Automakers' 3 million/5 million annual sales targets are crowding, not enough consumers

A truly healthy goal setting should be "within reach on tiptoe," rather than "beyond reach even when jumping."

Recently, it has been the time for major car companies to make their next five-year plans, and many companies have announced their goal to achieve an annual sales volume of 5 million vehicles by 2030.

On July 31, FAW Group set a phased goal to achieve annual sales of 5 million vehicles within 5 years. Just the day before, Changan, which has recently been upgraded to a central state-owned enterprise, also announced its goal to achieve a production and sales scale of 5 million vehicles by 2030.

At the beginning of this year, Geely Holding Group announced that it aims to reach the milestone of selling 5 million vehicles annually by 2027. BYD, which announced the target of 5 million vehicles even earlier than Geely, plans to achieve this goal by 2025.

For an automotive company or group to achieve 5 million vehicles, it means entering the top five global automotive groups. If these four car companies all announce plans to reach 5 million vehicles, then the combined scale of 20 million vehicles would almost take up more than half of the domestic market share. In the global context of an annual sales scale of over 90 million vehicles, it would account for nearly a quarter of the market.

The ambitious goals of our Chinese car companies are truly admirable.

If 5 million vehicles still seem far off at present, then the goal of 3 million vehicles is one that many car companies have proposed to achieve this year. According to statistics, four car companies, namely Changan, Geely, Chery, and Dongfeng Group, have clearly stated that they aim to reach a sales target of 3 million vehicles this year.

Using the same calculation method, BYD’s 5.5 million, SAIC Group’s 4.5 million, FAW Group’s 3.45 million, plus an additional 3 million for each of the above four automakers, just these few companies or groups alone will directly contribute to sales of 25 million vehicles.

At this point, the outside world can't help but ask: With such an enormous goal, does the market really need so many cars? The competition is so fierce that it seems there might not even be enough consumers.

As the saying goes, "A soldier who doesn't want to become a general is not a good soldier." Every car brand aspires to become the top player in China's automotive market, but reality is harsh—car companies are inevitably ranked into different tiers. So, which ones are actually more reliable?

From "collective wish-making" to "collective breach of promise"

When it comes to sales targets, every car company has to face this hurdle. As a business entity, setting targets is also an industry consensus; it reflects the ambition of the person at the helm and guides the entire organization to work together toward a common direction.

In the automotive industry, most car companies may appear somewhat inflated or even "irrationally optimistic" when setting their goals, making them seem less realistic to outsiders.

This issue exists not only among domestic car manufacturers but also among global automotive giants.

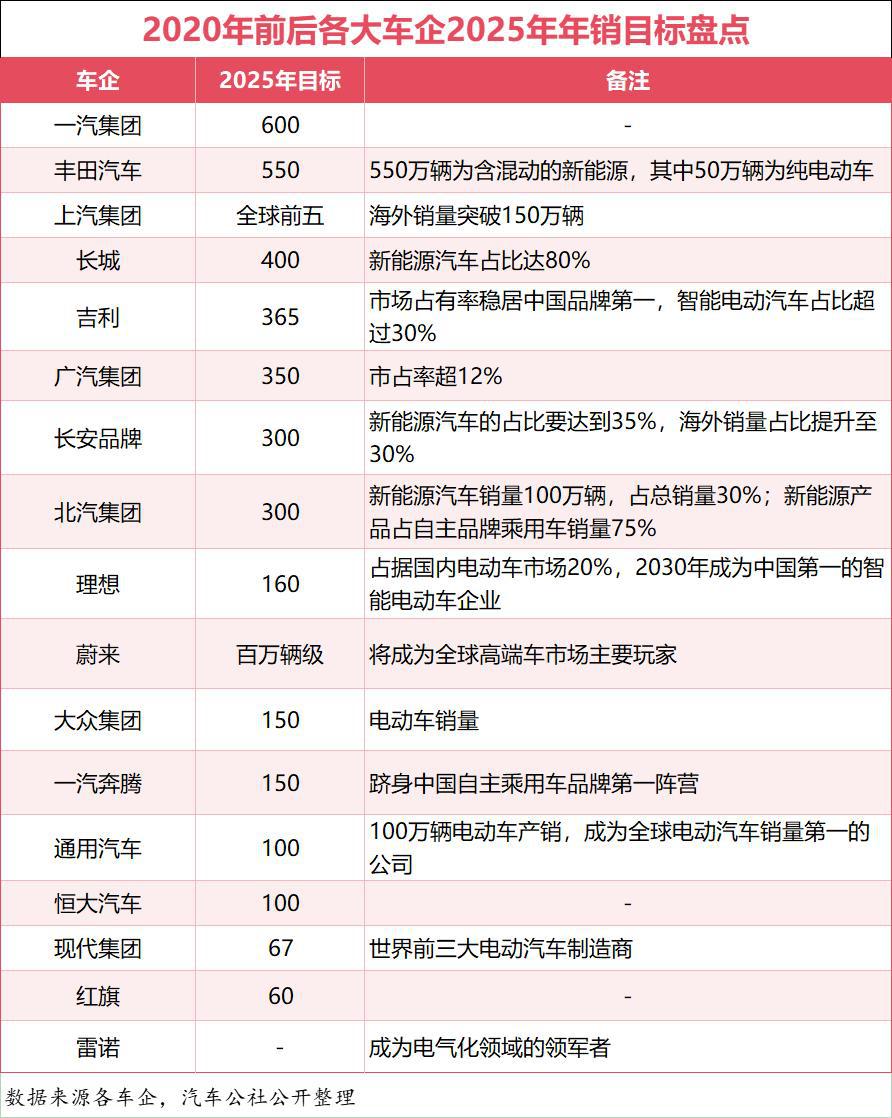

Looking back over the past five years, around 2020–2021, major automakers set their goals and plans for 2025. Now that we are halfway through 2025, the results are already quite clear: almost all automakers have "miscalculated" when it comes to their sales targets.

First, let's look at Toyota, the world's number one, which has set a global electric vehicle sales target of 5.5 million units by 2025, mostly achieved through hybrid vehicles. In terms of pure electric vehicles, Toyota plans to sell 500,000 units annually. As a result, in the first half of this year, Toyota's global sales reached 5.5448 million units, with hybrid vehicle sales accounting for 43%, while pure electric vehicle sales were only 82,000 units.

Five years ago, Volkswagen announced its 2025 plan, aiming to produce 1.5 million electric vehicles this year and become a leader in the global electric vehicle market. However, the current outcome shows that Volkswagen's pure electric vehicle sales for the first half of this year were 465,000 units, effectively declaring the failure of the plan to reach 1.5 million units for the entire year.

Looking at General Motors, it plans to sell 1 million electric vehicles globally in 2025 and aims to become the world's top-selling electric vehicle company. Renault, on the other hand, has not announced specific sales figures, only stating its goal to become a leader in electrification by 2025. Judging from the current results, the aspirations of both companies have already fallen short.

Back in the domestic market, the situation of "high targets, low completion rates" among car companies remains very severe.

For example, during the current five-year plan, FAW Group proposed to achieve a group sales volume of 6 million vehicles by 2025, with FAW Bestune reaching 1.5 million vehicles, entering the first tier of Chinese independent passenger car brands, and the Hongqi brand achieving an annual sales target of 600,000 vehicles. However, the actual result is that this year's target for FAW Group has become 3.45 million vehicles, and even the revised target for 2030 is 1 million less than the previous five-year plan.

SAIC Motor Corporation has set a goal to rank among the top five global automakers by 2025, with an operational scale reaching the trillion-yuan level and overseas sales surpassing 1.5 million units. In the first half of this year, SAIC Motor's sales reached 2.05 million units, with overseas sales accounting for 494,000 units. GAC Group had initially set a target to achieve annual sales of 3.5 million units by 2025, with a market share exceeding 12%. However, at the beginning of this year, the group revised this target to 2.3 million units, and the completion rate for their half-year target was only 32.8%.

Geely Auto had previously set an annual sales target of 3.65 million units, aiming to maintain the number one market share among Chinese brands. At the beginning of this year, Geely revised this target to 2.71 million units, and in July, it was adjusted again to 3 million units. Under the pressure from BYD, its position as the number one Chinese brand is no longer secure.

Changan had previously set a target of selling 3 million vehicles annually by 2025, with new energy vehicles accounting for 35% of this figure, but this was referring to the Changan brand rather than the entire Changan Automobile Group. This year, the 3 million vehicle target has become a shared goal for the entire group, with the proportion of new energy vehicles reaching 33.3% in the first half of the year, making it appear to be a fairly pragmatic car manufacturer.

Great Wall Motors previously mentioned that its sales plan for 2025 was 4 million vehicles, with new energy vehicles accounting for 80%. However, in 2024, Great Wall revised its sales target to 1.9 million vehicles and ultimately achieved only 1.23 million vehicles, with a completion rate of 65%. In the first half of this year, Great Wall Motors' sales reached 570,000 vehicles, with new energy vehicle sales at 160,000 units, accounting for 28%.

For emerging forces, Li Auto previously stated its goal to capture a 20% share of the domestic electric vehicle market by 2025 and become China's leading smart electric vehicle company by 2030. According to predictions at the time, Li Auto would need to achieve sales of 1.6 million vehicles by 2025 to reach this target.

This year, Li Auto adjusted its target to 700,000 vehicles, and later gradually lowered it to 640,000 vehicles. However, judging from Li Auto’s current sales performance and the market competition pressure, it will not be easy to achieve even the lowered target.

NIO stated that by 2025, it aims to become a major player in the global high-end car market, with a tripartite division of the market, and an expected annual sales target in the millions.

In addition, there is Evergrande, which announced in 2021 its goal to achieve "production and sales of 1 million vehicles by 2025." However, Evergrande Auto, which has now gone bankrupt, has long become a laughingstock in the industry.

From the current perspective, why is there such a significant gap between the annual sales targets set five years ago and the reality? The author believes that the core reason may be significantly related to car companies' misjudgment of the market, particularly the speed of new energy and intelligence. Pure electric vehicles are extending to ultra-low-end from both ends, and the transitional nature of the hybrid market is far more long-term than imagined. Additionally, the experience brought by range extension technology is much better than the value of the technology itself. Factors such as economic cycles have also made the trends and patterns of the entire car market quite different.

From "digital competition" to "practical capability"

The seemingly unattainable sales targets are still publicly announced by major car companies—why is that? Perhaps the companies themselves are well aware of whether these goals can be achieved, but due to certain pressures and helplessness, they have no choice but to announce them.

Firstly, it is about "painting a picture" for the capital market. The automotive industry is a capital and technology-intensive sector, requiring significant investment and having long cycles. In a context where resources and funds are limited, companies with more ambitious goals tend to inspire greater confidence among investors. For many car companies in need of financing, setting "high targets" serves as a key to attracting capital. This is especially true for emerging players like Li Auto, which, at the time of setting this sales target, had annual sales barely exceeding 30,000 units, yet boldly announced a sales target of one million vehicles by 2025.

The second point is to "apply pressure" on the team. In many car companies, setting targets is a tool for "top-down pressure." For instance, when a car company sets a target of 3 million, it is often not because they truly believe it can be achieved; instead, they want each department to "reach for the fruit." Even if they end up achieving only 1.5 million, it is better than setting a target of 1 million and only achieving 800,000.

The third is not to lose momentum, especially when competing against peers of the same level. "High and low targets" are often interpreted as "strength and weakness." Behind this is not only the ambition of car manufacturers but also the confidence and support of dealers and suppliers.

Sales volume is an important indicator of a company's development level. People in the industry seem to understand companies that set high targets, possibly thinking "aim high and achieve somewhere in the middle," intending to inspire morale and tap potential, which is understandable. However, the problem lies in the fact that if high targets are set year after year and consistently unmet, sometimes by a wide margin, it could actually have a negative impact on morale. It might be better not to set such flags. If a car company's sales targets are never met annually and it makes grand announcements every few years, the company's credibility could be affected.

However, considering the current competitive environment of the automotive market, setting a short-term or medium-to-long-term sales target is no longer something that can be casually announced. Particularly for the few companies aiming for an annual sales target of 3 million vehicles by 2025, it requires these companies to possess genuine strength and market performance. This also places higher pragmatic demands on the leaders of these enterprises.

After all, elevating a giant car company to the scale of 3 million vehicles is certainly not due to luck. It is the result of a series of systemic capabilities such as the speed of technological iteration, supply chain, economies of scale, talent, research and development, and cost control. Moreover, these capabilities will continue to drive an automotive company forward as long as there are no revolutionary changes in the general environment and market.

In terms of capability and influence, within the context of China's market of 30 million vehicles, a volume of 3 million units would mean a market share of over 10%, making it an absolute mainstream brand with a strong dominance in a single market. It will also become a weather vane for product, technology, and industry competition landscape.

From the perspective of enterprise operations, a car company with an annual production capacity of 3 million vehicles must have a stable production capacity system, which usually requires the collaboration of more than 10 production bases. The supporting supply chain needs to cover a wide range of parts suppliers, and it also requires a rich portfolio of product brands and matrices to cover different market segments and demographics.

Moreover, behind the 3 million vehicles, large-scale technological and product iterations are needed to ensure the continuous influx of new and upgrading users. This includes maintaining the talent system and the ability for sustainable development, which poses a significant challenge for the company.

From Geely's "Taizhou Declaration" that opened the curtain on strategic integration, to Chery's internal adjustments of several major business units, and then to Changan's new atmosphere and appearance after its upgrade, the goal of 3 million vehicles for these car companies this year highlights the main logic of improving quality and efficiency and reducing costs on a large scale. These factors have become the core support for companies to strive for annual sales of 3 million vehicles, achieving a transformation from "survival" to "industry leadership."

In the face of successive rounds of price wars in the automotive market, vehicle manufacturers are continuously squeezing the survival space of upstream and downstream suppliers and dealers, leading to growing calls within the industry to "fight against excessive competition." Regarding automakers' sales targets, it can be said that as industry competition becomes increasingly transparent, the allure of sales target comparisons will gradually fade. For those automakers lacking competitive advantages in the market and lacking significant products in core niche areas, setting high sales targets will be to no avail.

Just like the "unfinished checklist" for car companies in 2025, this list constantly reminds automakers that the competition in the car market is not about "who sets the highest targets," but rather "who can achieve their goals." Targets that are detached from reality will only become a laughingstock. Sales targets should be "a roadmap guiding the direction," not "a slogan for marketing and boasting."

In the new wave of target-setting, if someone is still fixated on the numbers game of "3 million, 4 million," the "story of missed targets" in 2025 might just repeat itself. A truly healthy goal-setting should be "reachable by standing on tiptoes," rather than "unattainable even by jumping."

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track