Basf leads the charge to 22,000 yuan/ton! with capacity collapse, when will the tdi price surge end?

The global toluene diisocyanate (TDI) market is experiencing a wave of sharp price increases. During the period from July to August 2025, TDI prices have shown a "triple jump" increase.

Recently, chemical giant BASF announced its latest pricing policy for the Chinese market, raising the listed price for August to 22,000 yuan/ton, far exceeding market expectations. This also indicates that the market supply in August will face severe shortages, and spot prices are very likely to be pushed to new highs.

Zhuan Su Shi Jie will start by examining the price increase situation across different regions worldwide, conduct an in-depth analysis of the global TDI production capacity landscape, and explore the underlying reasons for the current round of price increases. Additionally, it will forecast future market developments to provide industry professionals and investors with comprehensive market insights.

1. Global TDIPrice Increases Across the Board: From Regional Shortages to Widespread Tension

In the summer of 2025, the global TDI market experienced a rapid surge in prices, with major consumer regions consecutively breaking historical highs, displaying a rare synchronous increase. This price storm began in Europe, quickly spreading to Asia and the Americas, eventually evolving into a global supply crisis.

European marketLeading the rise and becoming the "epicenter" of the current global TDI price storm. On July 12,Covestro Dormagen Plant, GermanyA sudden electrical fire caused the shutdown of its 300,000-tonne-per-year TDI facility and associated chlorine production. This incident directly cut 55% of Europe's TDI capacity and 9% of the global supply.

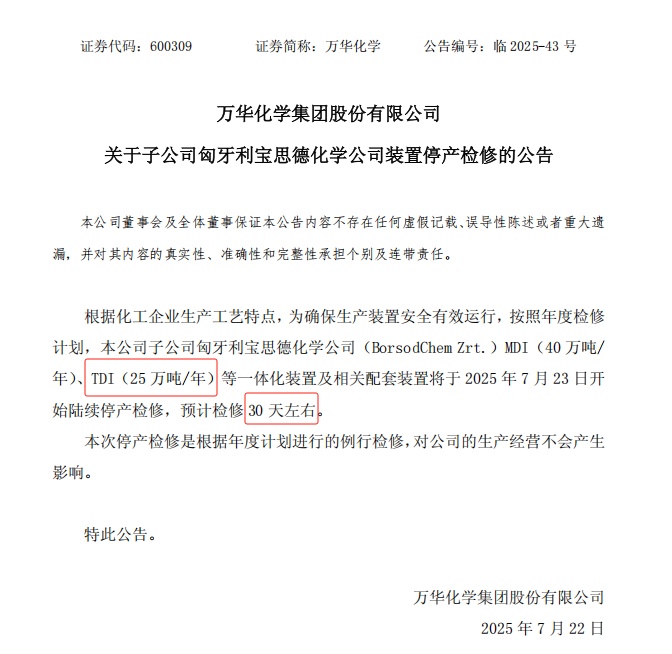

Coincidentally, just one week after the fire, Wanhua Chemical announced that according to the annual maintenance plan, the company's subsidiary...BorsodChem Co., Ltd. in HungaryThe integrated facilities of MDI (400,000 tons/year) and TDI (250,000 tons/year), along with related supporting installations, will begin a phased shutdown for maintenance starting on July 23, 2025. The maintenance is expected to last about 30 days.

Due to short-term maintenance and force majeure shutdowns, the price of TDI in Europe increased from 1,900 euros/ton to 2,500 euros/ton in July, a single-month increase of over 31%, putting significant cost pressure on downstream manufacturers.

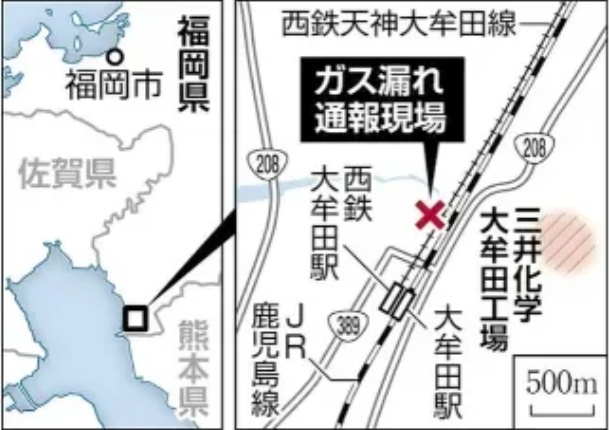

Soon after,Asia MarketsThe supply of TDI also experienced an "incident." On July 27, a chlorine leak occurred at Mitsui Chemicals in Japan, leading to the emergency shutdown of the Mu Tian plant's TDI unit with a capacity of 50,000 tons. Coupled with maintenance of some domestic TDI capacities, the TDI prices in the Asian market experienced a short-term surge. Fortunately, Wanhua Chemical announced that its Fujian Industrial Park's 800,000 tons/year MDI unit, 360,000 tons/year TDI unit, and 400,000 tons/year PVC unit have completed maintenance shutdowns and resumed normal production.

Source: Mitsui Chemicals

North American marketDue to the global supply shortage and production instability at some facilities, TDI prices have continued to rise. The TDI price in the U.S. market has increased to the range of $2,500-$2,800 per ton, and the supply is tight, with many distributors limiting their sales.

2. TDIWhy is it so critical?

The main upstream raw materials for TDI are toluene, nitric acid, carbon monoxide, and liquid ammonia, while downstream applications primarily include flexible foam (70%), coatings (20%), adhesives (5%), and elastomers (5%).

Toluene diisocyanate (TDI), as a core raw material in the polyurethane industry, contains two highly reactive isocyanate groups (-NCO) in its molecular structure, which can rapidly react with polyols and other compounds containing active hydrogen to form polyurethane materials. This characteristic makes it the main raw material for producing flexible polyurethane foam, which is widely used in fields such as furniture (e.g., sofas, mattresses), automotive seats, and packaging cushioning materials. The lightweight, high elasticity, and thermal insulation properties of polyurethane foam make it an indispensable functional material in modern industry. In addition to soft foam, TDI is also used to produce elastomers, coatings, adhesives, and other high value-added products.

China is a major global producer of TDI, with its production capacity ranking among the top in the world. In recent years, China's TDI exports have increased significantly, particularly in emerging markets such as Southeast Asia and the Middle East. TDI has become an important category driving the growth of chemical exports. Its upstream industry chain is connected to basic chemical raw materials such as toluene and nitric acid, while its downstream applications extend to industries like construction, automotive, and home appliances, significantly contributing to the national economy.

3. TDI Market Landscape

- China isGlobal TDI production center.

The global TDI production facilities are mainly concentrated in a few countries and regions, including China, Germany, Hungary, the United States, Japan, and South Korea. Among them, China, with its well-established chemical industry system and continuous investment expansion, has become the undisputed global TDI production center, with an existing capacity of 1.6 million tons (Wanhua 86 + Covestro 31 + BASF 16 + Cangzhou Dahua 15 + Gansu Yinguang 12). According to data from the Guanyan Report Network, China's TDI capacity reached 1.44 million tons in 2023, accounting for 46.02% of the global total capacity. This proportion is expected to further increase to 54.89% by 2025.

Global TDIIncomplete capacity statistics (Source: Kaiyang Chemical Chat)

Compared to this,The production capacity in Europe continues to shrink.From 90,000 tons at the beginning of 2023 (Covestro Germany 300,000 tons, BASF Germany 300,000 tons, Wanhua Hungary 250,000 tons, and others 50,000 tons) to 55,000 tons in 2025 (Covestro Germany 300,000 tons, Wanhua Hungary 250,000 tons), the capacity has decreased by nearly 40%. This regional imbalance makes the global supply chain more vulnerable, and any unexpected disruption in a major production center will lead to a severe supply-demand imbalance.

- TDI The giant holds the "life and death switch" of global production capacity.

The global TDI industry is characterized by an oligopolistic market structure, with production technology concentrated in the hands of a few companies such as Covestro (Germany), Wanhua Chemical (China), BASF (Germany), and Sadara (Saudi Arabia). By 2025, the combined production capacity of the top four companies will account for over 70% of the global total, with Wanhua Chemical and Covestro alone exceeding a 50% share. Notably, Wanhua Chemical, through a series of capacity expansions and acquisitions, surpassed Covestro in 2024 to become the world's largest TDI supplier with a capacity of 950,000 tons. In 2025, with the commissioning of the second phase of the Fujian project, adding 330,000 tons, Wanhua Chemical's total capacity will soar to 1.28 million tons (representing over 35% of the global share), further solidifying its market leadership.

- Global TDIFundamental changes in the trade pattern

Traditionally, TDI trade is primarily based on regional self-sufficiency, with cross-border supplementation playing a secondary role. Europe, America, and Asia each maintain relatively independent supply and demand balances. However, with the expansion of production capacity in China and the contraction of production capacity in Europe,Trade PatternA fundamental change has occurred. Chinese products not only meet domestic demand but are also exported in large quantities to Southeast Asia, the Middle East, Africa, and enter the European market through re-export trade.

The change in this trade pattern has increased global price linkage and expanded the impact of regional events. The fire at Covestro's German plant causing global upheaval is precisely a reflection of this high level of linkage.

4. TDIHow long can the price increase last?

From the above, it can be concluded that the sharp rise in global TDI prices this round is a typical supply-driven event.

According to statistics from the Chemical and Plastics Research Institute, the current global TDI production capacity is 3.3 million tons, of which 1.26 million tons are affected by maintenance and force majeure. In terms of capacity under construction and planning, new facilities such as Wanhua Fujian, Wanhua Juli, and Shanghai Covestro are expected to be put into operation in the third and fourth quarters, but "distant water cannot quench present thirst." Considering the current market supply constraints and the continued surpassing of export expectations, there is still upward potential for TDI prices.

However, it should be noted that although the TDI price increase has become a fact, the global macroeconomic recovery is slow, and the fundamentals of downstream industries such as furniture and automobiles have not fundamentally improved. Therefore, once the force majeure on the supply side is lifted and major production facilities resume normal operations, TDI prices may face significant downward pressure.

Editor: Lily

Source: Public reports from SunSirs, Western Chemical, Guanyan World, Jiufang Zhitou, Maihua Plastic Research Institute, 21st Century Business Herald, etc.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track