Compass for Going Global | What Packaging Do Overseas Buyers Want to Source from China?

CPiS2025 has reached a strategic cooperation with international authoritative chamber of commerce organizations, and will carefully organize international packaging buyers with packaging procurement needs to form an overseas buyers group. They will personally attend CPiS2025 to participate in packaging trade对接 activities and booth visits.

CPiS2025

International perspective, diverse cooperation opportunities

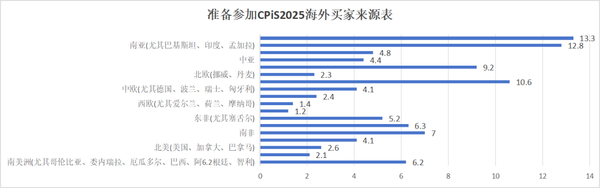

CPiS2025 attracted buyers from many countries around the world. In terms of source distribution (see Figure 1), buyers from Southeast Asia accounted for 13.3%, and those from South Asia accounted for 12.8%, ranking at the top.

In Southeast Asia, the economy has developed rapidly in recent years, leading to a continuous growth in demand for packaging products. The high level of attention indicates that the local market has huge potential, and Chinese packaging companies can take advantage of this opportunity to further explore business opportunities in the region. South Asia, with its large population and vast consumer market, also has significant demand for various packaging products, providing companies with ample space for business expansion.

CPiS2025

Analysis of Overseas Buyers Sector

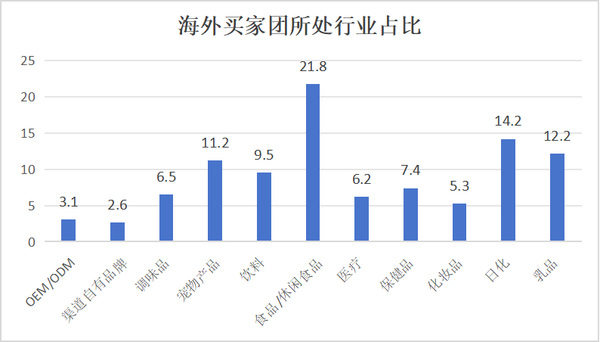

Latest data (see Figure 2) shows that overseas buyers come predominantly from the Food / Snack Food industry, accounting for 21.8%, followed by the Personal Care industry at 14.2%, and Dairy at 12.2%. The food and personal care industries are key areas for packaging demand among overseas buyers, with a particular emphasis on the procurement of food packaging materials and finished products.

Figure 2

CPiS2025

Overseas Buyer Procurement Analysis

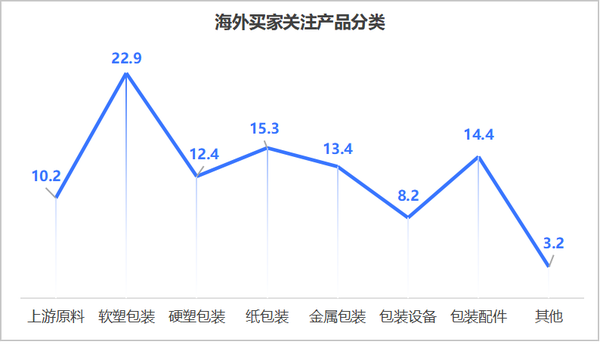

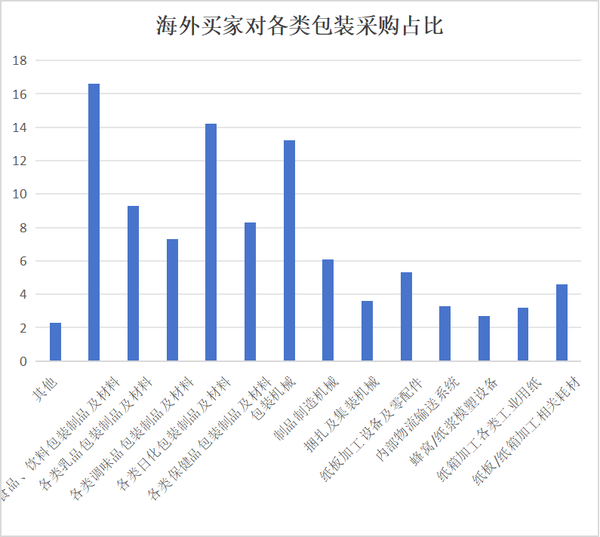

Overseas buyers show varying levels of interest in different packaging types. Flexible plastic packaging garners the highest attention, accounting for 22.9% (see Figure 3), followed closely by rigid plastic packaging and paper packaging. This aligns with the fact that food and beverage packaging products and materials constitute 16.6% of procurement (see Figure 4).

Flexible plastic packaging is widely used in industries such as food and daily chemicals due to its relatively low cost, strong plasticity, and convenience in processing and transportation, making it favored by overseas buyers. Paper packaging has gradually increased its market share in recent years due to its environmental advantages, especially in countries and regions with higher environmental requirements, where it has gained increasing attention. The higher proportion of food and beverage packaging products and materials in procurement further confirms the strong demand for packaging in the food industry, providing clear guidance for packaging companies in product development and production directions.

Figure 3

Figure 4

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track