Did 18 Listed Automakers Achieve the 60-Day Payment Term?

With NIO recently releasing its financial report, the semi-annual reports of major domestic listed automakers have all been disclosed.

Looking back at the first half of the year, "anti-involution" became one of the key phrases in the automotive industry. Relevant departments, industry associations, car companies, and dealers have all voiced their support for "anti-involution." Among them, the most notable was the joint commitment by 17 car companies to shorten the payment terms for suppliers to within 60 days, providing "blood transfusions" to ease the difficulties faced by component manufacturers.

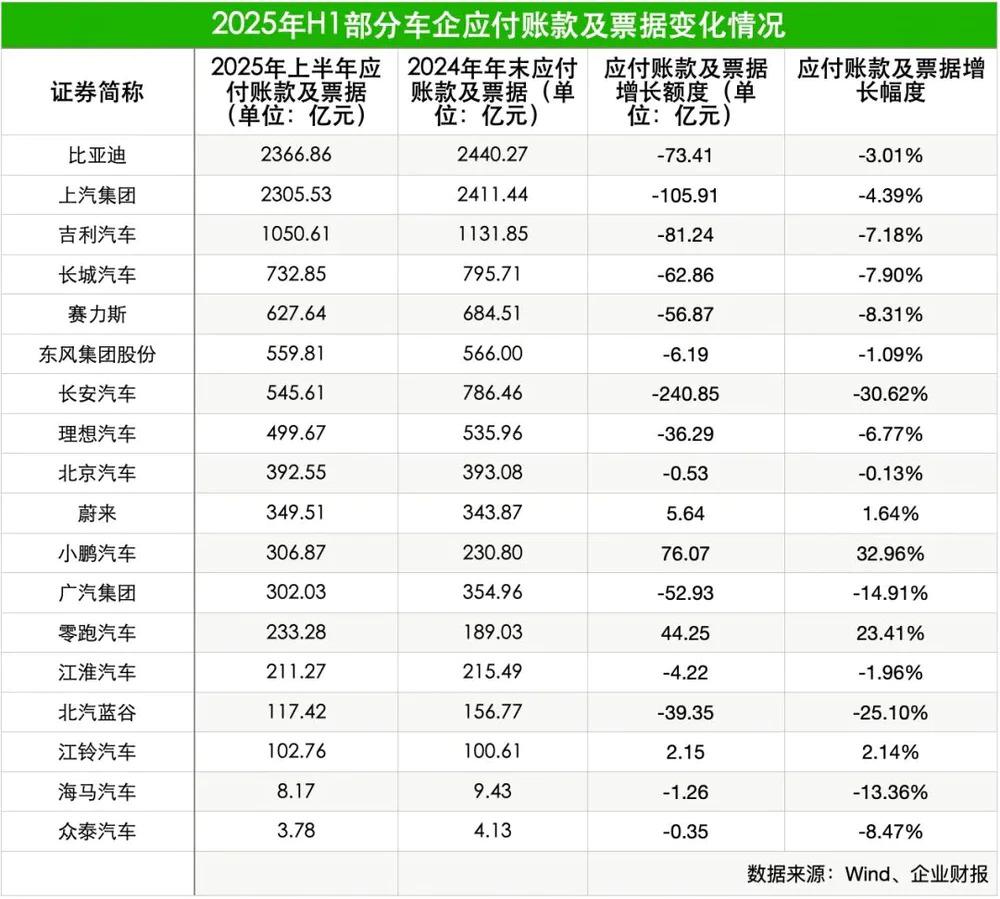

As the mid-year reports conclude, it is the perfect time to assess the effectiveness of commitments. After reviewing the semi-annual reports of 18 listed car companies, a reporter from "Daily Economic News" found that by the end of the first half of the year,The total accounts payable and notes payable amounted to 1,020.903 billion yuan, a decrease of 62.934 billion yuan compared to the end of last year; however, the average turnover days increased to 192.46 days, an increase of 6.17 days compared to the end of last year.The divergence manifests as a decline in total amount and an extension of the payment period.

At the individual company level, BYD, SAIC Motor, and Geely Automobile ranked as the "top three in accounts payable," with accounts payable and notes for the first half of the year reaching 236.686 billion yuan, 230.553 billion yuan, and 105.061 billion yuan, respectively—all surpassing the 100-billion-yuan mark. In terms of corresponding turnover days, Zotye Auto, Seres, and Haima Automobile ranked as the "top three with the longest payment periods."

Accounts payable decreased for most, and turnover days increased for most.

In the first half of this year, the accounts payable and notes payable scale of 14 car companies decreased compared to the end of last year. Among them, Changan Automobile, SAIC Motor, and Geely Automobile saw the largest reductions, with decreases of 24.085 billion yuan, 10.591 billion yuan, and 8.124 billion yuan, respectively. In terms of the decline rate, Changan Automobile, BAIC BluePark, and GAC Group lead this indicator.

Compiled by: Sun Lei, National Business Daily Reporter

In contrast,The accounts payable and notes payable of NIO, XPeng Motors, Leapmotor, and Jiangling Motors at the end of the first half of the year have increased compared to the end of last year.In the past six months, XPeng Motors increased by 7.607 billion yuan, a growth of 32.96%; Leapmotor increased by 4.425 billion yuan, a growth of 23.41%.

Some analysts have noted that, as sales increase, these two companies have correspondingly expanded their procurement scale in the upstream supply chain, resulting in a corresponding rise in accounts payable and notes payable. Meanwhile, with the growth in delivery volumes, XPeng Motors and Leapmotor have strengthened their bargaining power within the supply chain, allowing them to more effectively leverage suppliers’ financial support, thereby increasing the scale of accounts payable and notes payable.

Unlike accounts payable and notes payable, from the corresponding...Turnover DaysIn the first half of this year, only six companies showed improvement compared to the end of last year, namelySAIC Motor, Changan Automobile, XPeng Motors, BAIC BluePark, Haima Automobile, and Zotye AutomobileThe accounts payable and notes turnover days for XPeng Motors is 170 days, which is approximately 63 days shorter than at the end of last year, making it the automaker with the largest reduction in payment period.

Table: Every Economic Daily Reporter Sun Lei

On July 12, He Xiaopeng, Chairman of XPeng Motors, stated in a post: "After nearly a month of repeated internal discussions, XPeng has formulated steps for adjusting and implementing payment terms, and has begun to push forward." According to sources, some XPeng Motors suppliers received emails in July of this year mentioning that "based on long-term cooperation considerations, the signing of relevant supplementary agreements has been initiated—the payment period will be shortened to within 60 days."

In contrast, the accounts payable and notes turnover days of 11 other companies are still increasing. Among them, Seres' accounts payable and notes turnover days for the first half of this year were 266.3 days, an increase of more than 100 days compared to the end of last year; BYD increased by nearly 15 days to around 142 days, Li Auto increased by about 43 days to 208 days, and JAC Motors increased by more than 27 days to nearly 218 days.

From the above accounts payable and notes and the corresponding turnover days, it can be seen that there is an overall trend of decreasing accounts payable and notes, but an increase in corresponding turnover days. In this regard, some analysts believe that in the first half of the year, car companies generally accelerated their payments and had abundant cash, leading to proactive early payments. However, due to...The "60-day payment term commitment" starts from June 10th to 11th, while the deadline for the semi-annual report is at the end of June, and the changes in the payment terms for car manufacturers have not yet been clearly reflected.

It is worth noting that although the overall accounts payable and notes turnover days have not changed much,However, some companies have already stated in their financial reports that they will take corresponding measures.For example, BYD mentioned in its financial report that in the first half of the year, it further optimized account period management and channel management, and the turnover days for accounts payable and notes payable were at a relatively low level in the automotive industry.

Some companies' cash reserves are insufficient to cover accounts payable and notes payable.

In fact, apart from the statements made by companies in their financial reports,By analyzing changes in corporate cash flow, it is possible to see that automotive companies have begun taking actions to optimize their payment terms.For example, Li Auto's net cash used in operating activities for the second quarter was 3 billion yuan, a significant increase from 430 million yuan in the same period last year. However, its free cash flow was -3.8 billion yuan, which "deteriorated" by more than double year-on-year and further expanded from -2.5 billion yuan in the first quarter.

Li Auto explained that the above change is mainly the company's response to the regulatory requirement of a "60-day payment term," shortening the payment cycle to suppliers from 3 to 4 months to 60 days. Li Auto's Chief Financial Officer, Tie Li, stated during the earnings call that the company's cash flow is expected to improve in the fourth quarter.

Li Auto has informed reporters that the company completed the payment term adjustments for all direct procurement suppliers in mid-July. The contract payment term is 60 days, with payments made on a monthly basis and two unified payment periods each month. In terms of settlement methods, the majority are done via telegraphic transfer, with only a small portion using bank acceptance. A supplier stated, "Li Auto's payment term has changed to 60 days, with direct cash payments, no acceptance."

It is noteworthy that the adjustment of payment terms to suppliers by car companies involves complex processes and cannot be achieved overnight. Reporters have learned that many companies completed this work in July. On August 11, exactly 60 days after the commitment, the Ministry of Industry and Information Technology disclosed research information on the implementation of the commitment by three car companies—FAW Group, GAC Group, and Seres, which have achieved payment of accounts within 60 days.

Implement a 60-day payment term.The biggest obstacle may lie in the financial management capabilities and internal coordination mechanisms of some car companies."For instance, how to adjust cash flow in a short period to ensure timely payment to suppliers is quite a challenge. Additionally, the coordination between the financial, procurement, and production departments within car companies needs to be further strengthened to ensure timely allocation and payment of funds," said Cui Dongshu, Secretary-General of the China Passenger Car Association.

Wang Peng, an associate researcher at the Beijing Academy of Social Sciences, also believes that the automakers' failure to fulfill the "60-day payment period" commitment is due to their own cash flow pressures, forcing them to prioritize the stability of their own financial chains, thereby delaying payments. These views once again prove that shortening the payment period is primarily a "cash battle."Whether the book funds can fully cover accounts payable and notes is the critical point for the "60-day settlement" promise to be truly implemented.

Table: Every Business Daily Reporter Sun Lei

From the perspective of cash and cash equivalents, among the 18 car companies, only Jiangling Motors and Haima Automobile have sufficient book funds to fully cover their accounts payable and notes payable. If short-term investments that can be readily liquidated, along with cash and cash equivalents, are included in the "cash reserves" statistics, then Leapmotor, XPeng Motors, and Li Auto would have cash reserves sufficient to fully cover their accounts payable and notes payable.

However, even when estimated based on cash reserve size, some car companies are still unable to fully cover their accounts payable and notes: companies like BYD, Geely Auto, and NIO have reserve sizes that are still lower than their corresponding accounts payable and notes, putting pressure on their short-term solvency. Looking at the industry as a whole, the "60-day billing period" promise remains an "ultimate cash test" yet to be completed.

Source: NBD Auto

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track