China Titanium Ore and Titanium Dioxide Market Report for the Third Quarter of 2025

In the third quarter of 2025, the titanium market showed mixed trends. Prices of some products like titanium slag and sponge titanium continued to decline, while prices of titanium ore and titanium dioxide rebounded. The global economic environment remains challenging, and the strong season effect in September had a limited overall impact. With the continuous release of production capacity in recent years, the titanium industry is facing an increasingly severe oversupply situation, where costs and demand are in a constant tug-of-war, leading to a weakening trend in titanium market prices.

Titanium DioxideMarket Price Analysis

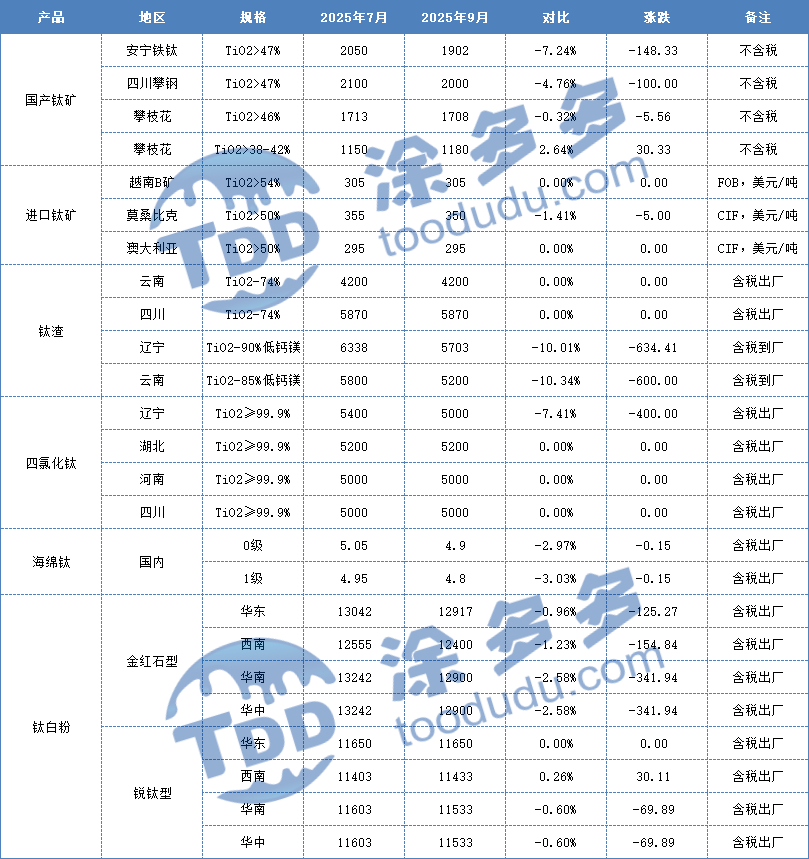

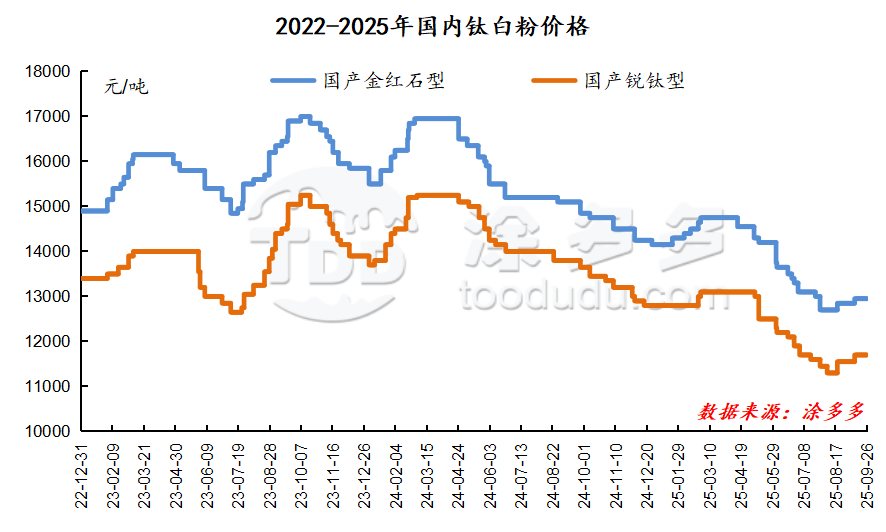

In the third quarter of 2025, the market prices of titanium dioxide in China experienced a "rise and fall" trend. By the end of the quarter, the ex-factory price of rutile titanium dioxide, including tax, was between 12,700 and 13,200 yuan per ton, while the ex-factory price of anatase titanium dioxide, including tax, was between 11,600 and 11,800 yuan per ton. Compared to the beginning of the quarter, the price of rutile titanium dioxide decreased by around 350 yuan per ton, a decline of 2.63%. The price of anatase titanium dioxide decreased by around 100 yuan per ton, a decline of 0.85%, compared to the initial price range of 11,600 to 12,200 yuan per ton.

In July, the price of titanium dioxide was reduced by about 600 yuan/ton. Due to the continuous rise in raw material costs, the situation of factory losses worsened. At the beginning of July, Longbai Group's distributor prices were reduced by 200-500 yuan/ton, and some companies in the market adjusted their prices accordingly. There was a slight improvement in short-term sales; however, the foreign trade market remained severe. Exports to Southeast Asia and re-exports began to implement tariffs, and the number of companies reducing production increased. Meanwhile, market inventory had not yet decreased. At the end of July, a rebate policy based on task completion was implemented, narrowing the price difference of titanium dioxide. In early August, Longbai Group's prices were reduced again, reaching basically the lowest point of the year. Coupled with a decline in production, a price increase trend began in the titanium dioxide market in mid to late August. With the impact of the peak season in September, the market anticipated stockpiling, and factory inventories gradually decreased. In September, market prices increased by 300 yuan/ton, but sales were not as expected. Due to some existing orders, there was no significant pressure on inventory. By the end of the month, major paint manufacturers' October bidding prices mostly remained unchanged, with a few high prices reduced by 100 yuan/ton, keeping titanium dioxide prices firm.

Demand in the peak season has been advanced, and the demand side continues to show a weak trend. It is reported that the tariffs on foreign trade exports to India will be canceled by the end of September. In addition, the suspension of capacity expansion by international titanium dioxide companies will be beneficial for the titanium dioxide market in the fourth quarter. Moreover, with the decline in sulfuric acid prices, factory profitability has improved, and the titanium dioxide market may see a rebound.

Average monthly price of titanium dioxide in the third quarter:

II. Forecast Analysis of Titanium Dioxide Market

This year, the demand for titanium dioxide is unlikely to change from its weak trend, with a tug-of-war between cost and demand suppressing the reduction of titanium dioxide production. The timeline for the resumption of operations at major companies' factories in Hubei remains uncertain, but new production capacities are expected to gradually be released in the fourth quarter, leading to a slight increase in titanium dioxide output. Exports of titanium dioxide are showing a downward trend due to disturbances from overseas anti-dumping measures, although there may be some increase in exports to India in the fourth quarter. The recovery in downstream demand from industries such as coatings and plastics remains sluggish, constraining the titanium dioxide market. Market opinions on the future are mixed, with both positive and negative factors intertwined in the fourth quarter, and the titanium dioxide market is still facing significant pressure going forward.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track