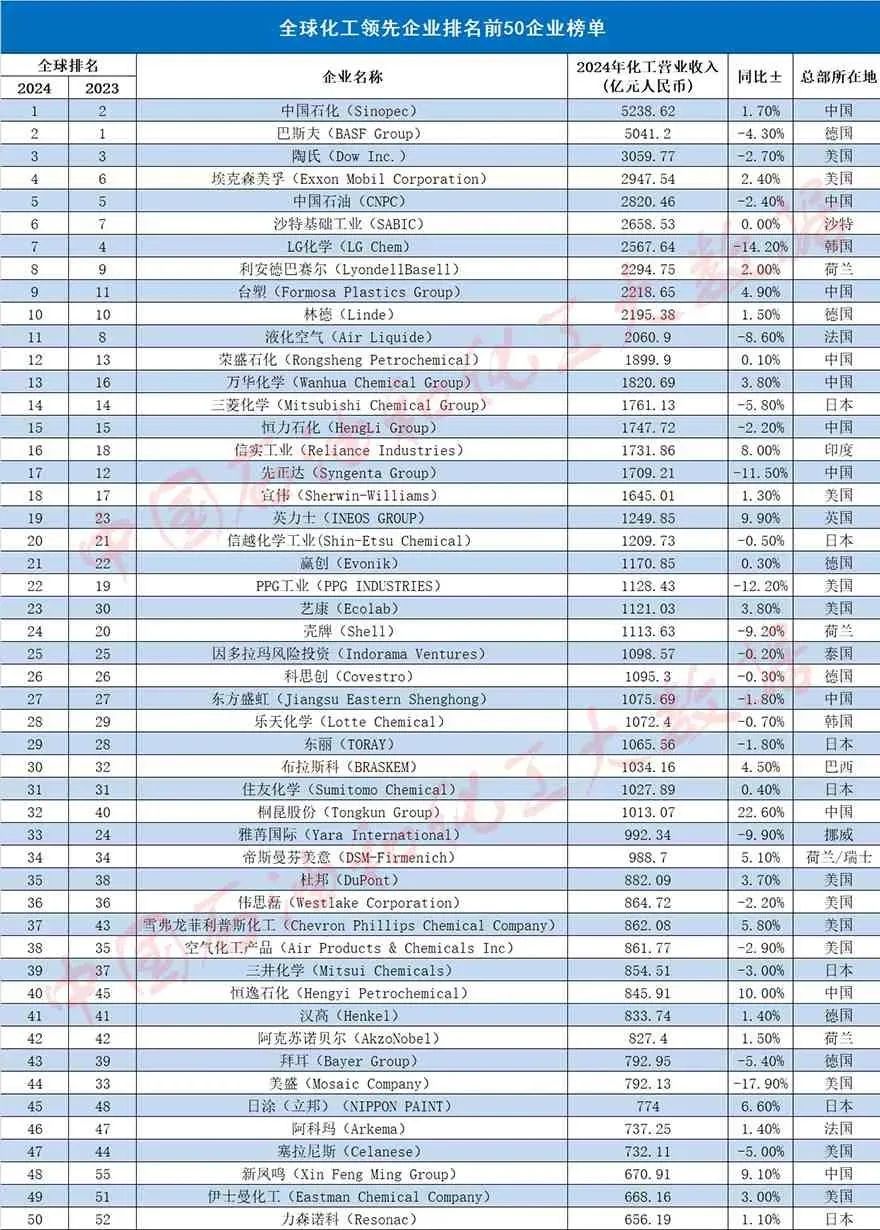

BASF Remains On Top, Sinopec Surges To The Lead! This Chinese Company Sees The Biggest Growth

Recently, the American magazine Chemical & Engineering News (C&EN) released the "Top 50 Global Chemical Companies in 2025." BASF remains the world's largest chemical manufacturer, Sinopec continues to hold the second place in Asia, and Dow remains in third place.

BASF ranks first, with chemical sales of approximately $70.6 billion in 2024; Sinopec's chemical sales are about $58.1 billion, and Dow's sales are around $42.9 billion.

In terms of Chinese companies, apart from Sinopec and PetroChina, Formosa Plastics ranks 11th with a sales revenue of $30.3 billion; Syngenta and Rongsheng Petrochemical follow closely, ranking 13th and 14th with $26.9 billion and $26.4 billion respectively; Wanhua Chemical ranks 15th with $25.3 billion; Hengli Petrochemical occupies the 18th position with $21.3 billion; Oriental Shenghong is 23rd with $15.3 billion; Tongkun Group's sales revenue of $13.7 billion has risen 7 places to 30th; Hengyi Petrochemical ranks 35th with $11.8 billion; and Xinfengming Group, with $9.3 billion, has risen 4 places to 44th.

Among the world's top 50 chemical companies, 11 are from China, the same number as the previous year. The United States has 10, Japan has 7, Germany has 4, the United Kingdom has 3, and South Korea has 2.

The revenue threshold for this year's top 50 is $8 billion, a slight decrease of nearly $400 million compared to last year. There are 2 companies with sales exceeding $50 billion, 3 companies with sales between $40 billion and $50 billion, 6 companies between $30 billion and $40 billion, 7 companies between $20 billion and $30 billion, and 22 companies between $10 billion and $20 billion.

Overall Situation

In 2024, the global chemical industry continued the downward trend seen in 2023, but the decline significantly narrowed, and regional differentiation accelerated. Leading companies showed initial signs of stabilizing profitability. The total chemical revenue of the top 50 global chemical companies reached 7,553.21 billion yuan (RMB), a year-on-year decrease of 1.0%, narrowing by 4.9 percentage points compared to 2023.

Data source: Corporate financial reports and public data, collected, organized, and analyzed by the China Chemical Industry Economic and Technical Development Center. (Click the image to view a clear, enlarged version)

Specifically, Sinopec topped the list of the top 50 global chemical leading companies in 2024 with a chemical business revenue of 523.86 billion yuan. Germany's BASF followed closely in second place with 504.12 billion yuan, and the United States' Dow surpassed ExxonMobil to rank third with 305.98 billion yuan.

China Petrochemical Corporation (Sinopec) showed a recovery growth trend, with chemical business revenue turning from a decline to an increase, growing by 1.7% year-on-year. In contrast, Germany's BASF's chemical business revenue decreased by 4.3% year-on-year, and the United States' Dow Chemical's revenue decreased by 2.7% year-on-year. Affected by the continued decline in fertilizer prices from the 2022 high, fertilizer producers such as Norway's Yara and the United States' Mosaic saw their performance continue to plummet significantly in 2023, building on already steep declines. Although the rate of decline has narrowed, Mosaic still experienced the largest year-on-year decline in chemical business revenue among the top 50 companies, reaching 17.9%, which also caused its ranking to drop significantly by 11 places.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track