BASF Zhanjiang Integrated Base Plans Full Production By The End Of 2025, Expected To Achieve Up To 1.2 Billion Euros In Profit By 2030

These achievements mark the steady progress of this production base towards the goal of full operation by the end of 2025, fully demonstrating BASF's firm commitment to meeting the growing demand for high-quality petrochemical products in the Asia-Pacific region.

On August 11, 2025, the butyl acrylate unit at BASF's Zhanjiang integrated base officially began operations, ahead of the original schedule, while maintaining an excellent record of zero safety incidents.

On August 17, the first batch of butyl acrylate was successfully delivered via tank truck from the Zhanjiang integrated base, marking the first customer delivery following the commissioning of the new plant. The butyl acrylate plant has a designed annual production capacity of approximately 400,000 tons, which will further strengthen BASF's leading position in the acrylic acid market and provide key raw materials for customers in the adhesives, industrial coatings, and architectural coatings industries.

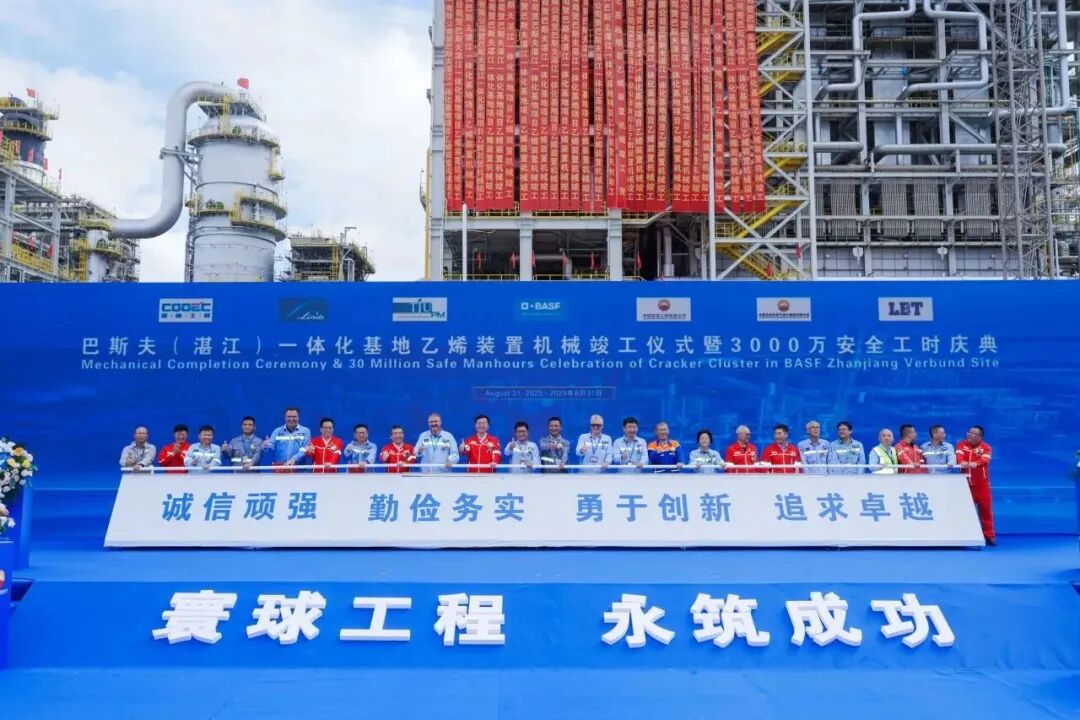

In addition, the ethylene joint venture facility at BASF's Zhanjiang integrated site and all downstream petrochemical plants have completed mechanical completion, including the ethylene oxide, oxo alcohol, syngas, and high-density polyethylene plants, marking the transition of the project from the construction phase to the operational readiness phase. This milestone ensures that all systems have been installed, connected, and tested, laying a solid foundation for the commissioning and production planned for the end of 2025.

On October 2, Markus Kamieth, Chairman of the Executive Board of BASF Group, stated that the adjusted EBITDA of the Zhanjiang integrated base is expected to reach between €1 billion and €1.2 billion by 2030. In the medium to long term, the base will play a key role in strengthening BASF's core business, with most plants expected to start production by the end of 2025.

BASF also stated that by 2028, the total investment in the Zhanjiang integrated base is expected to be around 8.7 billion euros, a reduction of 1.3 billion euros from the original plan of 10 billion euros. BASF mentioned that the company is making capital allocations, including reducing the expected payments for real estate, plants, equipment, and intangible assets from 17 billion euros to around 16 billion euros during the period from 2025 to 2028.

On that day, BASF presented the latest progress since the announcement of its "Winning Strategy" a year ago and reaffirmed its financial targets for 2028. Specifically, by 2028, the company expects its earnings before interest, taxes, depreciation, and amortization (EBITDA) excluding special items to reach between 10 billion and 12 billion euros. The cumulative free cash flow from 2025 to 2028 is expected to exceed 12 billion euros.

On September 26 last year, BASF proposed a new strategy called "Winning with Purpose," which includes specific measures such as redefining portfolio management by categorizing businesses into core and autonomous segments, adjusting the business structure by exiting non-core areas, and optimizing capital allocation to strengthen market competitiveness.

At that time, BASF planned to pay a dividend of at least €2.25 per share annually between 2025 and 2028, amounting to a total of approximately €8 billion, and committed to a share buyback program of at least €4 billion during the period from 2027 to 2028. The company currently expects to start the share buyback program ahead of schedule.

According to the reform plan previously announced by BASF, it will implement differentiated management for core and autonomous businesses. The core businesses include segments such as chemicals, materials, industrial solutions, nutrition, and care, while the autonomous businesses encompass environmental catalysts and metal solutions, battery materials, coatings, and agricultural solutions.

Kerry has provided the latest disclosure on the company's independent business, specifically including retaining the Environmental Catalysts and Metal Solutions (ECMS) business for a longer period. This business generated €7 billion in sales in 2024 and is expected to generate approximately €4 billion in cumulative cash flow between 2024 and 2030.

The company also plans to list a minority stake in its agricultural solutions division in 2027, which will have sales of 9.8 billion euros in 2024.

In the battery materials division, BASF has significantly reduced fixed costs and capital expenditures, and signed agreements with key customers such as CATL to fill existing capacity. The division's sales are projected to reach 600 million euros in 2024.

Kerry also stated that the company has completed the sale of its decorative paints business in Brazil. In the second quarter of 2025, BASF will begin exploring strategic options for other coatings businesses, including automotive OEM coatings, and is expected to make a decision in the fourth quarter of 2025. It was revealed that the sales revenue of BASF's Coatings division in 2024 was 3.8 billion euros.

Kerry stated, "Our focus on portfolio guidance, capital allocation, and performance culture will prepare BASF for future profit growth." BASF is addressing performance gaps by closing unprofitable plants, launching competitively new businesses, and exploring strategic options. These measures are expected to improve core business earnings by approximately 400 million euros by 2028.

BASF emphasizes that it is accelerating the implementation of its cost-saving plan, which is expected to save 1.6 billion euros annually by the end of 2025 (previously 1.5 billion euros).

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track