Covestro and Wanhua Chemical Carve Up the Industry’s No. 3 Player

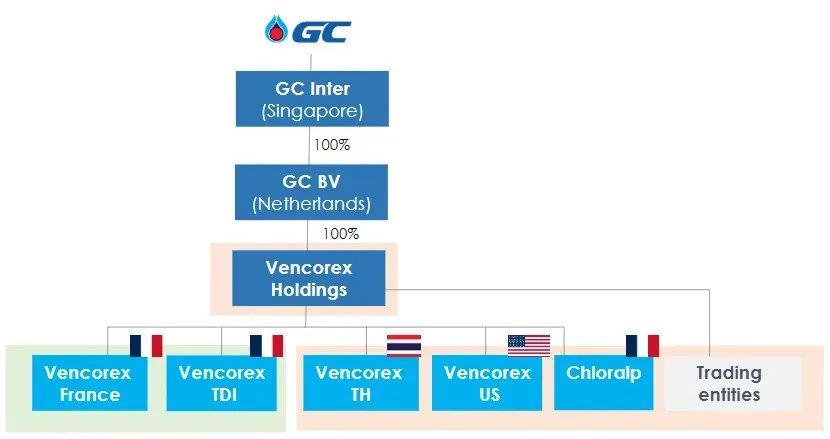

Recently, Covestro announced that it has signed an agreement with Vencorex, a subsidiary of Thai chemical company PTT Global Chemical (PTTGC), to acquire two independent hexamethylene diisocyanate (HDI) derivatives production sites located in Rayong, Thailand, and Freeport, USA, respectively. The transaction is expected to be completed by the end of 2025.

This is Covestro's first major move after announcing its semi-annual performance, despite the pressure on its performance. It is reported that Covestro completed the acquisition of DSM Group's Resins and Functional Materials business (RFM) for $1.886 billion in 2021, helping it become the world's largest producer of coating resins.Through this acquisition, Covestro has supplemented its existing production capacities in the United States, Germany, China, and India, further demonstrating the company’s strong confidence in its coatings and adhesives business.

It is reported that the company being acquired this timeVencorex's operations in France primarily include an HDI monomer production capacity of 79,000 tons per year and an HDI derivatives production capacity of 24,000 tons per year; in the United States, it has an HDI derivatives production capacity of 12,000 tons per year; in Thailand, it also has an HDI derivatives production capacity of 12,000 tons per year.Due to the European energy crisis following the Russia-Ukraine war, its subsidiaries Vencorex France and Vencorex TDI are in trouble.September 10, 2024Enter the judicial reorganization process.

At around the same time, Wanhua Chemical submitted through its Hungarian subsidiaryBorsodChem Vencorex's specialty isocyanate business in France. Proposal,April 10, 2025The Commercial Court of Lyon in France has approved the acquisition.。

The transaction is reportedly valued at approximately 1.2 million euros, with a commitment to invest 19 million euros by 2027. It involves Vencorex's production site near Grenoble, France, as well as its only HDI monomer production facility.

At this point, the two major chemical giants have completed the "division" of Vencorex. Wanhua is "expanding" in Europe, while Covestro is "encircling" in Asia.

Currently, Wanhua ChemicalHDI total production capacity reaches 200,000 tons/yearNingbo 100,000 tons/year, Yantai 30,000 tons/year, Kangrui 70,000 tons/year)With the addition of the 100,000-ton technological transformation in Ningbo, it will reach 300,000 tons in the future.Covestro 190,000 tons/year; Tosoh Japan,After the expansion is completedHDI has an annual production capacity of 30,000 tons; Asahi Kasei, 22,000 tons/year.

It is worth mentioning that the domestic dark horse, Meirui New Materials, has formed with its Henan subsidiary's Phase I project of the polyurethane industrial park, the HDI monomer plant.A production capacity of 100,000 tons of HDI monomer and its derivatives has achieved a breakthrough, rising to third place globally in this field, with an additional 200,000 tons under construction. Furthermore, New Harmony is in the process of building.100,000 tons.

HDI is a key component in products such as polyurethane coatings, adhesives, and sealants, and is widely used in various fields including automobiles, trucks, bridges, ships, wooden furniture, and electronic products. Among these, the automotive sector is the largest market.Electrophoretic paint, ultra-wear-resistant floor paint, protective coatings for wind turbine blades and towers, photovoltaic backsheet structural adhesive, and other emerging fields are also experiencing rapid growth in application.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track