CATL's Biggest Rival Is Its Customers

CATL is being "pulled away" by the market.

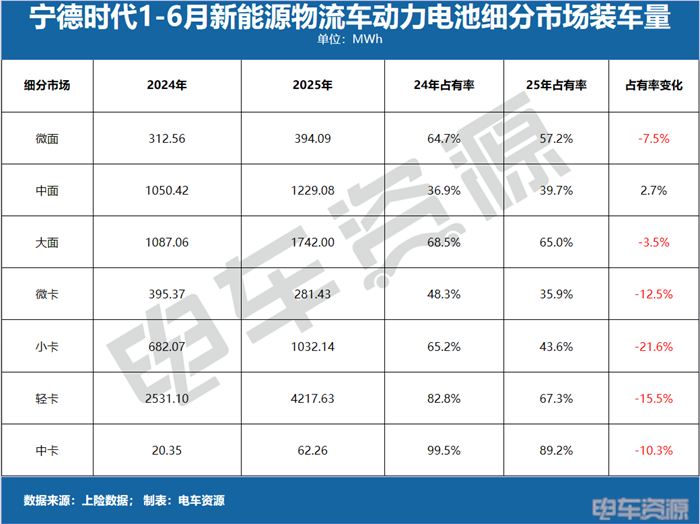

CATL's data on the installation volume of new energy logistics vehicle power batteries from January to June outlines a clear trajectory of market share changes. From mini vans to medium-duty trucks, the variations in market share across multiple segments convey a strong signal: CATL is experiencing a market "selective distancing."

In the micro van segment, the market share is 64.7% in 2024, dropping to 57.2% in 2025, a decline of 7.6% that marks the beginning of market changes; the micro truck, small truck, and light truck segments experience even greater declines in market share, with the small truck segment falling by 21.6% and the light truck segment by 15.5%, clearly reflecting a trend of being "drawn away" by more segmented markets.The dual changes in loading capacity data and market share reflect the weakening influence of CATL in the new energy logistics vehicle battery market, with its former "first-choice advantage" gradually being diluted by the market.

Looking at the comparison of installed volumes among the top 10 automakers, leading partners such as Farizon and Dongfeng have seen a decline in market share, with only a few automakers like BAIC Foton experiencing a slight increase. This indirectly confirms that CATL is being “selectively adjusted” by its partner automakers in terms of collaboration intensity for logistics vehicle battery supply. Its market dependence continues to decrease, further substantiating the trend of being “phased out by the market.”

The Automotive Industry's Breakaway: A Choice Driven by Costs, Risks, and the Pressure of Discourse Power and Brand Influence

New energy logistics vehicle companies have long been weighed down by the high battery costs from CATL. The proportion of battery costs in the total vehicle cost is too high, which severely squeezes the profit margins of car manufacturers. In the logistics vehicle industry, competitiveness comes down to cost-effectiveness during operations—every penny saved can determine whether a company survives. With the same budget, switching to another battery supplier can save a lot of money, so naturally, car manufacturers are making this “blood transfusion” decision. Since CATL is unwilling to share the costs with manufacturers, it can’t blame the market for voting with its feet.

Automakers have long been wary of the risks of "putting all their eggs in one basket." Even a slight fluctuation in CATL’s production capacity can immediately cause bottlenecks in vehicle manufacturing; its strong bargaining power also leaves automakers with no room to negotiate on capacity allocation or technical cooperation. Being controlled like this for the long term is hard for anyone to accept, so automakers have no choice but to actively "loosen the ties"—supporting second-tier suppliers and cultivating new battery players, all in an effort to break their dependence on CATL and fundamentally resolve potential supply chain issues.

The issue of capacity allocation has brought the rivalry between automakers and CATL into the open. When automakers are scrambling for market share, they are in urgent need of a steady "blood supply" of batteries, but CATL’s allocation schedule never seems to align with their demands. Leading automakers need to secure enough capacity to compete in the market, while small and medium-sized automakers find it even harder to get the resources they want. Rather than being led by the nose by CATL’s bargaining power, it’s better to look for new suppliers—what’s at stake is not just current capacity, but also the initiative to survive and thrive in the future.

What frustrates car manufacturers the most is that CATL's reputation is so overwhelming that it overshadows the car brands. Nowadays, when customers choose a car, the first question they ask is, "Does it have a CATL battery?" It seems as if the quality of the car itself and the technological capabilities of the car manufacturers are not important. Instead, the automakers have become "working for the battery." The cars they painstakingly build are regarded by customers as just "shells for CATL batteries," severely diminishing their brand presence. Who could be content with that? If this continues in the long term, how can car manufacturers maintain their brand identity? This sense of frustration has also become a hidden motivation for car companies to break away from CATL.

"Expensive" is just a facade; "suitability" is the essence.

When customers choose not to opt for models equipped with CATL batteries, their claim that it’s "expensive" is just a casual excuse; what they truly care about is whether the battery is suitable for their business needs.

For customers, when purchasing "money-making tools," their core thoughts revolve around whether it is "worth it, practical, and suitable." They are focused on how useful the tool can be, rather than the brand reputation of the battery. If a car equipped with a CATL battery is too expensive and exceeds the operational cost threshold, then it is obviously "not suitable." More importantly, customers have their own measure: does this battery suit their work? Those running short distances in the city might think that as long as the range is sufficient, there's no need to spend a lot on a high-range version. Meanwhile, those running long-distance routes might be more concerned about whether the range will significantly drop in winter or whether charging stations are easy to find. The same goes for after-sales service; if a repair takes half a month and delays work more than the money saved, then even the biggest brand is useless.

Once a more suitable battery appears on the market—for example, if those running cold chain logistics find a certain brand’s batteries perform more reliably at low temperatures, or city delivery drivers feel another brand has service centers right next to their homes—then no matter how famous CATL is, customers will still walk away. After all, for them, “suitability” means much more than “fame.”

Behind the game lies the beginning of an industry ecosystem reconstruction.

The changes in the new energy logistics vehicle battery market from January to June are far more than a simple shift in market shares; they represent a deep market game centered around cost, risk, bargaining power, and core needs. The heart of this contest, as revealed by the saying “CATL’s biggest rival is its customers,” is that as automakers proactively break free from the shackles of cost and supply chain risks, and as customers redefine their selection criteria with the word “suitability,” the former “battery giant dependence syndrome” is gradually being overcome by the market’s self-healing capability.

For CATL, the decline in market share is not the end, but a clear signal from the industry — in the field of new energy logistics vehicles, which highly relies on "pragmatism," the selection logic of customers (whether car manufacturers or B-end customers) has returned to its essence: car manufacturers seek controllable costs, independent supply chains, and brand independence, while customers want cost-effectiveness and suitability that align with operational scenarios.

The ultimate direction of this game is the rebalancing of the new energy logistics vehicle industry ecosystem. It signifies that the relationship between battery manufacturers and vehicle companies will shift from “one-way supply” to “symbiotic collaboration.” The rise of second-tier battery enterprises will break the monopoly, stimulate industry innovation, and the genuine needs of end customers will become the core driving force for the evolution of the industry chain. For the entire industry, this may not be the “decline” of a particular enterprise, but rather the beginning of a more mature and healthier market ecosystem. In the context of diversified competition, only an industry chain with better cost efficiency, more suitable technology, and more precise services can truly support the long-term development of the new energy logistics vehicle industry.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track