Decorative paints in china resume growth: AkzoNobel Reports First-Half Revenue of 43.8 Billion Yuan

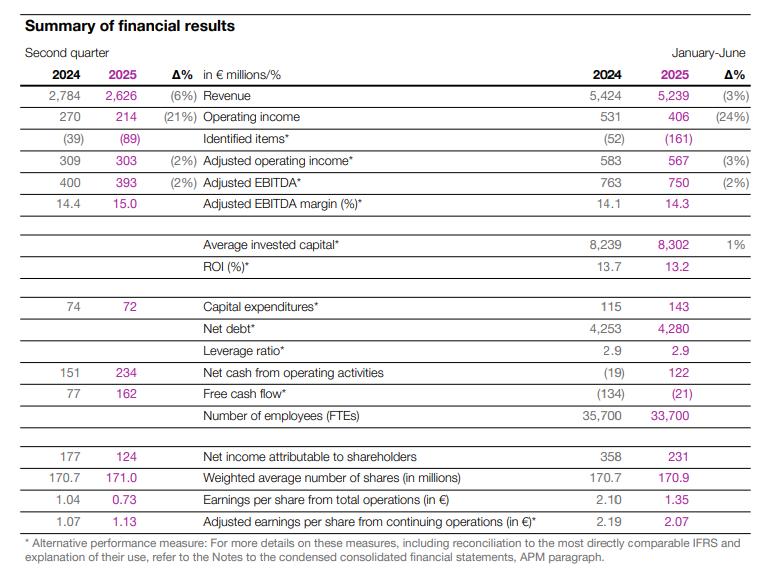

On July 22, 2025, AkzoNobel released its financial report for the second quarter of 2025. The report shows that compared to the second quarter of 2024, AkzoNobel's organic sales in the second quarter of 2025 remained flat, with prices increasing by 2%, and pricing/mix improvements offsetting the decline in volume. Due to adverse currency effects, revenue decreased by 6% to 2.626 billion euros (approximately 21.95 billion RMB). Operating profit declined by 21% to 214 million euros (2024: 270 million euros), mainly due to restructuring costs. Adjusted EBITDA decreased by 2% to 393 million euros, which includes a negative currency impact of 24 million euros (2024: 400 million euros). Efficiency improvement measures helped expand the adjusted EBITDA margin to 15% (2024: 14.4%). Net cash generated from operating activities was positive at 234 million euros (2024: positive 151 million euros).

AkzoNobel CEO Greg Poux-Guillaume commented:In the second quarter, our profitability improved, benefiting from price controls and structural gains from sales, general and administrative expenses (SG&A), and industrial efficiency programs. We achieved this despite significant exchange rate headwinds from a strengthening euro and an overall sluggish market, highlighting the strong strength of our business.

We are achieving a milestone in value creation by selling Akzo Nobel India Limited to JSW Paints, marking an important first step in our portfolio strategy assessment. We will continue to unlock value and drive the company towards stronger and more targeted growth.

Compared to the first half of 2024, AkzoNobel's organic sales in the first half of 2025 remained flat. Revenue decreased by 3% to €5.239 billion (approximately RMB 43.8 billion) due to unfavorable currency exchange rates. Operating profit declined by 24% to €406 million (2024: €531 million), mainly impacted by restructuring costs. Adjusted EBITDA decreased by 2% to €750 million, which includes a €31 million negative currency impact (2024: €763 million). The adjusted EBITDA margin was 14.3% (2024: 14.1%). Net cash generated from operating activities was a positive €122 million (2024: negative €19 million). Net profit attributable to shareholders was €231 million (2024: €358 million).

Decorative Coatings Business

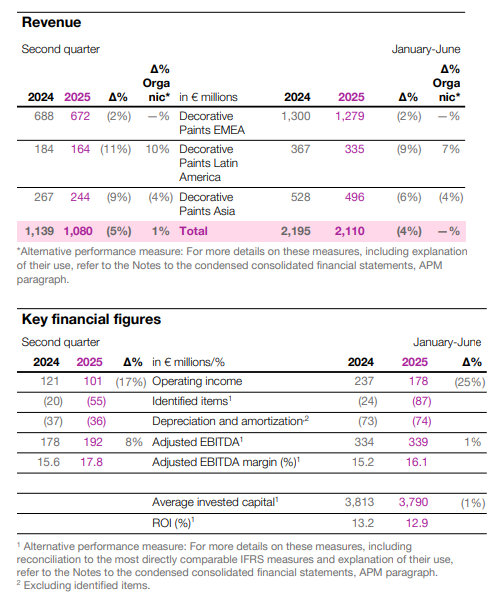

In the second quarter, organic sales in the decorative paints business grew by 1%, driven by positive pricing in decorative paints in Europe, the Middle East, and Africa, as well as in Latin America. Second-quarter volumes were flat, with strong growth in Asian decorative paints offsetting volume declines in Europe, the Middle East, Africa, and Latin America. Revenue decreased by 5% year-on-year to €1.08 billion (approximately CNY 9.03 billion) due to unfavorable currency effects. Operating profit fell by 17% year-on-year to €101 million, impacted by a negative €55 million in recognized items (2024: negative €20 million), mainly related to a restructuring plan. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) grew by 8% year-on-year to €192 million, including an unfavorable currency impact of €11 million. The adjusted EBITDA margin improved to 17.8% (2024: 15.6%).

In the first half of the year, organic sales in the decorative paints business remained flat, with price/product mix increases offsetting volume declines. Decorative paint volumes declined in Europe, the Middle East, Africa, and Latin America, while volumes in Asia remained stable (with a recovery in Chinese decorative paints). Exchange rates dragged down revenue by 3%, and other factors (primarily related to hyperinflation accounting) decreased by 1%, leading to a 4% decrease in revenue to €2.11 billion (approximately RMB 17.64 billion). Operating profit fell by 25% year-on-year to €178 million, impacted by a negative €87 million from recognized items (2024: negative €24 million), mainly related to restructuring plans. Adjusted EBITDA increased by 1% year-on-year to €339 million, including a negative €16 million impact from exchange rates. The adjusted EBITDA margin improved to 16.1% (2024: 15.2%).

Europe, Middle East and Africa:In the second quarter, organic sales remained flat, and revenue decreased by 2% to 672 million euros (approximately 5.62 billion RMB). The increase in pricing/product mix was offset by a decline in volume. The growth in sales volume in Western Europe was completely offset by declines in Southern and Eastern Europe. For the first half of the year, organic sales remained flat, and revenue decreased by 2% to 1.279 billion euros (approximately 10.7 billion RMB). The increase in pricing/product mix was offset by a decline in sales volume in Southern and Eastern Europe.

Latin America:In the second quarter, organic sales grew by 10% as positive pricing fully offset the decline in volume; revenue decreased by 11% to 164 million euros (approximately 1.37 billion RMB). Pricing was positive (even when excluding Argentine inflation pricing). The increase in sales in Colombia was completely offset by the decrease in sales in Brazil (where sales were affected by the timing of price increases). In the first half of the year, organic sales increased by 7% as positive pricing fully offset the decline in volume (primarily from Brazil); revenue decreased by 9% to 335 million euros (approximately 2.8 billion RMB).

Asia:In the second quarter, organic sales decreased by 4%, and revenue dropped by 9% to 244 million euros (approximately 2.04 billion RMB). Sales in China increased (returned to growth). Sales in Southeast Asia and South Asia remained flat (strong growth in Vietnam offset weakness in South Asia and Indonesia). In the first half of the year, organic sales decreased by 4%, and revenue fell by 6% to 496 million euros (approximately 4.15 billion RMB). Pricing/product mix continued to decline, with pricing in China stabilizing. Sales remained flat (growth in China and Vietnam, weakness in South Asia and Indonesia).

High-performance coatings business

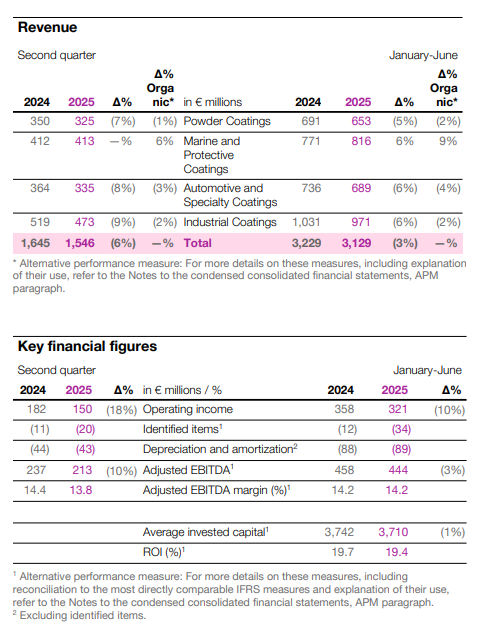

In the second quarter, organic sales in the high-performance coatings business were flat, with positive pricing across all businesses offset by a decline in volumes. Strong growth in marine and protective coatings volumes and growth in most businesses in Asia were completely offset by ongoing macroeconomic uncertainties, particularly in North America. Exchange rates negatively impacted revenue by 5%, while other factors (mainly related to hyperinflation accounting) led to a decline of 1%, resulting in a 6% decrease in revenue to €1.546 billion (approximately RMB 12.9 billion). Operating profit decreased by 18% year-on-year to €150 million. Adjusted EBITDA decreased by 10% year-on-year to €213 million. The adjusted EBITDA margin was 13.8% (2024: 14.4%).

In the first half of the year, organic sales in the high-performance coatings business remained flat, with positive pricing across all businesses offset by a decline in volume. Strong volume growth in marine and protective coatings was completely offset by macroeconomic uncertainty, particularly in North America. Currency effects reduced revenue by 3%, while other factors (mainly related to hyperinflation accounting) remained flat, resulting in a 3% decrease in revenue to €3.129 billion (approximately RMB 26.16 billion). Operating profit decreased by 10% year-on-year to €321 million, affected by a negative impact of €34 million from recognized items (2024: negative €12 million), mainly related to restructuring plans. Adjusted EBITDA decreased by 3% year-on-year to €444 million, including a €20 million adverse currency impact. The adjusted EBITDA margin was 14.2% (2024: 14.2%).

Powder coating:In the second quarter, organic sales decreased by 1%, and revenue declined by 7% to 325 million euros (approximately 2.72 billion RMB). Due to weak demand in the construction sector, sales volume slightly decreased. Signs of recovery were seen in the automotive sector. In the first half of the year, organic sales decreased by 2%, and revenue declined by 5% to 653 million euros (approximately 5.46 billion RMB). Growth in sales in the industrial and consumer sectors was completely offset by declines in sales in the automotive and construction sectors.

Ship and protective coatings:In the second quarter, organic sales increased by 6%, while revenue remained stable at approximately 413 million euros (approximately 3.45 billion RMB). Protective coatings achieved double-digit growth (driven by North America and Asia), while marine coatings stabilized due to a high base in the previous year. In the first half of the year, organic sales increased by 9%, and revenue grew by 6% to 816 million euros (approximately 6.82 billion RMB). Protective coatings achieved double-digit growth, and new marine construction remained strong.

Automobile and Specialty Coatings:In the second quarter, organic sales decreased by 3%, and revenue declined by 8% to 335 million euros (approximately 2.8 billion RMB). In the first half of the year, organic sales dropped by 4%, and revenue fell by 6% to 689 million euros (approximately 5.76 billion RMB). Both the second quarter and the first half saw a decline in sales volumes, reflecting continued weak demand in the automotive and vehicle repair sectors (especially in North America). Pricing/product mix was positive.

Industrial Coatings:In the second quarter, organic sales declined by 2%, and revenue decreased by 9% to 473 million euros (approximately 3.95 billion RMB). In the first half of the year, organic sales fell by 2%, and revenue decreased by 6% to 971 million euros (approximately 8.12 billion RMB). Sales in all sectors declined in the second quarter and the first half of the year, with the packaging sector affected by the high base from the previous year.

Progress of Business for Sale

Notably, on June 27, 2025, AkzoNobel announced that it had signed a binding agreement to sell its controlling stake in AkzoNobel India Ltd. (ANIL) to the JSW Group. The Indian powder coatings business and the international research center currently belonging to ANIL will remain fully owned by AkzoNobel. The transaction is expected to generate net cash proceeds of approximately 900 million euros.

The transaction involves the sale of up to 75% of ANIL's shares, subject to customary closing conditions (including regulatory approvals). The transaction is expected to be completed in the fourth quarter of 2025.

As of June 30, 2025, ANIL's assets and liabilities (excluding its powder coatings business and international research center) meet the criteria to be classified as held for sale. The business held for sale accounts for approximately 3% of revenue, with over 60% belonging to decorative coatings and the remainder to high-performance coatings.

AkzoNobel's performance guidance at constant exchange rates remains unchanged. Considering the current market uncertainties and adjusted based on the exchange rates at the end of the first half of the year, the company expects the full-year adjusted EBITDA for 2025 to exceed 1.48 billion euros.

In the medium term, AkzoNobel aims to increase profitability to an adjusted EBITDA margin of over 16% and a return on investment of 16% to 19% through organic growth and excellence in industrial operations.

AkzoNobel aims to reduce the ratio of net debt to adjusted EBITDA to below 2.5 times by the end of 2025, with a medium-term target of approximately 2 times, while continuing to commit to maintaining a strong investment-grade credit rating.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track