China's PVA Optical Film Breaks Japan's 20-Year Monopoly with 120% Sales Surge

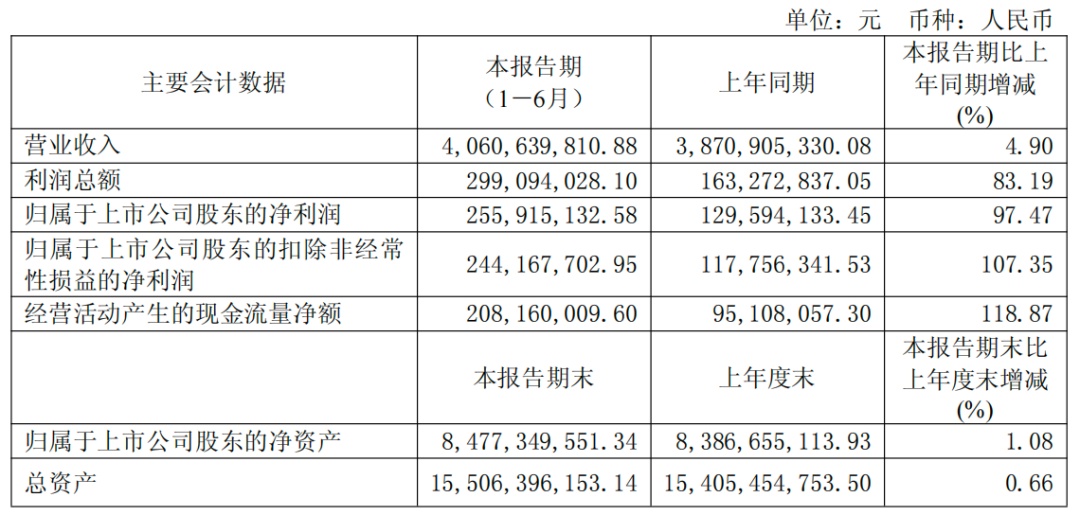

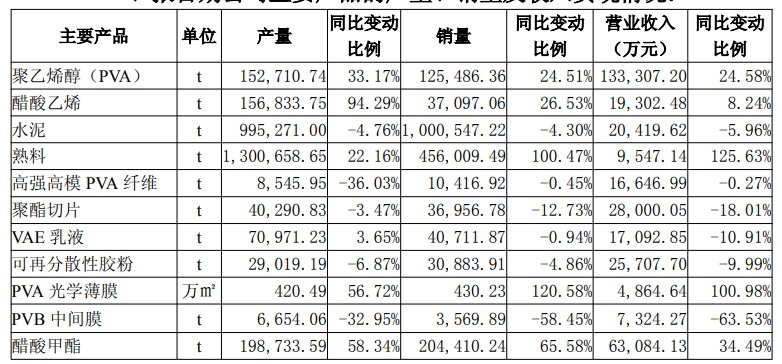

In August 2025, China's new materials industry witnessed a landmark event. Wanwei High-Tech (600063), a leading domestic enterprise in PVA optical films, released two significant announcements: a year-on-year net profit surge of 97.47% in the first half of the year and a 120.58% increase in PVA optical film sales. Additionally, the company announced a 10 billion yuan investment to construct a production base for ethylene-based PVA resin.

Source: Anhui Wanwei High-Tech

Source: Wanwei High-tech

These two sets of data reflect the complete breakthrough path of China in the field of high-end display materials, from technological innovation to the reconstruction of the industrial chain.

PVAOptical film breaks 20 Japanese companies.The pattern of annual monopoly

Polyvinyl alcohol (PVA), abbreviated as PVA, possesses the typical chemical properties of polyols, capable of undergoing reactions such as esterification, etherification, and acetalization. It has good chemical stability and excellent insulation, film-forming, gas barrier, and water solubility properties. These unique characteristics make it widely used in industries such as textiles, food, pharmaceuticals, films, construction, wood processing, paper making, printing, cosmetics, agriculture, metallurgy, and oil extraction.

PVA optical film, as the core material of polarizers, has long been monopolized by Japan's Kuraray and Sekisui Chemical, with Kuraray occupying 80% of the global market share and controlling the supply of upstream resin raw materials. Currently, the only domestic companies capable of independently producing PVA optical films are Anhui Wanwei High-Tech, Chuanwei Chemical, Chongqing Spectrum, and Taiwan Changchun, with a relatively low market share.

Source: Anhui Wuwei New Materials Co., Ltd.

This situation results in China's LCD panel industry incurring high import costs each year. According to data from Shiyin Film Chain, by 2025, China's demand for polarizer sheets will reach 300 million square meters, corresponding to nearly 200 million square meters of PVA optical film, with a market size exceeding 2 billion yuan.

Wanwei New Materials produced 4.2049 million square meters of PVA optical film in the first half of the year, a year-on-year increase of 56.72%; sales volume reached 4.3023 million square meters, soaring 120.58% year-on-year, achieving sales revenue of 48.6464 million yuan with a gross profit margin as high as 48.38%, up 18.55 percentage points compared to the same period last year. More notably, the company’s 7 million square meters per year wide-width production line has achieved stable mass production, and a new 20 million square meters production line will be put into operation in the second half of the year, directly targeting mainstream product specifications of Kolari.

Source: Anhui Weixin Materials

According to Zhang Qianlei, Deputy Director of the PVA Branch of Wanwei High-tech, at the 7th Polarizer Industry Conference held by Shiyin, the current domestic PVA optical films exhibit issues such as low stretching ratios in downstream applications, as well as defects like striations, curling, and scattered spots. The root cause of the insufficient product performance lies in the multi-scale structure and compositional inhomogeneity. To solve the "bottleneck" problem of PVA optical films, it is necessary to comprehensively overcome the technical barriers across the entire chain of resin, process, and equipment.

The PVA Behind the 10 Billion InvestmentResin Technology Route Dispute

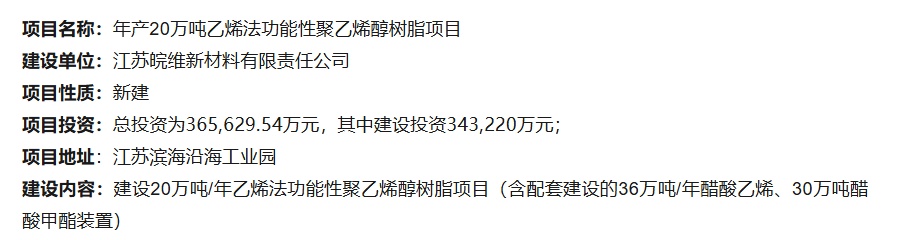

On August 15, Wanwei High-Tech announced plans to invest 10 billion yuan in building an ethylene-based PVA resin base in Binhai, Jiangsu, with an investment of 3.66 billion yuan for the first phase of the 200,000-ton project. This move is seen by the industry as a "direct confrontation" with Japan's Kuraray technology route.

Currently, there is a clear differentiation in the global PVA production process: China primarily uses the carbide acetylene process (accounting for 90% of domestic capacity), while Japan's Kuraray leads with the ethylene process, which, due to its low carbon and high-performance advantages, dominates the high-end market. Anhui Wanwei High-Tech has chosen to establish ethylene process capacity at coastal petrochemical bases, directly addressing industry pain points. According to DT New Materials, China's PVA exports will reach 210,200 tons in 2024, but high-end products still need to be imported. Once the ethylene process project is completed, it will fill the domestic gap.

Wanhua High-Tech has established a dual approach of "ethylene-based resin + optical film," forming a complete industrial chain from basic raw materials to high-end film materials. The company’s newly built 5,000-ton/year optical-grade PVA resin production line has already achieved mass production of TFT-grade resin, with performance indicators comparable to imported products, thereby providing a stable raw material supply for its optical film business. At the same time, Wanhua High-Tech actively carries out research and development related to PVA optical film technology, such as in-situ research methods for structural regulation during processing, gaining insights into the process-structure-property relationships of PVA optical films, and studies on the regulation of condensed structure uniformity in PVA optical films. As a result, the company has successfully developed TFT-LCD PVA optical films with thicknesses ranging from 30 to 75 microns and widths of up to 3.4 meters.

Challenges still exist. Japanese company Kuraray has begun to extend downstream by developing ultra-thin and high-transparency specialty optical films. Korean companies are also accelerating their technological reserves. Anhui Wanwei High-Tech stated in an announcement that it will allocate more resources to develop thin and high-transparency products, with plans to establish a production capacity of 60 million square meters by 2027, supporting polarizer production lines with a width of over 2 meters. In addition, to achieve investment savings and autonomy over core equipment, Anhui Wanwei High-Tech is actively promoting the domestic development of major equipment. Following the localization of large-size ultra-mirror casting rolls for PVA optical films, the company is pursuing the domestic development of major equipment for PVA optical film production lines, such as extruders and fully automatic winding machines.

Full Industry Chain Breakthrough: From Mass Production of Optical Films to Independent Ethylene-based Resin Manufacturing

The practice of Anhui Wei High-tech has revealed the development path of China's new materials industry: first achieving technological breakthroughs in niche fields (optical films), then extending upstream to core materials (PVA resin), and ultimately reconstructing the industrial chain through process innovation (ethylene method). This "reverse innovation" model provides a reference for tackling other bottleneck materials.

In this two-decade-long competition in PVA optical films, Chinese companies have transformed from followers into challengers. With the synergistic effect of technological breakthroughs and capacity expansion, the process of domestic substitution is expected to accelerate further, ultimately achieving independent and controllable key segments of the display industry chain.

Editor: Lily

Source of materials: Anhui Wanwei High-Tech Materials Co., Ltd. 2025 Semi-Annual Report, Shiyin Membrane Chain, DT New Materials, Yingji Petrochemical, High-Performance Membrane Materials, and other public reports.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track