Capacity expansion and incremental realization, polypropylene under pressure with lowering focus

Summary

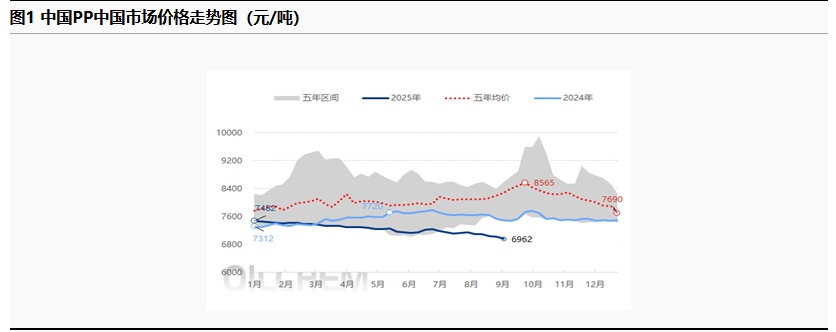

This week, the polypropylene market continued its downward trend, with an operating range of 6,860-7,050 yuan/ton.The market has weakened significantly, with market sentiment declining and downstream operations remaining persistently low. The market has retraced previous gains, falling back to low levels. Fundamentally, the commissioning of a new unit at Daxie Petrochemical has brought additional supply, and the return of previously repaired units has further increased supply, exerting obvious pressure on the market. On the demand side, the peak season atmosphere of September and October is relatively weak, with limited increases in downstream orders. Factories have insufficient stocking intentions, resulting in a lack of upward price momentum. With limited upstream and downstream drivers in the PP segment, prices continue to decline steadily. After a rise in futures on Wednesday, downstream buyers made purchases at low prices, resulting in overall decent transaction volumes.

Recent focus points in the polypropylene market:

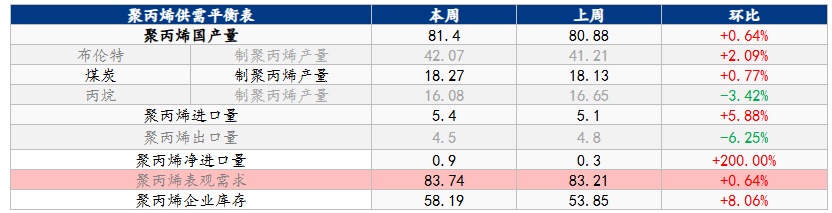

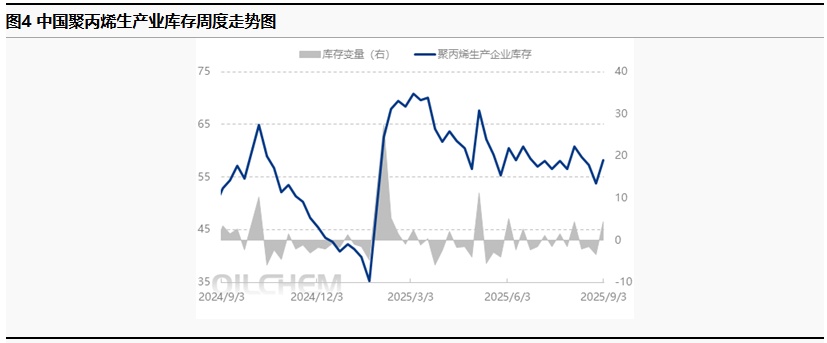

1. As of 2025 Year 9 Month 3 On that day, the total commercial inventory of polypropylene in China was 83.34 10,000 tons, an increase compared to the previous period. 6.63 10,000 tons, increased month-on-month 8.65% With new capacity being introduced to the market and previously halted facilities gradually restarting, supply pressure has intensified while demand is recovering slowly. As a result, production companies' inventories have risen during the week, with limited resource consumption, leading to a significant increase in traders' inventories as well. Ocean freight prices have fallen to relatively low levels, and previous orders are being delivered gradually, resulting in a smooth destocking at the ports this week. Overall, the total commercial inventory has increased this week.

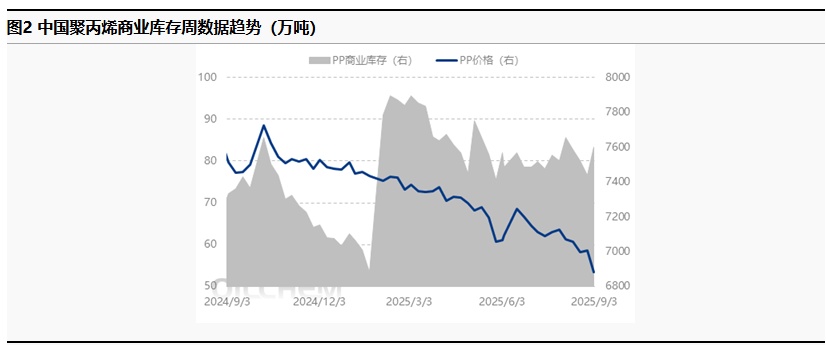

This week, domestic polypropylene production reached 814,000 tons, an increase of 5,200 tons or 0.64% compared to last week's 808,800 tons. Compared to the same period last year, production increased by 140,100 tons, a growth of 20.79% from 673,900 tons. During the week, facilities such as Sinopec Quanzhou and Lanzhou Petrochemical resumed operations, and the new 450,000 tons/year production line at CNOOC Daxie Phase II was put into operation. The pressure of increased supply on the polypropylene side continued to release, pushing the weekly production figures to a new high.

As of September 4, 2025, the weekly loss of domestic polypropylene production capacity was 205,110 tons, a decrease of 0.20% compared to the previous week. Among this, the loss due to maintenance was 139,290 tons, up 3.89% from the previous week, while the loss due to reduced operating rates was 65,820 tons, down 7.88% from the previous week. This week, the number of units undergoing maintenance due to malfunctions increased, leading to an unexpected rise in the maintenance loss. As more units are shut down for maintenance and the impact of peak season expectations, the loss due to reduced operating rates has decreased.

One,Polypropylene demand drags down Prices surprisingly decline during peak consumption season.

This week, the downward trend in the polypropylene market continues, with the operating range between 6,860-7,050 yuan/ton.The market has weakened significantly, with market sentiment receding and downstream operations remaining low. The market has given back previous gains and has once again fallen to a lower level. Fundamentally, the commissioning of new units at Daxie Petrochemical has brought additional supply increments, while previously maintained units have returned, further increasing supply and imposing a clear pressure on the market. On the demand side, the peak season atmosphere of September and October is relatively weak, with limited increase in downstream orders and insufficient factory stockpiling willingness, leading to a lack of upward price momentum. There is limited driving force from both upstream and downstream in the PP segment, resulting in a continuous downward trend in prices. After the futures rose on Wednesday, downstream buyers made purchases at low levels, and overall transactions were acceptable.

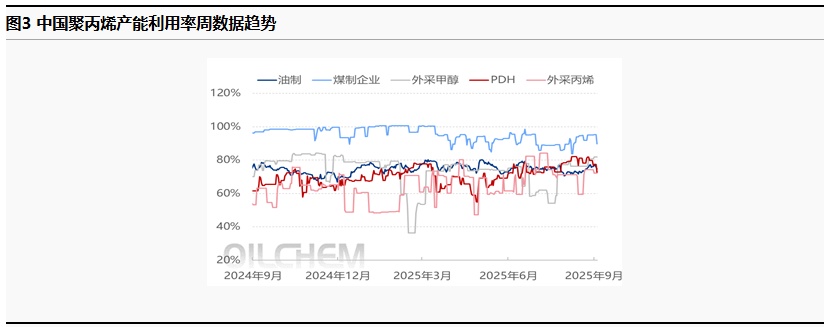

Table 1 Domestic Polypropylene Weekly Supply and Demand Balance Sheet

TwoMaintenance increments drag down production companies' capacity utilization rate month-on-month.

Forecast: The average polypropylene capacity utilization rate for this period is 79.91%, a decrease of 0.09% compared to the previous period. Sinopec's capacity utilization rate increased by 0.20% to 83.65%. The restart of Yanshan Petrochemical's first production line during the week led to an increase in Sinopec's capacity utilization rate. The shutdown of three production lines at Jinneng Chemical, four production lines at Yulong Petrochemical, and the first phase of CNOOC Daxie Petrochemical resulted in a decrease in the average polypropylene capacity utilization rate.

As of September 3, 2025, China's total commercial inventory of polypropylene stands at 833,400 tons, an increase of 66,300 tons from the previous period, representing a month-on-month increase of 8.65%.With new capacity being introduced to the market, combined with the gradual restart of previously halted facilities, supply pressure has intensified while demand recovery remains slow. Therefore, during the week, production enterprises... Inventory increased, resource consumption was limited, and traders' inventory also rose significantly. Sea freight rates fell to a relatively low level, and previous orders were being delivered successively, resulting in a smooth destocking status at the ports during this period. Overall, the total commercial inventory increased this week.

2 、Increased capacity expansion. Polypropylene capacity utilization rate rises.

The average polypropylene capacity utilization rate for this period was 79.91%, a decrease of 0.09% compared to the previous period. Sinopec's capacity utilization rate increased by 0.20% to 83.65%. The restart of the Yanshan Petrochemical production line during the week contributed to the increase in Sinopec's capacity utilization rate. The shutdown of the three production lines at Jinneng Chemical, four production lines at Yulong Petrochemical, and the first phase of CNOOC Daxie Petrochemical led to the decrease in the average polypropylene capacity utilization rate.

3Slow consumption of resources, rising inventory of manufacturing enterprises

As of September 3, 2025, the inventory of polypropylene production enterprises in China reached 581,900 tons, an increase of 43,400 tons from the previous period, representing a month-on-month increase of 8.06%. The introduction of new capacity into the market, combined with the gradual restart of previously halted units, has intensified supply pressure. Demand recovery has been slow, and resource consumption is limited, leading to an increase in inventory among production enterprises during the week.

Three,The downstream resumption of work is slow. New orders are relatively slow.

Predict : Book The average operating rate of the polypropylene downstream industry shows an upward trend, with BOPP and modified PP increasing significantly, while CPP remains stable. In the BOPP film sector, due to the bottoming out of raw material prices last week and limited downward space for film prices, end-users appropriately followed orders and restocked, resulting in a significant increase in industry operations. The automotive and home appliance industries are driven by policies, consumption upgrades, and product innovation, leading to an overall increase in demand. Coupled with the support of the traditional peak season, industry operations have significantly increased. Although there is a slight recovery in terminal demand in the CPP industry, new orders have not increased significantly, so there is no obvious improvement yet, and industry operations remain stable. After the high temperatures recede, downstream operations have increased, demand has recovered, and order growth has boosted operational enthusiasm, leading to a rise in PP pipe operations. Other industries are mostly driven by the demand peak season, with orders slightly increasing and industry operations rising. The traditional demand peak season supports the expectation of rising orders in the polypropylene products industry. It is expected that the operating rate of the polypropylene products industry will mainly increase week-on-week next week.

The follow-up on mainstream downstream orders is limited, and market prices are stable to slightly declining.

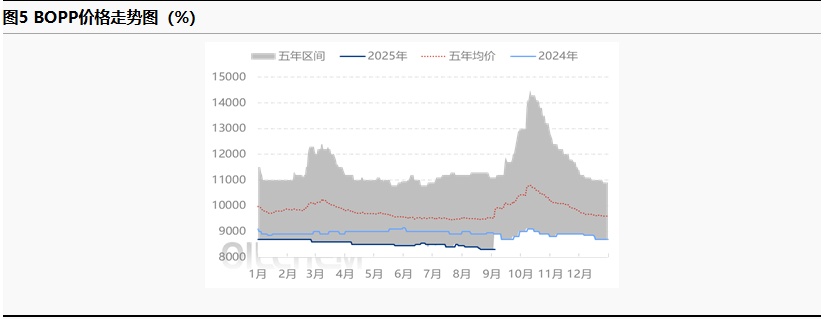

This week, the BOPP prices showed stability with slight declines. As of September 4, the mainstream ex-factory price for thick BOPP film in East China was between 8,300 to 8,500 yuan/ton, remaining stable compared to the previous period. With crude oil prices falling, PP futures declining, the spot market focus lowering, and the petrochemical ex-factory prices also dropping, the cost support is weakening. Film manufacturers' ex-factory prices fell by 50-100 yuan/ton, and mainstream market prices decreased by 50 yuan/ton in some cases. As raw material prices continue to drop, the mainstream BOPP prices tend to stabilize, with film manufacturers' profits increasing by 46.03% compared to the previous period. Downstream businesses and traders are following up with moderate orders. Although the traditional peak demand season has begun, there have been no reports of concentrated restocking due to weak raw material conditions and the gradual release of new BOPP production capacity. The supply pressure in the market is expected to increase, leading to a cautious market sentiment towards the future. Restocking is mostly maintained at small orders for immediate needs, and some facilities previously halted for maintenance and the September 3 parade have now resumed operations. In the short term, the film price trend is expected to remain stable with minor fluctuations.

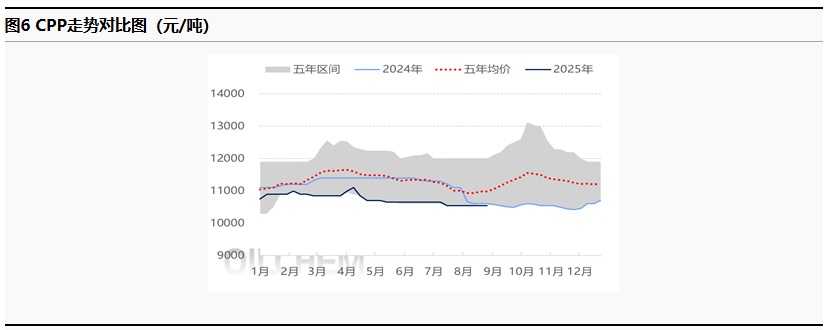

The price of East China low-temperature composite film remained stable this period, with the market sentiment still leaning towards caution. During the week, futures showed a fluctuating trend, and raw material market quotations adjusted within a narrow range, providing limited support for CPP. According to research, with the arrival of the traditional peak consumption season, some film companies have begun their Mid-Autumn Festival stocking cycle, and demand in core application areas such as food and packaging in the terminal market is gradually being released. However, the strength of demand recovery remains limited, with small and medium-sized film companies focusing on replenishing just-in-time inventory, and new orders being limited, without forming a concentrated surge in order demand. Companies need to maintain cautious procurement, with production facilities mostly maintaining normal operational loads. It is expected that with the boost from the upcoming National Day and Mid-Autumn Festival, there is an optimistic outlook for the CPP market to continue improving, with short-term prices expected to fluctuate slightly.

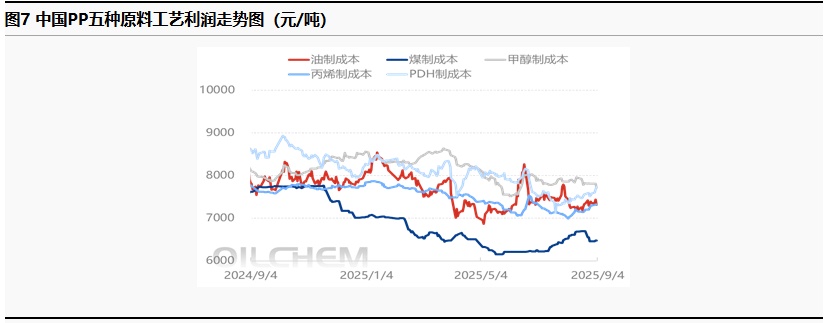

Four,Order follow-up downstream is sluggish, and market profitability is weak.

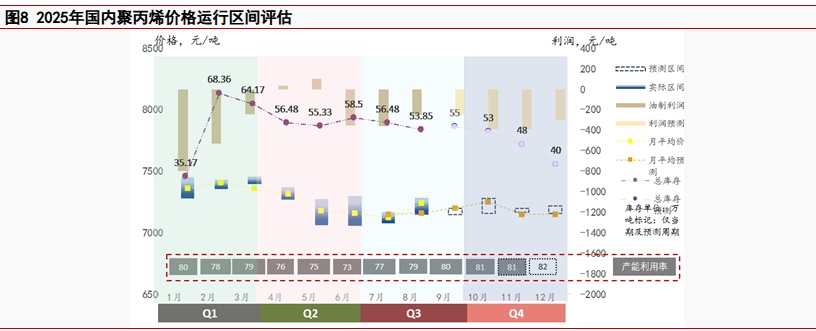

The profit margin for coal-based polypropylene (PP) production is in a profitable state this period, while the profit margins for PP production from other sources are all in a loss state.In the next forecast, the crude oil market may see OPEC+ increase production in October, heightening the risk of oversupply. As the traditional peak season for fuel ends, demand is expected to seasonally decline, and international oil prices are expected to fall next week, potentially leading to a recovery in oil-based PP profits. As for the thermal coal market, it may face downward pressure. With insufficient demand support, overall supply remains ample, and as the peak season for coal consumption is nearing its end, bearish sentiment in the market is growing. It is expected that coal-based PP profits may see a narrow increase next week.

In terms of the profit of polypropylene (PP) by category in China for this period, the weekly average profit of oil-based PP is -390.01 yuan/ton, a decrease of 62.30 yuan/ton compared to the previous period. The average profit of coal-based PP is 513.93 yuan/ton, a decrease of 5.8 yuan/ton compared to the previous period. The weekly average profit of PDH-based PP is -656.23 yuan/ton, a decrease of 90.75 yuan/ton compared to the previous period.

Supply, Demand, and Cost Intense Struggle: Polypropylene Breaking the Stalemate and Seeking New Breakthroughs

Table 3 Domestic Polypropylene Supply and Demand Balance Expectations

Supply: New capacity expansion increments are realized, supply-side increments

Supply-side increments, supply-side increments realized, the second phase of CNOOC Daxie Petrochemical's 450,000 tons/year unit expanded capacity this week, leading to a new high in PP production capacity. Although maintenance has increased, it is difficult to counter the massive PP production capacity. This week, domestic polypropylene production was 814,000 tons, an increase of 5,200 tons from last week's 808,800 tons, a rise of 0.64%; compared to the same period last year at 673,900 tons, it increased by 140,100 tons, a rise of 20.79%. Next week's polypropylene production is estimated to be around 805,000 tons.

Demand: Downstream demand is recovering slowly, and operations are gradually ramping up.

The demand side is recovering slowly. Downstream factories are maintaining production with existing orders, but new orders will take some time to recover. There is still a gap between the growth rate of demand and the increase in supply, and reversing the market's sluggishness will require additional external support.

Cost: There is room for flexibility on the cost side.

The cost side continues to ease, OPEC+ maintains production increase operations, and there is an expectation of easing in international oil prices; propane is expected to rise in overseas prices, providing stable short-term cost support for PDH production.

Conclusion (Short Term) : The next period of polypropylene is expected to experience bearish fluctuations, followed by opportunities for a rebound from low levels. The absolute low price is close to the cost baseline, and there is a chance for improvement in the supply-demand ratio.Key Focus: 1. Supply-side increments are being realized, with CNOOC Daxie Petrochemical's second phase line having a capacity of 450,000 tons/year expanding this week. The supply-side increment leads to new highs in PP capacity. Although there are more maintenance activities, they are hard-pressed to counter the massive PP capacity. 2. Demand side is slowly recovering. Downstream factories maintain operations with existing orders, but recovery of new orders will take time. The growth rate of demand still lags behind the supply increment, and reversing the market fatigue requires more external support. 3. Cost side continues to ease, with OPEC+ maintaining production increases and international oil prices expected to ease. Propane has a rising price expectation overseas, providing stable short-term cost support for PDH production. The main market price for East China raffia is 6,800-7,000 yuan/ton.

Conclusion (Medium to Long Term):The supply-side increment is becoming increasingly apparent, with concentrated production releases in early to mid-September. On the demand side, mainstream orders are not following up significantly, although there is a slight recovery in some areas. However, due to the impact of the sluggish global economy, both domestic demand and foreign trade are under pressure. The market is seeking more macro guidance from outside, and it is expected that the Federal Reserve will cut interest rates twice in September, which may enhance market liquidity. However, with the pressure of RMB appreciation emerging, export pressure will become more pronounced, which presents mixed implications for polypropylene. There is an intense struggle and game on the supply and demand side, and it is expected that the market will show a trend of weakening first and then slowly rising in September. In East China, wire drawing is expected to verify transactions around 6800-7100 yuan/ton. Key focus areas include changes in foreign trade export orders, changes in cost, and the volume release from new capacity expansion.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track