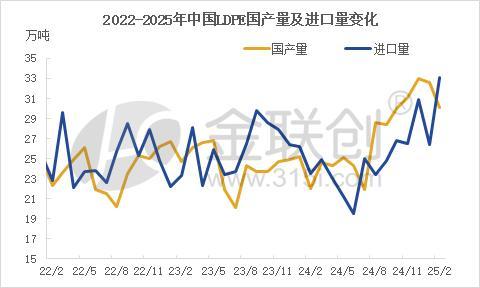

China's LDPE imports hit a three-year high in February

In February 2025, China's LDPE imports reached 331,000 tons, increasing by 40.72% year-on-year and 25.24% month-on-month. After the traditional Spring Festival holiday, some previously delayed orders arrived at the port successively. Coupled with the rapid rise in China's LDPE prices, the market outlook was optimistic, and the supply of overseas resources increased significantly, reaching a three-year high for monthly imports. According to customs data, the increase was more concentrated in major LDPE importing countries such as Iran, Russia, the United States, Saudi Arabia, and the United Arab Emirates. The import value was 394.9 million US dollars, increasing by 52.92% year-on-year and 21.55% month-on-month. The average import price was 1,193 US dollars/ton, increasing by 8.68% year-on-year and decreasing by 2.94% month-on-month.

Data source:Jinlianchuang

From the perspective of China's LDPE domestic production and import supply from 2022 to 2025, domestic production supply remains relatively stable, while import volumes fluctuate significantly due to differences in price volatility between domestic and international markets as well as changes in the global supply and demand landscape. However, a similar trend is observed: after August 2024, both domestic production and imports of LDPE in China increased, with peaks reaching their highest levels in nearly three years. Analysis shows that in China, the price spread inversion between EVA and LDPE has led to some EVA production facilities, such as those operated by Xinjiang TLHI Petrochemical and Ningxia Baofeng, temporarily switching to LDPE production. On the import front, a loose overseas supply coupled with China's traditional peak season driving LDPE demand has prompted international exporters to increase resource allocation to the stable Chinese market.

Data source:Gin Lite Join

From the perspective of the relationship between LDPE import volume and price from 2022 to 2025, the correlation coefficient between the two is -0.18, indicating an overall negative correlation. Currently, the flow of international resources is not only driven by profits but also influenced by the overall supply and demand dynamics both domestically and internationally. As a major consumer of plastics, China remains one of the key destinations for overseas resources. In terms of the changes in China's LDPE import volume from 2022 to 2025, imports began to decline continuously after August 2023, with a steep downward trend, reaching below 200,000 tons per month by June 2024. However, from July-August 2024 onward, China's LDPE import volume shifted to a fluctuating upward trend. By February 2025, the monthly import volume of LDPE in China reached its highest level since 2022.

In March, China's LDPE prices experienced a rapid decline, coupled with maintenance at some overseas facilities and reduced operations in certain regions due to Ramadan, leading to limited supply pressure for overseas resources. As a result, China's LDPE imports are expected to decrease in March. On the export side, driven by weaker LDPE prices in China and increased supply pressure, LDPE exports are projected to rise.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track