CATL Launches New Product First in Germany, Chinese and Korean Battery Firms Compete to Win Europe

On September 7, CATL (300750.SZ/03750.HK) held a product launch event in Munich, Germany, where it globally unveiled the NP3.0 battery safety technology platform and the first lithium iron phosphate battery equipped with this technology, the "Shenxing Pro." This marks the first time a Chinese battery company has globally launched new technology and new products for power batteries overseas.

CATL stated that the NP3.0 technology platform released this time represents the highest level of safety technology in the battery field. According to the information from the press conference, the battery system equipped with NP3.0 technology can not only prevent the spread of heat between cells in the event of thermal runaway but also maintain vehicle power supply and output for at least one hour, supporting the vehicle to safely drive away and perform emergency maneuvers.

Another highlight of this technology is that, in the event of thermal runaway, the battery system does not produce open flames or smoke, which can prevent secondary accidents caused by impaired visibility. This technology can also better cooperate with intelligent driving systems: in the event of an accident where the driver is unable to operate the vehicle, the assisted driving system can automatically drive the vehicle away from dangerous areas, thereby reducing the extent of damage.

Chinese battery companies have surpassed their Korean counterparts in overseas markets for the first time.

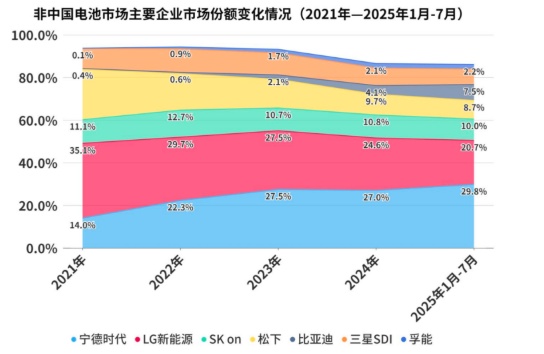

CATL globally launched its NP3.0 technology platform and Shenxing Pro battery in Germany because overseas markets have become a key source of growth for the company. According to data released by South Korean battery market research firm SNE Research, CATL’s share in the non-China battery market has risen from 14.0% in 2021 to 29.8% in 2025, while the market share of major competitors—Korean battery companies—has shown a downward trend (see the chart below).

In 2021, in the global electric vehicle battery market excluding China, LG's market share was more than twice that of CATL, and the combined market share of the three South Korean battery companies exceeded 55%. In 2023, CATL's market share caught up with LG's for the first time, with both holding 27.5%.

By 2024, the market landscape will have reversed.CATL became the annual leader in the non-Chinese market for the first time with an installed capacity of 97.4 GWh (gigawatt-hours) and a market share of 27.0%.The combined market share of the three South Korean companies has decreased to 43.5%, but they still lead Chinese companies by nearly 8.5 percentage points.

From January to July 2025, CATL expanded its leading position in non-Chinese markets with an installed capacity of 73.3 GWh and a market share of 29.8%. During the same period, the combined market share of the three Korean companies fell to 37.8%. Meanwhile, other Chinese battery companies, including BYD, have rapidly emerged in overseas markets.The combined market share of Chinese battery companies overseas has reached 43.4%, surpassing Korean battery companies for the first time.

The competitive landscape between Chinese and South Korean battery companies in non-Chinese markets has changed mainly because Chinese companies like CATL leverage the technological and cost advantages of lithium iron phosphate batteries to meet the global mainstream automakers' demand for high cost-performance batteries. Currently, CATL has established cooperation with 90% of European automakers.

Another reason is that Chinese battery companies are accelerating globalization by building factories overseas and expanding into emerging markets to reduce dependence on the domestic market.

In contrast, due to a misjudgment of technological trends years ago, Korean battery companies abandoned lithium iron phosphate (LFP) technology, resulting in a lack of competitive products in the low-cost battery market and a continuous decline in market share year by year.

Europe will be the key battleground in the next two years.

The global battery market has long been characterized by a tripartite competition among China, Europe, and the United States. As the largest market in the world, China is dominated by domestic enterprises. Due to various policy restrictions in the U.S. market, Chinese battery companies find it difficult to enter. The competitive landscape in these two major markets has become basically clear, making Europe, the world's second-largest market, a key battleground for Chinese and Korean battery companies.

In terms of product technology, cost control, and local production capacity, Chinese companies are currently ahead of Korean companies in Europe.

At the product technology level, in the highly demanded lithium iron phosphate (LFP) battery sector, Chinese companies lead in both technological maturity and market application scale. CATL’s recent launch of the Shenxing Pro battery leverages its LFP technology advantages to specifically meet the European market’s demands for safety, long range, fast charging, and long lifespan.

Chinese companies have a significant cost advantage. Currently, the cell price of Korean companies remains above $100 per KWh, while the price for Chinese companies has generally fallen below $90, with some reaching the level of $80. This cost advantage makes Chinese companies more competitive in securing orders for economical electric vehicles priced below 20,000 euros.

In terms of local production capacity layout in Europe, Korean companies currently have a first-mover advantage. LG’s factory in Poland, Samsung SDI and SK On’s factories in Hungary have a combined annual capacity exceeding 100 GWh. Chinese companies such as CATL are accelerating the construction of factories in Europe. CATL’s factory in Germany has already achieved mass production, and production bases in Hungary and Spain are expected to reach scale between 2026 and 2027.

China holds an advantage in two out of three aspects, which is why Chinese battery companies have steadily increased their market share in Europe over the past few years.

However, the strength comparison between Chinese and Korean battery companies will enter a new stage in 2027. Korean battery companies plan to achieve large-scale mass production and delivery of lithium iron phosphate batteries by 2027, and LG believes that with new technologies such as dry electrode technology, they can catch up with or even surpass their Chinese competitors in terms of the cost and performance of lithium iron phosphate batteries. Meanwhile, most of the European factories of Chinese battery companies are scheduled to start production between the end of 2026 and 2027, thereby closing the gap in local production capacity with Korean battery companies.

During the critical window period from 2025 to 2027, the strategic intentions of both parties are very clear. Chinese companies hope to leverage their current product and cost advantages to lock in as many customers and orders as possible, laying the foundation for comprehensive competition in the next phase. Meanwhile, Korean companies aim to use their advantages in domestic production capacity and patent portfolios to slow down the expansion of Chinese companies in Europe.

Patents have become an important tool for competition. In April 2025, LG and Panasonic jointly established a patent management company, Tulip Innovation, which is referred to domestically as the "Tulip Alliance." Subsequently, the company initiated multiple patent lawsuits against Chinese battery company Sunwoda in Germany. On May 22, 2025, the Tulip Alliance won two key patent lawsuits regarding battery separator technology, and the court issued a sales ban against Sunwoda in Germany. On July 17, 2025, the Munich District Court ruled that Sunwoda infringed the Tulip Alliance’s patent on the "electrode assembly structure," again issuing a sales ban in Germany and ordering the destruction of inventory.

Faced with patent risks, CATL is actively improving its global patent portfolio. According to a report released by Mitsui & Co. Global Strategic Studies Institute in April 2025, CATL has surpassed its Korean competitors in both the number and quality of patents. In terms of quantity, CATL currently holds over 50,000 patents, with more than 20,000 overseas patents, while LG holds a total of 38,000 patents. In terms of quality, based on the rating data released by the patent consulting firm LexisNexis, CATL's patent influence in the battery field surpassed LG for the first time in 2024, ranking first.

Due to earlier patent registration and richer experience in overseas patent layout, Korean battery companies still hold a significant advantage in key patents. However, Korean companies are also signaling cooperation. After Sunwoda’s patent litigation victory, Giustino de Sanctis, CEO of the Tulip Alliance, stated: "We hope to discuss broad licensing of relevant patents with all companies active in the lithium battery manufacturing field."

Both Chinese and Korean battery companies are well aware that before Korean firms’ next-generation LFP batteries are mass-produced and China’s domestic production capacity is fully released in 2027, the key to competition lies in who can secure more long-term orders from European carmakers and whether they can mitigate intellectual property risks. On the one hand, European carmakers hope to bring in Chinese battery companies to reduce costs, diversify supply chain options, and accelerate electrification. On the other hand, they remain highly vigilant about potential supply chain risks and patent disputes, preferring to work with partners whose technology is reliable, supply is stable, and legal risks are manageable.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track