Benzene | short-term demand improvement limited price increase

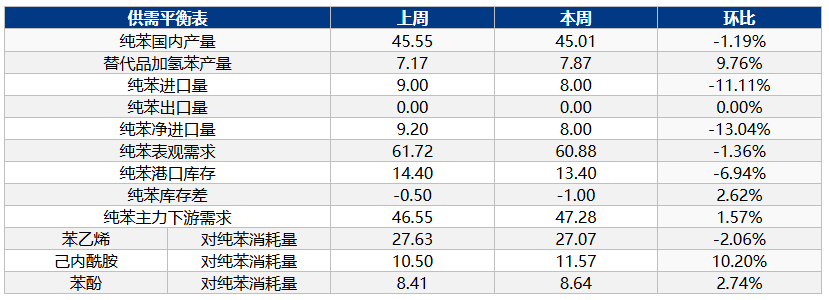

In this period, data from the supply side of pure benzene shows a decrease in petroleum benzene supply, an increase in hydrogenated benzene supply, and a decrease in imports, resulting in a comprehensive assessment of a decline in supply-side data. Demand data has increased, and the supply-demand balance sheet shows destocking, with a slight rebound in market prices. In the next period, port inventory is expected to decrease. Based on the calculated production increase from the startup and shutdown of upstream and downstream units, stable imports, and increased demand, the supply-demand differential is positive, providing limited support for prices.

Key Points of the Pure Benzene Market:

This week's total commercial inventory of benzene at Jiangsu ports is 134,000 tons, a decrease of 10,000 tons from the previous inventory of 144,000 tons.

2) New shipping orders from Europe are destined for the domestic market and are expected to arrive in the country by the end of October or November.

The Federal Reserve has initiated a rate cut in September as expected, with a reduction of 25 basis points that meets previous expectations, providing some positive support.

Spot volatility is limited.

In this period, the price of pure benzene in East China rose and then pulled back, fluctuating between 5900-6000 yuan/ton. This week, there was a destocking at East China ports, and with the approach of the National Day holiday, downstream buyers began to stock up. There was good demand for spot goods, resulting in strong pick-up from storage areas. Additionally, the price difference with Shandong continued to favor East China, further boosting pick-up from storage, thereby providing support for pure benzene prices. Subsequently, there were reports of unexpected load reductions and shutdowns in styrene units, and favorable macroeconomic signals were released mid-week, driving a further increase in the correlation with pure benzene market prices. Crude oil prices were also relatively strong during the week, but the market largely did not trade on the rise in crude oil. After the market prices went up, new short positions entered, trading on the expectation of inventory build-up in downstream styrene, which exerted pressure on pure benzene prices.

|

Figure 1: Domestic Pure Benzene Market Price Trend Chart for 2025 (RMB/ton) |

![[纯苯]:短期需求好转 价格涨势有限 [纯苯]:短期需求好转 价格涨势有限](https://oss.plastmatch.com/zx/image/7f5dffe543d047379728d3f448475997.png) |

|

Source: Longzhong Information |

2: Short-term supply decreases, long-term increases

Table 1 Domestic Weekly Production and Consumption of Pure Benzene

1. Domestic production increase

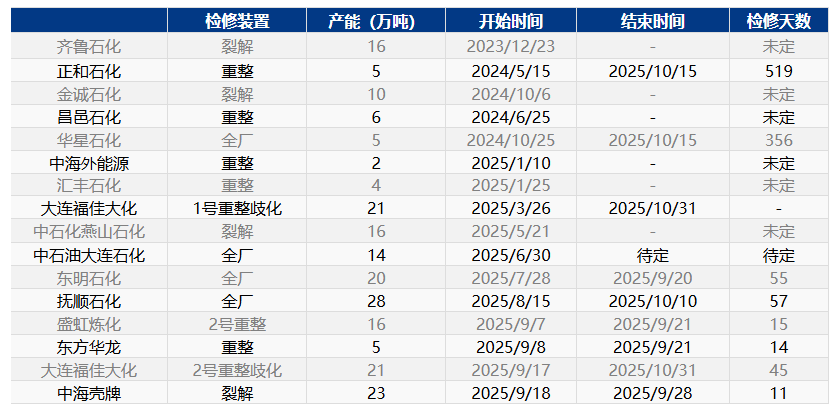

During this cycle, the production of petroleum benzene was 450,100 tons, a decrease of 5,400 tons compared to last week, with a growth rate of -1.19%. The capacity utilization rate was 78.35%, a decrease of 0.94% compared to last week. During this cycle, Fuhai Chuang experienced a short shutdown of its reforming unit, and Fuxia Dahua shut down one of its reforming and disproportionation units.

|

Figure 2 Price and Volume Trend Chart of Benzene for 2024-2025 |

![[纯苯]:短期需求好转 价格涨势有限 [纯苯]:短期需求好转 价格涨势有限](https://oss.plastmatch.com/zx/image/c66397f51f4f4e458c48adfc629ee3ab.png)

|

Source: Longzhong Information |

Table 2 Domestic Benzene Unit Maintenance/Restart Statistics

Port inventory decline

|

Figure 3: International Benzene Price Trend Chart for 2025 (USD/ton) |

![[纯苯]:短期需求好转 价格涨势有限 [纯苯]:短期需求好转 价格涨势有限](https://oss.plastmatch.com/zx/image/7c542b44e5ab4bc18f26857918428b3d.png) |

|

Source: Longzhong Information |

In this period, the closing price in the FOB Korea market is $721/ton, an increase of $4/ton compared to the previous period, representing a month-on-month increase of 0.56%; the closing price in the FOB USA market is $771/ton, a decrease of $12/ton compared to the previous period, representing a month-on-month decrease of 1.53%.

|

Figure 4 International Price Spread of Benzene in 2025 (USD/ton) |

![[纯苯]:短期需求好转 价格涨势有限 [纯苯]:短期需求好转 价格涨势有限](https://oss.plastmatch.com/zx/image/617e5b49a0404de4a8c9d1f01bc8eb9f.png) |

|

Source: Longzhong Information |

In August, the quantity of South Korean exports to China decreased, while imports increased continuously from September to October. During this period, the price difference between the US and South Korea was $50/ton. The theoretical shipping cost for a 40,000-ton vessel is approximately $60/ton, and even without considering the US imposing additional tariffs on South Korean benzene, the arbitrage window remains closed. The average price difference between China and South Korea is $20/ton, with the theoretical shipping cost for a 6,000-ton vessel from South Korea to the coastal regions of East China ranging from $21 to $26/ton. The weekly average price for the China-South Korea arbitrage window is closed, and selling benzene to East China mainly relies on the brief opening of the window. It is estimated that China's import volume will be around 430,000 tons in September and 480,000 tons in October.

|

Figure 5 Inventory of East China Ports in 2025 (10,000 tons) |

![[纯苯]:短期需求好转 价格涨势有限 [纯苯]:短期需求好转 价格涨势有限](https://oss.plastmatch.com/zx/image/1cc0ebffb1aa4d899edcb29161be5c52.png) |

|

Source: Longzhong Information |

As of September 15, 2025, the total commercial inventory of pure benzene at Jiangsu ports is 134,000 tons, a decrease of 10,000 tons compared to the previous inventory of 144,000 tons, a decrease of 6.94% month-on-month; compared to the same period last year when the inventory was 50,000 tons, it has increased by 84,000 tons, a year-on-year increase of 168.00%. From September 8 to September 14, approximately 18,000 tons were received and about 28,000 tons were delivered, according to incomplete statistics. During this period, in the surveyed storage areas, one area saw a decline while six areas remained stable. According to incomplete statistics, from September 15 to September 21, East China ports are expected to receive around 28,000 tons, with the pace of inventory reduction at the ports expected to slow down.

3. New production facilities put into operation in Shandong for supply and demand.

|

Figure 6: Trend Chart of the Price Spread of Benzene between Shandong and East China in 2025 (Yuan/Ton) |

![[纯苯]:短期需求好转 价格涨势有限 [纯苯]:短期需求好转 价格涨势有限](https://oss.plastmatch.com/zx/image/7ab9d54a1c6b461abd3ca64775496521.png)

|

Source: Longzhong Information |

During most of this period, Shandong's pure benzene performed well, with prices rising to a range of 5950-6070 yuan/ton. However, market transactions decreased towards the end of the period. Due to the delayed restart of regional refineries and the gradually emerging pre-holiday stocking atmosphere, daily transactions of Shandong pure benzene remained between 1800-3200 tons, with overall good sales. Nonetheless, in the latter half of the period, large factories in the region sold long-term spot goods at low prices, dampening purchasing sentiment in the market. On Thursday, local refinery sales were generally hindered, with transactions sharply reduced to below 200 tons.

3. Insufficient Profits in the Downstream of the Industry Chain

|

Figure 7: Trend of Main Downstream Consumption of Pure Benzene in 2024-2025 (10,000 tons) |

![[纯苯]:短期需求好转 价格涨势有限 [纯苯]:短期需求好转 价格涨势有限](https://oss.plastmatch.com/zx/image/5ad7a889576f40e789fedce1a9c68c35.png) |

|

Source: Longzhong Information |

During the week, the capacity utilization rates of major downstream products such as styrene, phenol, caprolactam, and aniline have declined compared to the previous period. This week, the load of a styrene plant in East China decreased, and two other plants were temporarily shut down, resulting in an overall decline in production. Caprolactam supply increased as Baling Hengyi and Hunan Petrochemical resumed normal production, while Juhua and Shenma's second phase experienced short-term shutdowns. The phenol-acetone plant at Shenghong Petrochemical completed maintenance on the 13th and resumed normal operations, while Jiangsu Ruiheng's plant increased its operational load. Yantai Wanhua restarted aniline production; Fujian Wanhua adjusted its load; Shanxi Tianji increased to full-load operation; Dongying Huatai restarted, currently operating at 70% capacity. The Hengli adipic acid plant experienced fluctuations. In the next period, considering the recent maintenance and resumption activities, the capacity utilization rates of styrene, caprolactam, phenol, aniline, and adipic acid in the downstream of pure benzene are expected to rise.

|

Figure 8 Price Trend Chart of Downstream Products of Benzene for 2024-2025 (Yuan/Ton) |

![[纯苯]:短期需求好转 价格涨势有限 [纯苯]:短期需求好转 价格涨势有限](https://oss.plastmatch.com/zx/image/41a5c7ad52a6403aacff213431dd8dfe.png) |

|

Source: Longzhong Information |

This week, domestic styrene prices mainly showed a trend of rising followed by a pullback. In Jiangsu, high-end spot transactions were at 7,050 yuan/ton, while low-end transactions were at 7,220 yuan/ton, with a price spread of 170 yuan/ton. During the week, crude oil and pure benzene showed weak performance, providing insufficient support for styrene costs. In terms of supply and demand, there was temporary maintenance at styrene factories, leading to a further decline in domestic supply, while demand remained strong, resulting in an overall tight supply-demand balance. Additionally, favorable news from both domestic and international macroeconomic perspectives contributed to slight price increases. However, styrene's fundamental support was lacking, and some capital was not consistently bullish, leading to a price pullback by the weekend.

|

Figure 9 Profitability Chart of Benzene Downstream Products in 2025 (CNY/ton) |

![[纯苯]:短期需求好转 价格涨势有限 [纯苯]:短期需求好转 价格涨势有限](https://oss.plastmatch.com/zx/image/04121b10caf0488f9aa4b7cb4ad39b07.png) |

|

Source: Longzhong Information |

In this period, based on Sinopec's costs and prices, the production profit of pure benzene is 425 yuan/ton, a decrease of 18 yuan/ton compared to the previous period, representing a growth rate of -4.06%. Due to insufficient terminal demand, the profits for pure benzene's five major downstream products—styrene, phenol, caprolactam, adipic acid—remain in deficit. Except for aniline, the profits of the five major downstream products of pure benzene continue to be in deficit. Although styrene and phenol have seen some recovery in losses during the period, the industry as a whole continues to suffer losses. Looking at the forecast for the next period, the profits of styrene, phenol, caprolactam, and aniline are expected to continue to recover, while the extent of losses for adipic acid is expected to slightly increase.

The future market price of pure benzene is expected to be weak.

Table 3 Domestic Benzene Supply and Demand Forecast

Conclusion (Medium to Long Term): In September and October, multiple new units for benzene and downstream products will be commissioned, and these units are of significant scale. The supply-demand fundamentals of the spot market are greatly impacted by the progress of these new units coming online. Based on the current supply-demand calculation data, considering the rebound in import volumes, the market price in September and October is expected to maintain an inventory accumulation price with a positive supply-demand gap. Benzene prices do not have the momentum for a sustained rebound.

Conclusion (Short Term): Next week, market demand will exceed supply. However, European goods impacting the far-month market will suppress spot prices, with negotiations expected to reference 5800-5900 yuan/ton. Pre-holiday restocking in the Shandong market will boost transactions, but continuous low-price large orders within the region might drag down the market's lower end, with negotiations referencing 5900-6100 yuan/ton. It is expected that Shandong-East China is not yet sufficient to form widespread arbitrage. The import volume of far-month pure benzene is expected to increase, with October at par with September.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track