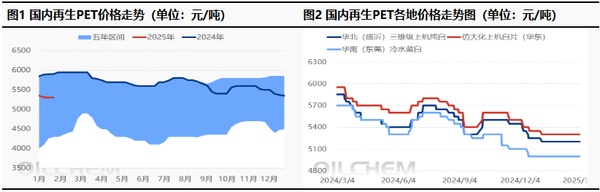

[Daily Regenerated PET Review] Following the market trend, prices have decreased.

1.Today's Summary

①. Today, the mainstream price of pure white clean sheets for imitation large-scale production in Jiangyin is around 5200 yuan/ton, and the mainstream price of blue and white clean sheets for imitation large-scale production is 5100 yuan/ton.

②. In this trading day, the spot price of PTA is -110 to 5300, ethylene glycol -31 to 4635, with a combined polymerization cost of 5733.675, a decrease of 104.44 from the previous trading day. (Unit: yuan/ton)

2.Spot Overview

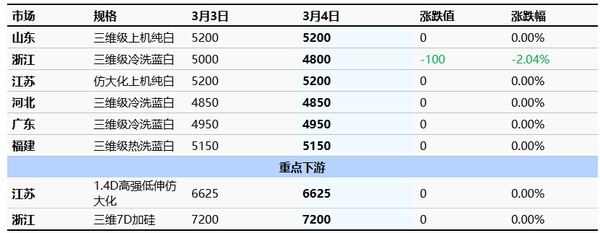

Table 1 Summary of Domestic Recycled PET Prices (Unit: yuan/ton)

Using Jiangsu as the benchmark, today's price for pure white clean sheets for imitation large-scale production closed at 5200 yuan/ton, unchanged from the previous period, in line with early expectations. The textile manufacturing industry is steadily achieving full resumption of work and production, with raw material inventories continuously decreasing. Meanwhile, the market for recycled winter wool containers is gradually becoming more active, with market circulation inventory tightening, prices stabilizing with minor fluctuations, and product transactions gradually returning to normal levels.

3.Production Dynamics

The weekly capacity utilization rate of recycled PET is 39.8%, an increase of 11.1% from the previous period. Most terminal and downstream recycled fiber plants have ended their holidays, and market operators are gradually resuming operations, with enterprise operating loads increasing. Washing plants have mostly ended their holidays, and the operating load of recycled PET enterprises is gradually and broadly increasing. The daily profit margin for recycled PET is 400 yuan/ton.

4.Price Forecast

As production enterprises gradually resume operations, overall capacity has not yet fully recovered. Demand in the terminal textile market remains weak, and new orders are unstable. At the same time, downstream chemical fiber companies are slowing down shipments, purchasing raw materials mainly to meet current needs, with low willingness to accumulate inventory. Currently, it is the off-season for wool container supply, and market circulation inventory is tight, with many recycling and packaging stations choosing to hold onto their goods, showing strong reluctance to sell. Due to limited profit margins, many washing and processing companies remain shut down. Considering the supply and demand situation, it is expected that the recycled PET market will continue to fluctuate within a certain range in the short term.

5.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track