Caprolactam Landscape Shifts? Japan Ube Cuts Plans Ahead of Schedule!

On September 3rd, Ube Industries, Ltd. announced that it will accelerate the timetable for structural reforms in its basic chemicals business in Thailand, deciding to adjust the previously planned production reduction and exit, originally set for "March 2027," to "March 2026."

The plan includes stopping the production of cyclohexanone, caprolactam, and ammonium sulfate at UBE Chemicals (Asia) Public Company Limited (UCHA), and reducing the two production lines of Nylon 6 (PA6) to one.

It also includes the cessation of production of 1,6-hexanediol and 1,5-pentanediol by UBE Fine Chemicals (Asia) Co., Ltd. (UFA), both of which are by-products of cyclohexanone production.

After the adjustment, the business in Thailand will focus on high-performance coatings for composites, polycarbonate diols (PCD), and elastomer production.

Despite changes in the situation in Thailand, Ube has confirmed that its previously announced production suspension plan in Japan will remain unchanged: the closure of ammonia and its related products by March 2028, and the closure of the remaining main production lines for caprolactam, as well as the key production lines for cyclohexanone and nylon 6 (PA6) by March 2027.

Ube’s Spanish plant will continue to produce caprolactam and polyamide, while expanding the recycling and production of bio-based products such as recycled nylon and bio-based nylon for the European market, as demand in Europe is stronger. Once coordination with customers and other parties is completed, the Spanish plant will also cease production of cyclohexane, 1,6-hexanediol, and 1,5-pentanediol, thereby promoting carbon neutrality in Europe.

The major adjustment in Ube is due to the fact that these products are highly susceptible to market fluctuations, leading to decreased profitability and high greenhouse gas (GHG) emissions. In addition, there is an oversupply from companies in other countries, and the current business environment, especially in the Asian market, has bleak recovery prospects.

On the other hand, to achieve a transformation in business structure, the company is actively investing in expanding its specialty chemicals business, including polyimide, separation membranes, ceramics, semiconductor gases, separators, composite materials, C1 chemicals, high-performance coatings, pharmaceuticals, and phenolic resins. At the same time, it is downsizing, exiting, or adjusting its basic businesses, including nylon polymers, caprolactam, ammonium sulfate, industrial chemicals, elastomers, polyethylene films, and processing resins.

In October 2024, it is noteworthy that Ube announced the acquisition of Lanxess's polyurethane and ethyl carbamate businesses, which was completed in April this year. Additionally, Ube has broken ground on a new plant in Louisiana, USA, which is expected to be completed in 2026. This plant will produce 100,000 tons per year of dimethyl carbonate (DMC) and 40,000 tons per year of ethyl methyl carbonate (EMC). It is reported that DMC and EMC are used as electrolyte solvents for lithium-ion batteries, and DMC is also used in semiconductor manufacturing processes. In the future, the plant will also produce polycarbonate diol (PCD), waterborne polyurethane dispersions (PUD), and other products.

In addition, apart from Ube in Japan, Sumitomo Chemical transferred the intellectual property related to its caprolactam production technology (gas-phase Beckmann rearrangement technology) to HighChem Co., Ltd. last November.

Regarding caprolactam

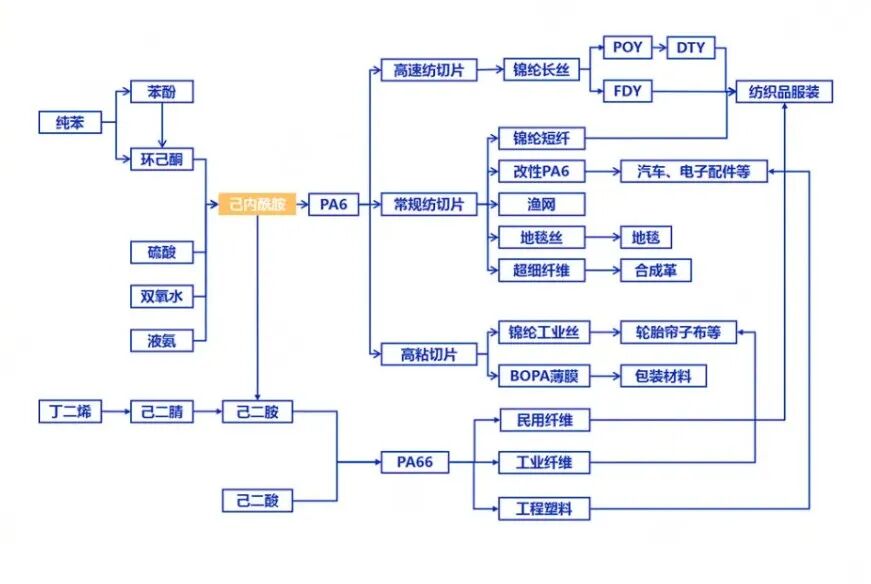

Caprolactam is an important organic chemical raw material with excellent physical and chemical properties. Its largest application field is nylon 6, which can be further processed into nylon fibers, engineering plastics, and plastic films, and is used in industries such as textiles, packaging, and automobile manufacturing.

Caprolactam industry chain

In contrast to Japan's Ube Industries, China's caprolactam production capacity is continuously expanding. In 2024, China's caprolactam production capacity is expected to reach approximately 6.94 million tons, with a production volume of 6.543 million tons and an apparent consumption of 6.49 million tons. In 2024, China will add 1.15 million tons of new capacity, including a new 300,000-ton facility by Hunan Petrochemical, a new 300,000-ton facility by Luxi Chemical, a new 400,000-ton facility by Hubei Sanning, and capacity expansion through technological upgrades by Hualu Hengsheng.

In the first half of 2025, the production capacity growth of the caprolactam industry was less than 0.1%, with only one company in Fujian completing technological transformation and capacity expansion. Although the caprolactam industry's capacity growth slowed down, downstream PA6 continued to release new capacity following rapid expansion in 2024. In the first half of 2025, PA6 added 145,000 tons of capacity, pushing the industry's total capacity beyond 8 million tons. The capacity gap between caprolactam and PA6 expanded to over 700,000 tons, resulting in demand growth outpacing caprolactam supply growth. This drove caprolactam producers to increase production enthusiasm, maintaining a high industry operating rate.

Major caprolactam producers abroad include BASF (Germany), Sumitomo Chemical (Japan), DSM (Netherlands), Toray (Japan), and Ube Industries (Japan).

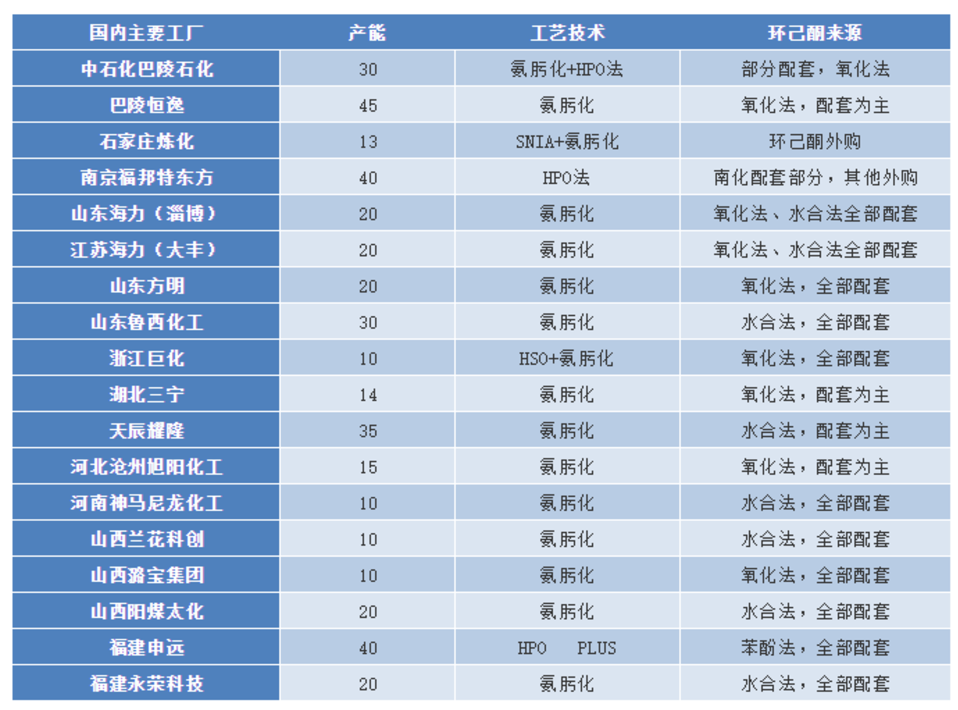

The main producers in China include Sinopec, Xuyang Group, Fujian Shenyuan New Materials, Pingmei Shenma, Hengshen Group, Hualu Hengsheng, Yankuang Energy, Juhua Group, Lanhua Technology, Haili Group, Luxi Chemical, Yongrong Technology, and others.

Major domestic factories, enterprises, and production process technologies are as follows:

It is worth mentioning that on August 4th, the Ecological Environment Bureau of the Ningdong Energy and Chemical Industry Base Management Committee issued a public notice regarding the planned review and approval of the environmental impact assessment documents for the 450,000 tons/year caprolactam integrated project of the nylon full industry chain by Pingmei Shenma (Ningdong) Nylon Chemical Co., Ltd.

The project is located in the Chemical New Material Industrial Zone C of Ningdong Energy and Chemical Base, covering an area of 156.1812 hectares, with a total investment of 8.85 billion yuan, including an environmental protection investment of 1.04 billion yuan. The project mainly involves the construction of key facilities such as a cyclohexanone unit, a caprolactam unit, and a PA6 polymerization unit, along with supporting installations. Upon completion, the main production capacity of the project will be 450,000 tons per year of nylon 6 chips and 37,800 tons per year of hydrogen.

It is reported that the Ningdong Nylon full industry chain project was signed in Yinchuan, Ningxia on December 28, 2024. The project's estimated total investment exceeds 10 billion yuan, and it will produce a full range of industry chain products such as caprolactam and nylon yarn. Pingmei Shenma (Ningdong) Nylon Chemical Co., Ltd. is a wholly-owned subsidiary of Pingmei Shenma Group, established in March 2025.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track