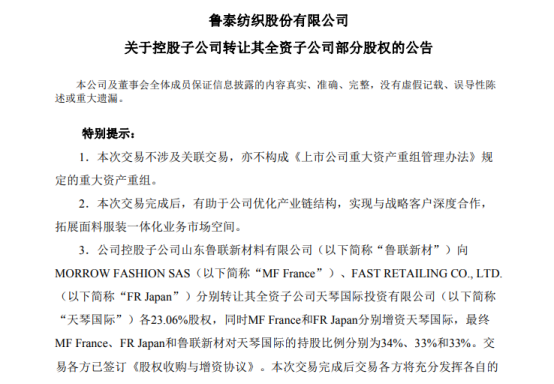

Lutai's Major Equity Change! Uniqlo's Parent Company Joins Hands With Chenfeng to Enter the Market, Creating a "Community of Destiny" in the Textile Industry

On January 27, Lutai A (000726) announced that its controlling subsidiary, Shandong Lulian New Materials, intends to transfer part of the equity of its wholly-owned subsidiary Tianjin International Investment Co., Ltd. (hereinafter referred to as "Tianjin International") to two overseas enterprises, and simultaneously accept capital increase. The specific transaction amount and valuation have not yet been disclosed.

According to the announcement, this transaction is divided into two stages: equity transfer and capital increase. First, Lulian New Material will transfer 23.06% of the equity of Tianqin International to Fast Retailing and MORROW FASHION SAS (hereinafter referred to as "MF France") respectively. Subsequently, the two transferees will increase the capital of Tianqin International respectively. After the completion of the transaction, the shareholding ratios of MF France, Fast Retailing, and Lulian New Material in Tianqin International will be 34%, 33%, and 33% respectively. Tianqin International will change from a wholly-owned subsidiary of Lulian New Material to a participating company jointly held by the three parties, and will no longer be included in the consolidated financial statements of Luthai A.

Investment background of two investors

One of the counterparties is Fast Retailing Co., Ltd. ("Fast Retailing Group"), the globally renowned apparel retail giant and parent company of Uniqlo, and also a long-term strategic customer of Luthai A. As a global manufacturer of high-end yarn-dyed fabrics and international first-line brand shirt manufacturer, Luthai A has entered Uniqlo's core supplier list, providing it with high-end yarn-dyed fabrics and garment products. This transaction may mark the upgrade of cooperation between Luthai and Uniqlo from the supply chain level to the capital tie-up level.

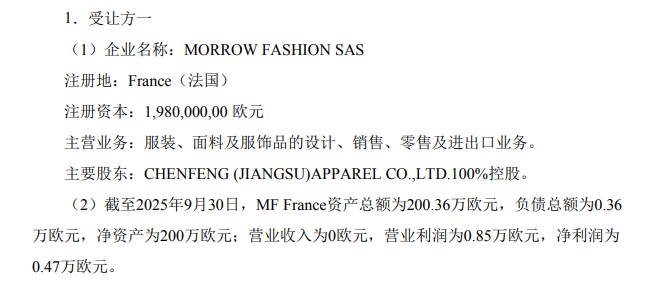

Morrow Fashion SAS, registered in France, is 100% owned by Jiangsu Chenfeng Garment. It has deep roots in the European high-end apparel fabric market and possesses mature experience in brand operation and European channel expansion. This perfectly complements Luthai A's shortcomings in the high-end European terminal market.

As a global leader in high-end yarn-dyed fabrics, Luthai Textile boasts a complete industrial chain from cotton cultivation to brand marketing, with an annual production capacity of 220 million meters of yarn-dyed fabrics and 30 million garments. Its high- and mid-range yarn-dyed fabrics account for over 18% of the global export market share. It has long supplied high-end fabrics and apparel to Uniqlo, solidifying its core position in the supply chain. MF France's controlling shareholder, Morning Star Group, has been deeply rooted in the apparel manufacturing sector for sixty years, having established an entire industrial chain ecosystem covering fabric weaving, accessory production, and garment manufacturing. Leveraging its mature intelligent hanging production line system, lean management capabilities, and industry-academia-research collaboration advantages, it can achieve efficient conversion from fabric to finished garments. Fast Retailing Group, as a globally renowned apparel retail giant, provides stable order demand and market guidance for the industrial chain through the brand influence of Uniqlo and its global channel resources. The three parties, through capital ties, achieve complementary advantages in fabric R&D, garment manufacturing, and brand operation, promoting deep integration across all links of the industrial chain.

Strategic significance

Lutai stated that this transaction aims to strengthen upstream and downstream collaboration in the industrial chain, deepen cooperation with strategic customers in business, marketing, and other aspects, and achieve common development for all parties.

As a core investment platform under Lulian New Materials, Tianqin International's business layout aligns with Lutai A's fabric and apparel integrated strategy. After introducing strategic investors like Fast Retailing Group, it is expected to leverage their brand resources and market channels to optimize Tianqin International's business structure and profitability.

From the perspective of LuTai's operating fundamentals, the company has been continuously advancing its integrated textile and apparel strategy in recent years, possessing a complete industrial chain from textile production, dyeing and finishing, and garment manufacturing to brand marketing. It has established 19 holding subsidiaries and over 40 production facilities in countries such as the United States, Italy, and Japan. The company boasts an annual production capacity of 220 million meters of yarn-dyed fabrics, 90 million meters of printed and dyed fabrics, 20 million meters of functional fabrics, 14,000 tons of knitted fabrics, and 30 million pieces of garments. Over 60% of its products are sold to more than 60 countries and regions, including the United States, the European Union, and Japan. The company has established strategic cooperative relationships with well-known domestic and international brand owners, and its export market share for mid-to-high-end yarn-dyed fabrics accounts for over 18% of the global market.

In 2025, the textile industry faces overall pressure. According to the company's latest disclosure, it is expected to achieve a net profit attributable to the parent company of 570 million yuan to 630 million yuan in 2025, an increase of 38.92% to 53.54% year-on-year. However, the net profit after deducting non-recurring items is expected to be 370 million yuan to 430 million yuan, a decrease of 10.85% to 23.29% year-on-year.

This tripartite collaboration is no longer just an ordinary inter-enterprise partnership – it marks a strategic leap for China's textile and apparel industry from "going it alone" to "ecological synergy" and then to "capital binding," holding milestone significance in the global supply chain restructuring wave.

Sources reveal that the three parties will use Tianqin International as an investment and operation platform to focus on promoting the construction of a textile and apparel production base in Cambodia. This base's construction differs from past single outsourcing transfers; the project marks the first full-chain closed-loop implementation from "spinning → weaving → dyeing & printing → garment making → brand export," making it arguably the first "full industrial chain overseas demonstration project" in the Chinese textile and apparel industry. The base plans to adopt a "joint factory + shared supply chain" model, with Luthai Textile providing localized high-end fabric supply to reduce reliance on cross-border logistics; Morning Star Group will lead intelligent garment production, introducing its mature domestic digital management system and full-process quality control standards, while simultaneously exporting professional technical skills cultivated through school-enterprise cooperation; Fast Retailing Group (Uniqlo) will export order standards and sustainable development requirements to achieve precise matching of production capacity and market demand. Morning Star Group's production management, Luthai's high-end fabric technology, and Uniqlo's terminal channels form an "iron triangle," enabling the Chinese textile and apparel industry to possess the ability to "export the entire industrial system as a whole" for the first time.

Simultaneously, this tripartite cooperation addresses the critical proposition of "dual circulation," innovatively implementing a "domestic headquarters + overseas base" dual-engine model: retaining high-end functions such as R&D and digital hub in China, while overseas undertaking labor-intensive production. This model not only responds to the "Belt and Road" initiative but also provides a "replicable solution" for circumventing trade barriers.

The alliance between Uniqlo, Chenfeng, and Luthai is not merely a convergence of commercial interests; it represents a groundbreaking exploration of deep supply chain synergy and value co-creation amidst the wave of globalization. This innovative practice not only offers a replicable "Chinese solution" for the textile industry to overcome global challenges such as trade barriers and high costs, but also accelerates the mature development of the "Chinese technology + Southeast Asian capacity + international brand" triangular cooperation model. This collaboration will not only fortify the three parties' risk resilience and profitability stability but also inject new impetus and set a new benchmark for global textile supply chain collaboration, continuously strengthening the resilience of regional industrial and supply chains. It will further consolidate the leading position of Chinese textile and apparel enterprises in the global textile industry landscape, writing a new chapter in the globalization of supply chain cooperation.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

New 3D Printing Extrusion System Arrives, May Replace Traditional Extruders, Already Producing Car Bumpers