Chery Officially Listed, Opening Surge Of 13%, Market Capitalization Exceeds HKD 200 Billion At One Point

Chery Automobile has finally successfully gone public, with the stock price surging over 10% at the opening!

On September 25th, CheDongXi reported that Chery Automobile Co., Ltd. (hereinafter referred to as Chery Automobile) was officially listed on the Hong Kong Stock Exchange.

Chery Automobile officially listed on the Hong Kong Stock Exchange.

Before the market opened, Chery Automobile's Hong Kong stock surged 11.22%, priced at HKD 34.2 per share (approximately RMB 31.36), with a market capitalization reaching HKD 197.239 billion (approximately RMB 180.848 billion).

Chery Automobile stock price before the opening.

After the market opened, Chery Automobile's stock price continued to rise, with a maximum increase of 13.17%, quoting at 34.8 HKD per share (approximately 31.91 RMB). The market value once exceeded 200 billion HKD (approximately 183.38 billion RMB).

Chirey Automobile's Hong Kong stock rose by a maximum of 13.17%.

Subsequently, Chery Automobile's stock price experienced a decline, closing at HKD 34 per share (approximately RMB 31.17) before the publication, with a market capitalization of HKD 196.086 billion (approximately RMB 179.791 billion).

▲ As of the time of publication, Chery Automobile's stock price and market value on the Hong Kong Stock Exchange.

Overall, Chery Automobile has issued a total of 297 million shares globally, including 29.7397 million H shares for public offering in Hong Kong, which received a subscription rate of 308.18 times, and 267.7 million H shares for international offering, which received a subscription rate of 11.61 times. The final price per share is set at HKD 30.75 (approximately RMB 28.15).

▲Chery Automobile Prospectus

Chery Automobile's global offering raised a total of HKD 9.15 billion (approximately RMB 8.39 billion), and after deducting the listing expenses, the net amount raised was HKD 8.879 billion (approximately RMB 8.141 billion).

Chery plans to use approximately 35.0% of the net proceeds for the research and development of different models and versions of passenger vehicles to further expand its product portfolio, about 25.0% for the research and development of next-generation vehicles and advanced technologies to enhance core technological capabilities, around 20.0% for expanding overseas markets and executing globalization strategies, approximately 10.0% for upgrading Chery's production facilities in Wuhu, Anhui, and about 10.0% for working capital and general corporate purposes.

Notably, Chery Automobile is the only vehicle manufacturing enterprise group among the top ten Chinese car companies in terms of sales in 2024 that had not yet gone public at that time. It first proposed a listing plan as early as 2004, but it was forced to shelve it multiple times afterward. (For more details, please refer to " ")

After a 21-year "long run," Chery Automobile has finally "realized its dream" of going public.

01.

In 2024, it will be the second best-selling domestic passenger car brand in China.

Revenue and net profit have increased year by year.

The prospectus shows that Chery Automobile's performance in recent years has been outstanding.

Chery Automobile's Business Highlights in Recent Years

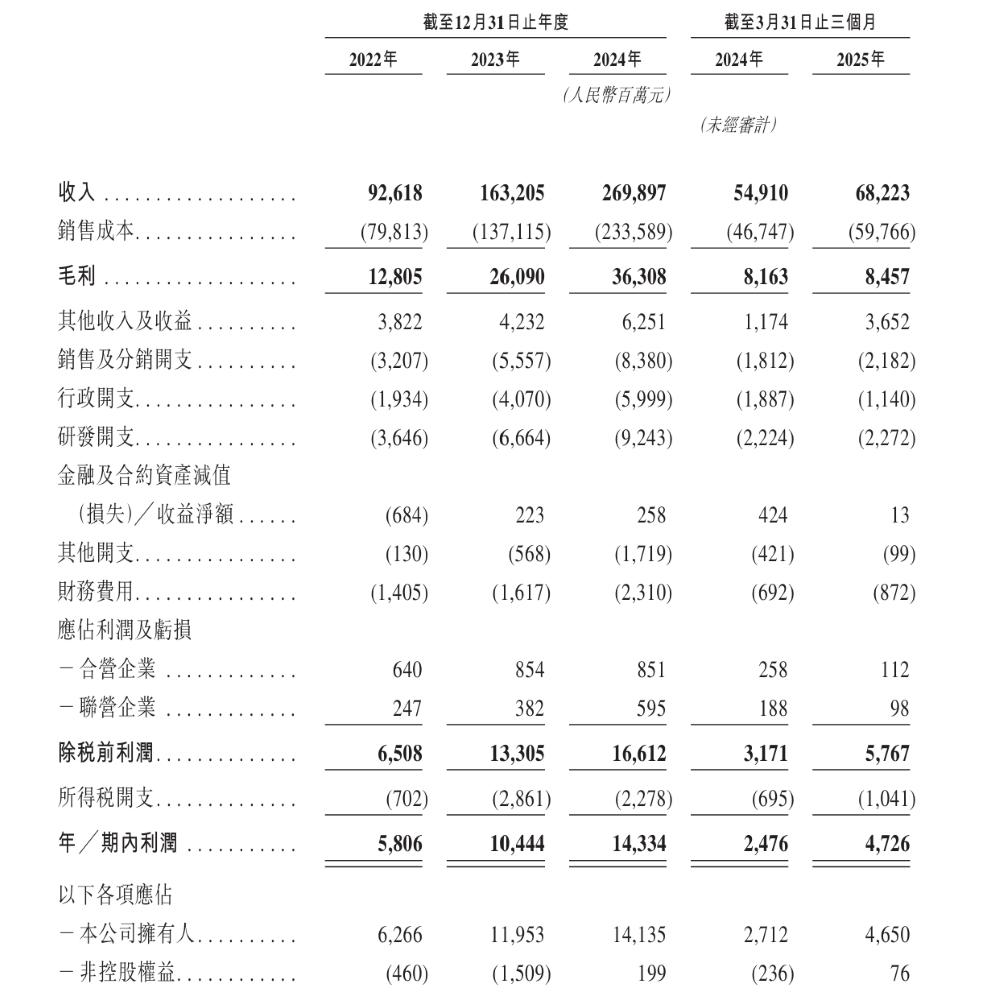

From the financial data in the prospectus, in 2022, 2023, and 2024, Chery Automobile'sThe revenues are 92.618 billion RMB, 163.205 billion RMB, and 269.897 billion RMB.CorrespondinglyThe net profits are 5.806 billion yuan, 10.444 billion yuan, and 14.334 billion yuan, respectively.The revenue and net profit can be seen to be growing year by year.

Chery Automobile's financial information in recent years

In the first quarter of 2025, Chery Automobile'sRevenue was 68.223 billion yuan, with a year-on-year increase of approximately 24.25%. The profit for the period was 4.726 billion yuan, representing a year-on-year growth of about 90.87%.。

Chery stated in the prospectus thatThe increase in revenue from 2022 to 2024 is mainly due to the increase in sales of fuel vehicles.Additionally, driven by marketing efforts and expansion into overseas markets, Chery Automobile's new energy vehicle sales have also increased, benefiting from the optimization of its new energy vehicle portfolio.The increase in revenue in the first quarter of 2025 is primarily due to the increase in sales of new energy vehicles.。

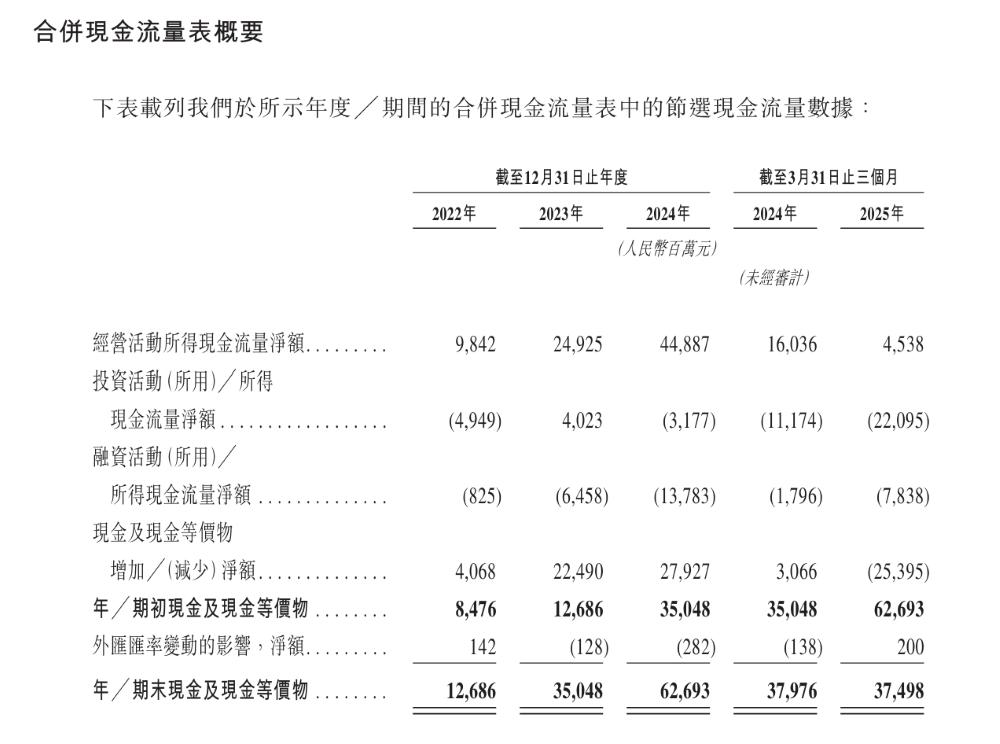

In terms of cash flow,As of the first quarter of 2025, Chery Automobile's cash and cash equivalents amounted to 37.498 billion RMB.。

▲Cash Flow Situation of Chery Automobile in Recent Years

Sales-wise,In 2024, Chery Automobile's annual sales reached 2.6039 million units, a year-on-year increase of 38.4%, setting a new record. Among these, exports accounted for 1.1446 million units, a year-on-year increase of 21.4%, maintaining the position as the number one exporter of Chinese passenger car brands for 22 consecutive years.。

▲ Chery Automobile's total sales for 2024

According to the introduction in the prospectus,Based on global passenger car sales in 2024, Chery Automobile is the second largest Chinese independent passenger car brand and the eleventh largest passenger car company in the world.。

Simultaneously, the prospectus also mentioned that, according to the information,Since 2003, Chery has ranked first in China's independent brand passenger car companies in terms of passenger car export volume for 22 consecutive years....consistently ranks among the top in sales across several major passenger car markets.In 2024, Chery ranked first among Chinese independent passenger car brands in terms of sales in Europe, South America, and the Middle East and North Africa, and ranked second in North America and Asia (excluding China) among Chinese independent passenger car brands.。

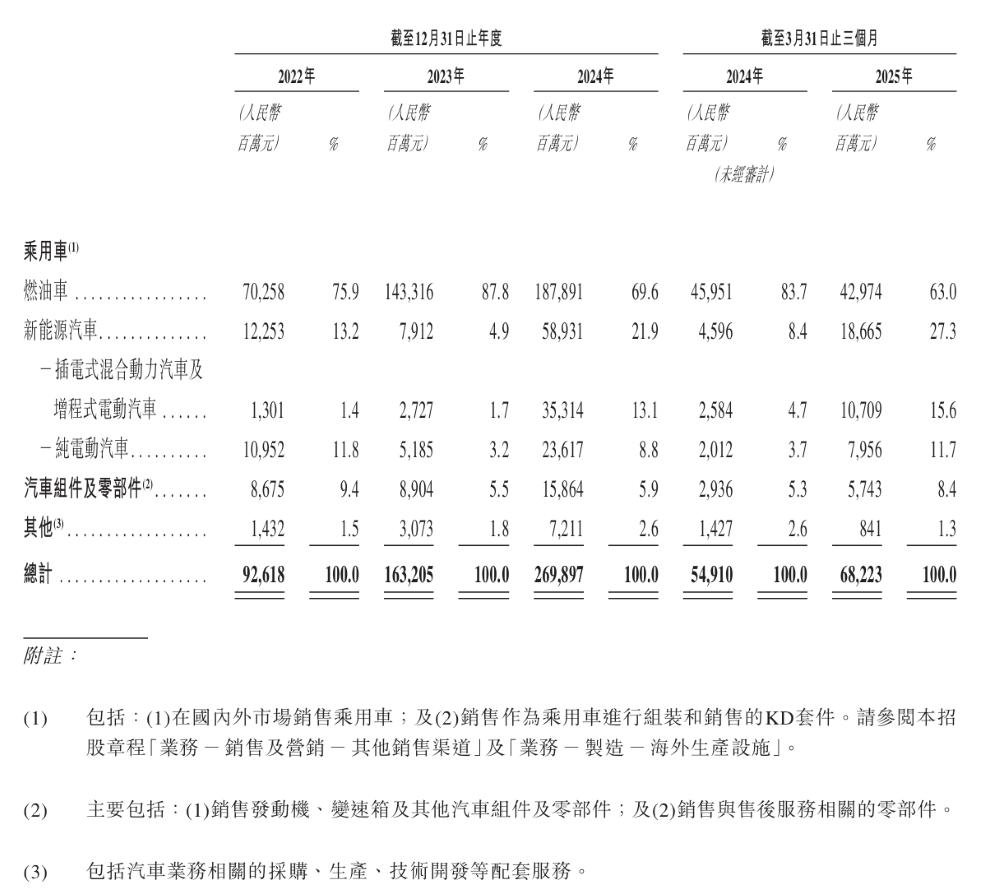

In the sales of Chery Automobile,From 2022 to 2024, the proportion of sales revenue from Chery's fuel vehicles in the total revenue is 75.9%, 87.8%, and 69.6%, respectively, while the proportion of sales revenue from new energy vehicles in the total revenue is 13.2%, 4.9%, and 21.9%, respectively.。

In the first quarter of 2025,The sales revenue of Chery's fuel vehicles accounts for 63.3% of the total revenue, while new energy vehicles account for 27.3%.It can be seen that the proportion of new energy vehicles is gradually increasing, but fuel vehicles are still the mainstay of Chery Automobile's revenue.

▲Recent Years' Revenue Breakdown by Product Category for Chery Automobile

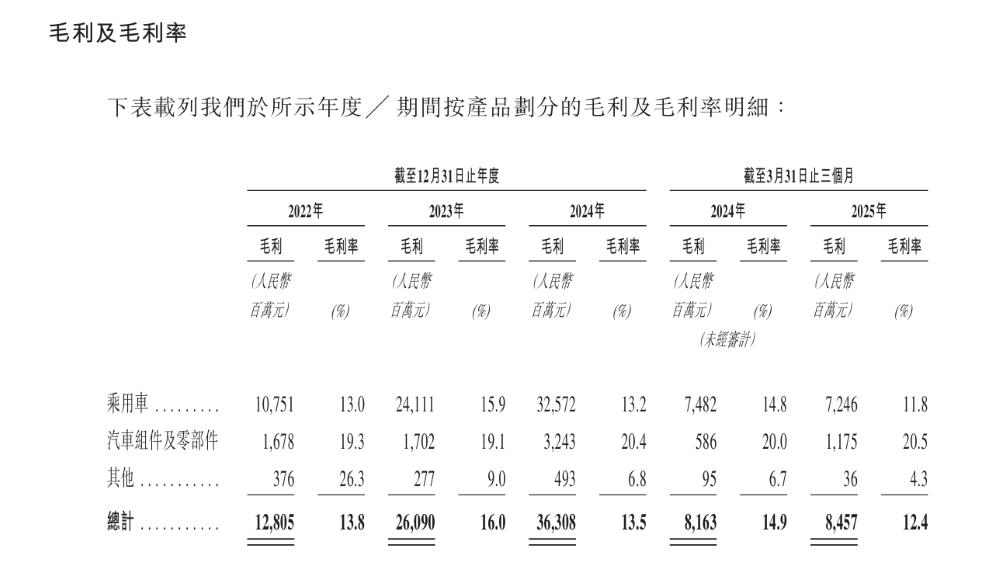

In terms of gross margin, Chery's overall gross margins for 2022, 2023, and 2024 are 13.8%, 16.0%, and 13.5%, respectively, with 12.4% for the first quarter of 2025.

▲Chery Automobile's Gross Profit and Gross Profit Margin Details in Recent Years

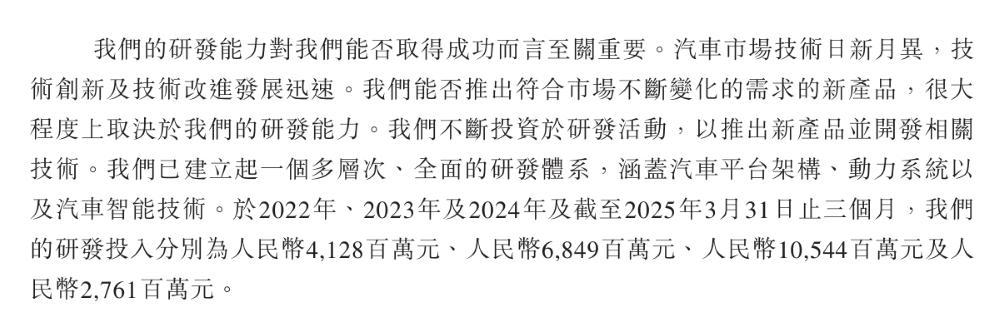

In terms of R&D investment, from 2022 to the first quarter of 2025,Chery's R&D investment amounts to 4.128 billion yuan, 6.849 billion yuan, 10.544 billion yuan, and 2.761 billion yuan respectively.The R&D investment is expected to maintain year-on-year growth. However, the proportion of R&D investment to revenue for the same period from 2022 to the first quarter of 2025 is estimated to be approximately 4.46%, 4.20%, 3.91%, and 4.05%, with overall changes in proportion being relatively small.

Chery Automobile's R&D Investment in Recent Years

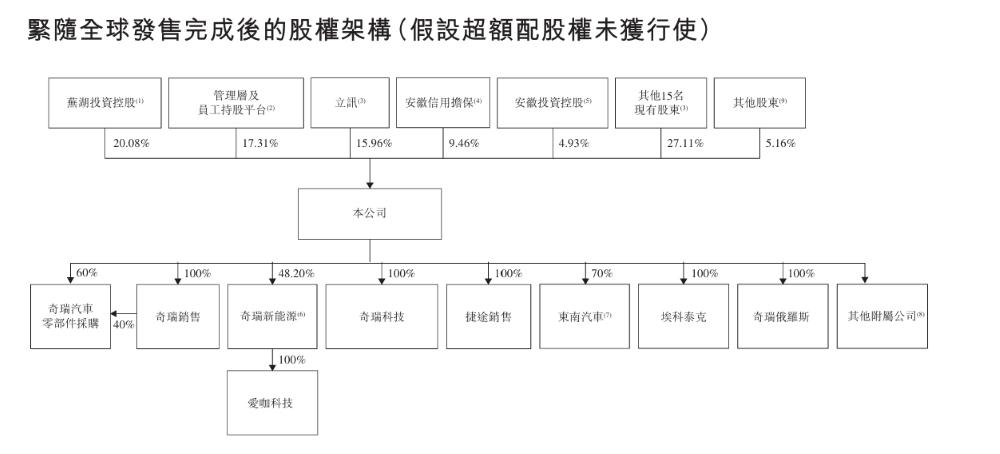

In terms of shareholding structure, Chery Automobile provided the shareholding structure after the global offering is completed in the prospectus (assuming the over-allotment option is not exercised).

▲ Chery Automobile's shareholding structure after the global offering is completed

02.

Behind the Impressive Data Lies a Concern

The cumulative sales from January to August this year have been surpassed by Geely.

Chery Automobile Group (hereinafter referred to as Chery Automobile) is the only unlisted vehicle enterprise group among the top ten Chinese car companies in sales in 2024. Its financial data details and other aspects have not been fully disclosed. So, what is the overall situation of Chery Automobile?

In terms of sales, the top three Chinese domestic passenger car brands in 2024 are BYD, Chery Automobile, and Geely Automobile (not referring to Geely Holding Group). Chery Automobile ranks as the second-best selling Chinese domestic passenger car company, surpassing Geely Automobile in sales, but there is a significant gap compared to the sales of BYD, which ranks first.

▲ 2024 financial data of Chery Automobile, BYD, and Geely Automobile

In terms of important business metrics such as revenue and net profit, where does Chery Automobile stand among the top three in sales?

In terms of revenue, in 2024, Chery Automobile's revenue was 269.897 billion yuan, more than half less than BYD's 777.102 billion yuan, but higher than Geely Automobile's 240.194 billion yuan, also ranking second among these three car companies.

However, in terms of net profit, Chery Automobile's 14.334 billion was surpassed by Geely Automobile's 16.632 billion, and its gross profit margin was also 2.4 percentage points lower than that of Geely Automobile.

For an automotive company, especially in the era of new energy, technological competition has become the core focus. Research and development investment has become increasingly important for automotive enterprises and is a key factor determining whether a company can survive and thrive in fierce competition.

In terms of R&D investment, BYD is "far ahead," while Chery Automobile and Geely Automobile are relatively close.

Overall, in 2024, based on the sales of China's passenger cars, Chery Automobile is in second place, still having a considerable gap compared to BYD, while having a certain advantage over Geely Automobile.

In the first quarter of this year, there have been some changes. Firstly, it can be observed that Geely Automobile's sales have surpassed those of Chery Automobile in the first quarter of 2025, with Chery Automobile's sales being 80,000 units lower than Geely's.

▲ Partial financial data for Chery Automobile, BYD, and Geely Automobile for the first quarter of 2025

From January to August this year, BYD's cumulative sales were approximately 2.8258 million vehicles, Chery Automobile's sales were approximately 1.7273 million vehicles, and Geely Automobile's sales were approximately 1.8971 million vehicles.

Chery Automobile's sales from January to August 2025 are about 169,800 units less than Geely Automobile's. It can be seen that the sales gap between Chery and Geely is widening. If this trend continues, Chery is very likely to be surpassed by Geely in annual sales this year.

At the same time, in terms of revenue and net profit for the first quarter of 2025, Geely Auto has also achieved a surpass. In terms of gross profit margin, Chery Auto's is 3.4 percentage points lower than that of Geely Auto, with the gap further widening.

Overall, especially considering the data from the first quarter of 2025, although Chery Automobile's sales, revenue, and net profit have increased year-on-year, rival companies like Geely Automobile are also accelerating their catch-up and even surpassing.

Chery Automobile's revenue pillar is still primarily based on fuel vehicles. In the context of the continuous rise in the penetration rate of new energy vehicles and the intense competition in the automotive market, Chery Automobile, as the second-largest Chinese independent brand in 2024, still faces strong competitive pressure.

03.

In conclusion: Chery Automobile's 21-year listing dream finally realized.

The for Chery Automobile marks the end of a long "marathon" and also a new starting point.

Its many years of accumulated technical strength and brand influence in the domestic market, along with its extensive presence and outstanding performance in overseas markets, have led to today's achievements.

In the current highly competitive automotive market, whether Chery can maintain its momentum and continue to make breakthroughs still requires time and market performance to observe.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track