Automakers' 3 Million/5 Million Annual Sales Targets Pile Up, Consumers Are Not Enough

Recently, it is the time for major automotive companies to make their next five-year plans, and many companies have announced their goal of achieving an annual sales volume of 5 million vehicles by 2030.

On July 31, FAW Group set a phased goal to achieve annual sales of 5 million vehicles within five years. Just the day before, Changan, which was recently upgraded to a central enterprise, also announced its aim to achieve a production and sales scale of 5 million vehicles by 2030.

Earlier this year, in early January, Geely Holding Group announced its goal to reach annual sales of 5 million vehicles by 2027. BYD, which set the 5 million target even earlier than Geely, plans to achieve this goal by 2025.

For an automotive company or group to reach 5 million vehicles, what does that mean? It is equivalent to entering the top five global automotive groups. If these four automakers all announce plans to reach 5 million vehicles, a combined scale of 20 million units would almost consume more than half of the domestic market share. In the context of a global annual automobile sales volume of over 90 million vehicles, this would also account for nearly one-quarter of the total market.

The ambitious goals of our Chinese car companies are truly admirable.

If 5 million vehicles still seem far from the present, then the target of 3 million vehicles is one that many automakers have set to achieve this year. According to statistics, currently four automakers—Changan, Geely, Chery, and Dongfeng Group—have explicitly stated that they aim to reach the sales target of 3 million vehicles this year.

According to the same calculation method, BYD's 5.5 million, SAIC Motor's 4.5 million, FAW Group's 3.45 million, plus the aforementioned four automakers each with a scale of 3 million, these few companies or groups will directly contribute to a sales volume of 25 million vehicles.

At this point, outsiders can't help but ask: With such an ambitious target, does the market really need so many cars? With such intense competition, there may not even be enough consumers.

As the saying goes, "A soldier who doesn’t want to become a general is not a good soldier." Every car brand aspires to take the top spot in China’s automotive market, but the reality is harsh—automakers are inevitably divided into different tiers. So, which ones are actually more reliable?

From "Collective Wish-Making" to "Collective Breaking of Promises"

When it comes to sales targets, no car company can avoid this hurdle. As a business entity, setting targets is also a consensus in the industry. It embodies the ambition of a leader and guides the entire system to work together towards a common direction.

In the automotive industry, most car companies may appear somewhat inflated or even "irrationally optimistic" when setting their targets, making them seem less realistic to outsiders.

This issue is not only present among domestic car companies, but it is also prevalent among major global automotive giants.

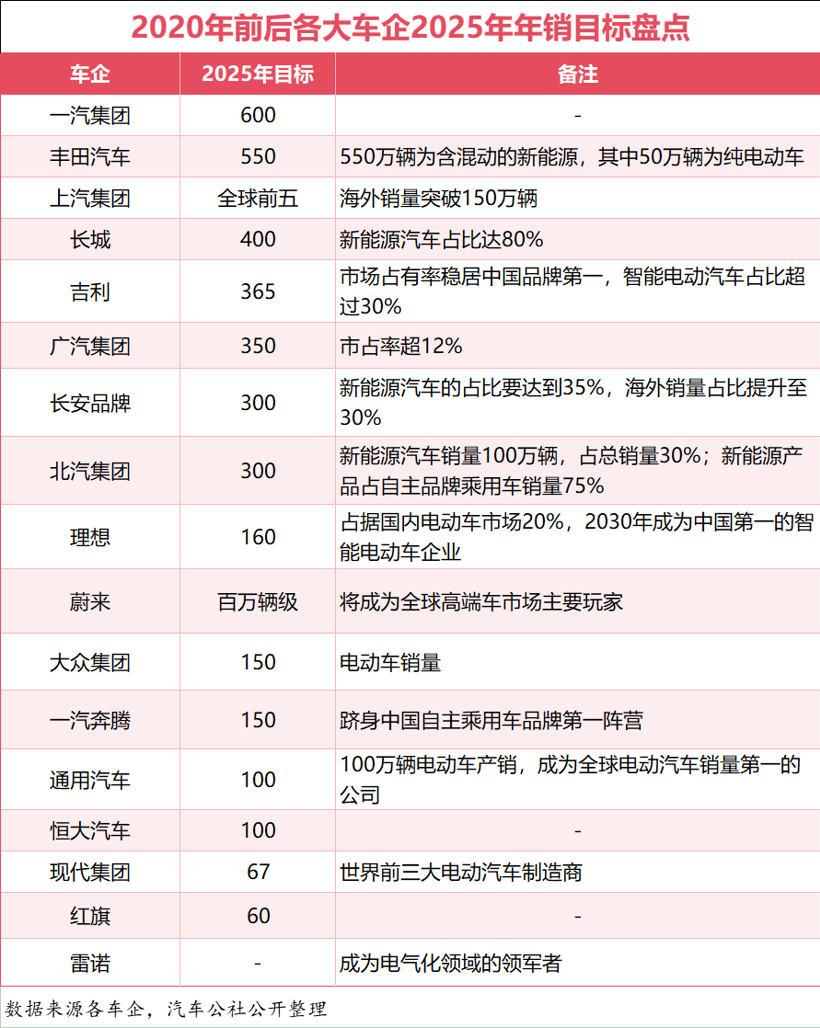

Looking back at the past five years, around 2020-2021, major automakers set their goals and plans for 2025. Now that we are halfway through 2025, the results are already quite clear: almost all automakers have “miscalculated” when it comes to their sales targets.

First, let's look at Toyota, the world's number one. It has set a global electric vehicle sales target of 5.5 million units by 2025, with the majority of this plan achieved through hybrid vehicles. Regarding pure electric vehicles, Toyota plans to sell 500,000 units annually. As a result, in the first half of this year, Toyota's global sales reached 5.5448 million units, with hybrid vehicles accounting for 43% of sales, while pure electric vehicle sales were only 82,000 units.

Five years ago, Volkswagen announced its Vision 2025, aiming to produce 1.5 million electric vehicles this year and become the leader in the global electric vehicle market. However, the current outcome shows that Volkswagen's pure electric vehicle sales in the first half of this year were 465,000 units, essentially declaring the plan for 1.5 million units for the entire year unattainable.

Looking at General Motors, it planned to sell 1 million electric vehicles globally by 2025 and aimed to become the world's top electric vehicle seller. Renault, on the other hand, did not announce specific sales figures, only stating its goal to become a leader in electrification by 2025. Judging from the current results, both companies’ aspirations have already fallen short.

Back in the domestic market, the situation of "high targets, low completion rates" among car companies remains very severe.

For example, during this Five-Year Plan, FAW Group proposed to achieve a group sales volume of 6 million vehicles by 2025, including 1.5 million units for FAW Bestune, aiming to enter the top tier of China's independent passenger car brands, and a target of 600,000 annual sales for the Hongqi brand. However, the actual result is that FAW Group's target for this year has been adjusted to 3.45 million vehicles, and even the revised 2030 target is 1 million vehicles less than that of the previous Five-Year Plan.

SAIC Motor Corporation has set a goal to enter the top five global car manufacturers by 2025, aiming for a business scale of one trillion yuan and overseas sales exceeding 1.5 million units. In the first half of this year, SAIC Motor's sales reached 2.05 million units, with overseas sales of 494,000 units. At that time, GAC Group proposed a target to achieve annual sales of 3.5 million units by 2025, with a market share exceeding 12%. However, at the beginning of this year, the group revised this target to 2.3 million units, with only 32.8% of the half-year target being achieved.

Geely Automobile previously set an annual sales target of 3.65 million vehicles, aiming to maintain its position as the number one Chinese brand in market share. At the beginning of this year, Geely revised this target down to 2.71 million vehicles, and in July, it was adjusted again to 3 million vehicles. Its status as the leading Chinese brand has been challenged under the pressure from BYD.

Changan previously set a target of 3 million annual sales by 2025, with new energy vehicles accounting for 35%, but this referred to the Changan brand rather than the entire Changan Automobile Group. This year, the 3 million target has become a collective goal for the entire group, with the new energy vehicle proportion reaching 33.3% in the first half of the year, appearing to be a quite pragmatic car manufacturer.

Great Wall Motors previously stated that its sales target for 2025 was 4 million vehicles, with new energy vehicles accounting for 80% of the total. However, in 2024, Great Wall revised its sales target to 1.9 million vehicles, but ultimately only achieved sales of 1.23 million vehicles, reaching just 65% of the target. In the first half of this year, Great Wall Motors sold 570,000 vehicles, with new energy vehicles making up 160,000 units, accounting for 28% of total sales.

For new forces, Li Auto previously proposed to capture a 20% share of the domestic electric vehicle market by 2025 and to become China’s number one smart electric vehicle company by 2030. According to the earlier forecast, Li Auto needed to achieve sales of 1.6 million vehicles in 2025 to reach this goal.

This year, Li Auto adjusted its target to 700,000 vehicles and subsequently lowered it to 640,000. However, considering the current sales performance and market competition pressure, achieving this lowered target will not be easy.

NIO stated that it aims to become a major player in the global high-end car market by 2025, aiming for a tripartite division of the market. Its annual sales target is also expected to be in the million-vehicle range.

Furthermore, Evergrande once announced in 2021 its goal to achieve "production and sales of one million vehicles by 2025." However, with Evergrande Auto now already bankrupt, it has long become a laughingstock in the industry.

Why is there such a significant gap between the annual sales targets set five years ago and the current reality? The author believes that the core reason may be closely related to car manufacturers’ misjudgment of the market, especially regarding the pace of new energy and intelligent vehicle development. Pure electric vehicles have been extending toward both ends of the market, particularly the ultra-low-end segment, while the transitional period for hybrid vehicles has turned out to be much longer than expected. Furthermore, experiences brought by technologies like range extenders have proven to be more valuable than the technical merits themselves. Factors such as the economic cycle have also caused the overall trend and structure of the automotive market to evolve differently than anticipated.

02From "digital competition" to "practical capabilities"

The seemingly almost unattainable target sales—why do major car manufacturers still lower themselves to publicly announce them? Perhaps deep down, they are fully aware of whether these goals can be achieved, but due to certain pressures and helplessness, they have no choice but to declare them.

First, it is about "drawing a pie" for the capital market. The automotive industry is capital- and technology-intensive, with large investments and long cycles. Under limited resources and funds, the more ambitious a company's goals are, the more confidence it can attract from capital. For many car companies in need of financing, "high targets" serve as a door opener to attract capital. Especially for some new players like Li Auto, at the time of setting this sales target, annual sales were just over 30,000 units, yet they proclaimed a sales target of one million vehicles by 2025.

Secondly, it is about "applying pressure" to the team. In many car companies, targets are tools for "top-down task imposition." For example, when a car company sets a target of 3 million units, they often do not truly expect to achieve it; instead, they want each department to "stretch to reach the fruit." Even if they ultimately only complete 1.5 million, it is still better than setting a target of 1 million and only achieving 800,000.

Thirdly, one must not lose momentum, especially when competing against peers of the same level. The "height of the goal" is often interpreted as "strength and weakness," which reflects not only the ambition of the automakers but also the confidence and support of dealers and suppliers.

Sales volume is an important indicator for measuring the development level of an enterprise. People within the industry seem to understand that companies setting high targets may be thinking "to follow the best and achieve something in between," intending to inspire fighting spirit and tap into potential, which is understandable. However, the problem arises when high-profile goals are set year after year but consistently missed, sometimes by a wide margin. This can actually have a negative impact on morale, making it better not to set such flags at all. If a car manufacturer fails to meet its sales targets every year and only occasionally announces standout achievements to the market every few years, the company's credibility will also be affected.

However, given the current competitive environment in the automotive market, setting a short-term or even medium- to long-term sales target is no longer something that can be declared casually. In particular, for those car companies aiming for annual sales of three million units by 2025, real strength and market performance are required more than ever. This also places higher and more pragmatic demands on the leaders of these companies.

After all, pushing a giant car company to the height of 3 million vehicles is certainly not a matter of luck. It is the result of a series of systematic capabilities such as the speed of technological iteration, supply chain, economies of scale, talent, research and development, and cost control. Moreover, if there are no revolutionary changes in the broader environment and market, these capabilities will continue to drive a car company upward.

In terms of capability and influence, within the context of China's 30 million vehicle market, a volume of 3 million means a market share of over 10%, making it an absolute mainstream brand with a strong dominance in a single market. It will also serve as a trendsetter for products, technology, and the competitive landscape of the industry.

From the perspective of business operations, an automaker with an annual production of 3 million vehicles must possess a stable production capacity system, which typically requires the coordinated operation of more than 10 manufacturing bases. Its supporting supply chain needs to cover a very wide range of parts suppliers, and it also needs a rich portfolio of product brands and lineups to cover different market segments and consumer groups.

What is even more noteworthy is that behind the 3 million vehicles, a large-scale technological and product iteration is required to ensure a continuous influx of new and upgrading users. This includes maintaining the talent system behind it as well as the capability for sustainable development, which poses a significant challenge for the enterprise.

From Geely’s “Taizhou Declaration,” which marked the beginning of a wave of strategic integration, to Chery’s internal restructuring of its major business units, and then to Changan’s complete upgrade and new outlook, behind the annual sales target of three million vehicles set by these automakers this year lies a fundamental logic of improving quality and efficiency, and scaling up to reduce costs. These factors have become the core support for companies striving to achieve annual sales of three million vehicles, transforming their focus from merely “surviving” to “leading the industry.”

Faced with round after round of price wars in the automotive market, vehicle manufacturers are continuously squeezing the living space of upstream and downstream suppliers and dealers. The industry's calls for "anti-involution" are growing louder. As for the sales targets of car companies, it can be said that with the industry's competition becoming more transparent, the allure of target PK will gradually diminish. For those car companies without a competitive advantage in the market and without significant products in core niche areas, setting high sales targets will be to no avail.

As the "unfinished checklist" for car companies in 2025, this list constantly reminds automakers that the competition in the car market is not about "who sets the highest targets," but about "who can achieve their targets." Unrealistic goals will only become a joke. Sales targets should serve as "directional signposts," and...

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track