Breaking: Applied Materials and Silicon Labs Cut Nearly 3,000 Jobs!

1. Sika

On October 24, Sika announced its operating results for the first three quarters and stated that the company is undergoing structural adjustments in persistently weak markets such as China, expecting one-time costs to reach between 80 million and 100 million Swiss francs by 2025. These measures include laying off up to 1,500 employees.

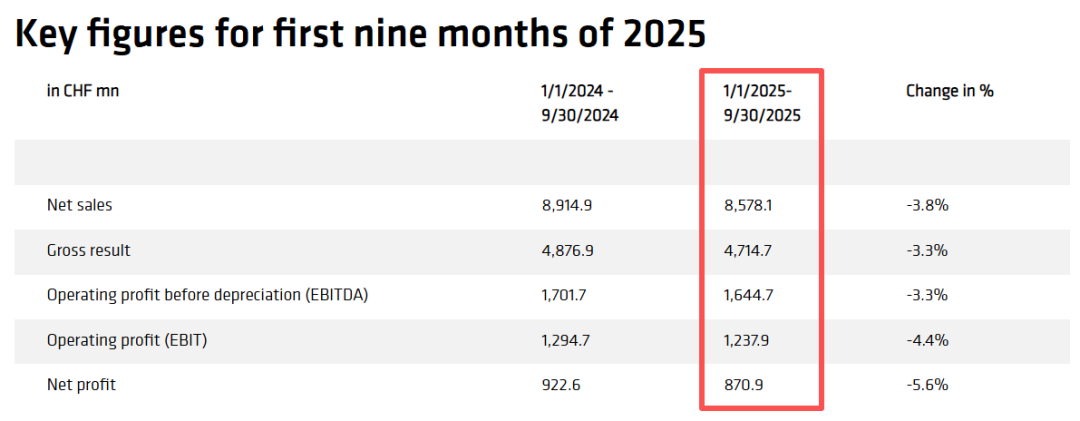

From the core performance highlights:

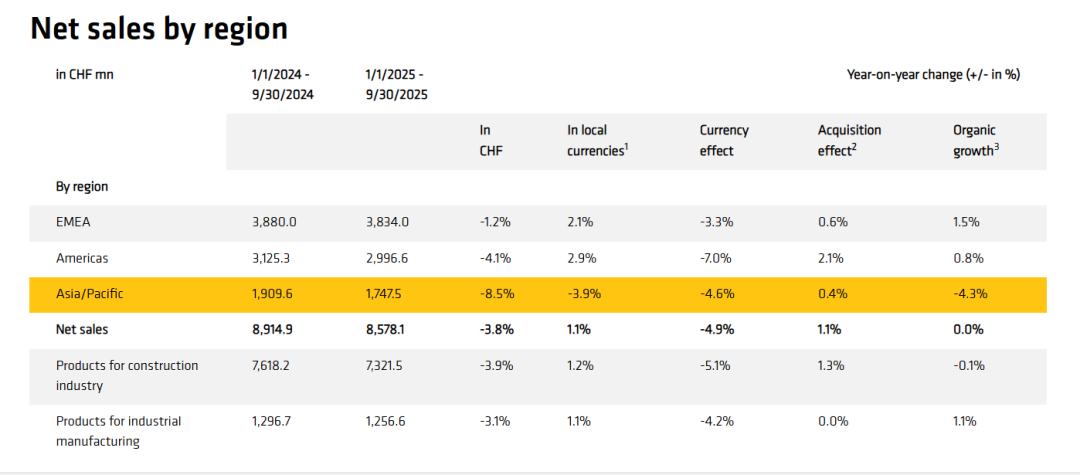

Despite a double-digit decline in the construction business in China, sales for the first nine months still grew by 1.1% in local currency terms; furthermore, excluding the construction business in China, the group's growth rate in local currency terms was approximately 3%.

Overall, due to the impact of a weak US dollar, the foreign exchange effect amounted to -4.9%, leading to a decline in sales calculated in Swiss francs to CHF 8.58 billion (previous year: CHF 8.91 billion). The material margin rose to 55.0% (previous year: 54.7%). The EBITDA margin expanded to 19.2% (previous year: 19.1%), thanks to a slight decrease in input costs and strong synergies from the successful integration of MBCC, although a decline in sales in the Chinese market led to a drop in EBITDA by approximately 50 basis points. Due to significant exchange rate fluctuations, the earnings before interest, taxes, depreciation, and amortization (EBITDA) for the first nine months was CHF 1.64 billion, lower than CHF 1.7 billion for the same period last year.

II. Application Materials

According to the 8-K filing by Applied Materials on October 2, the company expects a revenue reduction of $110 million in the fourth quarter of fiscal year 2025 and $600 million in fiscal year 2026, due to the new export control rules issued by the U.S. Department of Commerce on September 29. Under the new regulations, subsidiaries in which entities on the entity list hold more than 50%, as well as foreign affiliates directly or indirectly held, are subject to restrictions.

The financial report for the third quarter of fiscal year 2025 shows that revenue from the China region has increased year-on-year, remaining its largest revenue source. However, company executives stated that due to the need to digest equipment shipments from 2023 and 2024, they expect the Chinese business to continue declining in the coming quarters.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track