BDO and Tongde Chemical Involved in Contract Dispute, Net Profit Expected to Plunge 80% in First Half

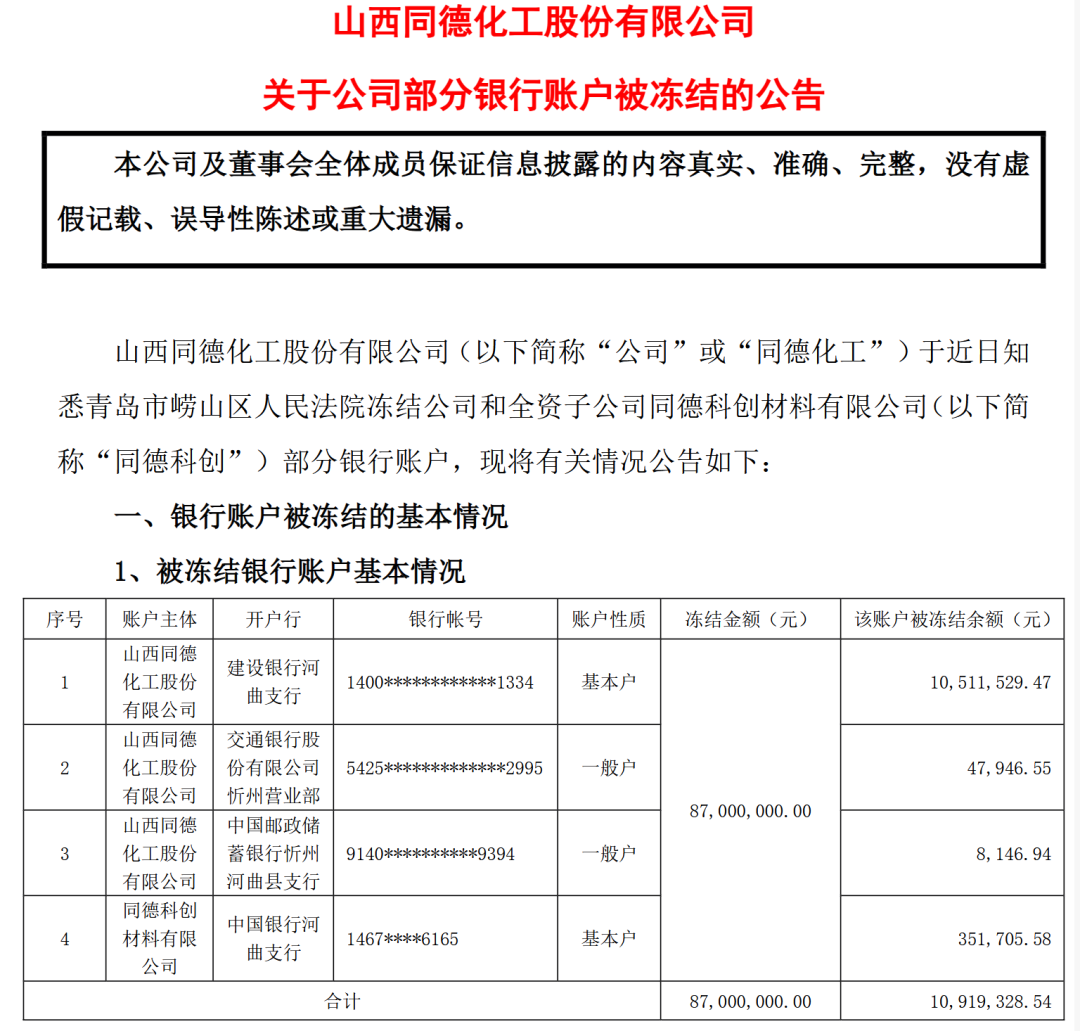

On the evening of July 21, Tongde Chemical (SZ002360, stock price 5.84 yuan, market capitalization 2.346 billion yuan) announced that due to a contract dispute, the company and its wholly-owned subsidiary Tongde Kechuang Materials Co., Ltd. (hereinafter referred to as "Tongde Kechuang") had several bank accounts frozen by the People's Court of Laoshan District, Qingdao City, with a total frozen amount of 87 million yuan. As of the date of this announcement, the balance frozen in these four accounts is 10.9193 million yuan.

Tongde Chemical stated in the announcement that the company's production and business activities are proceeding normally and have not been significantly adversely affected by the bank account freeze. Recently, Tongde Chemical has been involved in several financial leasing contract disputes, but all have been resolved through pre-litigation mediation.

Four accounts have been frozen, with a total frozen balance of 10.92 million yuan.

Due to a contract dispute between Tongde Chemical and Qingdao Huatong Financial Leasing Co., Ltd. (hereinafter referred to as "Huatong Leasing"), Huatong Leasing has applied to the Laoshan District People's Court of Qingdao for property preservation. As of the date of this announcement, the company has not yet received any official legal documents, notifications, or other information from the court. Tongde Chemical stated that it is actively following up and verifying this matter, and will fulfill its information disclosure obligations in a timely manner.

The announcement states that a total of four bank accounts have been frozen this time, involving the company's basic accounts at the Construction Bank Hequ Branch and the Tongde Kechuang China Bank Hequ Branch, among others. As of the date of this announcement, the frozen balance in these four accounts amounts to 10.9193 million yuan, accounting for 0.55% of the company's most recent audited net assets and 5.82% of the balance of monetary funds at the end of the period.

This freeze is a subsequent freeze. As early as May 23, Tongde Chemical announced that the company’s basic accounts at Construction Bank Hequ Branch and Tongde Kechuang China Bank Hequ Branch, among others, were frozen by the Shanghai Pudong New Area People's Court for an amount of 32.24078 million yuan due to a financing lease contract dispute between the company and Far East International Financial Leasing Co., Ltd. (hereinafter referred to as "Far East Leasing").

According to the company's most recent audited financial statements, Tongde Chemical's ending balance of monetary funds was 188 million yuan, and the net cash flow from operating activities during the reporting period was 15.3145 million yuan. The company stated that operating cash flow has continuously maintained a positive inflow, demonstrating strong cash flow support.

Tongde Chemical stated in the announcement that, considering the company's current continuous positive operating cash flow, asset structure, and funding arrangements, the company believes that the freezing of the aforementioned bank accounts does not have a significant impact on its daily production and business activities, and the company's overall operations remain stable.

The announcement shows that Tongde Chemical has been actively negotiating a settlement with Huatuo Leasing, fully considering the opinions of professional legal advisory firms, appropriately handling the dispute between the two parties, lawfully safeguarding the company's legal rights, and striving to restore the frozen bank account to normal status as soon as possible.

Net profit for the first half is expected to drop by 80%, dragged down by multiple factors.

Recently, multiple lawsuits involving Tongde Chemical have been resolved through pre-litigation mediation.

On July 11, Tongde Chemical announced the details of three recent lawsuits. Litigation Matter 1 and Litigation Matter 2 involve disputes over financial leasing contracts between the company, Tongde Kechuang, and Far East Leasing. Litigation Matter 3 concerns a financial leasing contract dispute between the company and Ping An International Financial Leasing Co., Ltd. (hereinafter referred to as "Ping An Leasing").

In Litigation Matter One, under the mediation facilitated by the People's Court of Pudong New Area, Shanghai, the company is required to pay a total rent of 10.186 million yuan and a purchase option payment of 1,000 yuan; in Litigation Matter Two, under the mediation facilitated by the People's Court of Pudong New Area, Shanghai, Tongde Kechuang is required to pay a total rent of 11.078 million yuan and a purchase option payment of 1,000 yuan; in Litigation Matter Three, under the mediation facilitated by the People's Court of Pudong New Area, Shanghai, both parties confirmed that as of June 20, 2025, the company still owes Ping An Leasing a remaining unpaid rent of 11.54 million yuan, a purchase option payment of 100 yuan, and a penalty of 52,700 yuan.

On July 14, Tongde Chemical released its 2025 semi-annual performance forecast, estimating a net profit attributable to shareholders of the listed company of RMB 6.5 million to 9.5 million for the first half of the year, representing a year-on-year decrease of 79.24% to 85.79%. The net profit after deducting non-recurring gains and losses is expected to be RMB 5.6 million to 8.3 million, representing a year-on-year decrease of 79.22% to 85.98%.

Regarding the reasons for the performance changes, Tongde Chemical provided three explanations.

First, the coal output in the company's business regions declined year-on-year in the first half of the year, resulting in a corresponding decrease in the sales of explosives and blasting services, and a year-on-year decline in operating revenue during the period; second, the general loans obtained from financial institutions were fully used for the integrated construction project of Tongde Kechuang PBAT (polybutylene adipate terephthalate, a fully biodegradable plastic), and the interest amount reached RMB 15.7476 million in the first half of the year. Out of prudence, the company expensed this portion of the interest; third, the company’s power business suffered a loss of RMB 11.4732 million due to insufficient capacity utilization caused by restricted raw material gas supply.

The PBAT new material industry chain integration project is a major construction project for the company's transformation and upgrading, with a total investment of approximately 3.5 billion yuan. It includes a 60,000 tons/year PBAT unit and a 240,000 tons/year BDO unit, aiming to build an intelligent and automated environmentally friendly new material production line. The main construction of the project has been completed, but due to funding issues, the installation and commissioning of equipment are currently on hold. The company is actively seeking industrial and financial investors in an effort to bring the project into operation this year.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track