China's Degradable Plastic Bag Industry in 2025: Regional Market Differentiation, Emerging Markets Become the New Blue Ocean

Under the awakening of global environmental awareness and the drive of the "dual carbon" goals, degradable plastic bags, as a green alternative to traditional plastics, are undergoing a transformation from policy-mandated substitution to market-driven choice. As the world's largest producer and consumer of plastics, China has created a market with trillion-yuan potential through the triple synergy of upgraded "plastic restriction orders," technological breakthroughs, and consumption upgrades.

I. Industry Development Status Analysis

(I) Policy Driven: The Upgrade from "Plastic Restriction" to "Plastic Ban"

The explosive growth of China's degradable plastic bag industry stems from continuous strengthening of policies. Since the National Development and Reform Commission issued the "Opinions on Further Strengthening Plastic Pollution Control" in 2020, policy tools have shifted from administrative bans to market incentives, such as providing tax reductions to bio-based material enterprises and granting green procurement priority to degradable plastic products. After the full implementation of the "Plastic Ban" in 2025, non-degradable plastic bags will be prohibited in supermarkets, takeaway services, and other sectors in cities above the prefecture level, promoting the industry’s shift from "passive replacement" to "active innovation." In addition, the Ministry of Ecology and Environment’s "Three-Year Action Plan for Plastic Pollution Control (2025–2027)" clearly requires that by 2027, the substitution rate of degradable plastics should reach 35%, and the biodegradability rate of packaging materials in key sectors should not be less than 55%, further unleashing policy dividends.

(2) Technological Iteration: Competition and Integration of Diverse Material Systems

According to the China Research Institute of Puhua's "2025-2030 Degradable Plastic Bag Market Development Status Survey and Supply-Demand Pattern Analysis and Forecast ReportThe current technological approaches for degradable plastic bags show a "tripartite" pattern.

PLA (Polylactic Acid): Derived from biomass such as corn and cassava, it is produced by fermenting to obtain lactic acid and polymerizing. It has the advantages of biocompatibility and transparency, and is widely used in food packaging and 3D printing materials. Its cost has decreased from 28,000 RMB/ton in 2020 to 16,000 RMB/ton in 2025, and is expected to further decrease to 8,000 RMB/ton by 2030, promoting its application share in the daily chemical field from 15% to 30%.

PBAT (Polybutylene Adipate Terephthalate): A chemically synthesized material that combines flexibility and processability, making it a mainstream choice for courier bags and agricultural films. Its cost decreased from 25,000 RMB/ton in 2020 to 15,000 RMB/ton in 2025 and is expected to drop to 10,000 RMB/ton by 2030. The cost reduction will narrow the price gap between biodegradable plastic bags and traditional plastic bags from 3 times in 2020 to 1.5 times in 2025.

PHA (Polyhydroxyalkanoates): These are microbially synthesized materials that can completely degrade in natural environments. However, their cost is relatively high, and they are currently primarily used in high-end medical fields. Technological advancements focus on reducing costs and enhancing performance, such as by blending to improve the heat resistance of PBAT, or by utilizing synthetic biology techniques to optimize the fermentation efficiency of PHA.

(3) Consumption Upgrade: Environmental Awareness Drives Demand Differentiation

The awakening of consumers' environmental awareness is reshaping market rules. Research shows that by 2025, the recognition rate of biodegradable plastic bags among consumers in first-tier cities will reach 92%, with over 50% willing to pay a premium; on e-commerce platforms, searches for the keyword "eco-friendly packaging" have increased by 200% year-on-year, driving a surge in related product sales. The younger generation is no longer satisfied with “passive substitution” but actively pursues “personalized environmental protection” — for example, eco-friendly phone cases made from a composite of biodegradable materials and bamboo fiber, which combine practicality and environmental attributes, have become a “social currency” highly favored by young consumers. In addition, the advancement of waste sorting policies, especially the classification and treatment of kitchen waste, has increasingly intensified the demand for biodegradable garbage bags.

(Source of data: Compiled from comprehensive industry reports, market research, and publicly available data)

2. Competitive Landscape Analysis

(1) Market concentration: leading enterprises dominate, with differentiation in niche segments

The industry's CR5 will increase from 40% in 2024 to 50% in 2025, forming a competitive landscape of "comprehensive industry leaders + specialized and innovative enterprises."

Comprehensive Industry Leaders: Companies such as Kingfa Sci & Tech and Hengli Petrochemical have captured over 60% of the market share for bulk products like PBAT and PLA through their scale advantages and full industry chain. For example, Kingfa Sci & Tech achieves complete chain coverage from raw material BDO to end products by controlling large-scale PBAT projects.

Specialized and innovative enterprises such as BlueCrystal Microbe and Weigou Biosciences focus on PHA synthetic biology technology, entering high-end markets like healthcare and cosmetics through customized services. For example, Weigou Biosciences has developed next-generation engineered strains that shorten the fermentation cycle by 40% and increase product purity to 99%.

Cross-sector transformation players: Traditional packaging companies such as Amcor and Zijiang Enterprises have entered the biodegradable plastic bag field through acquisitions, but their gross profit margins are generally lower than those of specialized manufacturers.

(2) Regional Competition: The Effects of Industrial Clusters Emerge

The regional layout features a "three belts and multiple points" pattern.

Yangtze River Delta: Centered around Shanghai and Jiangsu, relying on chemical industry parks and scientific research resources, a PLA and PHA research and production cluster has been formed. For example, the bio-based materials industrial park in Jiaxing, Zhejiang, has attracted more than 20 leading enterprises, driving the local degradable plastic bag production capacity to achieve an average annual growth rate of over 20% for five consecutive years.

The Pearl River Delta: Guangdong and Fujian focus on the fields of express packaging and electronic materials, promoting the integration of biodegradable plastics and intelligent manufacturing. For example, an intelligent equipment company in Dongguan has developed flexible printing technology, increasing the production efficiency of biodegradable plastic bags by 30%.

Northwest Region: Xinjiang and Inner Mongolia utilize biomass resources such as corn stalks and beet pulp to develop raw material bases for bio-based materials. For example, the PBAT project in Korla, Xinjiang leverages the region’s abundant natural gas resources to reduce production costs by 15%.

3. Supply and Demand Analysis

(1) Supply Side: The Game Between Capacity Expansion and Technological Bottlenecks

Domestic enterprises rapidly expand production capacity through "technology introduction plus independent innovation."

Leading companies such as Kingfa Sci. & Tech. and Hengli Petrochemical have established integrated PBAT production lines, achieving full-chain coverage from raw material BDO to end products.

New entrants: Chemical giants such as Wanhua Chemical and Sinopec are leveraging their advantages in synthetic technology to enter the PLA market, breaking the foreign technological monopoly on lactide (PLA intermediate).

Technical bottlenecks: Issues such as low PHA synthesis efficiency and insufficient heat resistance of PLA remain to be resolved. For example, the current heat distortion temperature of PLA materials is 120°C, whereas market demands require it to be increased to above 180°C to suit usage scenarios in high-temperature environments.

(2) Demand Side: Dual Pull from Rigid Policy Demand and Consumption Upgrade

Demand growth shows characteristics of "structural differentiation."

Policy-driven demand: The replacement demand in areas such as express packaging, takeaway food containers, and agricultural films is dominant. For example, according to data from the State Post Bureau, express delivery volume reached 130 billion parcels in 2023. If 30% use degradable bags, the market size will exceed 20 billion yuan.

Consumption upgrade demand: The preference for bio-based packaging materials in high-end cosmetics and maternal and infant products is increasing. For example, international brands like L'Oreal and Estée Lauder have adopted degradable plastic bags as standard configurations for high-end products.

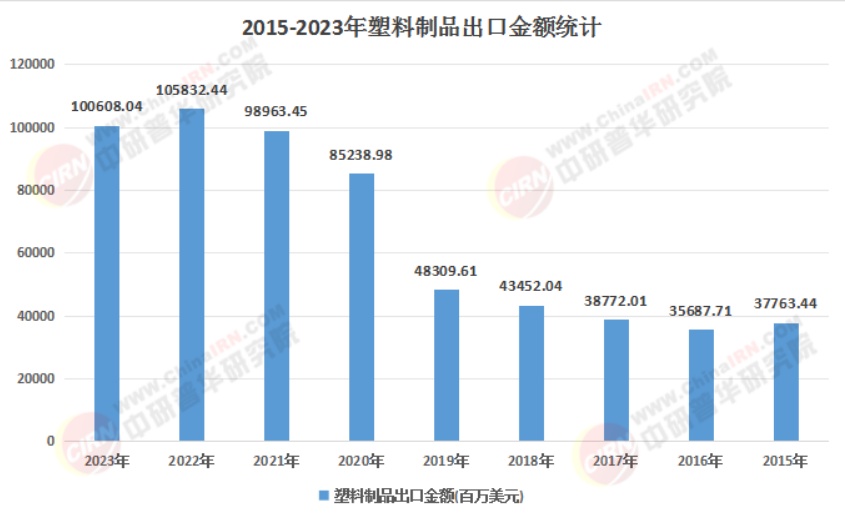

Export-oriented demand: The EU's "carbon tariff" policy compels Chinese export enterprises to adopt biodegradable packaging. For example, in 2025, the demand for biodegradable plastics in cross-border e-commerce surged, driving an 80% year-on-year increase in export volume.

4. Industry Development Trend Analysis

(1) Technological iteration: from "degradable" to "high performance"

The next generation of biodegradable materials will break through the limitations of being "environmentally friendly but low performance." For example, by 2027, the heat resistance of PLA will be improved (heat distortion temperature increased from 120°C to 180°C). By 2030, the cost of PHA materials will drop to 5,000 yuan per ton, promoting their application in high-end fields such as automotive interiors and 3D printing. In addition, breakthroughs in chemical recycling technology will address the issue of recycling waste plastics. For instance, Guangdong Dongyue Chemical's "one-step" mixed waste plastic pyrolysis technology reduces resource recovery costs by 35% compared to traditional physical recycling.

(2) Market Expansion: From Packaging to High-end Manufacturing

The application scenarios have extended from the packaging sector to high-end manufacturing, forming a "tripartite" pattern.

In the packaging sector, the demand for alternatives to express delivery bags, takeout food containers, and supermarket shopping bags is surging. For example, JD.com plans to achieve a 50% share of biodegradable packaging by 2025, driving the related market size to exceed 30 billion yuan.

In the agricultural sector, there has been a surge in demand for agricultural products such as plastic mulch films and seedling pots. For example, in pilot projects in Northwest China, biodegradable mulch films have demonstrated significant water retention effects and extended service life up to 180 days, effectively addressing the “white pollution” problem caused by traditional plastic mulch.

Medical field: High-end applications such as surgical sutures and drug sustained-release carriers are accelerating their penetration. For example, PLA sutures can be fully absorbed by the human body, avoiding the risk of secondary surgery and becoming a hot spot for innovation in the medical industry.

(3) Globalization Layout: From "Follower" to "Leader"

Chinese companies' share in the global market continues to rise. By 2025, China's production capacity for biodegradable plastics will account for 55% of the global total, with export volumes increasing by 60% year-on-year, mainly to emerging markets such as Southeast Asia and the Middle East. It is expected that by 2030, China will lead in the formulation of 60% of global biodegradable plastic technology standards. For example, the chemical recycling technology developed by East China Normal University has been included in the EU's "Green Technology Promotion List," and a leading company's "Blue Cycle" project has won the United Nations' Champions of the Earth award. Its digital tracking system has tripled the efficiency of ocean plastic recycling.

V. Investment Strategy Analysis

(1) Technology Positioning: Focusing on High-Performance Materials and Chemical Recycling

High-performance materials R&D: Industrialization projects for high-performance materials such as PHA and bio-based PC have explosive potential. For example, companies engaged in strain improvement that can reduce PLA costs by more than 20% often establish joint laboratories with research institutions such as the Chinese Academy of Sciences and East China University of Science and Technology, resulting in technology commercialization cycles that are typically shortened by 18 months compared to the industry average.

Chemical recycling technology: Companies with full-chain capabilities in "cracking-purification-modification" are worth attention. For example, technology companies with catalyst efficiency over 99% and product purity reaching 99.5% can shorten the equipment investment payback period to within 3 years.

(2) Market Expansion: Targeting Lower-Tier Markets and Cross-Border E-commerce

The sinking market: The market in third- and fourth-tier cities is becoming saturated, with the potential of the county market being particularly notable. For example, a certain company promoted an "eco-friendly points exchange" model in county supermarkets, where consumers could accumulate points by using biodegradable plastic bags to exchange for daily necessities. This led to an increase in the local market penetration rate from 12% to 45% within three months.

Cross-border E-commerce: The EU REACH regulation’s restrictions on oxo-degradable additives have hindered 80% of Chinese export enterprises, but companies whose products are certified under EN13432 can achieve a price premium of up to 40%. It is recommended to give priority to enterprises that have established R&D centers and testing laboratories in Europe.

(3) Full Industry Chain Layout: Building an Ecological Closed Loop

Enterprises with full industry chain layout are creating new value growth points. These enterprises typically have three major characteristics: controlling upstream raw material bases of 300,000 tons-level lactic acid/PTA, possessing midstream modified composite material production lines, and establishing a downstream “product-recycling-remanufacturing” closed-loop system. Data shows that eco-friendly enterprises have a gross profit margin 12 to 15 percentage points higher than single-segment enterprises. For example, a leading company developed a "degradable plastics cloud platform" that uses IoT technology to achieve full lifecycle management from raw material procurement to waste traceability, resulting in a 25% increase in customer retention.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track