Best m&a opportunities in 15 years! u.s. biotech stocks surge, china accounts for 38% of global deals

In the third quarter, several key indicators in the U.S. biotechnology market have rebounded, raising the question: Are we finally seeing the initial signs of recovery, or is it another illusion?

Typical examples include the steady rise of the Nasdaq Biotechnology Index (XBI) over the past six months, successfully surpassing the $100 mark at the end of last month. The Federal Reserve has also taken action by lowering interest rates by 25 basis points, a move that has reignited hope in the market — the trend of declining long-term borrowing costs is expected to inject strong momentum into the biotechnology industry in the coming months.

Chris Dokomajilar, the head of DealForma, delved into the relevant data once again, and the performance in the third quarter suggests that the biotechnology industry has reason to believe that the toughest times are over.

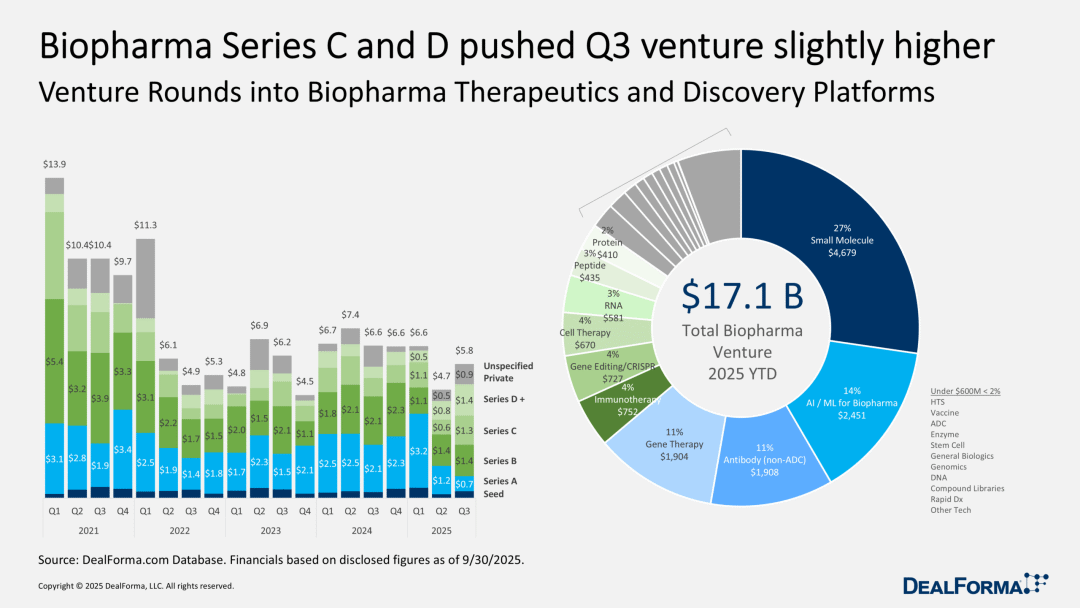

The trend line from the last quarter indicates that trading and merger activities have made solid progress toward achieving annual growth. Even after a dismal second quarter, venture capital in the third quarter saw a rebound: as investment funds began seeking returns in later-stage biotech companies, the size of Series C and D financing significantly expanded.

Chris Dokomajilar's perspective is as follows: After a prolonged downturn, biotech industry executives were evidently more optimistic about the new year at the beginning of 2025. However, uncertainties in tariffs, inflation concerns, regulatory upheaval, and market volatility in the first half severely dampened this optimism. When the "Endpoints 100" companies were surveyed in the first half of the year, it was found that executives' outlook had hit rock bottom. Nevertheless, unless there is a downturn at the end of the year, the outlook for the second half will be clearer—particularly for late-stage drug development companies with promising candidates in clinical stages.

Mergers and Acquisitions Surge: Large Pharmaceutical Companies Actively Seek New Drugs for Market Competitiveness

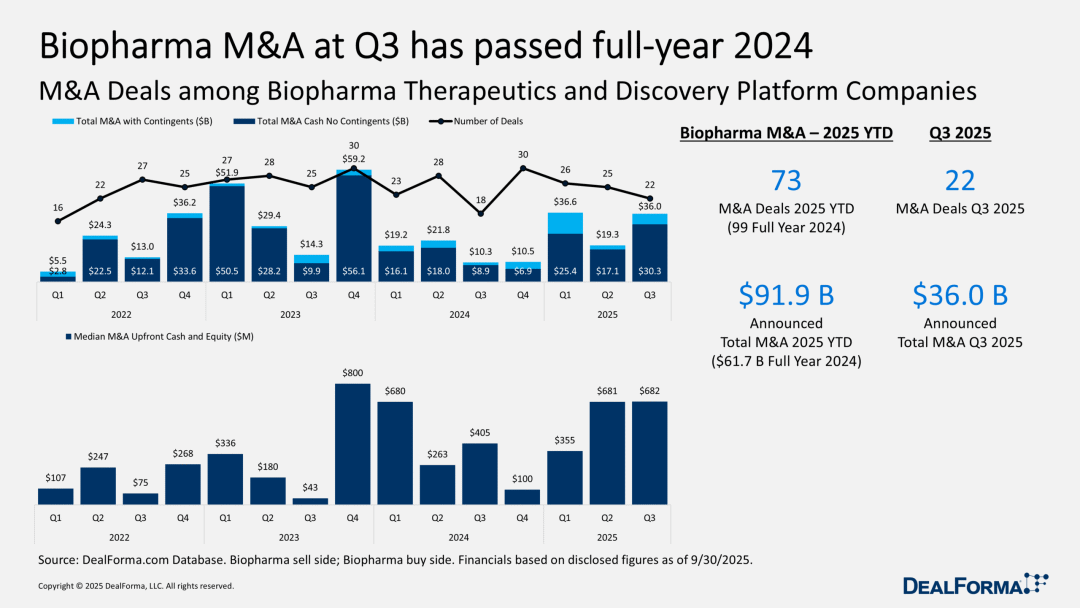

In 2028, with the expiration of Keytruda's patent, Merck will face the challenge of losing most of the revenue from this drug. The company is currently striving to demonstrate to analysts its ability to cope with this predicament. To this end, Merck has spent $10 billion to acquire Verona, kicking off a busy acquisition season in the third quarter. Similarly, facing market pressure, Pfizer has acquired Metsera with a nearly $5 billion upfront payment to enter the vast obesity drug market and has launched its own competing obesity medication.

During this period, we have also witnessed a series of smaller acquisition deals—according to statistics from Documagilar, there have been a total of 22 such transactions in the past three months. This confirms the predictions of many biotech company CEOs: as large pharmaceutical companies urgently need to offset losses caused by declining sales of their blockbuster drugs (whether past, present, or future), merger and acquisition activities will significantly increase. The scale of mergers and acquisitions in the third quarter is expected to boost the total M&A amount in 2025 beyond the sluggish level of 2024. If the fourth quarter maintains its performance from previous years, we may witness some remarkable figures.

Previously, it was reported that TCQX completed a $1.3 billion financing round. The fund's founder, Chen Yu, expressed gratitude for initially choosing a group of publicly listed biotech companies that have excelled in mergers and acquisitions as investment targets. For investors aiming to deliver returns to limited partners (LPs) in the short term, mergers and acquisitions have become a core strategy. If the closure of the IPO channel cuts off the path to Nasdaq, the avenues to find discounted targets will become even more scarce.

Currently, it may be the best time in 15 years for pharmaceutical companies to uncover real value through mergers and acquisitions. If the biotech industry is destined to recover next year, waiting could cause them to miss out on opportunities. Clearly, there is always a demand for mergers and acquisitions in the industry.

The global biotechnology landscape reshapes: Chinese transactions continue to surge.

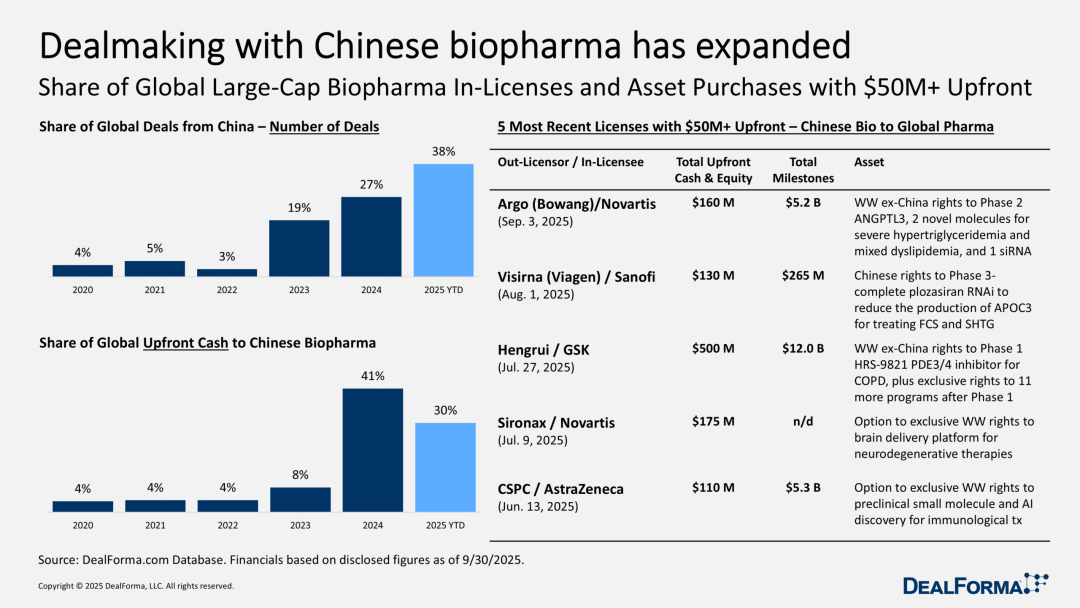

Even if you hadn't noticed this before, it's understandable—however, the biopharmaceutical industry reached a significant turning point in 2023: China rapidly rose from a "marginal player" in the trading field to a critical core player. In 2024, China further consolidated this position; by 2025, China is steadily securing its identity as a "major player," a change that has shocked many American biotechnology companies.

Duokema Jilar pointed out after an in-depth analysis of large-cap stock data that since the beginning of this year, China's trading volume accounts for 38% of the global total, a significant increase. Although the scale of advance payments has slightly decreased (from 41% last year to 30% in the first nine months of this year), this proportion is still quite considerable.

Initially, China was seen as an "interesting alternative" because of its attractive assets, but it has now become the primary market for large pharmaceutical companies seeking shortcuts in research and development. China's scientific research capabilities are solid, and due to the fact that pharmaceutical companies require less regulatory approval to conduct clinical trials, Chinese biotech companies obtain human trial data much faster than their counterparts in the United States or Europe.

Novartis, Sanofi, GlaxoSmithKline (GSK), and AstraZeneca—these pharmaceutical companies headquartered in Europe—completely ignore the increasingly tense geopolitical situation between the US and China, willingly paying over $100 million in advance payments, as well as potential milestone payments worth billions of dollars.

As an example, AstraZeneca's move is the culmination of years of efforts to strengthen its partnerships in China.

Transaction volume is expected to surpass the 2024 level.

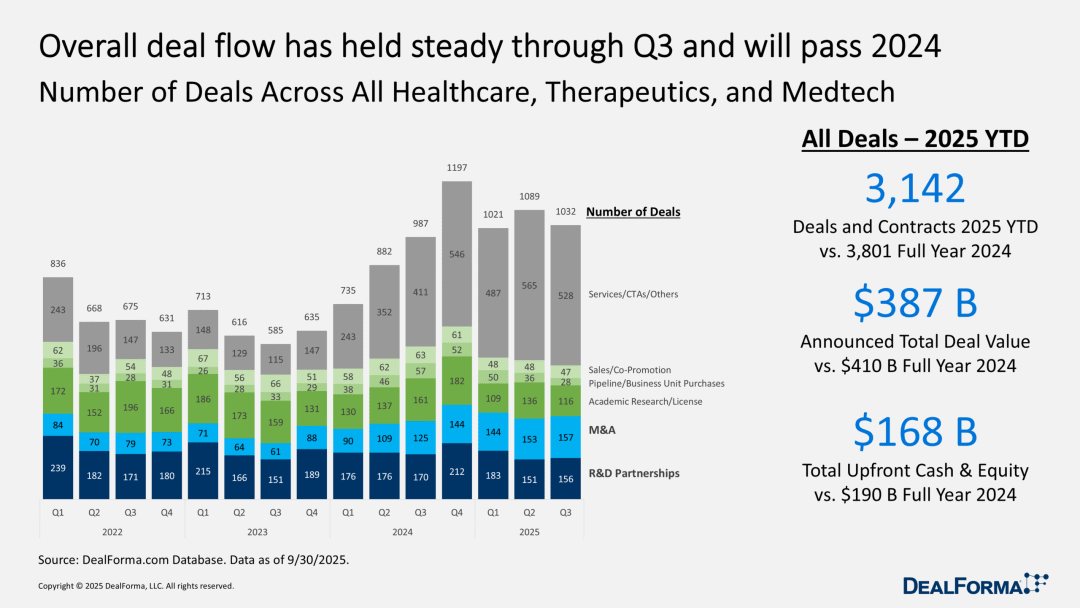

Based on all transactions in the comprehensive healthcare, treatment sector, and medical technology industry, the pace of transactions in the third quarter slowed slightly in the last month, but is still expected to surpass the overall level of 2024.

In the first nine months of this year, the total amount of prepayments and equity financing for these transactions has reached $168 billion, approaching the full-year figure of $190 billion reported by Dokomajilar for 2024. The total transaction value has reached $387 billion, while the total transaction value for the entire year of 2024 is $410 billion. An annual increase in the total transaction amount for 2025 is already a certainty.

Over the past year, the growth in transaction activities has been mainly concentrated in the area of new service collaboration agreements, while the biotechnology industry's investment in artificial intelligence (AI) continues to increase. However, as executives seek to help their companies navigate the downturn in the biotechnology industry through deals, the overall performance in the transaction sector remains robust.

Advance payments decreased in the third quarter, but the overall pace for the year remains strong.

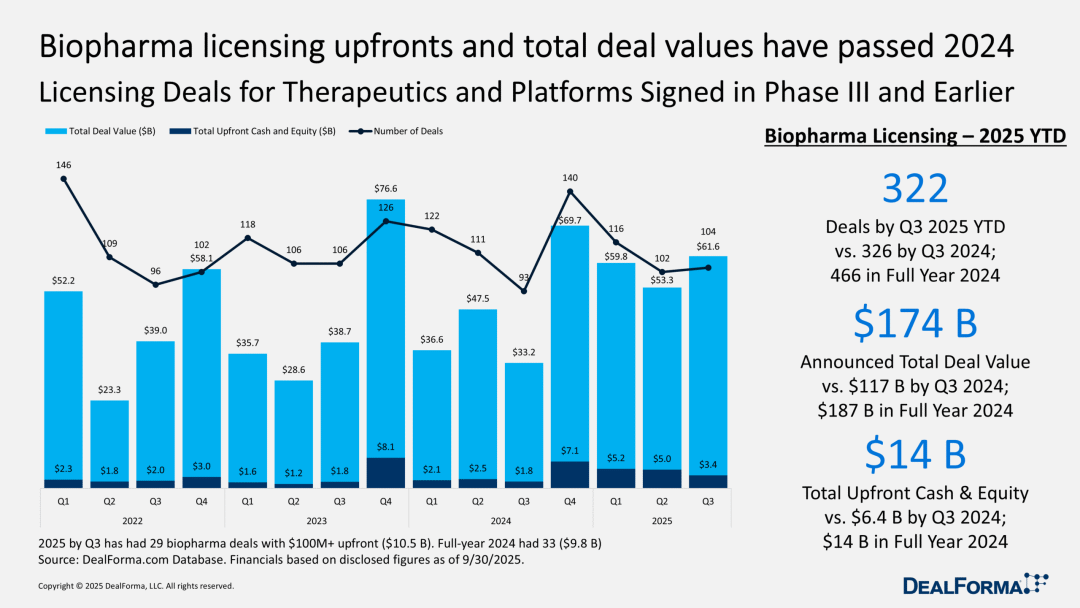

For CEOs of biotechnology companies focused on financing, the difficulty in the licensing field has increased. In the third quarter, although the total value of licensing deals has risen, the size of upfront payments has decreased.

Despite this, the total amount of advance payments in the first nine months of this year has already equaled that of the entire year of 2024, and the total amount of advance payments exceeding $100 million has far surpassed the level of the same period last year. In recent years, the scale of advance payments in the fourth quarter has usually far exceeded that of other quarters, which has led the market to generally expect that the total amount of advance payments in 2025 will still easily surpass that of the previous three years.

Currently, the total number of transactions has matched the entire previous year, but the total transaction value has significantly increased—reaching $174 billion so far, compared to only $117 billion during the same period last year.

The fundamentals of biotech licensing remain solid. Large pharmaceutical companies need to leverage the innovation capabilities of biotech companies (especially after divesting consumer businesses), while biotech companies rely on the funding and credibility of pharmaceutical companies to sustain operations. Although this cooperative relationship is often unstable, in this industry, "demand" will always take precedence over "willingness."

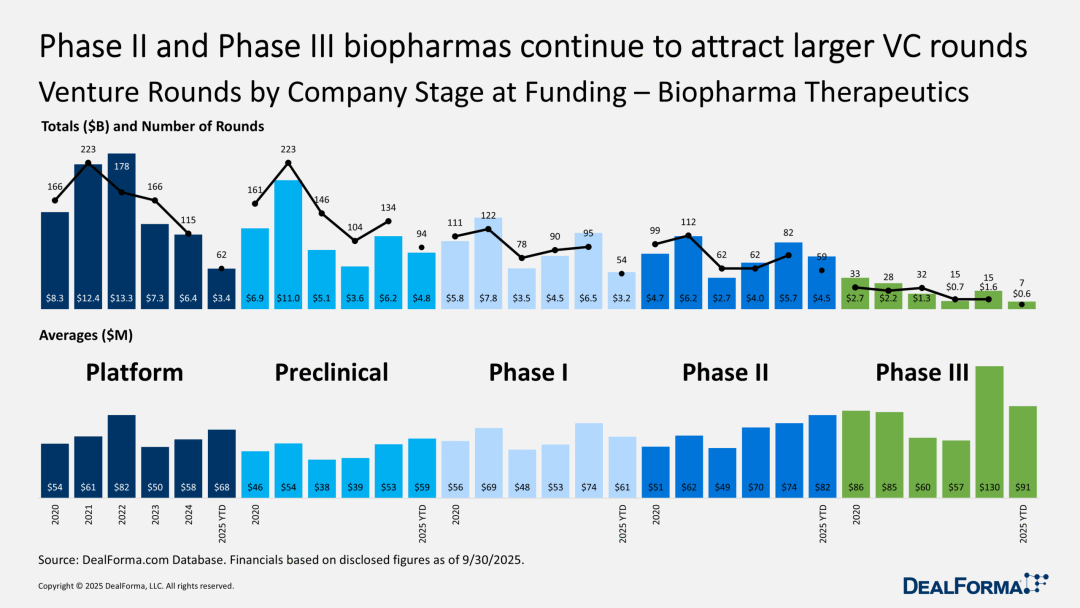

Impatient venture capital shifts towards clinical-stage biotechnology companies.

Data analysis reveals a significant trend: as biotech companies seek crucial human trial data—which can either bring them substantial returns or render them the "discarded pieces" of failed drugs—venture capital focus has shifted from early Series A funding to later-stage financing. Furthermore, due to the lack of support from versatile investors for IPOs, venture capital firms are compelled to continue providing later-stage funding for their most promising projects.

Currently, Series A funding has dropped to its lowest level in years, having hit rock bottom in the second quarter. The rebound in the third quarter was primarily driven by high market interest in Series C and D funding. However, the current scale of funding is still far from the record levels seen during the industry's boom period when exit channels were more accessible.

With few exceptions, mainstream biotech investors no longer pay for "breakthrough scientific prospects" and "long-term returns"—especially with IPOs at a virtual standstill. Their investment targets are drugs that can attract big pharmaceutical companies by boosting revenue. As a result, biotech company CEOs have to make tough decisions on how to concentrate resources to focus on the most promising drugs in their pipeline.

Therefore, the wave of layoffs continues, even in some of the most unexpected companies.

Venture capital focuses on Phase II and Phase III clinical stages.

Data analysis further confirms the trend of venture capital leaning towards Series C and D funding rounds. This year, with IPOs largely stalled, venture capital firms have been disappointed with "exit channels," leading to a confidence crisis in the venture capital industry. However, there has been a significant shift in the industry's focus: from the previously favored "company creation" during boom times to a bet on "reliable clinical data."

Therefore, it is not surprising that DealForma highlights the market's preference for Phase II and Phase III clinical stage projects. Financing for preclinical projects is particularly challenging, especially for biotech companies that are still a long way from their first human trials.

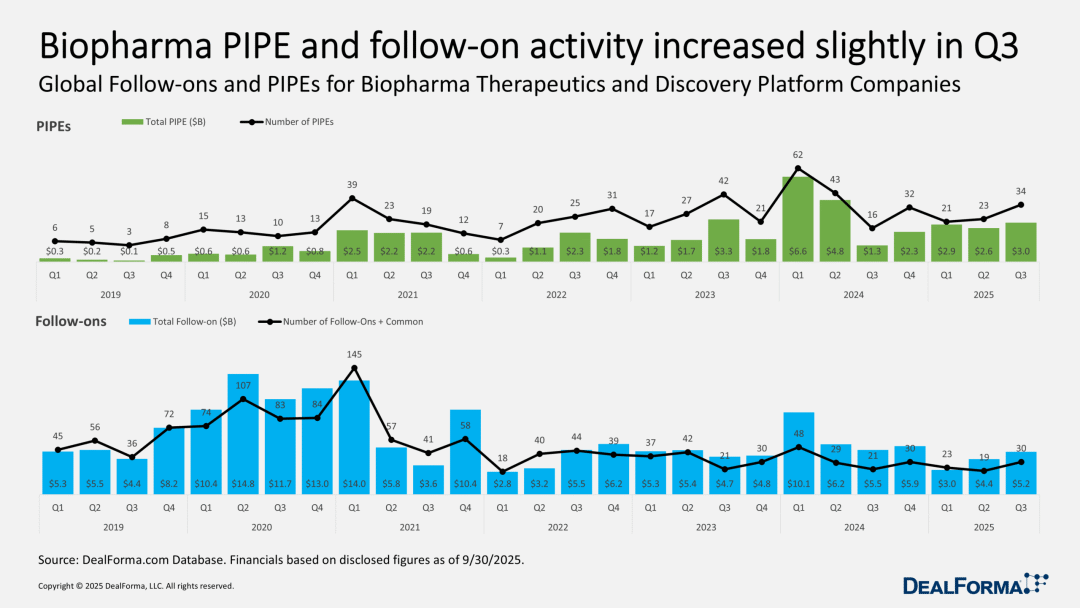

Private equity investments in publicly traded company stocks (PIPEs) and subsequent financing have slightly improved, but the extent is limited.

After the pandemic, a large number of publicly listed biotech companies are struggling to survive in the challenging market environment for high-risk stocks, finding it difficult to raise funds. However, for investors looking to bet on companies "likely to obtain positive human trial data," this market is quite attractive.

Since the beginning of this year, PIPEs transactions have stabilized, with both the number of transactions and the amount of funds in the third quarter showing significant growth compared to the previous three months. After a sluggish first quarter, follow-on financing also showed a recovery trend: in the third quarter, there were 30 follow-on financings completed in the therapeutic field and platform companies, with a total financing amount reaching $5.2 billion.

Despite the current pace being significantly slower than the hot levels of early 2024, and even further from the boom period of 2020, the stability of this recovery should alleviate executives' concerns about the market weakness earlier this year.

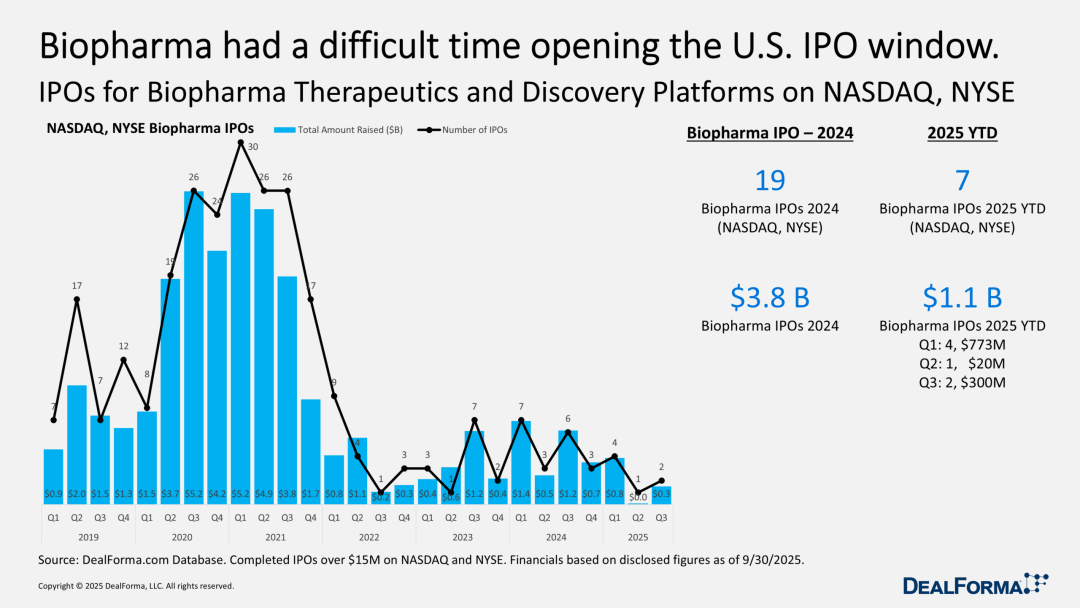

A Single Biotech Company's IPO: Glimmers of Recovery Amidst Challenges

In reviewing the biotech IPO data in the U.S. market, there are few optimistic factors. However, after stagnating in the second quarter, the market has finally shown a faint sign of activity over the past three months—a company successfully listed on NASDAQ.

In the biotechnology industry, there is a rule of thumb: ideally, one should raise funds when not in need of capital. If a company tries to list on Nasdaq with limited financial reserves, it often faces the "shock" of market skepticism. However, a few years ago, this ideal condition was abandoned by the IPO market.

LB Pharmaceuticals (stock code: LBRX) successfully avoided this pitfall: the company let the market determine its valuation, ultimately raising $285 million through its IPO, a move that drew attention. Its offering price was set at $15, which is in the middle of the offering range. At the time John Carroll wrote this article, the company's stock price remained around this level, which in itself can be considered a miracle.

Currently, several IPO application documents (S-1 forms) are shelved. The success of one company may not be enough to trigger an IPO boom, but if several more companies follow suit, it might start a new trend. At present, the only direction for the IPO field is "upward." If interest rates do indeed drop, this possibility is worth close attention.

Notably, despite the sluggish IPO activity on the Nasdaq, the Hong Kong market has been exceptionally active, with numerous new stocks going public. Overall, Chinese biotech companies have attracted the close attention of large pharmaceutical firms and have earned a good reputation for their characteristics of "fast clinical progress" and "quick successful returns."

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track