Counterintuitive insights from "weixiaoli zero" q2 financial report: Why Is Li Auto with 100 Billion in Cash the Most Anxious?

In the second quarter of 2025, competition in the new energy vehicle market continued to rise like the summer temperature, as the four leading new car-making forces—NIO, XPeng, Li Auto, and Leapmotor—successively released their respective quarterly performance reports.

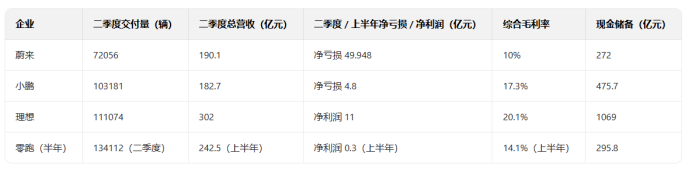

Every set of data, from the rise and fall of delivery volumes to the fluctuations in revenue and profit, from the subtle changes in gross margin to the amount of cash reserves, affects the nerves of the industry.

Some people, seeing that Li Auto remains profitable, assert that it firmly holds the leading position; others are amazed by Leapmotor's top sales, believing it has started its path to counterattack; some notice that XPeng's losses have significantly narrowed, nearing profitability; while others focus on NIO's promising financial report, with a bright future ahead.

However, the numbers on the financial report are ultimately just the tip of the iceberg.

Staying only at the interpretation of surface data can easily lead to misconceptions. The strategic transformation and market competition behind the numbers are far more exciting than the superficial rankings.

To truly understand the operational status and future potential of these four companies, it is necessary to place the data within a broader context.

After all, in the rapidly evolving new energy vehicle industry, short-term performance is not the final verdict. The trends hidden behind the data are the key to determining whether a company can maintain its footing in long-term competition.

Next, we will delve into the second-quarter financial reports of four emerging companies from three dimensions: core data breakdown, sales and model layout analysis, and industry trends and strategic thinking, to uncover the industry logic behind the data for our readers.

Q2 Financial Report Key Data Breakdown

Revenue, Profit, and Gross Margin Strategies

NIO: Sales Surge Drives Revenue Growth, Losses Narrow but Breakthroughs Still Needed

In the second quarter of 2025, NIO delivered an impressive financial report, with the most notable aspect being the substantial increase in sales.

The data shows that NIO's deliveries in the second quarter reached 72,056 vehicles, representing a year-on-year increase of 25.6% and a quarter-on-quarter surge of 71.2%.

This sales performance has also laid a solid foundation for its revenue growth. From the perspective of sub-brands, the newly launched LeDao brand and the Firefly brand, which targets the affordable market, have started to contribute incremental growth. In particular, the LeDao brand quickly captured the market after the launch of its first model, becoming a significant force in driving sales.

The increase in sales is directly reflected in the revenue data, with NIO's total revenue for the second quarter reaching 19.01 billion yuan, a quarter-on-quarter increase of 9% and a year-on-year increase of 57.9%. The revenue growth rate is basically in line with the sales growth rate, indicating that its product pricing strategy is relatively stable and it has not resorted to significant price cuts to boost sales.

On the profit side, NIO still faces significant pressure, with a net loss of 4.9948 billion yuan in the second quarter. Although this represents a year-on-year decrease of 1% and a quarter-on-quarter decrease of 26%, indicating a continuous narrowing trend of losses, the loss scale of over 4 billion yuan is still hard to overlook.

In terms of profitability, NIO's overall gross margin reached 10% in the second quarter, showing a steady improvement compared to 9.7% in the second quarter of 2024 and 7.6% in the first quarter of 2025, indicating that its cost control capabilities are gradually improving.

However, a 10% gross margin is still at a relatively low level among the four emerging companies, and there is still a certain gap compared to the profitability levels of leading enterprises in the industry.

NIO currently has 27.2 billion yuan in cash and cash equivalents, which can support its subsequent research and development, market expansion, and model iteration. However, considering that it is still incurring continuous losses, accelerating the improvement of its profitability and avoiding excessive pressure on its cash flow will be key issues NIO needs to address in the future.

Xpeng: Explosive Sales Growth, Approaching Profitability Line

XPeng's second-quarter financial report is full of highlights, particularly in terms of sales and profits, showcasing its rapid rise in the market.

The data shows that Xpeng's deliveries in the second quarter reached 103,181 vehicles, marking a year-on-year surge of 241.6%. This growth rate ranks first among the four emerging forces and is also at the forefront of the entire new energy vehicle market.

The explosive growth in sales directly drove high revenue growth. In the second quarter, XPeng's total revenue reached 18.27 billion yuan, a year-on-year increase of 125.3% and a quarter-on-quarter increase of 15.6%. The revenue growth rate is highly synchronized with the sales growth rate, reflecting the rapidly increasing market recognition of its products.

More noteworthy is the significant breakthrough Xpeng has achieved on the profit side, with a net loss of only 480 million yuan in the second quarter, a sharp decrease of 62.5% compared to the 1.28 billion yuan in the same period of 2024, and a 27.3% decrease compared to the 660 million yuan in the first quarter of 2025, approaching the break-even line.

In terms of gross margin, XPeng's overall gross margin reached 17.3% in the second quarter, higher than 14% in the same period of 2024 and 15.6% in the first quarter of 2025. This level of gross margin is among the upper-middle range of the four emerging forces, indicating that its products have a certain premium capability while also being able to control costs through economies of scale.

Xpeng currently has 47.57 billion yuan in cash and cash equivalents. This ample funding not only ensures support for its subsequent technological research and development and model iteration but also lays a foundation for coping with uncertainties in market competition.

For XPeng, the most critical task at present is to seize market opportunities, further expand sales scale, and achieve profitability as soon as possible, so as to occupy a more advantageous position in the fierce market competition.

Ideal: "Profitability Benchmark" Status Remains Firm, but Revenue Decline Year-on-Year Reveals Hidden Concerns

As the only company among the four new powerhouses to achieve long-term profitability, Li Auto maintained its status as a profitability benchmark in the second quarter of 2025. However, some details in the financial report also revealed underlying concerns it faces.

In terms of sales, Li Auto's sales reached 111,074 units in the second quarter, a year-on-year increase of 2.3%. Its sales volume ranks second among the four emerging forces, only behind Leapmotor, maintaining strong market competitiveness.

However, the year-on-year growth rate of 2.3% appears to lack momentum compared to the high growth rates of XPeng and Leapmotor, reflecting that Li Auto may have encountered certain bottlenecks in product appeal and market expansion.

The slowdown in sales growth directly impacted revenue performance. In the second quarter, Li Auto's total revenue reached 30.2 billion yuan, representing a quarter-on-quarter increase of 16.7%, but a year-on-year decline of 4.5%. This is a rare instance of year-on-year revenue decline for Li Auto.

Despite a year-on-year decline in revenue, Li Auto still performed well in terms of profit. In the second quarter, net profit reached 1.1 billion yuan, a year-on-year decrease of 0.4% but a quarter-on-quarter increase of 69.6%. Its net profit is far ahead among the four emerging companies, mainly due to its high gross profit margin and meticulous cost control.

In the second quarter, Li Auto's overall gross profit margin reached 20.1%. Although this figure is slightly lower than the 20.5% in the first quarter of 2025, it is higher than the 19.5% in the same period in 2024, maintaining a relatively high level.

In terms of cash reserves, Li Auto currently holds 106.9 billion yuan in cash and cash equivalents. This amount not only ranks first among the four major new energy vehicle companies but also surpasses many traditional car manufacturers. The ample funds provide strong support for the company to respond to market changes and advance its transition to pure electric vehicles.

However, the signal of a year-on-year decline in revenue also reminds Li Auto that it must accelerate its strategic adjustments, especially in the research and market promotion of pure electric models, or it may gradually lose its competitive advantage in the future market.

Leapmotor: Impressive Semi-Annual Report, First Half-Year Profit, Sales Top New Forces

Among the four emerging forces, Leapmotor, although previously not as well-known as NIO, XPeng, and Li Auto, successfully attracted industry attention with its outstanding performance in the first half of 2025.

Since Leapmotor has not released its quarterly financial report, we will analyze the data from its interim report.

In terms of sales, Leapmotor delivered a total of 134,112 vehicles in the second quarter, with 41,039 units delivered in April, 45,067 units in May, and 48,006 units in June, showing a trend of consecutive month-on-month growth. Not only did it top the sales chart among new forces, but it also became the company with the strongest growth momentum among the four new forces.

The high growth in sales directly led to a significant increase in revenue. Leapmotor's total revenue in the first half of the year reached 24.25 billion yuan, a year-on-year increase of 174%, ranking among the top in revenue growth among the four new forces.

Moreover, it is worth celebrating that Leapmotor achieved a net profit of 30 million yuan in the first half of the year, marking the first time it has achieved a positive net profit for a half-year period. This breakthrough not only challenges the industry perception that "value-for-money brands struggle to be profitable," but also injects strong confidence into its subsequent development.

In terms of gross profit margin, Leapmotor achieved a comprehensive gross profit margin of 14.1% in the first half of the year, a qualitative leap from 1.1% in the same period last year. Although this gross profit margin is lower than that of Li Auto and XPeng, it is higher than that of NIO, indicating that its profitability is rapidly improving.

From the perspective of cash reserves, Leapmotor currently has 29.58 billion yuan in cash and equivalents. The financial situation is good, which can support its subsequent market expansion, technology research and development, and model iteration.

In terms of sales volume, Leapmotor ranks first with 134,112 units delivered in the second quarter, followed closely by Li Auto with 111,074 units. XPeng and NIO rank third and fourth with 103,181 and 72,056 units, respectively.

In terms of profitability, Li Auto is undoubtedly the best-performing company, achieving a net profit of 1.1 billion yuan in the second quarter, with a gross margin as high as 20.1%, demonstrating strong profitability. Although Leapmotor's net profit is relatively small, it achieved a profit for the first half of the year, marking the preliminary formation of its profit model. XPeng's net loss has decreased to 480 million yuan, just a step away from profitability, with an optimistic outlook. NIO, on the other hand, is still facing significant pressure with a net loss of 4.9948 billion yuan, which needs to be improved as soon as possible.

In terms of gross margin, Li Auto (20.1%) > XPeng (17.3%) > Leapmotor (14.1%) > NIO (10%).

In terms of funding, Li Auto leads with a cash reserve of 106.9 billion yuan, followed by XPeng with a cash reserve of 47.57 billion yuan, Leapmotor with a cash reserve of 29.58 billion yuan, and NIO with a cash reserve of 27.2 billion yuan.

The growth key behind the financial reports of each new force

To determine whether the growth of an automotive company is sustainable, it is not enough to look only at quarterly data; it is also necessary to analyze its monthly sales trends and model lineup.

NIO: Le Tao Turns the Tide

For NIO, the delivery volume of 72,056 vehicles in the second quarter of 2025 is impressive, but what is more noteworthy is the distribution of model sales behind it and the sales trend from July to August.

From the distribution of vehicle sales in the second quarter, NIO's three major brands showed a diverging trend. The NIO brand delivered 47,132 vehicles, the Ledo brand delivered 17,081 vehicles, and the Firefly brand delivered 7,843 vehicles. This data indicates that the Ledo brand, as NIO's new brand targeting the mid-to-high-end market, has begun to take on the responsibility of driving sales growth, while the Firefly brand, as an attempt to penetrate the affordable market, has also achieved initial success.

Based on the sales data from July to August, NIO delivered 21,017 vehicles in July and 31,305 vehicles in August, showing a clear upward trend, with the performance of the Leto brand being particularly outstanding.

Among them, the LeDao L60, as the first model of the LeDao brand, has maintained stable sales since its launch, with an average monthly delivery volume of around 6,000 units, becoming an important support for NIO's sales. The LeDao L90, on the other hand, can be described as a dark horse, with delivery volumes exceeding 10,000 units in its first month on the market. This achievement not only far exceeds market expectations but also validates the competitive strength of the LeDao brand in the mid-to-high-end market.

In contrast, the performance of the Firefly brand is relatively subdued. As a model targeting a niche market, its sales, while not phenomenal, basically meet market expectations and are deeply favored by specific consumer groups, helping NIO build a certain user base in the affordable market.

However, the decline in sales of NIO's main brand models cannot be ignored.

As the core brand of NIO, its gradually declining sales not only affect NIO's overall sales volume but also reflect that consumer interest in its existing models is decreasing.

Fortunately, NIO has already recognized this issue and announced that it will undertake a major overhaul of its models this year. The all-new ES8, as NIO's flagship model, has opened for pre-sale and attracted widespread attention with its more sincere pricing. Many potential customers are waiting for the delivery of the revamped model, which is expected to boost NIO's sales in the coming months.

Overall, the future development of NIO will heavily rely on the collaborative efforts of its three brands. The Le Dao brand, with its competitiveness in the mid-to-high-end market, will become the core engine for NIO's sales growth. The NIO brand needs to rejuvenate the high-end market through model upgrades to reverse the declining sales trend. The Firefly brand serves as a complement to the affordable market, currently with only one model, but is expected to further open up the market by expanding its product line in the future.

As NIO founder William Li once stated, one reason consumers do not buy NIO is due to concerns about the company going bankrupt.

As sales continue to improve and financial report data gradually improves, consumer doubts will also be gradually dispelled, which will further aid in the increase of NIO's sales.

From this perspective, the future of NIO is still promising, but the prerequisite is that it can accelerate the iteration speed of its models and fully leverage the synergies of its three major brands.

Xpeng: A Blockbuster Maker

Compared to NIO, XPeng's sales growth is more comprehensive, mainly due to its well-rounded model lineup and balanced performance across various models. In the second quarter of 2025, XPeng delivered 103,181 vehicles, with models such as the XPeng G7, MONA M03, and X9 all contributing significantly to the sales.

In July and August, XPeng's sales continued to maintain a steady upward trend, with deliveries reaching 36,717 units in July and 37,709 units in August, repeatedly setting new records.

Especially notable is the sales performance of certain models. The Xpeng G7 has accumulated over 10,000 deliveries since its launch and has consecutively achieved the weekly sales champion in its class for four weeks. The Xpeng MONA M03 delivered over 15,000 units in August, with total deliveries surpassing 160,000 units. The Xpeng G6 also saw an 11% month-on-month increase in deliveries in August.

The newly launched XPeng P7 has great potential to become a blockbuster, likely driving XPeng's sales to a new level.

Overall, XPeng's product lineup covers various price ranges, with the MOMA M03 as a hit in the low price segment, and the G6, G7, and P7+ models in the high-end segment. For the higher-end market, there is the X9. This comprehensive product layout provides XPeng with strong risk resistance and market penetration capabilities.

Based on the continued narrowing of net losses to 480 million yuan in the second quarter financial report, it can be seen that XPeng Motors is just a step away from crossing the profitability threshold. After the delivery of the all-new XPeng P7 begins, it is very likely to achieve this goal.

Ideal: In transition

In terms of Li Auto, although sales increased in the first half of the year, considering the sales from July to August, there is a decline with 30,731 units delivered in July and 28,529 units delivered in August.

In the third quarter outlook, Li Auto has set a delivery target of 90,000 to 95,000 vehicles, with revenue expectations lowered to 24.8 billion to 26.2 billion yuan.

The challenges faced by Li Xiang mainly stem from the limitations of the range-extended market. Range-extended electric vehicles have always been a relatively niche segment within the entire spectrum of new energy vehicles, lacking the development potential of pure electric and plug-in hybrids. As more and more car companies enter the range-extended market, competition intensifies while the total market size declines, making continued reliance on the range-extended route clearly unsustainable.

Li Xiang has also adjusted its strategy in this regard, focusing on the pure electric market. Among them, Li Xiang MEGA and Li Xiang i8 are key models in Li Xiang's transition to pure electric vehicles. Although MEGA encountered negative publicity at its initial launch, its sales have been steadily climbing, with deliveries exceeding 3,000 units in August, and production capacity expected to surpass 3,500 units in September. This is quite remarkable for models in this price range.

The i8 is expected to deliver 8,000 to 10,000 units by the end of September, while the Li Auto i6 will also be launched soon, priced in the range of 250,000 to 300,000 yuan, demonstrating greater market sincerity.

It can be seen that Li Auto is transitioning from a sole focus on extended-range vehicles to a "pure electric + extended-range" dual-drive approach. On one hand, this allows them to explore the entirely new pure electric market. On the other hand, Li Auto's biggest advantage lies in its large base of extended-range vehicle users and strong brand reputation. When extended-range vehicle owners switch to pure electric vehicles, they are likely to continue choosing Li Auto, providing a fundamental sales guarantee for Li Auto's pure electric models.

Overall, Li Auto is still the leader among these car companies. Although it is currently encountering a bottleneck, as long as adjustments are made properly, a rebound in sales will not be an issue.

Leapmotor: Brand elevation is the top priority.

Leapmotor delivered 134,112 vehicles in the second quarter of 2025, repeatedly achieving record-high performance with very strong growth.

Based on the performance in July and August, with 50,129 vehicles delivered in July and 57,066 vehicles delivered in August, Leapmotor has firmly secured the top position in sales among the new forces.

Leapmotor has several popular models. The C10 delivered over 100,000 units within 13 months of its launch and has now exceeded 150,000 units. The C11 surpassed 250,000 cumulative deliveries by June. The C16 remained the top-selling mid-to-large SUV under 200,000 yuan for eight consecutive weeks before August 13. The B10 delivered over 10,000 units in its second month after launch, and the B01 exceeded 10,000 units in its first month.

Leapmotor is one of the car companies that achieved a turnaround through the extended-range market. In the context of high battery costs at the time, Leapmotor saved on battery costs by switching to the extended-range market. Coupled with full-stack self-research and a high rate of component commonality, this made their product prices more competitive and won market favor.

Leapmotor's founder Zhu Jiangming is well aware that range extenders are just a transitional solution. Therefore, while stabilizing its position in the range extender market, Leapmotor is also making frequent efforts in the pure electric market. The fact that the B01 delivered over ten thousand units in its first month of sales is a clear signal.

Leapmotor's strong growth has also attracted the attention of traditional car manufacturers. For instance, on March 3, 2025, it signed a "Strategic Cooperation Memorandum of Understanding" with China FAW. The two companies will collaborate in the joint development of new energy passenger vehicles and components, and the first model project has already been implemented.

Previously, the collaboration with the Stellantis Group further broadened Leapmotor's path to internationalization. In the first half of 2025, Leapmotor exported 20,375 vehicles, ranking first among the new forces. The pace of expansion overseas is still accelerating, with plans to establish a localized production base in Europe by the end of 2026.

Leapmotor also faces challenges. As it focuses on a cost-effective strategy, its models are mainly concentrated in the market below 200,000 yuan. Although the gross margin has increased to 14.1%, it is still lower than that of Li Auto and XPeng.

Leapmotor needs to break through the price ceiling and enter the high-end market, not only to improve its profit margins but also to enhance its brand image.

Through financial report analysis, it can be seen that each new force has its own highs and lows. Li Auto, as the king of profitability, faces transitional pains; Leapmotor strives to enhance its brand power with its position as the sales champion; XPeng, with a complete product matrix, is approaching the profitability line; and NIO, with its three-brand strategy, is beginning to see results and reversing its decline.

Everyone has the opportunity to make a comeback, and similarly, there is a possibility of decline. Financial reports are past report cards, while strategy is the passport to the future.

There is no absolute winner, only a path that suits oneself. In this never-ending marathon, only those who continuously evolve can ultimately navigate through cycles.

The only certainty is that future battles will be even more exciting.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics