China's Wearable Wristband Device Market Hits Record High in First Half of 2025, Huawei Remains First, Xiaomi Growth Exceeds 100%

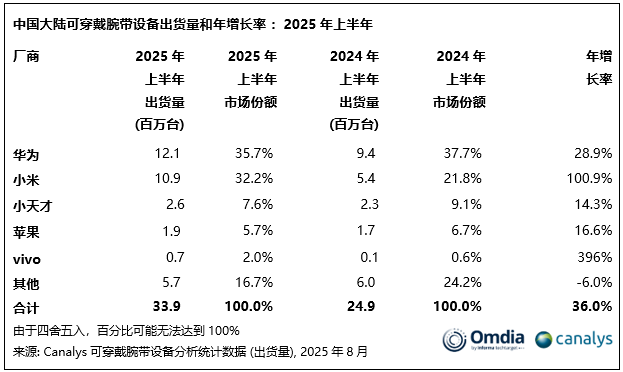

According to data from Canalys (now merged into Omdia), wearable band device shipments in mainland China reached 33.9 million units in the first half of 2025, representing a year-on-year growth of 36%. This follows a strong 33% growth in the second half of 2024, marking a continued robust upward trend. This growth has set a new historical high for first-half shipments in the mainland China wearable band device market, signaling that the market has entered a new stage of development.

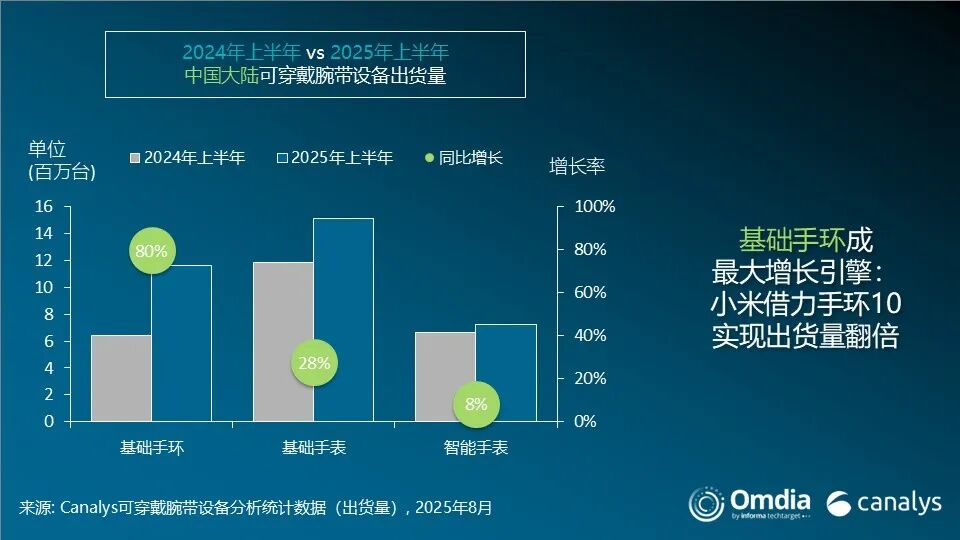

The basic wristband category achieved a remarkable growth rate of 80%, making it the fastest-growing segment and the main driver behind the strong performance of the mainland China market. Huawei led the market with shipments of 12 million units, capturing a 36% share; Xiaomi followed closely with shipments of 11 million units and a 32% market share. Both companies achieved the milestone of shipping over 10 million units in the first half of the year for the first time, with Xiaomi’s year-on-year growth particularly impressive at 101%.

Claire Qin, an analyst at Canalys (now part of Omdia), stated, "The national subsidy policy effectively boosted the demand for wearable bands by encouraging upgrades from existing users, attracting new users, and even reigniting interest among former users. Combined with large '618' promotional events, it lowered the purchasing threshold for price-sensitive consumers and encouraged them to consider buying more expensive basic and smartwatches, exemplifying the 'lipstick effect.' This aligns with the recent development trends in wearable bands — even devices priced in the range of 1,599 to 2,999 RMB (approximately 400 USD) have seen price reductions under the influence of the subsidy policy, further stimulating the desire for mid-to-high-end devices."

Canalys(Merged intoOmdia OmdiaResearch Manager Chen QiufanCynthia Chen)Express: "Manufacturers with a complete wearable device portfolio perform better.。 Watch GTThe series has established a strong position in the basic watch market by deeply integrating health management functions with premium coaching services. Coupled with a subsidy policy that effectively lowers the price to below a thousand yuan, this pricing strategy further strengthens the series' market competitiveness. Meanwhile, Xiaomi has launched the Xiaomi Band.10Continuously increasing investment in the basic smart band category, upgrading features and adopting fashionable designs to enhance personalized experiences while maintaining affordable pricing. This strategy helps Xiaomi achieve101%Its growth rate accelerated, and by attracting young users who are enthusiastic about chasing trendy technology, it consolidated its dominant position in the affordable market.

Apple's online and offline direct sales channels participated in the subsidy program for the first time in the second quarter, indicating the importance of using policies to optimize channel structure and strengthen official direct sales channels, which helps it maintain its market position in the high-end smart watch segment.

Chen Qiufan concluded: "As the National Health Commission"Health Management Year"With the promotion of the initiative, the public's fitness awareness has significantly increased, leading to a growing demand for high-end sports watches.。Although the scale of this niche market is still not large, it accounts for a significant portion of the market value of wearable wristbands in mainland China.10%, and for Garmin (Garmin)Brands like Gucci offer higher profit margins, providing a reference path for other manufacturers to achieve high-end transformation.。With the continued promotion of policies encouraging exercise fueling a nationwide fitness craze, manufacturers must seize the trend of localized fitness and introduce products that are more suitable for individual and group users.AICoaches and intelligent guidance in different sports scenarios. These innovations not only influence consumer behavior but also enable continuous optimization of product functions through feedback and data analysis.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories