China Baoan and BTR Join Restructuring of Shanshan Group, Anode Material Industry May Face Consolidation

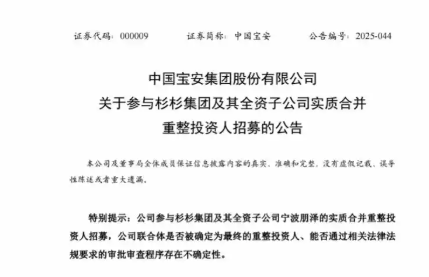

On the evening of December 12, China Baon (000009.SZ) announced that the company has decided through a board resolution to act as the leading party in a restructuring investment consortium. It will collaborate with its subsidiary Betteri (920185.BJ) and other potential investors to participate in the recruitment of investors for the substantive merger and restructuring of Suning Group Co., Ltd. (hereinafter referred to as "Suning Group") and its wholly-owned subsidiary Ningbo Pengze Trading Co., Ltd. (hereinafter referred to as "Ningbo Pengze").

The first round of restructuring was once close to being implemented.

Tracing back the reorganization journey of the Shanshan Group, it reveals a dilemma intertwined with a debt crisis and a power struggle. In February 2023, the sudden passing of Shanshan founder Zheng Yonggang due to a heart attack sparked a control dispute between his son Zheng Ju and stepmother Zhou Ting. This internal conflict directly led to frequent changes in the company's management, severely impacting its operational stability.

In 2024, Shanshan Co., Ltd. (600884.SH) experienced its first annual loss since going public, with a net loss attributable to shareholders of 367 million yuan, a significant year-on-year decline of 147.97%. By the end of 2024, Shanshan Co., Ltd.'s total liabilities had risen to 23.673 billion yuan, with interest-bearing liabilities accounting for 67.29%, and a short-term debt gap reaching 5.355 billion yuan, leading to a full-blown funding crisis.

The continued fermentation of debt pressure ultimately triggered the judicial reorganization process. On February 25, 2025, the People's Court of Yinzhou District, Ningbo City, Zhejiang Province, ruled to accept the bankruptcy reorganization case of Shanshan Group; on March 20, the court further ruled for the substantive merger and reorganization of Shanshan Group and Ningbo Pengze, designating Beijing Zhonglun (Shanghai) Law Firm and other institutions as the administrators responsible for advancing the reorganization work.

Previously, the first round of restructuring recruitment for Shanshan Group was once close to being finalized. On September 29, Shanshan Group and the administrator signed a "Restructuring Investment Agreement" with a consortium composed of Jiangsu New Yangzi Trading, TCL Industrial Investment, and Shenzhen Branch of Dongfang Asset Management, intending to acquire 23.36% control of Shanshan Shares for a consideration of 3.284 billion yuan.

However, this plan encountered a setback at the creditors' meeting on November 4th. The restructuring plan draft was declared invalid as the secured creditors group, the general creditors group, and the contributors group all failed to pass it. The key factor that led to the stalling of the draft was the litigation blockade by the original intended investor, Semcorp. The company claimed that after winning the bid, it was "kicked out" by Xin Yangzi Trading, and its qualification was replaced by TCL Industries. As a result, Semcorp applied to the court to declare the restructuring plan invalid. This dispute directly disrupted the restructuring process of the Shanshan Group.

The new round of restructuring attracts "Fangda Group" and Hunan State-owned Assets to join.

After the first round of restructuring failed, Shanshan Group's administrator restarted the recruitment of investors on November 7th, clearly stating the selection criteria of "priority given to those with backgrounds in polarizers and/or negative electrode industries."

According to the announcement, the scope of investment by prospective investors should include all assets held by Shanshan Group and Ningbo Pengze. The restructuring investment plan mainly includes two options: first, restructuring investment through the overall transfer of 100% equity of the debtor, with the investment consideration not allowing the ordinary creditors' recovery rate to be lower than the recovery rate obtainable through bankruptcy liquidation procedures; second, prospective investors may form a consortium on their own, arranging stock investors and trust investors separately within the consortium according to the restructuring framework determined by the "Restructuring Plan (Draft)." The overall investment conditions should, in principle, be better than the "Restructuring Plan (Draft)." The stock investors' tax-inclusive offer per share for Shanshan shares should, in principle, not be lower than 11.50 yuan. Under the same conditions, the first investment plan will be given priority consideration.

This adjustment quickly attracted multiple investors to join in. On November 24, Fangda Carbon (600516.SH) announced its intention to participate in the recruitment. On December 3, Hunan Salt Industry Group also completed a deposit of 50 million yuan, officially announcing its registration. The entry of China Baoan has further highlighted the technical and industrial attributes of this competition.

From the actions taken by China Baoan, it has completed the preliminary core preparation work. According to the announcement, the company has submitted the registration materials as required, paid a 50 million RMB due diligence deposit, and commissioned intermediary agencies to conduct due diligence. Meanwhile, the company's board of directors has authorized the management team to be fully responsible for drafting the investment plan, participating in on-site presentations, and engaging in competitive negotiations.

The core advantage of China Baon is its industrial synergy.

It is worth noting that the core advantage of China Baoan and BTR's participation lies in the industrial synergy of their consortium.

As the absolute leader in the global lithium battery anode material industry, BTR has maintained its position as the world's number one in anode material shipments for 15 consecutive years. In the first half of 2025, its artificial graphite business sales increased by 46.2% year-on-year, and it has also taken the lead in the technological layout of solid-state battery materials. Meanwhile, Shanshan Group's Shanshan Co., Ltd. is the domestic market share champion of artificial graphite anodes. In the first three quarters of 2025, its market share of artificial graphite anodes remained the industry's number one, and its silicon-based anodes have achieved mass shipments. The two companies form a strong complement in terms of technology pathways and capacity layout.

Regarding the strategic logic behind the joint restructuring, market analysts point out that if successful, it will achieve a strong alliance between the "global leader in anode materials" and the "leading producer of artificial graphite," releasing multiple industrial values. The integrated graphitization capacity of the Shanshan Group will solidify BTR's cost moat and further enhance its price competitiveness. Additionally, the technological collaboration between the two parties in cutting-edge fields such as silicon-based anodes and solid-state battery materials will significantly enhance the voice of Chinese companies in the battery materials sector.

However, China Baowu and Bettery have also explicitly pointed out the multiple uncertainties associated with this investment in their announcements. The announcement mentions that there is no conclusion yet on whether the consortium can be determined as the final reorganization investor; even if shortlisted, the signing of the "Reorganization Investment Agreement" and the draft reorganization plan still require approval from the creditors' meeting and the court ruling; this matter may constitute a significant asset restructuring, which requires compliance with the approval procedures of securities regulatory agencies; the transaction may also trigger antitrust reviews; Bettery itself must also complete its internal decision-making process, and there remains uncertainty as to whether this decision-making process can be approved.

Market participants have stated that with the involvement of various capitals such as China Baoan, Fangda Carbon, and Hunan Salt Industry, the restructuring of Shanshan Group has evolved from merely debt resolution to a battle for integration in the new energy materials sector. Regardless of who ultimately prevails, the outcome will profoundly impact the future trajectory of the lithium battery materials industry.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Nissan Cuts Production of New Leaf EV in Half Due to Battery Shortage

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

Mexico officially imposes tariffs on 1,400 chinese products, with rates up to 50%