Car sales soar while dealership owners face losses and closures

"By the end of 2023, when the M9 was launched, basically every salesperson in the store was selling one car a day. We had a salesperson who joined us at that time and sold 28 M9s in a month. That wave was truly profitable."

In February this year, "Automobile Commune" visited several new power sales stores in Shanghai. At that time, a newly-entered salesperson recalled the glorious days of their predecessors, saying that if they were lucky and caught the launch of a popular new car, they could earn tens of thousands in a month.

However, in stark contrast to the "high salary myth" that may be associated with front-line sales at stores, there is an increasingly severe survival crisis behind the channel network. According to data from the China Automobile Dealers Association, over 4,400 4S stores will exit the network in 2024, and in the first half of last year, the proportion of car dealers experiencing losses once reached as high as 50.8%. It was only after the introduction of subsidy policies, such as those for car trade-ins, that the loss ratio relatively narrowed.

On one hand, there is the hot-selling opportunity for new forces, while on the other hand, traditional 4S dealerships are experiencing widespread losses and network withdrawals. Despite both being in sales, there seems to be a significant divide between individuals and networks.

In July, more than 10 major new models from brands such as BYD, Chery, Geely, Zeekr, Audi, Li Auto, and Leador were launched in the market. Heavyweight models like the AITO M8 pure electric version and Galaxy A7 are also poised to start pre-sales.

As salespeople gear up once again, eager to replicate the "monthly income of tens of thousands" success, "Automobile Commune" chooses to delve into frontline sales outlets and dealer networks again at this critical juncture in July. They aim to explore: Is there truly a gap between sales individuals and the dealership system? This wave of new car models, will it become the "timely rain" that saves dealers from dire straits, or will it exacerbate the paradox of "losing money selling cars" amid intense price wars and the pressures of channel transformation?

01Under the myth of high salaries in sales, there is an overwhelming work intensity.

"When the AITO M8 first came out, I sold 18 units in a month, which was almost the local sales champion." When asked about the performance of the popular AITO M8 model at its launch, Xiao Dong, a salesperson at HarmonyOS Smart Mobility, was a bit proud.

Half a year ago, when they first met, Xiao Dong, who had just switched from a research and development position, was still a sales rookie and was lamenting missing the launch of the hot-selling model Wenjie M9. In the blink of an eye, with the arrival of another blockbuster model, the Wenjie M8, Xiao Dong finally reaped the benefits. It is reported that in just that one month, Xiao Dong's monthly income reached thirty to forty thousand yuan.

However, the other side of a high salary is the extremely saturated work intensity and uncertainty. Just half a year later, stepping into the same HarmonyOS smart travel store again, it appears calm at first glance, but upon closer inspection, one can sense the undercurrents.

"The sales team has almost completely changed," said Xiao Dong. Compared to the last time he was here, currently only he and another colleague remain in the sales team; the rest are new faces. As for the reasons for leaving, they are nothing more than the inability to cope with the high work intensity and voluntarily resigning due to low performance and consequently low salary.

Xiao Dong has also changed. Compared to six months ago when he was full of energy after starting his job, now when we meet again, he appears more fatigued. Not only is his tone unable to hide his exhaustion and his voice hoarse, but his face also easily reveals his weariness and fatigue.

Some things remain unchanged, such as responding to customer messages anytime and anywhere, going back and forth to the garage multiple times a day to take customers for test drives, and delivering a car to a customer dozens of kilometers away for an experience, even if it's late at night, just with a phone call.

When it was time to say goodbye, the AITO M8 pure electric version's exterior photos were released, and the AITO M7 was about to be launched. However, since pre-sales had not started and it was still the off-season in July, Xiao Dong's sales figures for the month were not impressive. "I've only sold 5 so far, but even if it's just 5, I'm still the top seller at our store."

During the same July off-season, the LeDao store, located just next to Hongmeng Zhixing, has a relatively larger crowd. After undergoing brand integration, the store that originally had a NIO sign has now been transformed into a LeDao store. Even on a weekday afternoon, there are still couples visiting the LeDao store to look at cars.

"Our store has 7 or 8 salespeople, and there are 70 to 80 pre-orders for the L90," the salesperson from Ledao introduced. On average, each salesperson has about 10 orders. According to him, due to the impact of the new car launch, the store is crowded with visitors every weekend, including many highly interested potential customers.

Li Auto, which also has a major new model launching, has fewer staff in the store as the new car has not yet arrived. According to a salesperson in the store, there is no Li Auto i8 display car in this area, and customers who want to see the car need to visit a store in a neighboring area.

During a field visit, the author also noticed another phenomenon: several salespeople who had hosted the author six months ago had already left their positions, involving multiple brands. A familiar salesperson mentioned that he had received an offer from another brand and was planning to take a break due to work fatigue before officially starting the new job. This indicates that despite the high salary, the job intensity in car sales is quite high, and the turnover rate is also high.

02The wave of dealers exiting networks behind the difficult transformation dilemma.

New forces in sales can retreat at any time under pressure, while traditional dealers find it difficult to make a big turnaround when facing losses.

The prosperous era when customers paid a premium to buy cars is gone, and nowadays, most 4S dealerships are losing money on new car sales.

According to a report by the China Automobile Dealers Association, the proportion of dealers experiencing losses in 2024 reached as high as 41.7%, and the number of 4S stores withdrawing from the network reached 4,419, marking the first occurrence of negative growth since 2021. The phenomenon of price inversion affected 84.4% of dealers, with 60.4% experiencing an inversion margin exceeding 15%.

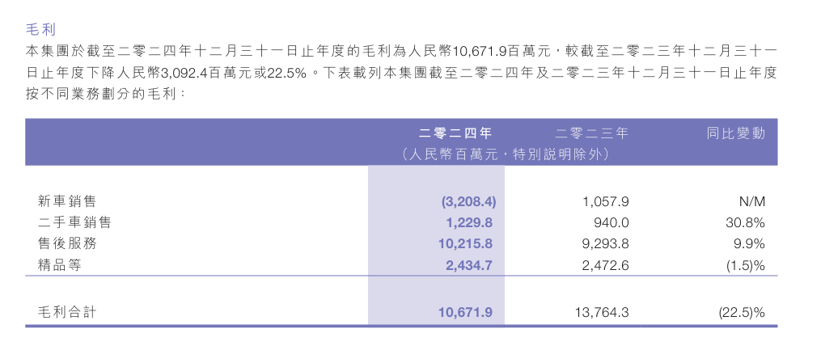

In 2024, among major automobile dealership groups such as Zhongsheng Group, Yongda Auto, ZhengTong Auto, Harmony Auto, New Focus Auto, Pangda Auto, and Meidong Auto, only Harmony Auto saw an increase in new car sales year-on-year. Strangely, despite the increase in sales, Harmony Auto's new car sales revenue continued to decline, and even the gross profit from new car sales turned from positive to negative.

Among several dealers, only Yongda Auto, which focuses on luxury brands and new energy vehicles, can still maintain profitability. However, even so, its profitability is significantly declining. Due to the drag from the new car business, the net profits of several companies have plummeted year-on-year, with many groups turning from profit to loss.

This year, the predicament of car dealers continues.

"The automobile industry is too competitive, and it's really hard to sell domestic cars. I stayed the whole day without seeing a single customer. Just like that, silently and dejectedly, I clocked out after work. With no sales, I don't know how long the boss can hold on. If we can't sell cars, I don't know if I'll be fired."

In March, a leading domestic car dealership in Zhaotong, Yunnan, reported that they didn't see a single customer in one day. On March 28th, the entire car sales center where their brand is located did not make a single sale. Searches show that this car sales center not only clusters traditional car companies such as BYD, Great Wall, Chery, Geely, Dongfeng, Changan, and SAIC, but also new power brands like XPeng and Lynk & Co.

This predicament is not an isolated case. At a large 4S dealership in Henan with nearly 100 employees, only five cars were sold in 10 days at the beginning of July. With such a level of profit, the monthly rent and property fees of nearly 200,000 yuan, as well as the salaries of nearly 100 employees, are simply a drop in the bucket.

In addition to the inability to sell cars and recover funds, the "inventory pressure policy" of the main manufacturers has also greatly restricted the capital turnover of dealers. According to data from the China Passenger Car Association, as of the end of May 2025, the national passenger car inventory reached 3.45 million vehicles, and the inventory support days increased to 54 days, compared to 51 days in May 2024.

In the context of a slowing market growth and accelerated vehicle iteration, inventory vehicles not only imply a substantial occupation of funds but also conceal a highly threatening risk of depreciation.

Since June, under multiple pressures, the Chinese automotive distribution sector has witnessed an unprecedented channel game. Various local automobile dealer associations have consecutively issued proposals, urging manufacturers to provide multiple forms of support to dealers.

03After-sales stabilize the new energy expansion, coexisting opportunities and crises in sales channels.

According to the table, after-sales services remain profitable and have become an important pillar of profitability for traditional dealers. Among them, Zhongsheng Group, which has the most profitable after-sales business, expanded its after-sales services in 2023, with 46 Zhongsheng brand service centers completed or under construction.

"In 2024, our after-sales service business achieved another record high, with an annual growth of 9.6% in after-sales service output value to RMB 22.0 billion, and a three-year compound annual growth rate of 10.8%."

In the 2024 annual report of Zhongsheng Holdings Group, the growth of after-sales service and the profits it brings are the biggest highlights. This also provides insights for other dealership groups, indicating that core after-sales services such as maintenance, warranty, and accident car repairs are expected to become new profit growth points for dealership groups.

In terms of new car sales, collaborating with emerging forces may also become an effective hedge against the dual decline in revenue and profit. Last November, when it was rumored that they secured authorization for about 50 Huawei Smart Selection cars, Zhongsheng Holdings' stock soared for two days, with an increase of over 50%, and trading was suspended urgently on the afternoon of the 11th. This shows that the outside world is particularly optimistic about the cooperation between leading dealers and strong emerging brands.

As of now, Zhongsheng Group's 2025 semi-annual report has not been released, making it impossible to determine the impact of its cooperation with the Seres brand on its new car business. However, some insights can be gleaned from its 2024 annual report.

"Through multidimensional business restructuring, especially with the strategic cooperation with Seres on the AITO brand and the potential expansion into the HIMA (HarmonyOS Intelligent Mobility) business, combined with the operational and management capabilities of Zhongsheng Excellence, we ensure the completion of this round of adjustments in the shortest possible time."

The cooperation with Seres has been elevated to a very high level by Zhongsheng Holdings, even being regarded as the key to completing the group's transformation in a short period of time.

Strengthening cooperation with new energy is not just a "privilege" for large dealership groups. For mid-sized and local small dealers, seizing the opportunity presented by new energy is also a powerful option for breaking through.

The China Automobile Dealers Association simultaneously released the "2025 China Automobile Circulation Industry Dealer Top 100 Rankings" and the "2025 China Automobile Circulation Industry Dealer Group New Energy Rankings," where the top-ranked companies are highly mismatched. Among them, Anhui Donghe Automobile Group Co., Ltd., ranked 91st in the Top 100 list, secured the fourth position in the new energy rankings with sales of 48,000 new energy vehicles.

Focusing on a single brand, Leapmotor has seen strong sales growth, with the cumulative profitability rate of Leapmotor dealers nationwide approaching 85% in 2024, leading the industry.

For traditional brand dealers, deeply cultivating the local market and effectively utilizing manufacturer resources can also achieve breakthroughs.

"Last May and June, I conducted a large-scale manufacturer campaign for 60 days. I didn't take a single day off, leaving home at 7 a.m. and returning at 10 p.m. every day. Over two months, I sold nearly 70 cars." With the encouragement of national subsidy policies and the support of the manufacturer's resources, the sales performance of Luo Qing from BYD in Hubei was particularly impressive.

The "high salary myth" earned through high-intensity work in individual sales, along with the survival anxiety of dealers, precisely demonstrates the risks and opportunities of industry transformation from both micro and macro perspectives. The former reflects localized opportunities under the wave of new energy, while the latter exposes the deep-seated friction between traditional models and the demands of the times.

For dealers who stick to old ways, industry transformation might be the last straw that breaks the camel's back. However, for those who proactively break the mold, whether it's individual salespeople stepping in for high salaries, mid-sized companies like Anhui Donghe Automobile overtaking on the new energy track, or large dealership groups like Zhongsheng Holdings building moats with after-sales services, they all prove that transformation has never been a single-choice question.

The ultimate solution to channel transformation lies in the cooperation and mutual assistance mentioned in the proposal by the Automobile Dealers Association. OEMs should relax their absolute control over dealers, providing them with more flexibility; dealers need to break away from the inertia of "earning price differences" and find new positions in after-sales value-added services, user operations, and new energy cooperation; meanwhile, individual salespeople can significantly reduce their work pressure through the collaboration between the two.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track