China's Building Materials Companies Struggle Abroad | Juchao

The domestic real estate market has plunged into a freeze, and the building materials industry is caught in the crossfire. This industry, which once "parasitized" the real estate ecosystem, is now facing a systemic decline.

Data shows that just last year, 2,400 construction companies nationwide "died," with an average of 6 exiting the market each day. As numerous real estate companies are collapsing one after another, construction sites have fallen silent, and the entire building materials market is experiencing unprecedented quietness. Coupled with rigid environmental constraints and the collapse of traditional channels, the building materials industry is facing a life-or-death transformation.

Currently, going overseas has become a common choice for many building material enterprises. After all, besides Europe and America, the overseas market is still quite vast, with many emerging countries having low urbanization rates and huge potential for real estate investment and development. Moreover, overseas countries generally lack large-scale industrial manufacturing capabilities, and their high-end technology equipment, supporting supply chains, and levels of environmental protection are not keeping up with market demand.

For Chinese building materials companies, this is a clear market opportunity.

The problem is that the Chinese building materials and home furnishing industry is mixed, with participants of varying quality. The industry is not short of rough entrepreneurs and newly wealthy individuals who have made their fortunes during the golden era of real estate. The overseas market is unpredictable, with different languages, laws, and consumer preferences, which require meticulous cultivation and localized operations. It also necessitates strong Chinese construction companies to "take the lead."

These restrictive factors make the building materials industry seem to have many enterprises, but only a very few truly have the capability to successfully expand overseas.

Due to the influence of urbanization levels and infrastructure standards in various countries, the domestic and international building materials and home furnishings markets are in completely different development cycles.

The building materials market, as an upstream and downstream part of the real estate industry, was once thriving. Real estate giants rapidly expanded, and a large number of building materials companies profited alongside them. However, when the wave of defaults hit the real estate industry, transaction volumes and investment development plummeted, severing the "blood supply arteries." Demand suddenly weakened, and thousands of building materials practitioners found themselves trapped in a life-and-death predicament.

The real estate data appears extremely harsh and cold, leaving little room for survival for building materials companies. Over the past three years, the prices of commercial housing across the country have continued to decline, with typical examples such as Wuhu dropping by 52%, and Xiamen, Nanjing, and Xuzhou experiencing declines of over 40%.

The three major indices that reflect the prosperity and decline of the industry have all turned downward. Following a decline in 2024, there is still no improvement after 2025.

In the first ten months of this year, nationwide real estate development investment reached 73,563 billion yuan, a year-on-year decrease of 14.7%; the area under construction and the area delivered also decreased by 9.4% and 6.8%, respectively.

Building materials companies are suffering greatly; the "parasitic prosperity" that relied on the expansion of real estate has no choice but to collapse.

Hefei Construction and Nantong Sixth Construction, among other "industry veterans," have gone directly into bankruptcy liquidation; even strong companies like Shanghai Construction and Beijing Urban Construction have started looking for work outside their provinces; Guotian Co., which was severely impacted by Evergrande, is left with 3.247 billion yuan in commercial bills that have turned into worthless paper and is reluctantly seeking to sell itself to survive; the national decoration leader Jintantang is owed 4.1 billion yuan by Evergrande; Jiayu Co., primarily engaged in curtain walls and windows, is holding 1.316 billion yuan in Evergrande commercial bills and ultimately had to delist.

In 2024, among the 17 listed companies in China's building materials industry, 14 experienced a decline in net profit or losses compared to the previous year. By the first three quarters of this year, except for the improvement in the cement and glass fiber sectors, the two leading companies, Oriental Yuhong and BNBM, are still undergoing performance adjustments.

Even large enterprises are facing such difficulties, making it even harder for small and medium-sized enterprises to survive. On online platforms, Mr. Li, a steel dealer from Tangshan who has been in business for 20 years, now has an account balance of less than 50,000 yuan; a ceramic factory in Foshan has shut down its kilns, and employees are on leave...

The incremental growth has almost been cut off, upstream prices are fluctuating dramatically, and downstream real estate companies are unable to settle their accounts. Even if completed, they can only receive accounts receivable, commercial bills, and housing offsets that cannot be monetized.

Just as the domestic building materials and home furnishings market enters a state of saturation and sluggish sales, the situation overseas presents a different picture.

The Middle East, Australia, Southeast Asia, Africa, and other regions are experiencing new cycles of urbanization, population growth, or housing construction, with demand remaining strong. More importantly, overseas markets are far less competitive than the domestic market, and many countries lack the capability to produce basic building materials. Many countries have long been in a state of supply shortage, resulting in higher building material prices and higher profit margins.

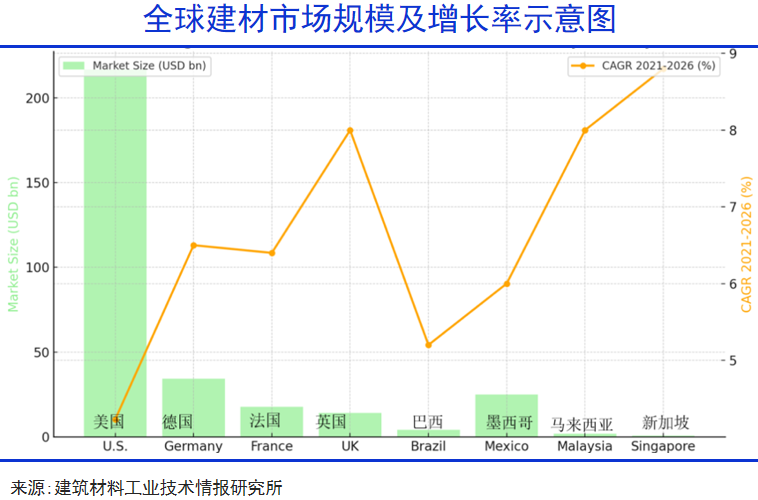

Research shows that the construction materials market in Malaysia, Singapore, Mexico, Brazil, the Middle East, and the vast region of Africa is expected to grow significantly faster than that of the domestic market in the coming years.

Clearly, a contrasting pattern of "ice and fire" has emerged between domestic and overseas markets, making overseas expansion a mandatory course for Chinese building materials companies.

Nowadays, whether overseas deployment has been achieved has become one of the core indicators for evaluating the value of building material enterprises.

Based on the released third-quarter reports, there is significant divergence within the building materials industry. Companies with a high overseas presence generally perform well, while those relying on domestic demand are generally facing difficulties.

For example, one of the leading building materials companies in China, Beijing New Building Materials, has only a 2.4% share in foreign markets and has ended two years of counter-cyclical growth. In the first three quarters of this year, both its revenue and profit declined, with a net profit attributable to shareholders dropping by 17.77%. In the third quarter, it plummeted by nearly 30%, and its profitability also weakened simultaneously.

One major reason for this situation is that Taishan brand gypsum board, under Beijing New Building Materials Group, faced significant pressure during the domestic real estate downturn, encountering severe challenges with both volume and price declines.

Oriental Yuhong, a waterproof faucet manufacturer, is closely tied to the real estate sector, caught in a fate of "success and failure both depend on real estate." 80% of the waterproofing projects in residential developments by major real estate developers Poly and Vanke are handled by Oriental Yuhong. In 2022, the domestic top 50 real estate companies contributed 65% of Oriental Yuhong's revenue, and by 2025, this proportion will still be as high as 45%.

Over-reliance on real estate channels has led to increased difficulty in returns and a surge in bad debts. In the first three quarters alone, the company made provisions for losses amounting to 688 million yuan, indirectly causing a 37% drop in net profit. As a result, Oriental Yuhong has shifted its business focus to the Middle East and Latin American markets.

Companies that have proactively expanded into overseas markets have achieved growth against the trend during this adjustment cycle.

West China Cement, listed in Hong Kong, was originally a leading cement company in Shaanxi. It began its overseas expansion strategy as early as 2020, setting its sights on the vast regions of Sub-Saharan Africa. Its first production line was established in Mozambique, and since then, it has entered a new country each year. By the end of 2024, it had expanded into Mozambique, the Democratic Republic of the Congo, Ethiopia, and Uzbekistan in East Asia.

In the first half of this year, its African business accounted for as much as 40%, becoming a significant growth driver for the company.

Moreover, the selling price and profit of cement in Africa are much higher than those in China. China's cement production has declined by 30% from its peak. In terms of price, in October 2021, cement prices once exceeded 600 yuan/ton, and then continued to decline, dropping below 350 yuan/ton by mid-year. In contrast, cement prices in Africa are generally higher, with the lowest in South Africa at 66 USD/ton, while in the Democratic Republic of Congo and Cameroon, prices are as high as 110 USD/ton.

High prices lead to high profitability, with West Cement achieving a gross profit margin of 30.03% and a net profit margin of 16.52% in the first half of the year, both of which are 5 percentage points higher than the industry giant Conch Cement.

The leading ceramic company, Keda Industrial Group, has also been focusing on Africa, with 11 production bases in 7 countries including Kenya, Ghana, Tanzania, Senegal, Zambia, Cameroon, and Ivory Coast. They operate 21 building ceramic production lines, 2 glass production lines, and 2 sanitary ware production lines. Meanwhile, their glass project in South America, Peru, is also progressing and is expected to commence production in 2026.

The profitability of the African tile business is also significantly higher than that of the domestic market. Driven by both volume and price, its overseas building materials business achieved a revenue of 3.771 billion yuan in the first half of the year, a year-on-year increase of 90.08%, with a gross profit margin of 36.8%.

Huaxin Cement, backed by its foreign shareholder (Swiss Holcim Group, one of the world's largest cement manufacturers), is expanding its presence in Africa. Following its previous acquisition of cement assets in Nigeria, it plans to invest $187 million to acquire four aggregate plants in Brazil. In the first half of this year, Huaxin Cement's overseas revenue reached 4.43 billion yuan, accounting for 27.6% of total revenue, with a gross margin of 37.3%. In the first three quarters, it achieved a net profit of 2.004 billion yuan, a year-on-year increase of 76.01%.

With the support of their overseas business, these companies have demonstrated an "alpha attribute" in the capital market that surpasses the overall trend. Among them, Western Cement's stock price has reached new highs, Huaxin Cement has doubled this year, and Keda Manufacturing has risen by 65%.

It is evident that going overseas has become a powerful tool for building materials companies to break free from the quagmire of transformation, and it has gained recognition from the discerning capital market.

In summary, for domestic building material companies struggling in tough conditions, going overseas means a vast world of opportunities. The differing climates of the domestic and international construction industries are causing the overseas building material market to burst with limitless potential.

According to data from the General Administration of Customs, under the RCEP framework, the average annual growth rate of ASEAN's export of decoration materials over the past five years has reached 35.6%, making it one of the fastest-growing regions in the global building materials industry.

As one of the representatives of ASEAN countries, Kuala Lumpur, the capital of Malaysia, is lined with cranes. After the Malaysian government announced a construction investment plan of 611 billion ringgit (about 140 billion US dollars), skyscrapers are rising one after another in this "bridgehead of Southeast Asia."

Middle Eastern tycoons are also spending lavishly to achieve strategic plans for economic transformation in their countries.

Saudi Arabia's "Vision 2030" is set to unleash approximately $1.1 trillion in infrastructure investments, with plans to build 150 smart cities and 85 industrial projects this year alone. Dubai has announced that it will allocate 46% of its government budget to infrastructure this year, covering roads, bridges, energy, and new airports. Qatar's "Vision 2030" has also earmarked over $200 billion for investments focused on urban development, transportation, and energy.

Australia is experiencing a similar situation. The Housing Industry Association (HIA) in Australia indicates that there is a housing shortfall of over 300,000 units nationwide, prompting the government to urgently advance plans for renovating old buildings and constructing new ones.

Even in impoverished Africa, the "demographic dividend" is driving the demand for housing, transportation, and other infrastructure. According to United Nations projections, Africa's urban population is expected to surpass 1 billion by 2035. This unprecedented process of urbanization will create a rigid demand for 2 million housing units and 35,000 kilometers of roads each year, revealing the emergence of a huge new runway for building materials.

However, exporting is not equivalent to going overseas; there is a dimensional difference between foreign trade and going overseas.

In China, the industry ecosystem of doors and windows, flooring, tiles, and decoration is composed of numerous participants, with a mix of quality and capabilities. The "rough and tough" entrepreneurs who got rich overnight due to the era's dividends find it difficult to adapt to the complex processes of entering the global market. Meanwhile, the small and medium-sized bosses who have achieved wealth through the opportunities provided by the times also lack sufficient financial resources to participate in international competition.

Only a few building materials companies are truly capable of overseas expansion, landing, and operation. Moreover, going abroad requires restructuring of supply chains, channels, brands, production capacity, and other aspects, which is not a game that small players with limited financial management capabilities can participate in.

Moreover, overseas markets, particularly in developed countries, have extremely strict reviews regarding product quality. As mentioned earlier, a leading domestic enterprise in the building materials industry, China National Building Material Group Corporation (CNBM), faced lawsuits from multiple American homeowners and construction companies starting in 2009 due to various issues, demanding compensation for damages.

In 2019 alone, Beixin Building Materials incurred 2.091 billion yuan (extraordinary expenditure) in litigation and settlement costs, nearly five times its net profit for that year. As of today, there is still one case that remains unresolved, and the economic loss has yet to be assessed.

Although Dongfang Yuhong started its overseas expansion early, it still cannot escape the torment of the domestic real estate cycle. Now, the company has chosen a difficult path—merging and acquiring distributor networks/overseas enterprises, along with building its own production bases.

The company plans to acquire a 60% stake in Brazilian cement additives and concrete admixtures company Novakem for 144 million yuan. It has also acquired leading Hong Kong building materials retail company Man Cheong Hardware and well-known Chilean building materials retailer Construmart, establishing an exclusive distribution system overseas.

At the same time, Dongfang Yuhong is accelerating the establishment of production bases in Houston, Saudi Arabia, Malaysia, and other locations to achieve localized supply.

Currently, this overseas strategy has been effective, with overseas contributions reaching 576 million yuan in the first half of the year, a year-on-year increase of 42.12%, accounting for 4.42% of the total. However, due to the excessively high proportion from the domestic market, the rapidly growing overseas business has not yet been able to offset the downward trend in the domestic market, and the company's adjustment period is still ongoing.

For the larger number of small and medium-sized enterprises, they have already suffered a huge impact from the Chinese real estate industry and have even fewer resources to expand overseas. The high cost of trial and error makes it a game only for the strong when it comes to the export of building materials.

Written at the end

Written at the end

In the historical tide of globalization, Chinese building materials enterprises are not the pioneers; industry giants such as Saint-Gobain, Swiss Holcim Group, and Irish CRH Group are leaders in international layout.

According to the list released by the China Building Materials Federation, although there are many Chinese-funded enterprises (33 in total), their average revenue and operating profit have both decreased by 7.1% and 17.6%, respectively.

China National Building Material, the largest company in the domestic market, ranks fourth in global revenue but only tenth in profit. In comparison, companies with operating profits exceeding $2 billion are all from Europe and North America. Saint-Gobain, with 1.7 times the revenue of China National Building Material, generates three times the profit of the latter, fully demonstrating the strength of this 360-year-old company.

While Chinese companies are generally under pressure in their performance, European companies are achieving sustained value growth by maintaining high product prices and high profits in different markets, thanks to domestic supply-side constraints and diversified layouts across multiple global markets.

The problem is that the successful experiences of these large European and American companies are difficult for Chinese building material enterprises to replicate. The situations faced by both sides on the supply side are almost completely different, which results in Chinese companies' profitability and risk resistance capabilities being unable to approach those of the European and American giants.

Drifting overseas is an inevitability for Chinese building materials companies that are unwilling to perish in a downturn cycle, and it will inevitably lead to a fateful confrontation between Chinese enterprises and their European and American counterparts.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Nissan Cuts Production of New Leaf EV in Half Due to Battery Shortage

-

Mexico officially imposes tariffs on 1,400 chinese products, with rates up to 50%

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?