Breaking the Monopoly! Domestic Technology Enters Trillion-Dollar Market

On August 30, the bio-based PC specialty engineering plastic, a collaboration between Kunlun Engineering Company under CNPC Engineering and Puyang Shengtong Juyuan, was showcased at the 7th New Materials Industry Expo. As the largest capacity facility in China, it uses bio-based monomers to replace bisphenol A, offering better performance without bisphenol A, breaking the monopoly of foreign enterprises.

The biobased PC industrial production facility, jointly developed by Kunlun Engineering Company and Puyang Shengtong Juyuan, successfully commenced operations in February 2025. As the first and largest biobased PC industrial production facility in China, it has an annual production capacity of 5,000 tons. The process replaces the co-monomer bisphenol A with a biobased monomer and introduces a unique dibenzofuran ring structure into the polymer products, thereby surpassing traditional bisphenol A-type PC in key indicators such as optical performance and weather resistance. With the inherent advantage of being bisphenol A-free, it precisely targets the trillion-level application markets in food packaging, medical devices, and more.

This technology is spearheaded by Puyang Shengtong Juyuan New Material Co., Ltd. for fundamental research, with Kunlun Engineering Company leading the process package development and engineering design. It overcomes technical challenges such as core monomer synthesis and purification, efficient polymerization process development, product performance balancing and regulation, industrialization, and cost control. This breaks the monopoly of foreign companies' products in the Chinese market, opens up the possibility of domestic commercialization of bio-based PC, and enhances China's core competitiveness in the functionalization, differentiation, and high-end development of polycarbonate.

From the perspective of technology, the synthesis of PC typically involves two processes: the phosgene method and the non-phosgene method. The phosgene method includes solution phosgenation, interfacial polymerization, and ester exchange methods. The interfacial polymerization method is currently the most commonly used approach, where bisphenol A sodium salt reacts with phosgene to produce polycarbonate. This method is mature, stable in production, and easy to control.

Non-phosgene method: This primarily involves transesterification of dimethyl carbonate with phenol to produce diphenyl carbonate, which then undergoes transesterification and polycondensation reactions with bisphenol A to form polycarbonate. This method is referred to as a "green process" because it does not use toxic phosgene as a raw material, making it safer for the environment and operators.

Biobased PC is synthesized using biobased bisphenol A and diphenyl carbonate as raw materials through a non-phosgene polymerization process, which requires high-temperature reactions and exhaust gas treatment during production.

Shengtong Juyuan invested 1.95 billion yuan in 2017 to build the first phase of a 130,000 tons/year polycarbonate project, utilizing the "non-phosgene melt transesterification" production technology, which has independent intellectual property rights. The company is also one of the first in China to master the non-phosgene melt transesterification method for PC production. The second phase of Shengtong Juyuan's project is a 54,000 tons/year specialty polymer project under construction in collaboration with PetroChina, which includes low melt index PC sideline projects, bio-based PC projects, PPS projects, hydrogenated bisphenol A projects, isomannitol projects, and modified plastic production line projects.

The competition in the PC market is intensifying.

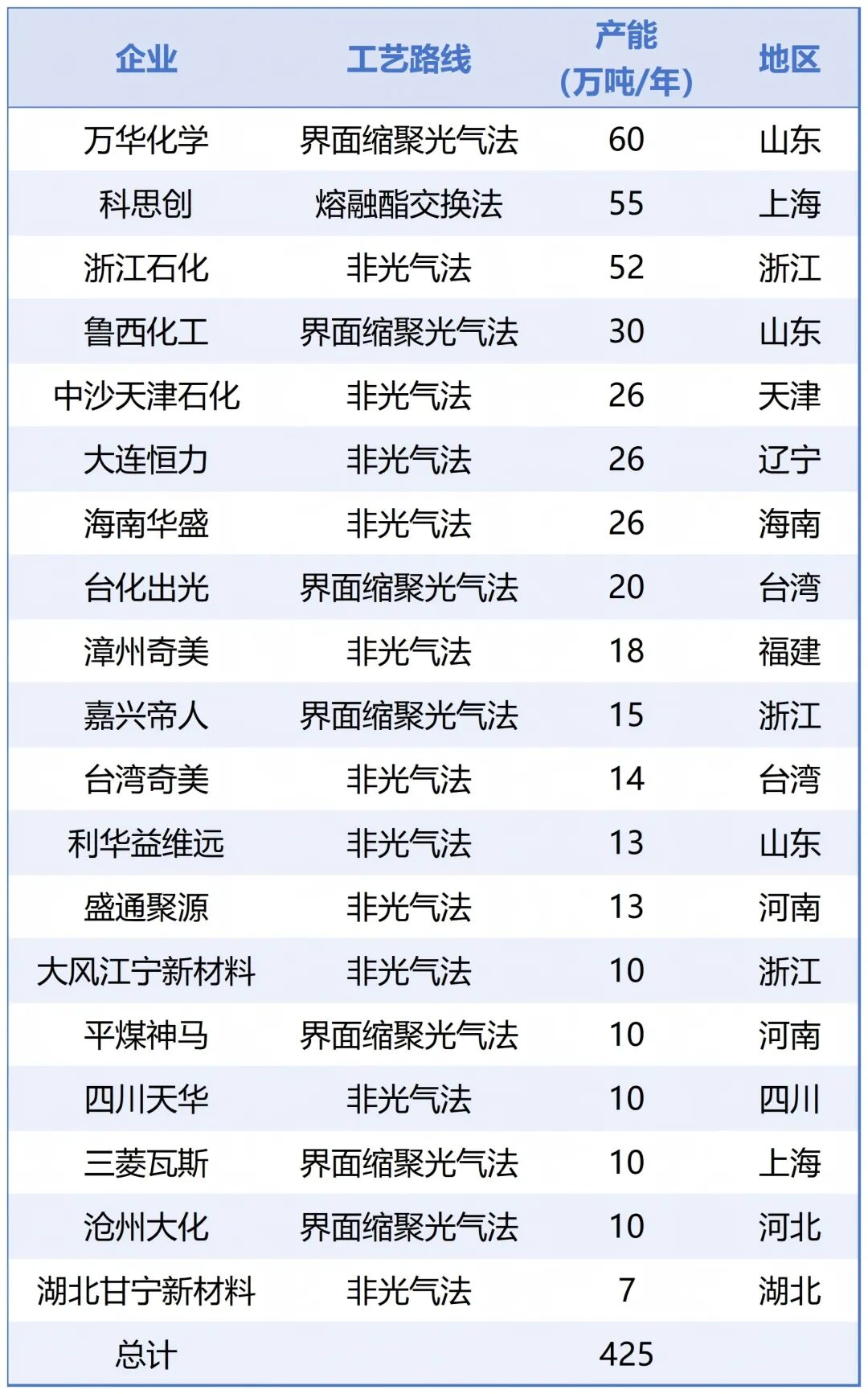

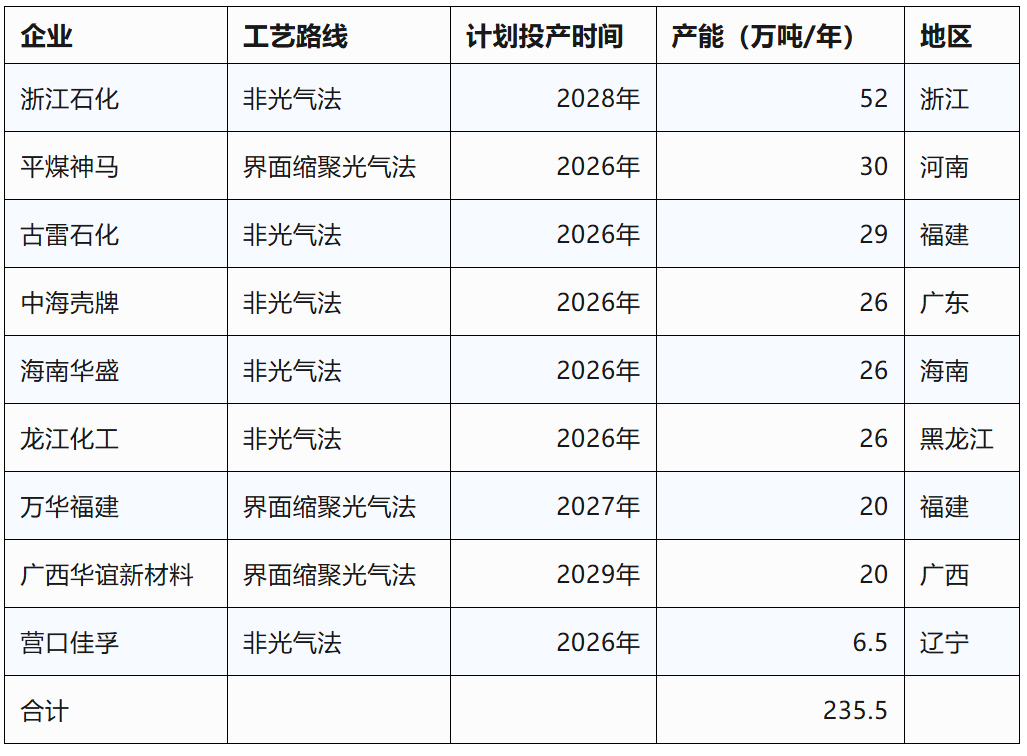

In 2024, the global PC production capacity will grow to approximately 7.8 million tons per year, with China's PC industry showing a rapid development trend. By the end of 2024, the total domestic production capacity will reach 3.81 million tons, with an output of 2.3 million tons, accounting for almost half of the global production capacity, ranking first globally. In the past five years, the growth of PC production capacity in China has seen a significant increase in non-phosgene production methods, which have now become the most important PC production process domestically, accounting for nearly 50%.

In addition, the projects under construction and planned exceed 2 million tons.

Although China's PC production capacity ranks first nationwide, the import volume in 2024 is 887,300 tons, and the export volume is 487,100 tons, with the import dependence rate dropping to 24.7%. However, high-performance and specialty PC products still need to be imported, such as high fluidity, high heat resistance, medical-grade, optical-grade, and other high-end grade products.

Future PC products to watch.

In the face of fierce market competition,During the "15th Five-Year Plan" period, the PC industry will focus on high-end products.

1. Medical-grade PC: The medical industry requires extremely high standards for material safety and reliability. The FDA certification process is lengthy and requires passing stringent biocompatibility and other tests.

Medical-grade PC can be used in the field of medical devices (such as syringes, dialysis machines, surgical instruments, etc.), diagnostic equipment (such as lenses and cover slips for optical microscopes), artificial organs (such as heart valves and ideal materials for artificial blood vessels), drug delivery systems (such as capsules and implants for sustained-release drugs), as well as housings and protective covers for medical equipment. Medical-grade PC manufacturers include Covestro, Wanhua Chemical, Teijin, SABIC, and others.

2. Optical-grade PC: The light transmittance needs to reach 92% or higher, and nanometer-level control technology needs to be improved.

Optical-grade PC is widely used in optical lenses, display panels, LED lampshades, and other fields. Internationally, companies such as Japan's Teijin, Covestro, and SABIC are prominent players, while domestic companies like Wanhua Chemical and Luxi Chemical continue to invest in research and development in this field. On August 27th this year, Wanhua Chemical and Geely Automobile jointly released the collaborative results of automotive-grade light-guided PC material Clarnate® LED1355. Wanhua Chemical became the first Chinese company to enter Geely Automobile's core supply chain for automotive lamp light-guiding materials. This material achieved breakthroughs in raw material ratio, additive optimization, and production process through the interface polycondensation phosgene method independently developed by Wanhua.

Some special grades of PC, such as flame-retardant PC and bio-based PC, are worth paying attention to.

Flame-retardant PC: Mainly used in the fields of electronic and electrical enclosures, automotive parts, etc.

Bio-based PC: The main companies in this sector include Mitsubishi Chemical, Covestro, and Teijin of Japan. As a green and environmentally friendly specialty material, the collaboration project between Shengtong Juyuan and Kunlun Engineering has achieved an industrial breakthrough, with the potential to rapidly replace traditional products in fields such as food contact and medical applications. For example, Covestro has launched "bio-based Makrolon®" for use in eyeglass lenses; Teijin has developed 100% bio-based PC; and Mitsubishi Chemical uses isosorbide (ISO) as a bio-based monomer in its DURABIO series, which has been applied in a variety of interior and exterior components, such as high-gloss speaker covers and center control panels.

Overall, the successful industrialization of bio-based PC marks a critical leap for China from "following" to "leading" in the field of specialty PC. The "state-owned + private enterprise" cooperation model provides an efficient pathway for technology transformation. Facing the dual challenges of intensifying global PPC market competition and reliance on imports for high-end products, the PC industry needs to focus on "high-end, differentiated, and green" as its core direction, concentrating on technological breakthroughs in key areas such as medical-grade and optical-grade products. By leveraging the advantage of independent processes to reduce costs, the industry can consolidate its capacity advantage amidst fierce competition and achieve a qualitative transformation from a "capacity powerhouse" to an "industrial powerhouse."

Sources: Sujie Consulting, Chemical New Materials, World Chemical Industry Research, and other publicly available online information.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track