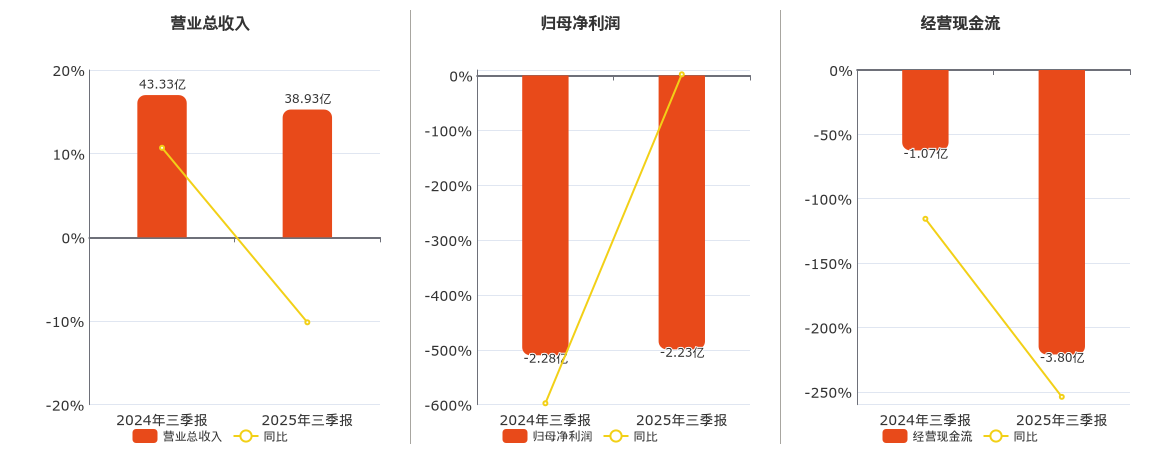

On October 26, 2025, China's leading polyester film company Shuangxing New Materials (stock code: 002585.SZ) officially released its third-quarter financial report. The report shows that the company's revenue for the first three quarters was 3.893 billion yuan, a year-on-year decrease of 10.16%; the net profit attributable to shareholders was -223 million yuan. Although still in a loss-making state, the loss narrowed slightly compared to the same period last year (a year-on-year increase of 2.11%). On a quarterly basis, third-quarter revenue was 1.267 billion yuan, a year-on-year decrease of 15.92% but a quarter-on-quarter increase of 1.81%; the net profit attributable to shareholders was -73 million yuan, a year-on-year decline of 19.03% but a quarter-on-quarter improvement of 31.18%.

Source: Shuangxing New Materials

Overall, from a financial performance perspective, Shuangxing New Materials still faces challenges such as a shrinking revenue scale and negative net profit. However, there are some positive signals: the gross profit margin slightly improved to 0.34%, and the asset-liability ratio decreased from 33.24% at the end of 2024 to 31.08%, indicating some signs of financial structure optimization. Nevertheless, the net cash flow from operating activities was -380 million yuan, a significant decline of 253.9% year-on-year, reflecting ongoing cash flow pressure.

Image source: Youlianyun

1. Industry Environment and Company Financial Performance

Shuangxing New Material mainly focuses on the research and manufacturing of high-performance functional polymer materials. The company's new material business primarily includes "five major sectors": optical materials, new energy materials, energy-saving materials, information materials, and heat-shrinkable materials. It successfully went public in June 2011.

From the financial data, from 2011 to 2016, the company's performance was mediocre, with revenue basically in the 2 billion range and net profit fluctuating around 100 million yuan. Starting in 2017, revenue began to increase significantly, reaching a peak in 2021 with a revenue of 5.931 billion yuan and a net profit attributable to shareholders of 1.385 billion yuan.

In 2023, the company began to incur losses, achieving an operating revenue of approximately 5.289 billion yuan, a year-on-year decrease of 12.74%; the net profit attributable to shareholders was a loss of 168 million yuan. In 2024, Shuangxing New Materials achieved a revenue of 5.908 billion yuan, a year-on-year increase of 11.7%, while the net profit attributable to shareholders was a loss of 398 million yuan, indicating an intensified loss.

Since 2025, the BOPET (Biaxially Oriented Polyethylene Terephthalate) industry has been under pressure. Constrained by sluggish recovery in downstream demand, continuous capacity expansion in the industry, and fluctuations in raw material costs, the price of general-purpose films has shown a volatile downward trend, continuously squeezing the profit margins of companies. According to industry data, by 2024, domestic BOPET capacity had increased to approximately 6.47 million tons, while the operating rate was only about 63%, and the supply-demand imbalance has not been fundamentally alleviated.

In this context, the revenue decline of Double Star New Material is generally consistent with the overall industry trend. However, its third-quarter revenue and net profit both achieved positive growth compared to the previous quarter, particularly with the loss narrowing by over 30% compared to the second quarter, indicating initial signs of stabilization for the company in a counter-cyclical environment. This is partly attributed to the company's strict control over costs and expenses, and partly related to the increase in the proportion of high-end products.

II. Product Structure and Corporate Strategy: Focusing on High-End and Functional Transformation

Shuangxing New Materials was established in 1997 and has long been focused on the research and manufacturing of high-performance functional polymer materials. Its main business covers five major sectors: optical materials, new energy materials, variable information materials, energy-saving window film materials, and heat shrinkable materials. The products are widely used in strategic emerging industries such as AI terminals, new energy vehicles, photovoltaics, and consumer electronics.

Source: Shuangxing New Materials

As one of the few domestic enterprises with full industry chain capabilities from "substrate to film," Shuangxing New Materials has continuously driven its product structure towards high-end and functional adjustments in recent years. Particularly in the field of MLCC (Multi-layer Ceramic Capacitor) release films, the company has become an important force in domestic import substitution.

In the first half of 2025, the sales volume of MLCC release film increased by 118.6% year-on-year, and sales revenue grew by 144.4%. Currently, the company's general-grade release films have been stably supplied to domestic customers such as Micro Container Technology and Sanhuan Group, and have entered the validation or mass supply stages with leading international manufacturers like Murata, Samsung, and Taiyo Yuden. High-smoothness release films have successfully broken the monopoly of Japan and South Korea, achieving mass substitution, and the ultra-high smoothness release films are also being actively promoted.

In addition, the company has made breakthroughs in emerging fields such as carrier copper foil, with its products gaining customer recognition and about to sign a second purchase contract, demonstrating its technical responsiveness in niche markets.

In terms of research and development investment, the company's R&D expenses amounted to 160 million yuan in the first three quarters of 2025, accounting for 4.12% of its revenue. Currently, Shuangxing New Materials has mastered the complete set of process technologies ranging from raw material development, extrusion stretching to magnetron sputtering and electro-ceramic optical carving molds, and has established a research and development system and patent layout, continuously focusing on technological breakthroughs in high-end film materials. As of the first half of 2025, the company has obtained 15 new authorized patents, covering multiple high-tech fields such as optics, new energy, and consumer electronics, and has been selected in the "Top 100 Chinese Light Industry Technology" list.

3. Future Outlook: Challenges Persist, but the Path to High-End Breakthroughs is Clear

Despite the difficulty in quickly resolving the industry's supply-demand imbalance in the short term and the persistent pressure of price competition, the long-term development logic of Shuangxing New Materials remains unchanged.

Firstly, the company's strategic positioning in the high-end materials sector has entered a harvest period. Products such as MLCC release films, high-barrier films, and optical base films are gradually increasing in volume, which will help improve the overall gross profit margin. With the commissioning of new coating equipment and the advancement of international customer certification, high-end products are expected to become the core driving force for performance rebound.

Secondly, the company continues to invest in green transformation and intelligent manufacturing. In July 2025, the company will invest 150 million yuan to launch a digital and green transformation project for the functional polyester film production line. Upon completion, it is expected to add a production capacity of 6,000 tons per year and achieve a 100% green manufacturing process. Combined with the construction of a 5G information-based factory and a distributed photovoltaic full coverage project, the company is expected to further optimize production costs and improve operational efficiency.

Thirdly, the management has completed the transition between the old and new, and the governance structure tends to be stable. On the evening of June 5, Best Star New Material announced that the company had completed the re-election of the board of directors, the board of supervisors, and the management. The actual controller of the company, Wu Peifu, stepped down from the position of general manager, and his son Wu Di officially took over as general manager. Prior to this, Wu Di had accumulated 14 years of experience working as a secretary to the board of a listed company, familiar with capital operations and corporate governance. The market anticipates that the new generation of management will further enhance the company's refined operational capabilities based on strategic continuity.

But also need to pay attentionThe company still faces issues such as cash flow pressure and a 82.89% increase in short-term debt, requiring enhanced cash turnover management. Moreover, if the industry's price war continues, it may hinder the pace of profit recovery.

Shuangxing New Material is currently in a critical phase of transformation. Although the financial report data still appears weak, its technological accumulation in the high-end materials field, breakthroughs with clients, and full industry chain coordination capabilities form an important foundation for medium to long-term recovery.

With the gradual clearing of industry capacity and the continuous release of demand in emerging fields, the company is expected to regain its advantage in the next round of industry recovery through product structure upgrades and management optimization.

Edited by: Lily

Source materials: Public reports from Zhoukou Net, Tongbi Finance, Radar Finance, You Lianyun, Duchaung, and Caizhong Society.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track