BBA Loses Ground in China Market, Mercedes-Benz Q3 Deliveries Plunge 27%

The luxury car market structure is rapidly adjusting, with BBA showing a differentiated trend of "BMW leading, Mercedes under pressure, Audi catching up."

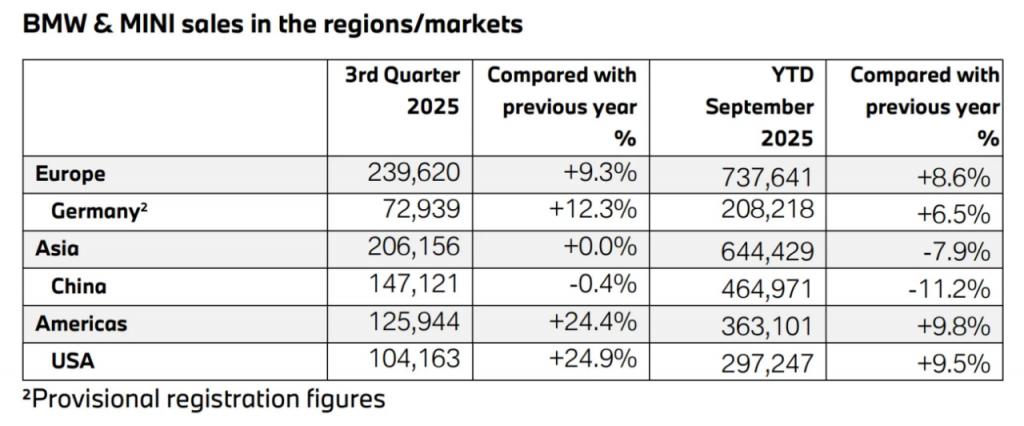

BMW is the only company among the BBA that achieved positive sales growth.In the third quarter, sales data shows that BMW's global deliveries reached 588,300 units, an increase of 8.8% year-on-year, pushing the cumulative sales for the first three quarters to 1,795,900 units, a year-on-year growth of 2.4%. With nearly 1.8 million units, its strong performance in the North American and European markets offset the pressure of declining sales in the Chinese market.

In contrast, Mercedes-Benz and Audi are facing greater sales pressure. Mercedes-Benz Group's global sales in the third quarter were 525,300 vehicles, down 12% year-on-year and 4% quarter-on-quarter. Its cumulative sales for the first three quarters were 1,601,600 vehicles, a year-on-year decrease of 9%.

Audi's global sales in the third quarter were 397,100 vehicles, a year-on-year decrease of 2.5%; the cumulative sales for the first three quarters were 1,191,100 vehicles, a year-on-year decrease of 4.8%. This means that Audi's sales volume has fallen behind BMW by more than 600,000 vehicles.

Losing the Chinese market, the pricing system faces a shock.

As the global market recovers, the Chinese market has become a common challenge for BBA.

According to data disclosed by BMW, in the third quarter of this year, BMW delivered 147,100 new cars in the Chinese market, a slight decrease of 0.4%. The cumulative delivery volume for the first three quarters fell by 11.2% to 464,000 vehicles.China has become its only global market in decline.

(BMW sales by region, source: BMW official)

Mercedes-Benz is facing more significant pressure. In the third quarter, the company's delivery volume in the Chinese market plummeted by 27% year-on-year to 125,000 units, and the sales for the first three quarters fell by 18% to 418,000 units.China remains its largest market for global declines.

Although Audi has not directly disclosed its global sales figures in China, data from its joint ventures indicate signs of recovery: FAW Audi's sales in the first three quarters reached 58,000 vehicles, a year-on-year increase of 13.5%; SAIC Audi's terminal sales in September this year were 5,700 vehicles, a year-on-year increase of 90%.

A luxury car dealer once told the 21st Century Business Herald reporter:"Instead of saying that BBA is no longer viable, it is better to say that there are more choices in the Chinese market."

The data disclosed by the China Passenger Car Association confirms this trend: the market share of German brands fell from 18.4% in January 2025 to 14.3% this September; meanwhile, luxury car retail sales in September were 240,000 units, a year-on-year decrease of 1%; the retail share of luxury brands was 10.8%, down 0.8 percentage points year-on-year, indicating that the traditional luxury car market is facing greater structural pressure than joint venture brands.

The loosening of the BBA pricing system has become a core challenge.In the price range of 200,000 to 400,000 yuan, the entry-level models from BBA are facing challenges from Chinese brands.

In the price range of 200,000 to 300,000 yuan, models like Zeekr and Tesla Model 3/Y, with their stronger performance or higher cost-performance ratio, have made entry-level sedans and SUVs from BBA lose their aura of being the "only luxury choice." In the market above 300,000 yuan, NIO, Li Auto, and AITO have directly competed for BBA's core users by offering better space, intelligent cockpits, and user experiences. In the ultra-luxury market above 700,000 yuan, models like NIO ET9, BYD Yangwang, and Zuncheng S800 have begun to challenge BBA's top models.

Affected by the Chinese market, BMW announced on October 8 local time that it is lowering its full-year profit forecast. After the adjustment, BMW expects its pre-tax profit for the full year of 2025 to be "slightly below" last year's 10.97 billion euros (approximately 90.98 billion RMB), whereas the previous expectation was to be on par with last year. Meanwhile, the full-year earnings before interest and taxes (EBIT) margin is expected to fall within the range of 5% to 6%, which is also below the previously set target.

BMW stated that the higher-than-expected tariff costs and the financial support provided to local dealers have jointly impacted its revised performance outlook.

Hybrid supports the present, while pure electric wins the future.

BBA's electrification path is showing three different trajectories.BMW leads, Mercedes aggressively attacks, Audi makes pragmatic adjustments, but the core consensus is "betting on pure electric to counterattack the Chinese market."

In the German automotive camp, BMW's transition to pure electric vehicles is more advanced. In the first three quarters, the cumulative delivery of its pure electric models reached 323,000 units, a year-on-year increase of 10%.

At the Munich Auto Show, BMW showcased the beginning of a new generation of pure electric strategy—the new generation BMW iX3. The car is based on a brand-new electronic and electrical architecture, with a design that highly restores the Vision Neue Klasse X concept car. The overseas version will start delivery in Europe by the end of the year, and the Chinese version will be unveiled within the year and achieve domestic production by 2026. As the first mass-produced car on the new platform, the BMW iX3 is equipped with a 108 kWh large cylindrical battery, with a CLTC range of over 900 kilometers.

Mercedes-Benz has launched the "biggest product offensive in history," aiming directly at the new era of electric vehicles. Its core strategic model, the all-new pure electric GLC, targets the Chinese luxury pure electric SUV market. The long-wheelbase version will be launched next year, equipped with pilot-assisted driving and integrated with ByteDance's "Doubao" AI large model.

To enhance its intelligent driving capabilities, Mercedes-Benz is building a cooperative ecosystem in China. On September 25, Mercedes-Benz announced that a new generation of intelligent driving assistance systems developed in collaboration with local intelligent driving company Momenta is set to be released. On the same day, Mercedes-Benz invested 1.3 billion yuan to acquire a 3% stake in Qianli Technology, becoming the fifth largest shareholder of the company.

Mercedes has announced that the electric versions of the GLB and GLA will debut in 2026, and has committed to launching at least 40 new models by the end of 2027.

(Source: Mercedes-Benz Official)

Audi's pure electric strategy appears more pragmatic. In June 2025, Audi CEO Gernot Döllner announced an adjustment to the electrification strategy, no longer insisting on the plan to completely stop selling fuel vehicles by 2033. This does not mean giving up on electrification, but rather a shift towards a balance between "long-term electrification goals and a flexible product portfolio."

Audi's all-electric future is staked on two major platforms. The first is the PPE luxury electric platform developed jointly with Porsche, on which the first China-exclusive long-wheelbase model, the Audi Q6L e-tron, has officially debuted. The second is the Volkswagen Group's future core—the SSP platform, which Audi regards as the ultimate solution for "software-defined vehicles."

The current hybrid market is still an important support.

In the third quarter of this year, BMW Group's sales of new energy vehicles increased by 8% year-on-year to 152,000 units. Against the backdrop of a slight year-on-year decline of 0.6% in sales of its pure electric models, this growth was primarily driven by plug-in hybrid models.

Mercedes-Benz also relies on the hybrid market, delivering 96,000 hybrid vehicles during the same period, a year-on-year increase of 10%.

However, the Chinese market has passed the "range extender boom," and the growth of pure electric vehicles is surpassing that of hybrid vehicles. According to statistics from the Passenger Car Association, in September of this year, the wholesale growth rate of the pure electric market reached 32.4%, significantly higher than the 8.4% and 8.7% for plug-in hybrids and range extenders, respectively.

With the BBA collectively increasing their focus on pure electric products, this battle that will determine the future landscape has fully commenced in the Chinese market.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track