Breaking monopoly: Dual Leaders in PEEK and Robotics See Profits Soar by 170%!

Lightweight humanoid robots are the trend!

PEEK material is becoming the key factor in the competition for lightweight solutions!

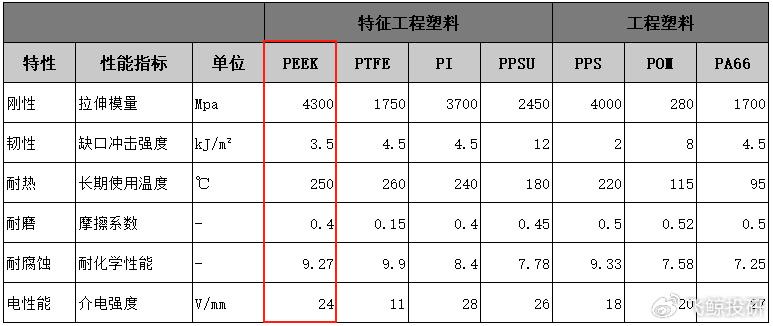

PEEK material is not an ordinary engineering plastic, but is referred to as a special engineering plastic at the pinnacle of the pyramid.

From Tesla's Optimus-Gen2 successfully reducing weight by 10 kilograms, to Unitree's robotic dog agilely rolling over complex terrains, and to UBTECH's Walker S1 with its precision joint design, all of these advancements are made possible by the use of PEEK (polyether ether ketone) material.

Moreover, it has not only been used in the field of humanoid robots but has also already made significant advances in various other fields such as automotive and medical.

According to estimates, by 2031, the domestic market size for PEEK materials is expected to exceed 5 billion yuan.The compound annual growth rate from 2025 to 2030 exceeds 14%!

So, what exactly is the magic of PEEK material?

On one handPEEK has a density of only 1.3 g/cm³, which is less than half of that of aluminum alloy, but its specific strength is as high as 1500 N·m/kg, which is 7.9 times that of aluminum alloy, and its flexural modulus is 4 times that of aluminum alloy.

By replacing the metal components in the joints and limbs of robots with PEEK composite materials, the required strength of the parts can be met while significantly reducing their weight.

On the other handThe melting point of PEEK is as high as 343℃, and its long-term use temperature can reach 240℃, which is far higher than the temperature resistance range of 100-150℃ for general engineering plastics such as POM and PET.

Moreover, PEEK material is almost resistant to acid and alkali corrosion, with only a few strong oxidizing acids like concentrated sulfuric acid capable of damaging its structure, making it more resistant to aging than metal.

PEEK material can be said to be both lightweight and durable, integrating seemingly contradictory characteristics of lightweight, high strength, and durability in engineering materials.

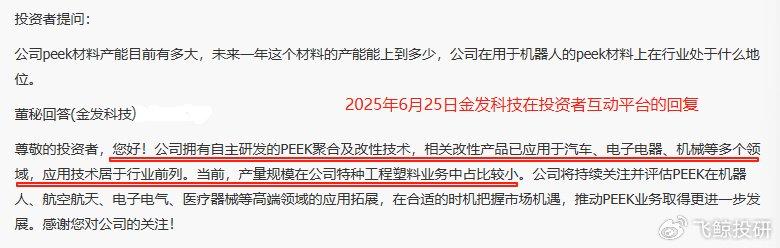

In the field of PEEK materials, Kingfa Sci. & Tech. Co., Ltd. has already taken a leading position!

At present, Kingfa Sci. & Tech. Co., Ltd. is one of the few companies in China that has mastered PEEK polymerization technology. It not only possesses independent research and development capabilities for PEEK materials but has also successfully achieved large-scale production of PEEK materials.

This breakthrough is attributed to Kingfa Science & Technology's profound technical expertise in the field of modified plastics.

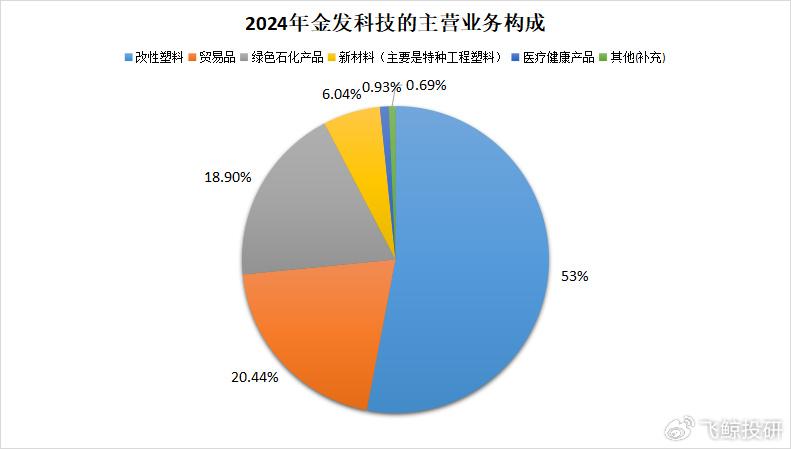

Modified plastics have consistently supported half of Kingfa Sci & Tech's total revenue. Meanwhile, its trade products and green petrochemical products businesses each contribute 20% of the revenue, and the special engineering plastics business is also growing rapidly.

In the field of specialty engineering plastics, Kingfa Sci & Tech has broken the monopoly.The first in the country, the second in the world.A supplier of liquid crystal polymer materials with strong capabilities has obtained international sustainability and carbon certification.

In the field of modified materials, the company's development of high heat-resistant, high dimensional stability, halogen-free flame retardant PA10T material has been mass-applied in the new generation of DDR5 memory connectors and has been recognized by many well-known customers.

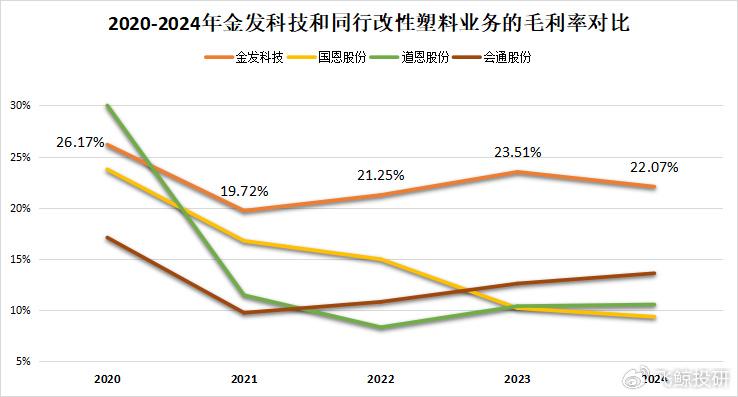

What is even more remarkable is that in the context of intense industry competition, the gross profit margin of Kingfa Sci & Tech's modified plastics has consistently remained at a high level in the industry for many years, reaching 22.07% in 2024, far exceeding peers such as Go-On Group and Dawn Polymer.

However, unexpectedly, the profit margin of Kingfa Sci. & Tech. Co., Ltd. shows a bizarre aspect!

Since 2020, Goldwind's net profit margin has plummeted from 13.15%.After 2023, it never exceeded 1% again.

This inevitably raises doubts: the company's modified plastics business has a gross profit margin at a high level in the industry, indicating that the company's products are competitive in the market. So why is its net profit margin so sluggish?

In the end, the profit margin of Jinhair Technology has been crushed by two big stones!

The first big stone is high interest expenses.

We know that, in addition to the field of humanoid robots, the demand for modified plastics and specialty engineering plastics is experiencing a surge due to the trends of lightweighting in new energy vehicles, the advancement in high-end home appliance components, and the rapid rise of the low-altitude economy.

To meet market demand and increase revenue, Kingfa Sci. & Tech. Co., Ltd. has been significantly expanding its production capacity in recent years. By the end of 2024, the company has established an annual production capacity of 3.72 million tons.The production capacity has risen to the top position in the industry.

Moreover, the company's capacity expansion process continues to deepen. By the end of 2024, there are still more than a dozen modified plastic projects under construction in South China, West China, as well as overseas regions such as India and Germany, with a construction capacity exceeding 500,000 tons.

However, behind this, Ganfeng Technology has paid a considerable price.

In order to ensure the smooth construction of production capacity, Kingfa Sci. & Tech. Co., Ltd. undertook large-scale external borrowing between 2020 and 2024, with its interest-bearing liabilities expanding from 10.122 billion yuan to 27.233 billion yuan, and its asset-liability ratio increasing from 53.73% to 66.64%.

With increased borrowing, the company naturally has to pay more interest. In 2024 alone, Kingfa Sci. & Tech. Co., Ltd. will pay as much as 1.099 billion yuan in interest expenses.Higher than the company's net profit of 825 million yuan for that year.

As a result, the financial costs of Kingfa Technology are undeniably high, with its financial expense ratio reaching 2% in 2024, eroding its profit margins.

The second major obstacle is the significant loss in the green petrochemical business.

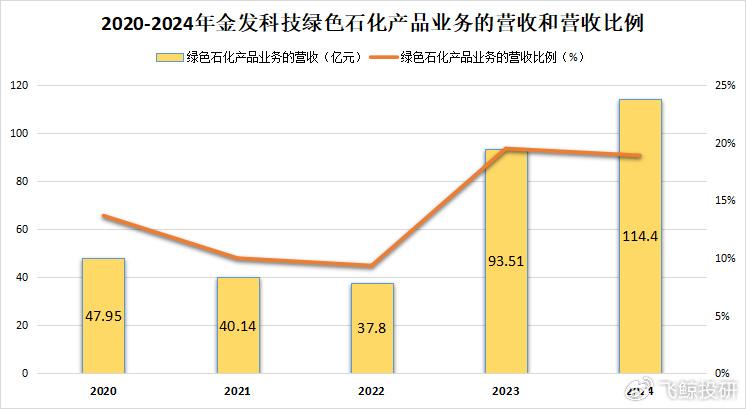

The green petrochemical business of Kingfa Sci & Tech Co., Ltd. is developed by two subsidiaries, Ningbo Kingfa and Liaoning Kingfa. The main products are resins such as polypropylene and acrylonitrile. In 2024, the revenue proportion of this business segment is 18.9%.

Starting from 2021, new production capacities for petrochemical products such as polypropylene and ABS resin have been released in China, leading to an oversupply. The average price of polypropylene has decreased from around 8,750 yuan/ton in 2022 to about 7,550 yuan/ton in 2024.

Moreover, after 2022, the 600,000-ton ABS resin production capacity of Liaoning Golden Hair has not reached full production for two consecutive years, failing to adequately distribute the fixed costs.

Starting from 2022, the gross profit margin of Kingfa Sci & Tech's green petrochemical product business turned negative. According to the 2024 annual report, the company's green petrochemical business achieved a revenue of 11.44 billion yuan, but the overall loss for this segment was 727 million yuan.

This is not over yet. It's important to know that Ningbo Kingfa and Liaoning Kingfa were subsidiaries acquired by Kingfa Sci & Tech in 2019 and 2021, respectively. However, they later faced changes in industry supply and demand, leading to profits falling short of expectations.

Therefore, in 2024, Kingfa Sci. & Tech. Co., Ltd. had to deal with these two subsidiaries.A provision for goodwill impairment of up to 277 million yuan was made.This further dragged down the performance on the profit side.

At this point, we might think that the performance of Jingfa Technology will not be impressive.

On the contrary!

In 2024, Kingfa Sci. & Tech. Co., Ltd. achieved a revenue of 60.521 billion yuan, representing a year-on-year growth of 26.23%; moreover, even with the drag of the green petrochemical business,The company still achieved a net profit of 825 million yuan, a significant increase of 160.36% year-on-year!

This is also sufficient to demonstrate the excellence of Kingfa Sci. & Tech.'s modified plastics and specialty engineering plastic products.

In 2024, the sales volume of the company's modified plastics and special engineering plastics reached 2.5515 million tons and 23,900 tons, respectively, with year-on-year increases of 20.78% and 16.59%. The revenue from the modified plastics business reached 32.07 billion yuan, representing a year-on-year growth of 18.19%.

Furthermore, this increase in sales has offset the losses in the company's green petrochemical business, thereby supporting the rise in net profit.

Thanks to the increase in these two products, the first quarter report of 2025 shows that the company's performance continued the growth trend of 2024, achieving a net profit of 247 million yuan, with a year-on-year increase of 138%.The year-on-year increase in net profit after deducting non-recurring gains and losses reached 168.63%!

In short, if one end doesn't work out, the other end will.

Although Kingfa Sci. & Tech. Co., Ltd. faced setbacks in the green petrochemical business, it can already see the light at the end of the tunnel thanks to its strong capabilities in the fields of modified plastics and specialty engineering plastics.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track