Building an Asian Application R&D Center! Why Is DOMO Chemicals Firmly Betting on China's High-End Nylon Track?

Source: DOMO Chemicals

On February 6th, DOMO Engineering Materials, a subsidiary of DOMO Group, announced the construction of a new Asian Application Development Center at its Haiyan production base in Jiaxing, Zhejiang. Preparatory work for the project has already begun. This center will collaborate with European R&D teams to provide support to customers in China and other parts of Asia.

Source: Dow Chemical

This layout stands in sharp contrast to the bankruptcy filings of its three German subsidiaries in late 2025, serving as a direct manifestation of DOMO Chemicals' differentiated strategy for the Chinese and European markets amid the restructuring of the global nylon industry. According to Focus on Plastics, this strategic divergence is not accidental; rather, it is based on multiple considerations of the current market status in China and Europe, the company's own industrial positioning, and downstream demand potential. Furthermore, it represents an inevitable choice for the global chemical industry amidst transformations in energy, costs, and supply chains.

I. Sino-European Nylon Market: A Structural Dichotomy of Ice and Fire

The global nylon engineering plastics market is undergoing a structural adjustment, with contrasting development trends in China and Europe, forming the core context for Domo Chemicals' strategic choices.

China's nylon market is currently in a phase of rapid capacity expansion and high-end breakthroughs. In the PA6 sector, upstream capacity is severely oversupplied, and the ordinary chip market is embroiled in a price war. In the PA66 sector, a breakthrough in domestic adiponitrile technology has led to a surge in capacity. By 2025, domestic adiponitrile production capacity is expected to exceed 800,000 tons, with over 3 million tons under construction or planned, bringing the total PA66 production capacity to over 1.5 million tons per year.

However, the domestic PA66 market faces significant structural contradictions. New capacity is concentrated in the mid-to-low end, and the stability of product quality remains to be verified. Meanwhile, the self-sufficiency rate for high-end modified products is less than 30%, with critical areas such as automotive electric drive systems and 800V connectors still heavily reliant on imports. At the same time, emerging fields like photovoltaics, low-altitude drones, and robotics are continuously generating new demands, providing vast market space for high-end nylon materials. The Chinese high-end PA66 market still possesses immense growth potential.

The European nylon market is mired in the dual predicament of sluggish demand and soaring costs. From March 2024 to December 2025, spot prices for phenol and acetone in Europe plummeted, yet local production costs remained stubbornly high, with phenol production costs far exceeding those in Southeast Asia and the Middle East. Following the Russia-Ukraine conflict, European natural gas prices have remained elevated; coupled with stringent environmental standards, companies must bear heavy carbon allowance expenses, further raising industrial thresholds. Meanwhile, Chinese nylon products have not yet been included in the initial scope of the EU's Carbon Border Adjustment Mechanism (CBAM), allowing them to enter the European market at low costs and creating a significant impact on the local industry.

Against this backdrop, the European nylon industry is shrinking at an accelerating pace. Fibrant in the Netherlands has closed its caprolactam plant, and giants such as BASF and Covestro are shifting their production capacities to Asia, making the trend of industrial hollow-out increasingly evident.

II. Technology as King+Scene Disruption, Daoomer Chemical's Core Competitive Advantages

In the global nylon industry, DOMO Chemicals holds a core position within the second tier. Leveraging over 70 years of R&D experience in polyamides, it has become a key player possessing both deep technical heritage and advantages in niche segments. This industrial standing has laid a solid foundation for its strategic differentiation between Asia and Europe.

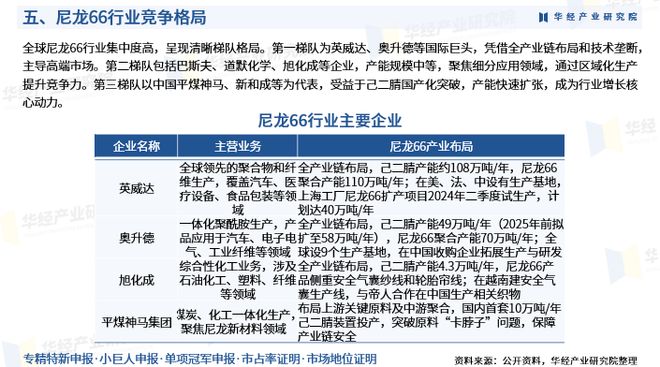

From the perspective of the global nylon 66 industry competitive landscape, the market is highly concentrated and clearly tiered: the first tier consists of international giants such as Invista and Ascend, which dominate the high-end market with their integrated value chain and technological monopolies; the second tier includes companies like BASF, DOMO Chemicals, and Asahi Kasei, with medium production capacity, focusing on niche application areas and improving competitiveness through regionalized production; the third tier, represented by Chinese companies such as Pingmei Shenma and NHU, has achieved rapid capacity expansion benefiting from breakthroughs in the domestic production of adiponitrile.

PA66 Industry Competitive Landscape. Source: Hua Jing Industrial Research Institute

As a medium-sized specialty chemical enterprise, Domo Chemicals' core strengths lie in technological innovation and product development. Its flagship factories, Leuna and Premnit, were once vital pillars of the European nylon industry, producing key intermediates such as phenol and acetone for long-term supply to high-end manufacturing sectors.

DOMO Chemicals is deeply invested in TECHNYL®The brand's product portfolio covers conventional engineering polymers such as PA6 and PA66, as well as high-end materials like PA6.10 and PA6T. It offers compounded materials and copolymer solutions suitable for various processes, with excellent thermal management performance and hydrolysis resistance. Its products are widely used in advanced industrial fields such as connectors, photovoltaics, and low-altitude drones.

In the field of sustainable materials, DOMO Chemicals' technological advantages are particularly prominent, building four core circular low-carbon pathways: TECHNYL. ®4EARTH®Mechanical recycling can recover up to 100% of material components, with performance comparable to virgin materials.

MOVE4EARTH®Patented chemical recycling technology transforms PA66 airbag textiles into high-quality engineering plastics; TECHNYL

®Bio-based polyamides made from castor oil can replace a variety of materials.

Bio-based mass balance solutions enable the replacement of fossil-based feedstocks and a low-carbon transition.

In addition, its Haiyan, Jiaxing factory has obtained international sustainability certifications such as ISCC+ and GRS, and has consecutively achieved EcoVadis Platinum rating, with its accumulated green material technology aligning with the global "dual carbon" trend.

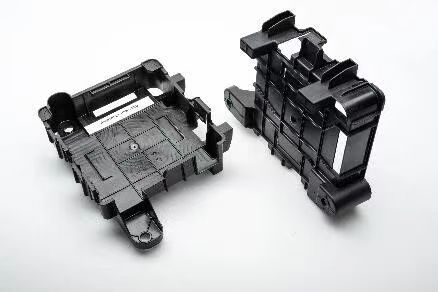

Currently, DOMO Chemicals' typical products have achieved commercial application in multiple fields: in the automotive sector, TECHNYL... ®The 4EARTH series materials are applied to components such as wheel cover trims. Co-developed with TATA Group, these grades meet the high strength and weather resistance requirements of automotive manufacturers. In the electronics and electrical sector, its materials are used in the core components of Siemens residual current circuit breakers, precisely meeting electrical safety standards. In the industrial sector, barrel fixing devices developed based on impact resistance characteristics have significantly improved the stability of industrial transportation. These products, with their excellent performance and environmental characteristics, have formed a differentiated competitive advantage in the high-end market.

Image source: ©AUDIAG

Downstream demand explodes, the Chinese market becomes the core engine of growth.

Dow Chemical's decision to increase its investment in the Chinese market is primarily driven by the rapid development of China's downstream markets, especially the rise of the new energy vehicle industry, which has created unprecedented market opportunities for nylon engineering plastics. Meanwhile, the development of renewable energy and energy storage further expands the application boundaries.

China is the world's largest new energy vehicle market, with its market share continuously increasing. Intensified competition among automakers has shortened vehicle development and validation cycles, placing higher demands on upstream materials. Nylon engineering plastics, with their lightweight, high-temperature resistance, and high-strength properties, have become a core material for new energy vehicles to achieve lightweighting through "plastic instead of steel." The amount of nylon used per vehicle is approximately 100 kilograms, and it is widely applied in core components such as battery packs, connectors, and cooling systems.

Compared to traditional gasoline vehicles, new energy vehicles have more stringent performance requirements for nylon materials. Materials surrounding the battery pack need to have excellent hydrolysis resistance and flame retardancy, while motor components require high heat resistance. This creates a broad application scenario for high-end nylon materials. DOMO Chemicals' TECHNYL... ®The series of materials can precisely match the material needs of new energy vehicles, thus becoming important partners for car manufacturers.

The technological iteration of the new energy vehicle industry is driving the development of nylon materials towards high-end and customized solutions. As new energy vehicles upgrade to longer range, faster charging, and more intelligent features, the popularization of 800V high-voltage platforms demands connector materials with higher voltage resistance and arc resistance. Integrated die-casting processes, on the other hand, require nylon materials to have better adhesion with metals. Simultaneously, the entry of non-traditional automotive companies into the parts and components sector places higher demands on the research and development response speed and technological accumulation of modified plastics enterprises.

DOMO Chemicals' investment in its Asian Application Development Center is a precise response to this trend. Leveraging its localized production bases and mature supply chain, the company will accelerate the transformation from R&D to large-scale production, swiftly responding to the customized needs of Chinese automakers by providing comprehensive technical support—from product prototyping to final molding and processing.

In addition to new energy vehicles, the development of renewable energy, energy storage, and smart living sectors in China provides continuous demand support for nylon materials. In the photovoltaic field, nylon materials are used in components such as brackets and connectors, requiring weather resistance and anti-aging properties. In the energy storage field, the housings and structural components of battery energy storage systems demand nylon materials with flame retardant and high-strength characteristics. In the smart home appliance sector, the demand for lightweight and aesthetic designs drives the widespread application of nylon materials in various components. Domo Chemicals' material products already fully cover these high-growth areas, and China, as the world's largest production base for photovoltaics, energy storage, and home appliances, provides a solid market foundation for its development. Furthermore, China's "dual carbon" goals are promoting green and low-carbon transformation across industries, and Domo Chemicals' sustainable nylon materials are continuously expanding their applications in fields such as food contact and water management, further opening up market growth opportunities.

Four Core Considerations: The Underlying Logic of Dow Chemical's Strategic Differentiation

Domochemical's differentiated strategy of increasing investment in China while scaling back in Europe is essentially a rational choice in the context of energy transformation and supply chain restructuring. It is a response to the changing global nylon industry landscape and a global resource reconstruction based on cost and demand, underpinned by four core layers of logic.

Cost and profitability considerations are the direct cause of strategic differentiation.High energy costs, stringent environmental regulations, and persistently low product prices in the European market have created a severe profitability dilemma. DOMO's German subsidiary faces production costs significantly higher than market prices, making it difficult to profit even with a stable customer base. In contrast, the Chinese market boasts significant cost advantages and a complete chemical industry chain, effectively reducing raw material procurement and manufacturing costs. DOMO's Chinese factory has achieved consecutive years of profit growth.

The difference between market demand and growth potential is the core driver of strategic focus. As the "ballast stone" of global manufacturing, China boasts the most complete supply chain system, agile response mechanisms, and a vast domestic market. High growth in sectors such as new energy vehicles and photovoltaics provides continuous demand support for nylon materials, while manufacturing growth in Europe is relatively sluggish. Domo Chemicals' Asian Application Development Center can not only serve the Chinese market but also radiate to surrounding markets such as Japan, South Korea, and Southeast Asia, where nylon demand is growing rapidly, offering broad growth opportunities for the company.

The supporting advantages of the supply chain and industrial ecosystem are crucial foundations for Domo's deep roots in China. China possesses the world's most comprehensive chemical industry chain, forming a complete industrial ecosystem from upstream key raw materials to downstream product processing, which can provide Domo with stable raw material supply and efficient production support. Meanwhile, breakthroughs in the domestic production of key raw materials such as adiponitrile in China have broken foreign technological monopolies, providing raw material guarantees for the development of the PA66 industry and reducing supply chain risks for Domo's high-end product manufacturing. In contrast, the European supply chain system is facing restructuring, with geopolitical uncertainties and rising trade protectionism driving companies to relocate to regions with supply chain security. China's stable industrial environment has thus become an important choice.

The alignment of a company's self-positioning is the intrinsic logic of strategy implementation.As a mid-sized specialty chemicals company, Domo Chemicals cannot withstand the continued cost pressures in the European market. Conversely, the structural contradiction in the Chinese market – overcapacity in the low-end sector and insufficient supply in the high-end sector – complements Domo's technological advantages. By focusing on high-end fields such as high-temperature nylon and bio-based nylon, Domo can precisely match the high-end demands of the Chinese market. The construction of the Asian Application Development Center will further strengthen its localized R&D and production capabilities, realizing the synergy between European R&D accumulation and China's cost advantages and terminal market diversity, thereby building a core competitiveness based on global resource integration.

V. Summary

DOMO Chemicals' diverging Asia-Europe strategy is a microcosm of the global chemical industry undergoing energy transition and supply chain restructuring. Amidst the overarching trend of the global nylon industry shifting towards China and other Asian regions, DOMO Chemicals' decision to root itself in China and strategically position itself in Asia is both an inevitable market response and a strategic choice to leverage its technological advantages and achieve sustainable development. Its business contraction in Europe is not a failure of corporate management, but rather a reflection of the collective predicament faced by the European chemical industry due to the "impossible triangle" of energy, environment, and cost.

With the establishment and operation of the Asian Application Development Center in the future, DOMO Chemicals will further strengthen its presence in China and the Asian market. Leveraging localized innovation and the synergistic effect of its global R&D network, the company will continue to focus on high-growth areas such as new energy vehicles and renewable energy. DOMO Chemicals' strategic layout will become a typical paradigm for global chemical companies' development in China.

Editor: Lily

Sources: DOMO Chemicals, ECHEMI, AdsaleCPRJ, Aibang Polymer, Huaon Industrial Research Institute, etc.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Sony Joins 13 Chemical Material Firms to Build World's First Renewable Plastic Supply Chain in Electronics

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

Building an Asian Application R&D Center! Why Is DOMO Chemicals Firmly Betting on China's High-End Nylon Track?

-

Lutai's Major Equity Change! Uniqlo's Parent Company Joins Hands With Chenfeng to Enter the Market, Creating a "Community of Destiny" in the Textile Industry

-

New Global Polyolefin Giant to Emerge! Evonik Expands HTPB Global Capacity; DOMO Steps Up Investment in China