China-Europe Automotive Trade Deficit Reaches 19 Billion Yuan, Who Still Dares to Say Chinese Cars Are Not Strong?

With the development of the industry and technological advancements, Chinese automobiles are gradually entering overseas markets and connecting with the global landscape. In this process, the influence of Chinese automobiles is also gradually increasing. However, it is surprising to see just how strong the influence of Chinese automobiles has become. According to reports, by the end of this year, the number of cars imported from China to EU member countries may surpass the number of cars exported for the first time.

What is important to note is that in our inherent impression, although China's automobile exports are booming, especially with the continuous breaking of sales records in recent years, Europe, as the cradle of the automotive industry, has always been an output market for automotive products and technology, exporting advanced products and technologies to the world and earning a considerable "profit margin," known as trade surplus.

In 2022, Europe had a surplus of 15 billion euros in automotive exports to China. However, just three years later, the situation has fundamentally reversed. Reports indicate that for the first time, Sino-European automotive trade is expected to show a deficit, with the EU's imports of automobiles from China projected to exceed its exports by 2.3 billion euros (approximately 19.09 billion yuan).

Do not underestimate this phenomenon of offensive and defensive transformation, because this shift is not only a clear signal of the rise of China's automotive industry but also a landmark event in the restructuring of the global automotive industry's power structure. In the future, the trade surplus of European car exports to China may be gone forever. Given this perspective, who can still say that Chinese cars are not strong?

01Relying on the new energy revolution, China-Europe automotive offensive and defensive reshaping.

For a long time, the European automotive industry has been almost synonymous with automotive civilization.

German engineers' exquisite craftsmanship, Italian design's dynamic aesthetics, and French cars' unique character collectively form an unshakeable brand perception in the minds of global consumers. Despite its vast size, the Chinese automotive market has long played the role of a "student"—exchanging market for technology and capacity for experience.

At the beginning of the 21st century, the medium-to-high-end cars on Chinese roads were almost all European brands. German brands such as Volkswagen, Mercedes-Benz, BMW, and Audi dominated the Chinese high-end car market. In contrast, Chinese domestic brands were squeezed into the low-end market, struggling to survive. At that time, the European automotive industry had full confidence in the Chinese market with its technological superiority, strong brands, and mature supply chains, forming a comprehensive competitive advantage.

The turning point began with the wave of the new energy revolution. While traditional automotive giants were meticulously refining internal combustion engines, Chinese car companies keenly captured the historical opportunity of energy transition. Through a multifaceted approach that includes policy support, capital investment, technological innovation, and market cultivation, China's new energy vehicle industry has achieved leapfrog development. Now, the tide of offensive and defensive has shifted.

The rise of China's automotive industry is not a coincidence; it is built on technological breakthroughs. These breakthroughs collectively constitute a "dimensionality reduction attack" on the traditional advantages of Europe.

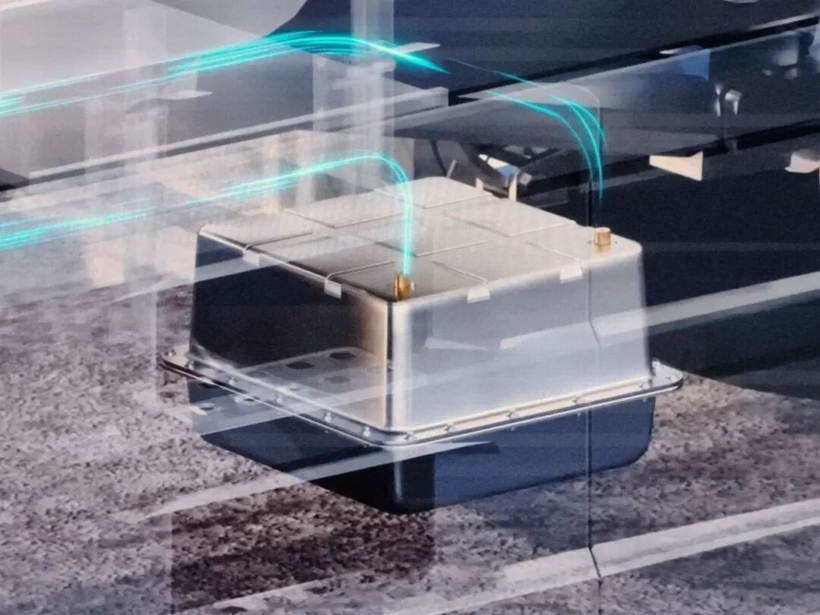

Among them, breakthroughs in battery technology in China are the cornerstone of the rise of the new energy vehicle industry. Companies like CATL and BYD not only dominate the global battery market but also have made early deployments in next-generation technologies such as solid-state batteries and sodium-ion batteries. The average range of Chinese new energy vehicles has increased from less than 200 kilometers a decade ago to over 600 kilometers now, with some high-end models even exceeding 1,000 kilometers. This indicator has far surpassed most similar products in Europe.

If electrification is the first half of the automotive industry's game, then intelligence is the decisive key to the second half. Chinese car companies have invested and innovated far more in areas such as smart cockpits, advanced driver assistance systems, and vehicle networking than their European counterparts. Companies like Huawei, Xpeng, and NIO have transformed cars from mere transportation tools into "mobile intelligent spaces," achieving a qualitative leap in human-vehicle interaction experience. This comprehensive intelligent experience precisely hits the core needs of young consumers.

At the same time, Chinese new energy vehicles not only lead in technology but also have significant advantages in cost control. Through vertical integration of the industrial chain, large-scale production, and innovative business models, Chinese car companies have successfully lowered the price of high-end electric vehicles to a range acceptable to ordinary consumers. The pricing strategy of BYD's Dolphin and Seal series in the European market has placed unprecedented price pressure on local European car manufacturers.

Of course, the rise of China's automotive industry is inseparable from a large and efficient new energy vehicle industry chain. From upstream lithium ore mining and battery materials to midstream battery manufacturing and electric drive systems, and down to downstream vehicle manufacturing and charging facilities, China has formed the world's most complete and dense new energy vehicle industrial cluster.

The advantages brought by this cluster effect are multifaceted: first, collaborative R&D allows enterprises at all stages of the industrial chain to quickly respond to technological changes; second, cost advantages are realized as industrial clusters reduce logistics and collaboration costs; third, innovation is accelerated as a complete industrial chain provides rich application scenarios and opportunities for iteration in technological innovation.

In contrast, although the European new energy vehicle industry chain is also under construction, the dispersed industrial layout, high labor costs, and lack of unified technical standards make it difficult to form a cluster effect comparable to that of China. European car companies have to rely heavily on batteries, electric drive systems, and even intelligent cockpit solutions from China, further exacerbating their dependence on the Chinese supply chain.

Certainly, the success of Chinese car manufacturers in the European market is not only attributed to product strength but also benefits from precise market strategies. Contrary to the early impression of "low price, low quality" associated with Chinese manufacturing, the new generation of Chinese automotive brands has adopted a distinctly different approach in Europe. This includes the localization of service networks, differentiated brand positioning, and culturally integrated brand narratives. Together, they have woven an industrial web that successfully captures Europe, the cradle of the automotive industry, with a respectful approach.

02Europe's Anxiety: Can Protectionism Reverse the Downturn?

Faced with the strong rise of Chinese automobiles, the European automotive industry has shown clear anxiety.

The recent report released by the German Association of the Automotive Industry (VDA) indicates that the share of technological patents in the electric vehicle sector held by Europe has decreased from 50% in 2015 to 35% in 2024, while China's share has increased from 15% to 40% in the same period. This change in data directly reflects the shift in technological advantage.

Faced with anxious sentiments, Europe's response strategy is showing two trends: on one hand, some European companies are calling for stricter protectionist measures, such as the "EU Made" labeling system (requiring a localization rate of over 80% for complete vehicles), attempting to protect domestic industries through trade barriers; on the other hand, European car manufacturers are also accelerating the integration of resources, with the cooperation plan between Renault and Ford being a typical example, aimed at reducing research and development costs through alliances and speeding up the transition to electrification.

However, protectionist measures can be a double-edged sword. Excessively strict localization requirements will drive up production costs and weaken the price competitiveness of European electric vehicles; while alliances and collaborations among companies can help share costs, they also face challenges such as cultural integration and decision-making efficiency. More importantly, there remains a significant question as to whether European consumers will be willing to pay higher prices to "protect domestic industries."

Overall, the emergence of a trade deficit in the automotive sector between China and Europe reflects a deep-seated trend in the global transition to new energy vehicles. Behind this shift lies a competition between two different industrial development paths.

The transformation path of the European automotive industry is "gradual," transitioning progressively towards electrification while retaining the advantages of traditional fuel vehicles. The advantage of this path is its stability, but its disadvantages include a slower transformation speed and susceptibility to obstruction by vested interest groups.

The path of China's automobile industry is "leapfrogging," using the new energy vehicle track to achieve a curve overtaking of traditional automotive powerhouses. This path carries higher risks, but once successful, it can establish a brand-new industrial advantage and competitive barriers.

At a deeper level, the China-Europe automotive trade deficit is a reflection of the restructuring of the global supply chain. The global division of labor system, previously centered around developed countries with developing countries on the periphery, is undergoing change. Through independent innovation and industrial upgrading, China is transforming from an "executor" to a "designer" and "leader" in the global supply chain. This transformation is not only evident in the automotive industry but is also occurring simultaneously in various high-tech fields such as semiconductors, artificial intelligence, and biotechnology.

However, the emergence of the Sino-European automotive trade deficit does not signify the start of a zero-sum game; instead, it may foster a new cooperative competitive balance. The global automotive industry's transition to electrification and intelligentization requires substantial R&D investment and market development, which a single country or region can hardly bear all the costs and risks. The complementarity between China and Europe in the automotive industry still exists.

For example, Europe still has advantages in automotive design, chassis tuning, and brand operations, while China leads in electrification technology, smart experience, and cost control. The potential for cooperation between the two sides far exceeds the space for confrontation. In fact, many European car manufacturers have already engaged in deep cooperation with Chinese companies in areas such as battery technology and smart cockpits.

For China's automobile industry, the emergence of a trade surplus is merely a new starting point, not the end. Chinese car companies need to face the challenges of the European market: strict safety standards, complex cultural environments, and mature consumer preferences, which are long-term learning and adaptation subjects for Chinese brands. Meanwhile, Chinese car companies must also be wary of the risks of trade protectionism and achieve a truly global layout through localized production and technological cooperation.

The first trade deficit in the automotive sector between China and Europe marks a historic moment as China's automotive industry transitions from being a "manufacturing giant" to a "manufacturing powerhouse." Behind this transformation lies decades of relentless commitment and accumulation by Chinese companies in technological innovation and industrial upgrading, as well as the relentless pursuit of the "automotive powerhouse dream" by countless engineers, designers, and industrial workers.

The temporary predicament of the European automotive industry reminds us that no industry advantage is eternal. Only through continuous innovation and embracing change can we maintain vitality in the fierce global competition.

Therefore, for the Chinese automotive industry, today's achievements are worthy of pride, but the challenges ahead are equally daunting. In the unprecedented changes facing the global automotive industry, Chinese car manufacturers need to maintain strategic focus, adhere to open cooperation, and work together with global partners to promote the green and intelligent transformation of the automotive industry.

The rise of China's automotive industry is transforming from a follower to a leader, and this is just the beginning of a new round of global industrial transformation.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Nissan Cuts Production of New Leaf EV in Half Due to Battery Shortage

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

Mexico officially imposes tariffs on 1,400 chinese products, with rates up to 50%