Automobile Industry Profit Margins Still Not Rising

Since 2025, the "Two New" policies have continued to release their effects, injecting strong momentum into the development of the Chinese automotive industry. Against this backdrop, the industry has shown a steady expansion in production scale.New EnergyThe penetration rate continues to rise, further solidifying its position in the global automotive industry landscape. However, in stark contrast to the impressive growth in industry scale, profit margins remain relatively low. Increasing cost pressures, coupled with intensified market competition, present dual challenges that continue to weigh on the profitability of car companies.

Significant structural differentiation, continued trend of scale expansion

According to the latest data shared by Cui Dongshu, Secretary General of the China Passenger Car Association, the Chinese automotive industry continued its expansion trend in the first nine months of 2025, demonstrating its production resilience. The data shows that from January to September, a total of 24.05 million vehicles were produced nationwide, marking an 11% year-on-year growth. This growth rate not only surpasses the 5% year-on-year increase for the entire year of 2024 but also significantly outperforms most industries in the industrial sector during the same period.

Image Source: Chery Automobile

From the perspective of subdividing energy types,New Energy VehiclesBy 2025, it has become the absolute core driving industry growth. From January to September 2025, the production of new energy vehicles reached 10.96 million units, marking a significant year-on-year increase of 30%, with a penetration rate rising to 46%. In September alone, the production of new energy vehicles was 1.58 million units, representing a year-on-year growth of 20%, with the penetration rate reaching 49%.

Looking back at data from the past four years, new energy.Car productionFrom 7.22 million units in 2022 to 10.96 million units by September 2025, the penetration rate doubled from 26% to 46%, achieving the leap from "niche" to "mainstream" in just over three years, becoming a "Chinese model" for the development of the global new energy vehicle industry.

In contrast, the fuel vehicle market shows a differentiated characteristic of "phased recovery and long-term pressure." From January to September 2025, 13.09 million fuel vehicles were produced, a slight decrease of 1% year-on-year. Compared to the 11% decline for the entire year of 2024, signs of marginal improvement have already appeared.

This positive change is closely related to the policy direction of the central and local governments to "stabilize fuel vehicle consumption." The various subsidies for scrapping and upgrading, as well as tax incentives for purchasing fuel vehicles, have effectively met consumers' replacement needs and revitalized the fuel vehicle market. For example, in September, the production of fuel vehicles increased by 8% year-on-year, becoming an important supplementary force for short-term growth in the industry and alleviating the impact of the rapid expansion of new energy vehicles on the fuel vehicle market to some extent.

However, from a long-term perspective, the shrinking of the fuel vehicle market remains an industry inevitability. According to data shared by Cui Dongshu, from 2022 to 2024, fuel vehicle production decreased from 20.26 million units to 18.39 million units, with a cumulative decline of over 9% in three years. Even if there is a short-term recovery in 2025, its market share has already been significantly squeezed by new energy vehicles.

Profit levels remain persistently low, with multiple factors restricting profit growth.

In stark contrast to the scale expansion, the profit performance of the automotive industry from January to September 2025 remains "unsatisfactory," with profit levels consistently staying in a low range.

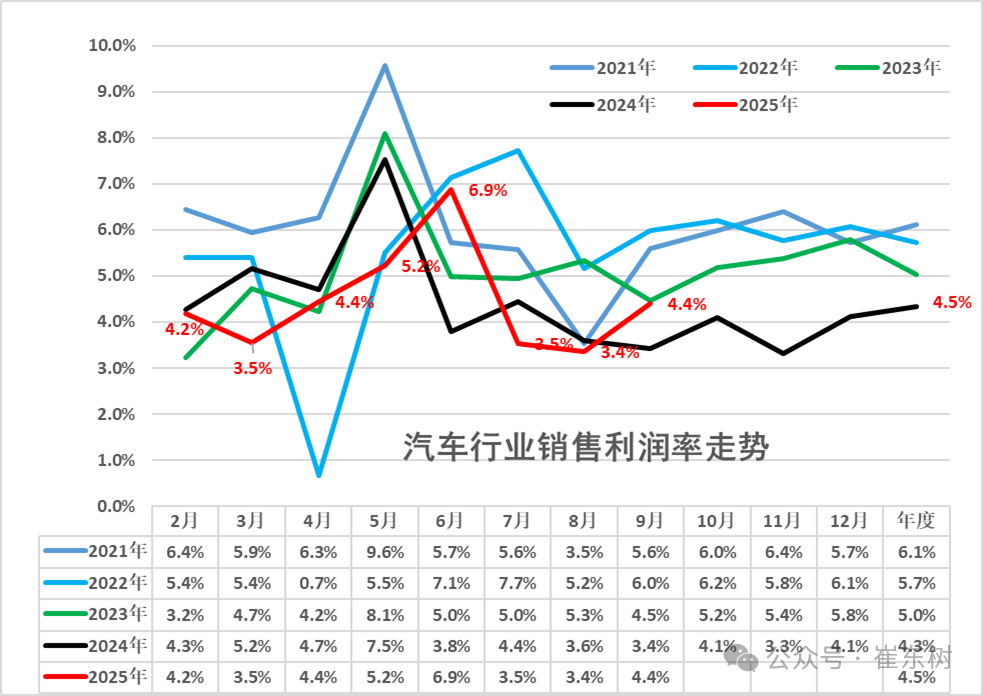

From January to September 2025, data shows that the automotive industry achieved an operating income of 7,823.5 billion yuan, a year-on-year increase of 7.8%, and a profit of 348.3 billion yuan, a year-on-year increase of 3.4%. In terms of profit margin, the automotive industry's profit margin was only 4.5%, which is not only below the average level of 6% for downstream industrial enterprises but also slightly higher than the historical low of 4.3% in 2024. It remains at the "second lowest level" in the industry's development, and there is an urgent need to improve profitability quality.

Image source: WeChat official account "Cui Dongshu"

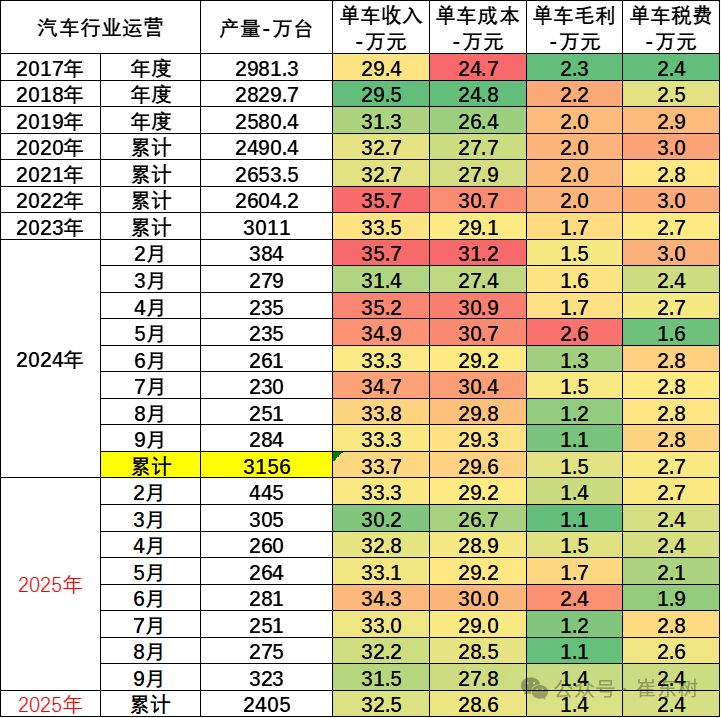

Cui Dongshu pointed out that since the production and sales in the automotive industry are basically balanced with a small gap, the National Bureau of Statistics' production data can be used to estimate the economic indicators per vehicle. From January to September 2025, the unit cost of overall industrial enterprises remained stable. The prices of bulk commodities were running at low levels, reducing the raw material cost pressure on midstream and downstream industries. From January to September, the total per-vehicle revenue of the automotive industry chain was 325,000 yuan (including repeated calculations within the industry chain), and the per-vehicle gross profit of the industry chain was 14,000 yuan.

According to a longitudinal analysis of profit data, the per-vehicle profitability in the automotive industry has shown a continuous downward trend: in 2017, the gross profit per vehicle reached 23,000 yuan, declining to 22,000 yuan in 2018, remaining stable at 20,000 yuan from 2019 to 2022, and dropping to 17,000 yuan in 2023. It is projected to fall to 15,000 yuan in 2024 and further decrease to 14,000 yuan in the first nine months of 2025. From 2017 to 2025, the gross profit per vehicle has gradually decreased from 23,000 yuan to 14,000 yuan, and the ongoing contraction of profit margins has become a core challenge that the industry urgently needs to address amidst the appearance of scale expansion.

Image source: WeChat public account "Cui Dongshu"

The core issue of profit pressure lies in the fact that the growth rate of costs exceeds the growth rate of revenue, with pressure from the cost side continuously "eroding" corporate profits. From January to September 2025, the costs in the automotive industry reached 6,886.7 billion yuan, an increase of 8.6% year-on-year, which is 0.8 percentage points higher than the revenue growth rate. The rapid growth of costs has directly led to the profit growth rate lagging behind the revenue growth rate by 4.4 percentage points, significantly weakening the profitability of enterprises.

Even in the month of September, this issue was not significantly alleviated. Revenue in the automotive industry grew by 9.8% year-on-year in September, while costs increased by 11.3% year-on-year, with the cost growth rate still 1.5 percentage points higher than the revenue growth. Although the profit growth rate reached 38% year-on-year in September, seemingly achieving substantial growth, this high growth rate was largely due to the "low base" effect of the 3.4% profit margin in September 2024, rather than a result of a substantial improvement in the company's profitability. In terms of actual profit margin, it was only 4.4% in September, without achieving a meaningful breakthrough, and the profitability dilemma has not been effectively resolved.

In addition to high costs, the "involution" of market competition and the imbalance in profit distribution within the industrial chain have also intensified the profit pressure on car manufacturers.

On the one hand, the price war in the new energy vehicle market has continued from 2023 to the present. Although the price advantage of new energy vehicles has become increasingly evident under the support of policies, effectively promoting market sales growth, it has also led to a continuous decline in car manufacturers' per-vehicle profits. In order to capture market share in the fierce competition, many car manufacturers have had to attract consumers through price reductions and promotions, further squeezing their profit margins.

On the other hand, fluctuations in upstream raw material prices have a significant impact on profit distribution within the industry chain. According to Cui Dongshu's analysis, although the cost of upstream lithium carbonate has decreased, the issue of car companies not producing batteries independently is quite serious, with some profits being occupied by upstream battery companies. The risk of sustained decline in car companies' profits still exists.

Policy efforts break the deadlock, and the industry hopes to achieve "stability with improvement."

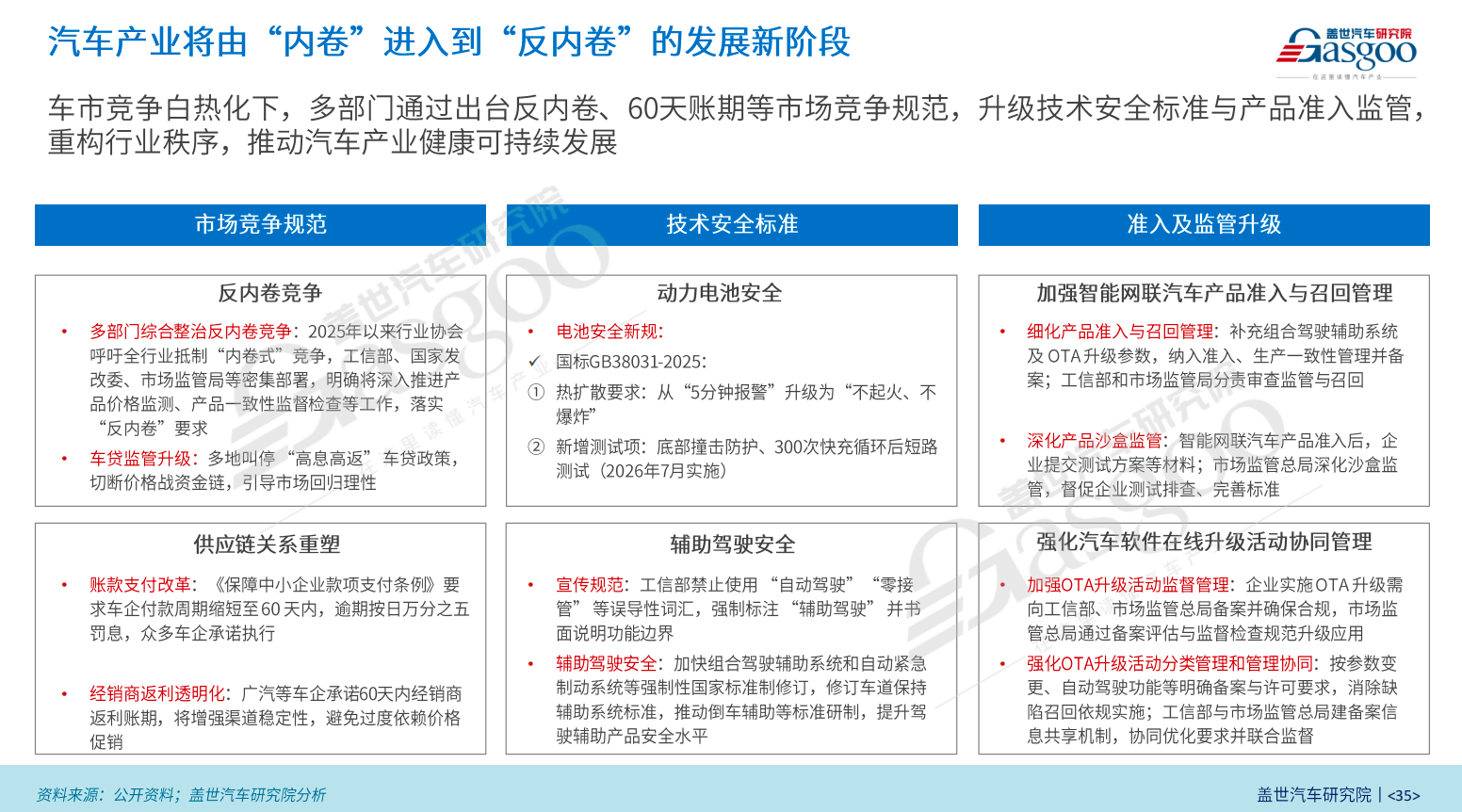

Faced with the dilemma of imbalance between industry scale and profit, policy measures have actively taken action, focusing on two key dimensions: "anti-involution" and "promoting consumption," providing strong support for improving industry profitability and driving the industry towards stable and positive development.

Since the beginning of this year, at the national level, promoting the regulation of competitive order in the automotive industry has been clearly defined as an important task in terms of "anti-involution." It is determined to avoid chaotic price wars and maintain a fair and orderly market competition environment.

On May 31, the Ministry of Industry and Information Technology and the China Association of Automobile Manufacturers held industry symposiums, clearly stating that the chaotic "price war" among car manufacturers is a typical manifestation of "involution" competition. This not only harms the profitability of the companies themselves but also affects the industry's long-term investment in research and development and quality improvement.

On June 3, the China Automobile Dealers Association released an initiative titled "On Improving the Survival Status of Automobile Dealers," directly addressing the impact of "price wars" on dealers. By 2024, the average gross profit margin for automobile dealers nationwide is expected to be less than 3%, a decline of 4 percentage points compared to 2021, with approximately 15% of dealers facing bankruptcy due to losses. The initiative explicitly calls for a "resolute resistance to inward competition primarily in the form of 'price wars'" and suggests that car manufacturers "reasonably set sales targets based on market demand, reducing inventory pressure assessments on dealers." It also promotes a "shared benefits mechanism between manufacturers and dealers," allowing dealers to participate in the profit distribution of automobile companies.

On June 5, He Yongqian, spokesperson for the Ministry of Commerce, stated at a regular press conference that in response to the current "involutionary" competition phenomenon in the automotive industry, they will actively cooperate with relevant departments to strengthen comprehensive rectification and compliance guidance, maintain a fair competitive market order, and promote healthy industry development.

According to Cui Dongshu, as the country's efforts to combat involution continue to advance, the positive effects on improving the profits of the upstream steel industry have already become apparent.

In the future, if the "anti-involution" policies can further extend to the complete vehicle market and more specific regulatory measures are introduced to address issues such as chaotic pricing and malicious competition in the new energy vehicle market, it is expected to further alleviate the profit pressure on car manufacturers. This will promote a shift in industry competition from "price competition" to "value competition," achieving healthy and sustainable development in the industry.

In terms of "promoting consumption," policies such as the "two new" policies have become important tools for driving demand. From January to September 2025, the car replacement and renewal subsidy policy directly led to an 11% year-on-year increase in automobile production, effectively unleashing consumption potential.

Certainly noteworthy is that by the second half of 2025, policies related to the "two new" sectors have shown signs of tightening adjustments. Specifically, from late September to late October, automotive subsidy policies in various regions of the country entered a critical period of "adjustment and suspension." According to incomplete statistics from Gasgoo, as of October 23, Qingdao, Jilin, and Shanghai have successively optimized and adjusted local car replacement or scrappage subsidy rules in October. Meanwhile, several provinces and cities, including Hefei in Anhui, Yunnan, Wenzhou in Zhejiang, Hainan, Shanxi, and Hangzhou, have announced the suspension of car replacement or scrappage subsidies. They have also specified the application deadlines and document submission requirements for eligible consumers during the transition period.

In addition, to cope with the increase in consumer costs due to the halving of the purchase tax in 2026, many car manufacturers have introduced "purchase tax difference subsidies." These subsidies compensate consumers for the tax fee difference between the old and new policies for cars ordered before the end of the year, with the maximum subsidy reaching 15,000 yuan. While this short-term incentive can stimulate order growth, it directly compresses the already thin profit margins of car manufacturers, putting significant pressure on small and medium-sized enterprises with lower net profit margins.

From a long-term development perspective, the automotive industry's fundamental trend of "steady improvement" remains solidly supported. On one hand, as the penetration rate surpasses 50%, competition in the new energy vehicle industry will gradually shift from the current "price war" to a "technology war." Automakers with core technological advantages (such as advanced battery technology, intelligent driving technology, and vehicle networking technology) will stand out in the competition, leading industry technological innovation and product upgrades, and driving the overall profitability of the industry to improve.

Many industry insiders believe that to solve the profitability dilemma in the automotive industry, it is not enough to rely solely on "anti-involution" policies to alleviate short-term price competition; promoting "equal rights for oil and electricity" and establishing a fair market competition environment are the key factors.

Oil-electric parity refers to granting equal treatment to fuel vehicles and new energy vehicles in terms of market access, tax policies, purchase incentives, and usage environment. This aims to eliminate one-sided policy biases and allow consumers to independently choose which type of car to purchase from a truly competitive market perspective.

Cui Dongshu has emphasized multiple times the importance of promoting "equal rights for fuel and electric vehicles." "Due to the slim profits of fuel vehicles in the early stages, but the market is shrinking too quickly, some companies are suffering significant losses; while new energy vehicles are experiencing high growth, they are also facing substantial losses, creating a significant pressure from the contradiction between high profits from batteries and losses from complete vehicles. Therefore, it is essential to actively stabilize fuel vehicle consumption and implement stronger measures for scrapping and updating."

This time, he reiterated his expectation that equal rights for oil and electric vehicles would promote the strengthening of both, and that the overall situation in the automobile industry would surely continue to improve steadily in the future.

Conclusion:

The data from the automotive industry for January to September 2025 not only fully demonstrates the "scale advantage" of China's automotive industry in the global market, highlighting its strong capabilities, but also clearly exposes its shortcomings in "profit quality," reflecting the imbalances existing in the industry's development.

For car companies, the future requires accelerating the transformation of development concepts from "scale expansion" to "quality improvement." This can be achieved by increasing investment in technology research and development, optimizing product structure, and enhancing product value-added to reduce production costs and improve profitability. On the policy front, it is necessary to further refine the "anti-involution" mechanism, strengthen market supervision, and regulate market competition order. Additionally, the continuous optimization of "consumption promotion" policies is needed, especially the deepening of the implementation effects of the "equal rights for oil and electricity" policy to promote the reasonable distribution of profits along the industry chain.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track