Capex Cut, Production Reduced Across All Product Lines! Two Major Panel Makers Warn of a Tough Second Half in 2025

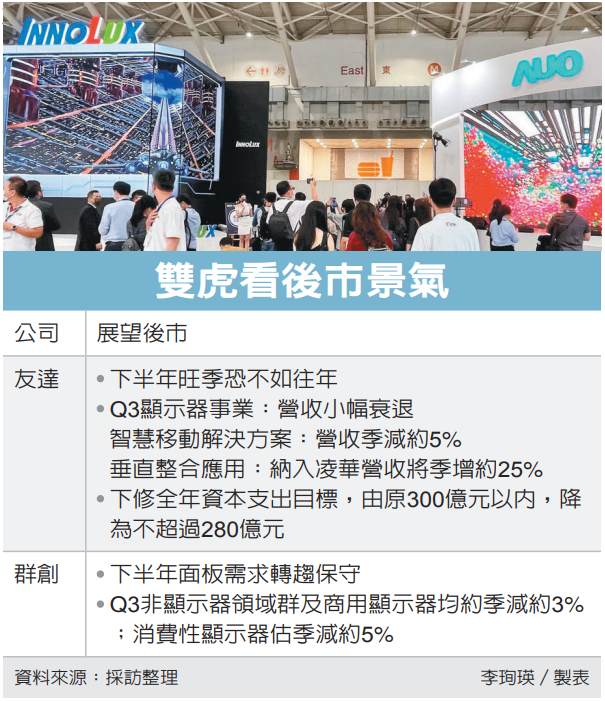

Panel industry giants warn that the second half of 2025 looks bleak; Innolux bluntly stated that shipments across all product lines will decline in the third quarter. On July 31, panel giants AUO and Innolux both warned that the traditional peak season in the second half of the year will not be as strong as usual. AUO has revised down its capital expenditure target for this year from the originally planned NT$30 billion to no more than NT$28 billion, a decrease of about 7%.

Innolux frankly stated that demand has turned conservative, and shipments for all product lines will decline this quarter. Panels are essential components for consumer products such as mobile phones, laptops, and PCs. With both major companies warning that the peak season in the second half of the year will not be strong, it suggests that consumer product demand for the year-end Thanksgiving and Christmas seasons in Europe and the United States will be conservative, effectively cancelling the peak season.

AUO held an earnings call on July 31. Chairman Peng Shuanglang admitted that due to factors such as the appreciation of the New Taiwan Dollar and uncertainty over tariffs, client-side inventory buildup this quarter is conservative, and brand manufacturers are strictly controlling inventory in response. The peak season effect in the second half of the year is expected to be weaker than in previous years. AUO estimates that shipments of all types of panel products this quarter will decline compared to the previous quarter.

AUO also estimates that the average exchange rate of the New Taiwan Dollar against the US Dollar for the second half of the year will be 29. Since more than 90% of its revenue is denominated in US Dollars, it is expected that the New Taiwan Dollar revenue from the display business this quarter will decrease compared to the second quarter. However, US Dollar revenue is expected to remain flat with the second quarter.

Considering the conservative end-market demand, AUO announced a downward revision of its 2025 capital expenditure target, lowering it from the originally planned within NT$30 billion to no more than NT$28 billion.

In July last year, AUO announced its transformation plan towards three major operational pillars, aiming for the two main businesses, Mobility Solution and Vertical Solution, to account for more than half of its revenue by 2027.

Regarding the details of the two major business outlooks for this season, AU Optronics General Manager Ko Fu-Jen pointed out that Mobility Solution's revenue in US dollars will maintain growth, while revenue in New Taiwan dollars is expected to decline by 5%. The annual related revenue is projected to increase by a single-digit percentage, slightly below the original forecast, mainly due to exchange rate effects.

In the Vertical Solution segment, as AUO holds a 32.8% stake in ADLINK and increased its board seats in the June board reelection to gain control, the revenue will be consolidated in the third quarter, showing a quarter-on-quarter growth of 25%.

Peng Shuanglang added that the combined revenue contribution of the two major businesses in the second quarter reached 43%, increasing by 2 percentage points year-on-year, steadily progressing towards the goal of exceeding 50% next year.

Regarding the tariff issue, Peng Shuanglang reiterated that panels are components, with a low proportion directly exported to the United States, and most shipments are conducted under FOB terms, so the direct impact of tariffs is limited. Observing that customers' products are mostly on the exemption list, after AUO's acquisition of BHTC, it has completed operational layouts in Southeast Asia, India, Europe, Mexico, and North America. In the future, it can flexibly adjust according to tariff changes and does not rule out collaborating with the supply chain to evaluate the most suitable production model.

On the same day, AUO also announced that the company will establish the positions of Group CEO and COO, which will be concurrently held by Chairman Paul Peng and President Frank Ko, respectively.

AUO announced that, in response to the company's organizational structure for display technology, smart mobility, and vertical sectors, the Board of Directors has approved the establishment of the Group Chief Executive Officer position. Chairman Mr. Paul Peng will concurrently serve as Group CEO, overseeing the group's global strategy and development direction, as well as leading the group’s operational support units.

In addition, to accelerate the integration among the three major operational pillars, business development, and global expansion, as well as to enhance organizational efficiency and collaborative operations, the Board of Directors has approved the establishment of the position of Group Chief Operating Officer, which will be concurrently held by the company's General Manager, Dr. Ko Fu-Jen. This move aims to respond to external changes, strengthen competitiveness, and expedite strategic transformation. The new personnel arrangement will take effect from August 1, 2025.

Innolux stated that due to tariff issues and some customers having already pulled orders forward, panel demand in the second half of the year will become more conservative. Panel manufacturers in the industry generally adopt a production strategy based on demand, which helps maintain supply-demand balance and price order.

Due to the sluggish market conditions, Innolux expects shipments across all product lines to decline this quarter. Shipments in the non-display sector and commercial displays are both expected to decrease by approximately 3% quarter-on-quarter, while consumer displays are estimated to decline by about 5% quarter-on-quarter.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track