Behind a 33% surge in net profit: Why Is This Chemical Company Making Brokerages Shout "Buy"?

Recently, Satellite Chemical disclosed its semi-annual report for 2025.

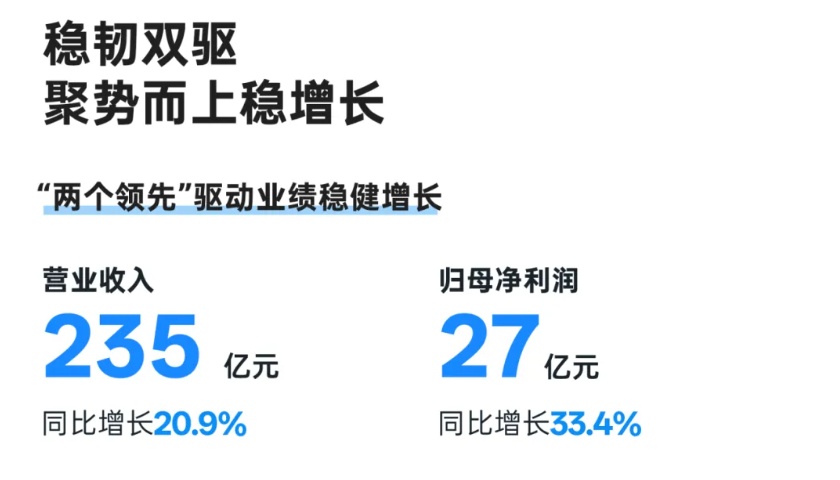

In the first half of 2025, Satellite Chemical delivered an impressive performance. According to the company's semi-annual report, it achieved an operating income of 23.46 billion RMB, a year-on-year increase of 20.93%. The net profit attributable to shareholders of the listed company was 2.744 billion RMB, a year-on-year increase of 33.44%. The net cash flow generated from operating activities reached 5.052 billion RMB, a significant year-on-year increase of 138.88%.

The outstanding performance of this series of key financial indicators fully demonstrates the company's strong operational resilience and excellent management capabilities in a complex market environment.

Source: Satellite Chemistry

Satellite Chemical is a leading domestic enterprise in the integrated production of the light hydrocarbon industry chain. It has taken the lead in establishing an independent and controllable global supply chain for light hydrocarbons. The company utilizes green processes to produce functional chemicals, new polymer materials, and new energy materials, promoting the comprehensive utilization of carbon dioxide and hydrogen. Its application fields cover key national industries such as aerospace, automotive, electronics and semiconductors, medical and health, nutrition and care, sports and fitness, construction engineering, and environmental governance. Satellite Chemical represents a direction encouraged by the state for diversifying raw materials in the petrochemical industry and is one of the important implementation plans for the national "dual carbon" goals.

I. Performance Highlights: Dual Growth+Cash flow doubled

According to the company's quarterly announcements, in the second quarter of 2025, the company achieved operating revenue of 11.131 billion yuan, an increase of 5.05% year-on-year and a decrease of 9.72% quarter-on-quarter. The net profit attributable to shareholders was 1.175 billion yuan, up 13.72% year-on-year and down 25.07% quarter-on-quarter. Huatai Securities pointed out that the quarter-on-quarter decline in Q2 was mainly due to the impact of repair and maintenance provision expenses, while the operational aspects remained stable. It is noteworthy that the China-U.S. ethane trade resumed normal operations at the beginning of July, eliminating the company's supply chain risks and laying a foundation for performance recovery in the second half of the year.

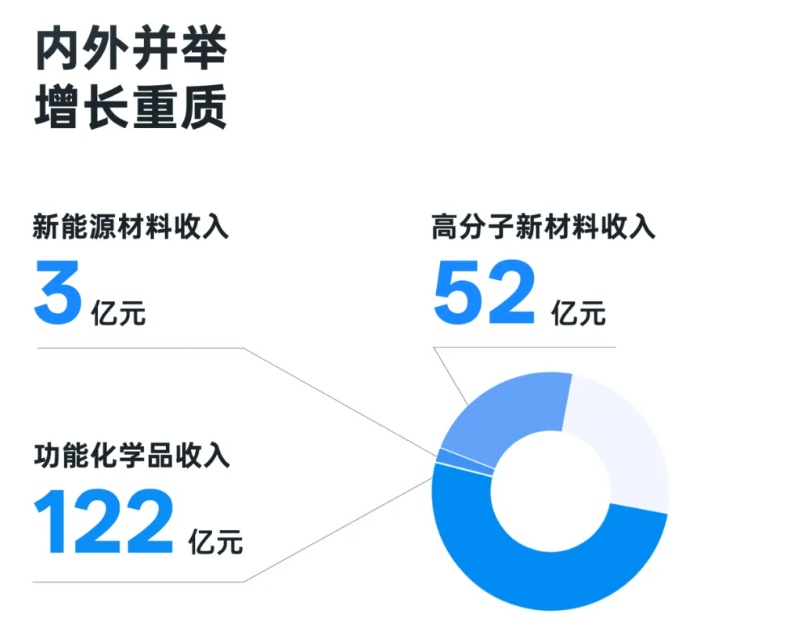

Analyzing from the business structure, the company's three main business segments have shown varied performances but remain overall stable.

Data source: Company announcement

Functional chemicalsThe sector performed the most outstandingly.Achieved a revenue of 12.217 billion yuan, a year-on-year increase of 32.12%, with the gross profit margin increasing by 2.64 percentage points to 19.92%.

High-performance polymer materials The operating revenue reached 5.245 billion yuan, a year-on-year decrease of 4.43%, but the gross profit margin still increased by 0.74 percentage points year-on-year to 29.54%, reflecting the high value-added characteristics of the products.

New energy materials Although operating revenue decreased by 14.93% year-on-year to 304 million yuan, the gross profit margin increased by 0.30 percentage points to 21.63%.

Integration advantages of the industrial chainSatellite Chemistry's steady performance growth is the core support.In the C2 sector, the company has established a comprehensive development matrix for downstream ethylene oxide chemicals, forming a production capacity of 1.82 million tons of ethylene glycol, 500,000 tons of polyether monomers and surfactants, 200,000 tons of ethanolamines, and 150,000 tons of carbonates. The actual production of ethanolamines and polyether monomers ranks first and second nationwide, respectively, with a market share exceeding 20%. In the C3 sector, the company has built the largest domestic and the second largest global production capacity for acrylic acid and esters. The Pinghu base's new material and new energy integration project (with an annual production of 800,000 tons of polyalcohols) succeeded in its first trial run in 2024, further consolidating its industrial chain advantages.

In terms of R&D innovation, the company continues to increase its investment efforts, with R&D investment reaching 773 million yuan in the first half of 2025, and an R&D expense ratio of 3.29%. During the reporting period, the company applied for 122 patents and was granted 57 patents, and launched a high-performance catalytic new material project. The company also announced that its R&D investment will exceed 10 billion yuan in the next five years, with achievement rewards exceeding 1 billion yuan, demonstrating a firm commitment to driving high-quality development through technological innovation.

2. Institutional View: Unanimous Optimism

Several brokerage firms have given positive evaluations of Satellite Chemical's semi-annual report performance and unanimously hold an optimistic view of the company's future development prospects. Although each brokerage has different areas of focus, there is a consensus on the growth potential brought by the company's integration advantages in the light hydrocarbon industry chain and its layout in high-end new materials.

Dongwu Securities:

After adjusting the profit forecast, the company's net profit attributable to the parent company is expected to be 6.6 billion, 8 billion, and 9.8 billion RMB for the years 2025-2027, respectively. The institution is particularly optimistic about the company's α-olefin comprehensive utilization high-end new material industrial park project, believing that the project, once its first phase is expected to be put into operation in 2026, will significantly enhance the company's profitability. Dongwu Securities emphasized that the company uses independently developed high-carbon α-olefin technology to extend its downstream layout to high-end polyolefins of 1.7 million tons (including metallocene polyethylene), 600,000 tons of polyethylene elastomer, and 30,000 tons of poly α-olefin. These high-end products will effectively break through the foreign "chokepoint" technology monopoly.

Huaxin Securities:

The forecasted net profit attributable to the parent company for 2025-2027 is 6.303, 7.794, and 9.033 billion yuan, respectively. The report from the institution points out that the company is "continuously enhancing its integrated synergy advantages and refining high-value-added products," with particular emphasis on the company's complete layout in the C2 and C3 industrial chains. Huaxin Securities believes that the company's ongoing construction of new acrylic acid production capacity at the Pinghu and Jiaxing bases will further strengthen the company's cost advantages and product competitiveness.

Hua An Securities:

Although the performance forecast has been lowered due to unexpected fluctuations in crude oil and maintenance factors within the year, the "buy" rating is still maintained. The company's net profit attributable to the parent company for 2025-2027 is expected to be 6.524 billion, 8.893 billion, and 10.982 billion yuan, respectively. The report from Huazhong Securities highlighted the company's breakthroughs in the field of high-end new materials.

Shanxi Securities:

The company's net profits for 2025-2027 are expected to be 6.36/7.60/9.63 billion yuan respectively. The institution particularly highlights the company's strategic layout in R&D: "The company's future R&D center will commence construction in May 2024, with a planned R&D investment of 10 billion yuan. The company aims to increase talent acquisition and focus on key strategic materials and frontier new materials, including catalysts, new energy materials, polymer new materials, and functional chemicals, for research and industrialization."

Guosen Securities:

In the second quarter of 2025, the company was affected by the "reciprocal tariffs" import policy and U.S. ethane export restrictions. However, in the third quarter, the decline in cost prices and the expansion of price differences led to improved profitability for the company's C2 and C3 industrial chains on a quarter-on-quarter basis. The report emphasized: "The company is investing 25.7 billion yuan in a new high-end new material industrial park project for comprehensive α-olefin utilization in the Xuwei New District of Lianyungang. The first phase of the project has already commenced construction and is expected to be operational by 2026."

Based on the perspectives of various brokerage firms, despite the different angles of analysis, institutions generally believe that:

The company has significant advantages in the integration of the light hydrocarbons industry chain and outstanding cost control capabilities.

The layout of high-end new materials will open up long-term growth opportunities.

Increasing investment in research and development will consolidate the leading position in technology.

The current valuation level is attractive, and most brokerages provide target prices that imply significant upside potential.

3. Future of the Industry: Five Major Trends

Based on company practices and brokerage analysis, we can outline several key directions for the future development of the plasticization industry.

1. Green and low-carbon development has become an inevitable choice for the industry.

Satellite Chemical, as a leading integrated production enterprise in the domestic light hydrocarbon industry chain, has taken the lead in establishing an independent and controllable global supply chain for light hydrocarbons. It uses green processes to produce functional chemicals, new polymer materials, and new energy materials while promoting the comprehensive utilization of carbon dioxide and hydrogen. This development model aligns with the national petrochemical industry's encouragement for raw material diversification and is an important implementation plan for achieving the "dual carbon" goals. In the future, the industry will focus more on promoting the use of lightweight raw material routes (such as light hydrocarbon utilization), efficient energy resource utilization, the application of energy-saving and emission-reduction technologies, the development of carbon dioxide capture and utilization technologies, and the coupling development of renewable energy with chemical production.

2、High-end new materials are the core direction of industrial upgrading.

Satellite Chemistry's strategic layout in the fields of α-olefins and high-end polyolefins reflects the industry’s trend towards high-end transformation. With China's high-quality economic development, there will be a continuous increase in demand for high-performance materials in sectors such as aerospace, automotive industry, electronics and semiconductors, and healthcare. Breaking through the "bottleneck" of key material technologies (such as high-performance resins and special elastomers), developing new materials to meet the demands of high-end manufacturing (such as semiconductor materials and biomedical materials), enhancing the quality and performance stability of existing products, strengthening collaborative innovation along the industrial chain, and accelerating the transformation of scientific and technological achievements will become key focus areas for the future development of the industry.

3. Technological innovation will become the core driving force.

The satellite chemical plan will invest over 10 billion yuan in research and development over the next five years, which fully demonstrates the central role of technological innovation in the future development of the chemical industry.

4、Digitalization and intelligent transformation will reshape the industrial structure.

It is noteworthy that Satellite Chemical mentioned in the report "exploring frontier application scenarios such as robotics, artificial intelligence, and semiconductors," which reflects the digital transformation that the chemical industry is undergoing.

5、Global Layout and Supply Chain Security

Satellite Chemical has established Satellite Global Corporation to concentrate resources on accelerating the expansion of the overseas market. It has already established partnerships with customers in over 160 countries and regions worldwide. Against the backdrop of complex and ever-changing geopolitical conditions, the chemical industry needs to build diversified raw material supply channels, optimize the layout of global production bases, and strengthen international technical cooperation and exchange in order to enhance supply chain resilience and risk resistance capabilities.

In summary, Satellite Chemical's 2025 semi-annual report not only showcases the operational achievements of an excellent chemical company but also provides valuable insights for the future development of the industry. Satellite Chemical's practice demonstrates that adhering to technology leadership, deepening industrial chain collaboration, and investing in high-end new materials are effective paths for chemical companies to achieve high-quality development.

Editor: Lily

Sources: Satellite Chemical, China Chemical Industry Information Weekly, Coal-Oil Integration, Petrochemical Industry Going Global Alliance, and major brokerage reports.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track