Compensation of 6.29 Billion! DuPont Soars

According to the financial report for the second quarter of 2025 released by DuPont on August 5, net sales were $3.3 billion (an increase of approximately 3.1% year-over-year), with GAAP income from continuing operations at $238 million, up 35% year-over-year; operating EBITDA was $859 million, an increase of 8%.

In terms of specific business developments: (1) Net electronic sales and organic sales increased by 6%, with an operating EBITDA margin of 31.9%. Specifically, the Semiconductor Materials business benefited from the application of artificial intelligence technologies and the recovery of the semiconductor market, achieving low double-digit organic growth, particularly driven by strong demand for advanced node chip materials and a significant contribution from the Chinese market. The Electronics Interconnect Technologies business achieved high single-digit organic growth due to broad market demand, enhanced product competitiveness, and AI-driven technological upgrades, resulting in notable volume benefits. (2) The healthcare (biopharmaceuticals, medical packaging) and water treatment end markets (driven by reverse osmosis technology) experienced a recovery in demand, leading to low single-digit organic growth for the business, with net sales and organic sales increasing by 1% and an operating EBITDA margin of 24.4%.

Regarding business strategy adjustments, the spin-off of the electronics business (new company name: Qnity) is progressing smoothly. Management has completed the submission of the Form 10 registration statement and executive restructuring. The official spin-off is planned for November 1, 2025. Along with the potential divestiture of businesses such as aramid, this move aims to unlock approximately $9 billion in potential incremental value and strengthen the parent company's core positioning in areas such as water treatment and healthcare.

DuPont's performance has surged by perfectly seizing the opportunities in the current global high-value-added emerging industries while reducing reliance on traditional energy industries (such as the current difficulties in Europe). Additionally, it has controlled costs through proactive strategic adjustments (divesting low-growth sectors and focusing on high-potential ones).

However, like other major manufacturers, DuPont is still facing many global challenges, including weak demand in industrial sectors such as construction and automotive (especially in the North American market), fluctuations in energy and raw material costs and uncertainties in the supply chain (such as the impact of trade tariffs) that may erode profit margins, as well as global trade frictions (such as US-China tariffs), carbon tax policies, and regional regulatory changes (such as European chemical regulations).

In terms of regional regulation, there is the PFAS case that has been entangling and causing significant reputational and financial damage to DuPont in recent years. Just yesterday, it reached a new conclusion.

On August 4th, three American chemical companies—Chemours, DuPont, and Corteva—announced an environmental settlement agreement to pay $875 million (approximately 6.29 billion yuan) to the state of New Jersey to address per- and polyfluoroalkyl substances (PFAS) contamination, including contamination from aqueous film-forming foam.

Chemours will be responsible for 50% of the settlement amount, approximately $250 million, DuPont will be responsible for 35.5% of the settlement amount, approximately $177 million, and Corteva will be responsible for the remaining 14.5% of the settlement amount, approximately $72 million.

It is reported that this is one of the largest environmental settlement agreements reached individually by U.S. states. According to the agreement, the three companies must also clean up four polluted plant sites (Chambers Works, Parlin, Pompton Lakes, and Repauno) and establish a remediation fund of up to $1.2 billion and a reserve fund of $475 million to prevent future bankruptcy or default.

PFAS is a general term for various organofluorine compounds such as perfluoroalkyl and polyfluoroalkyl substances. Currently, the known harms of PFAS to the human body include: increased risk of cancer, increased risk of hypertension, hyperglycemia, and hyperlipidemia, impaired fertility, disruption of hormone levels, inhibition of growth and development, and impact on immune function.

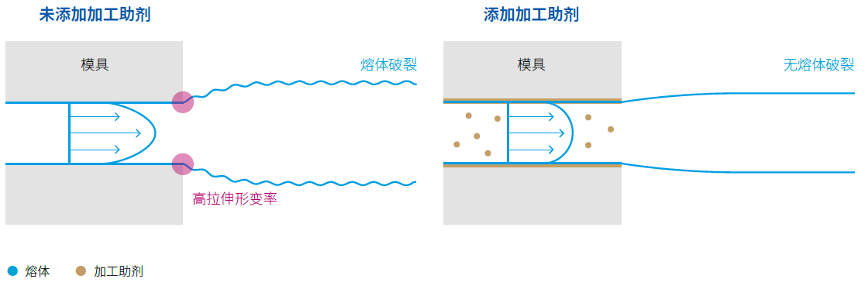

Due to their outstanding hydrophobicity, oleophobicity, high-temperature resistance, surface activity, and chemical stability, PFAS have been widely used, including in non-stick coatings (Teflon), raincoats and outdoor sportswear surface treatments, waterproof cosmetics, packaging materials, firefighting foams, and more. In the plastics industry, PFAS have been extensively used as additives, not only for fire retardancy but also to reduce friction and shear stress between the melt and the mold surface during flow, thereby improving processing efficiency and reducing the occurrence of problems.

Mechanism of Processing Aids - Preventing Melt Fracture

Image source: BYK

Countries around the world are advancing the "PFAS phase-out" process, including the United States, the European Union, Canada, Australia, China, and others. They have enacted legislation to strictly control PFAS pollution and have implemented very high-level regulations on its production and use. Major chemical giants have consequently become targets of public condemnation, accountability, and litigation claims. These giants are also the world's primary PFAS suppliers, including BASF, 3M (USA), Solvay, DuPont, Chemours, Clariant, and Japan's Mitsubishi Group. Most PFAS pollution claims involve issues related to drinking water.

In June 2023, Solvay USA reached a settlement with the state of New Jersey regarding PFAS-related claims. Solvay agreed to pay $75 million for natural resource damage compensation (NRD) and $100 million for remediation projects in the vicinity of the West Deptford plant. In September 2024, due to TFA and its derivatives being classified as PFAS, Solvay was forced to announce the cessation of TFA and its fluorinated derivatives production at the Salindres plant in France and implement layoffs.

In June 2023, U.S.-based 3M Company announced it would provide $10.3 billion over the next 13 years to public water systems to resolve water pollution claims related to PFAS. On May 12, 2025, 3M announced it had reached a settlement with the state of New Jersey regarding PFAS-related claims, with an expected payment of $285 million this year and additional payments over the next 25 years, bringing the total amount to as much as $450 million. 3M has also announced it will completely exit PFAS production by the end of 2025.

In June 2023, DuPont, Chemours, and Corteva reached an $1.18 billion agreement to resolve complaints from approximately 300 drinking water providers regarding PFAS. In November 2023, DuPont and Chemours jointly announced a settlement with the state of Ohio, agreeing to pay a total of $110 million in compensation and establishing an additional $1.185 billion settlement fund.

In May 2024, BASF's North American subsidiary agreed to a settlement with nationwide public water systems, with a settlement amount of $316.5 million.

In June 2025, an Italian court ruled on the PFAS groundwater contamination issue, sentencing 11 executives of the Miteni fluorochemical plant to imprisonment and ordering three companies—Japan's Mitsubishi Group, Luxembourg's International Chemical Investment Group (ICIG), and Miteni—to jointly pay 57 million euros in compensation.

Despite its significant hazards, PFAS are key components in etching agents and cleaning agents used in semiconductor manufacturing. In addition, PFAS are indispensable in lithium-ion battery separator coatings and electrolyte additives in the new energy battery industry. China's 14th Five-Year Plan explicitly proposes vigorously developing strategic emerging industries such as semiconductors, new energy, and high-end manufacturing. The demand for PFAS in these fields will increase significantly, leading to a gradual shift in the focus of PFAS market growth from North America and Europe to China.

Even in the additives industry, although the importance of defluorination has been recognized, there are still many obstacles to replacing PFAS in the short term. From modifier manufacturers to end brands, there has long been a reliance on PFAS, especially in the consumer electronics industry, which has used a large amount of flame retardant additives, including perfluorobutane sulfonate (PFBS) and anti-drip polytetrafluoroethylene (PTFE). Replacing these materials requires consideration of a series of issues such as performance requirements, supply chain, cost, compliance, and recycling.

However, from a long-term perspective, the defluorination of the additives industry has become inevitable. Even though there are short-term challenges in finding alternatives to PFAS, the sustainable development path toward "defluorination" in the plastics industry will become increasingly clear in the future.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track