Automakers' 2025 H1 Net Profit: More Than Half Decline, Only Four Reach 6 Billion Yuan

With NIO's Q2 earnings report arriving belatedly, the first-half 2025 results of major listed Chinese automakers have now all been disclosed.

As the penetration rate of new energy vehicles in the domestic passenger car market approaches 50%, the performance of new energy business has become a core factor affecting automakers’ results. Those who can take the lead in establishing a competitive advantage in this field will be able to demonstrate relatively stable growth in revenue and profit. In contrast, automakers with a high proportion of traditional business and slow progress in transformation will face sluggish growth or even declining profits.

They have also "made it out."

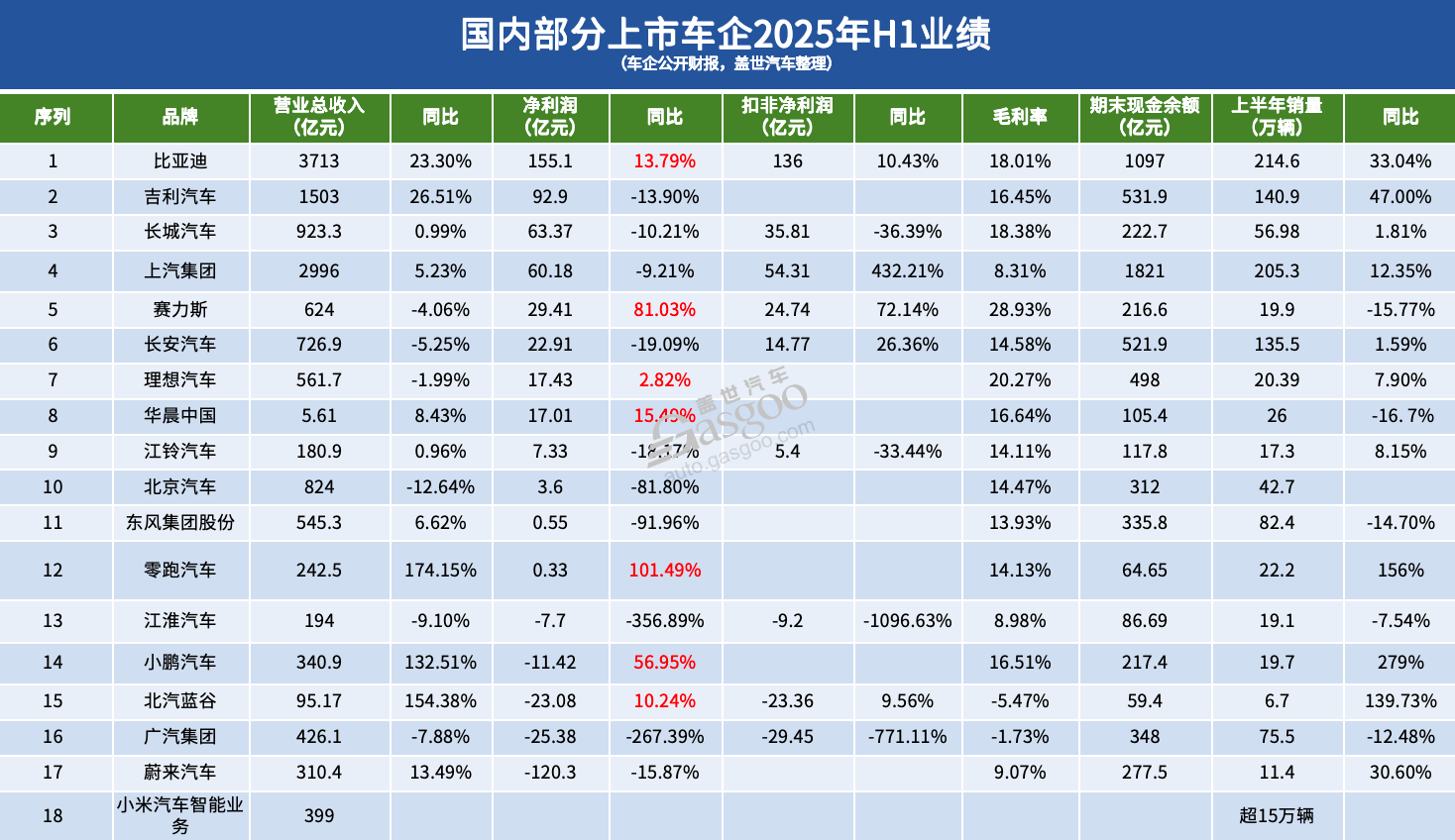

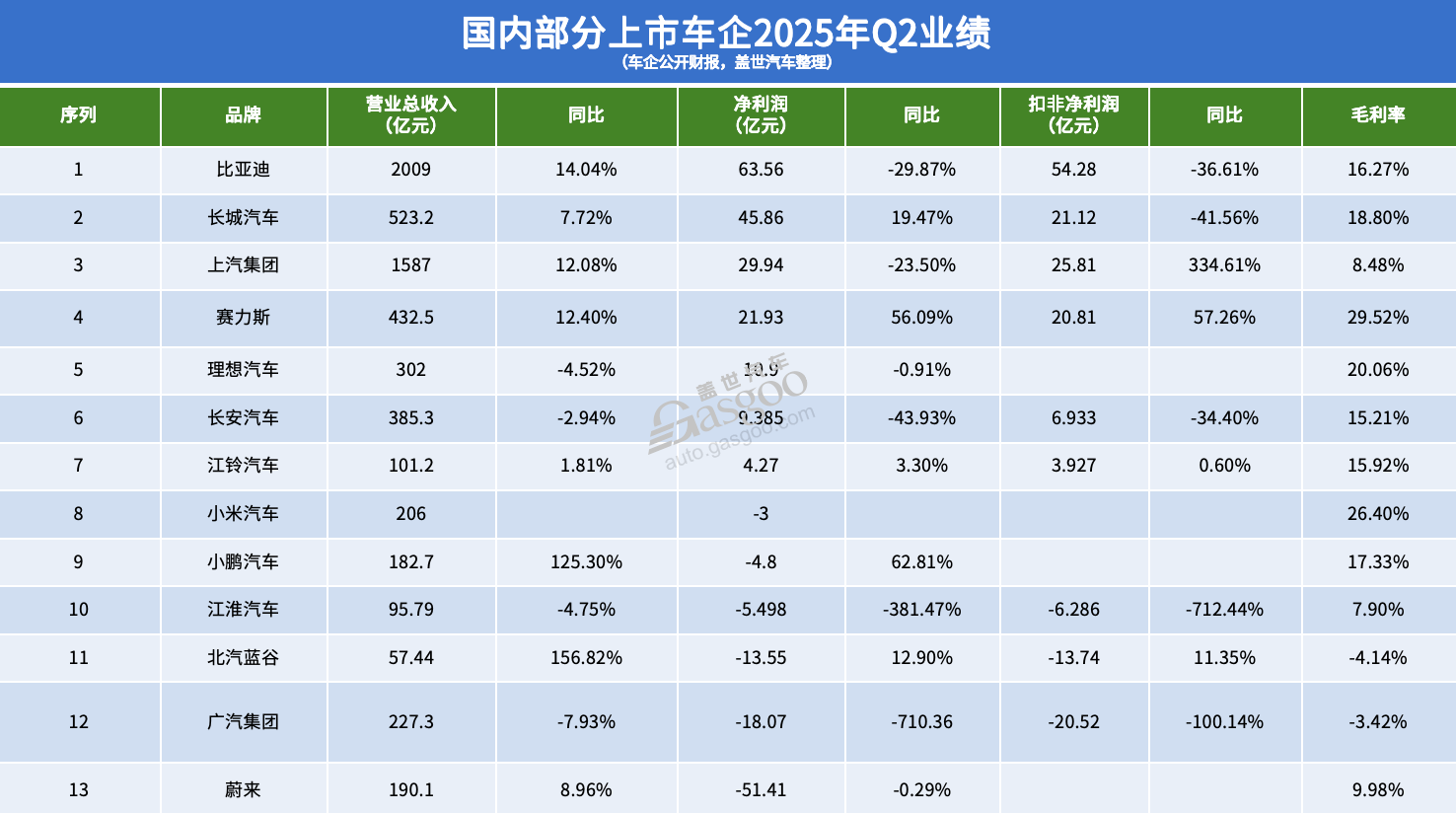

Gasgoo has compiled the financial report data of 17 listed automobile companies and conducted a comparative analysis of their performance based on the traditional automakers and emerging players in the new energy vehicle market.

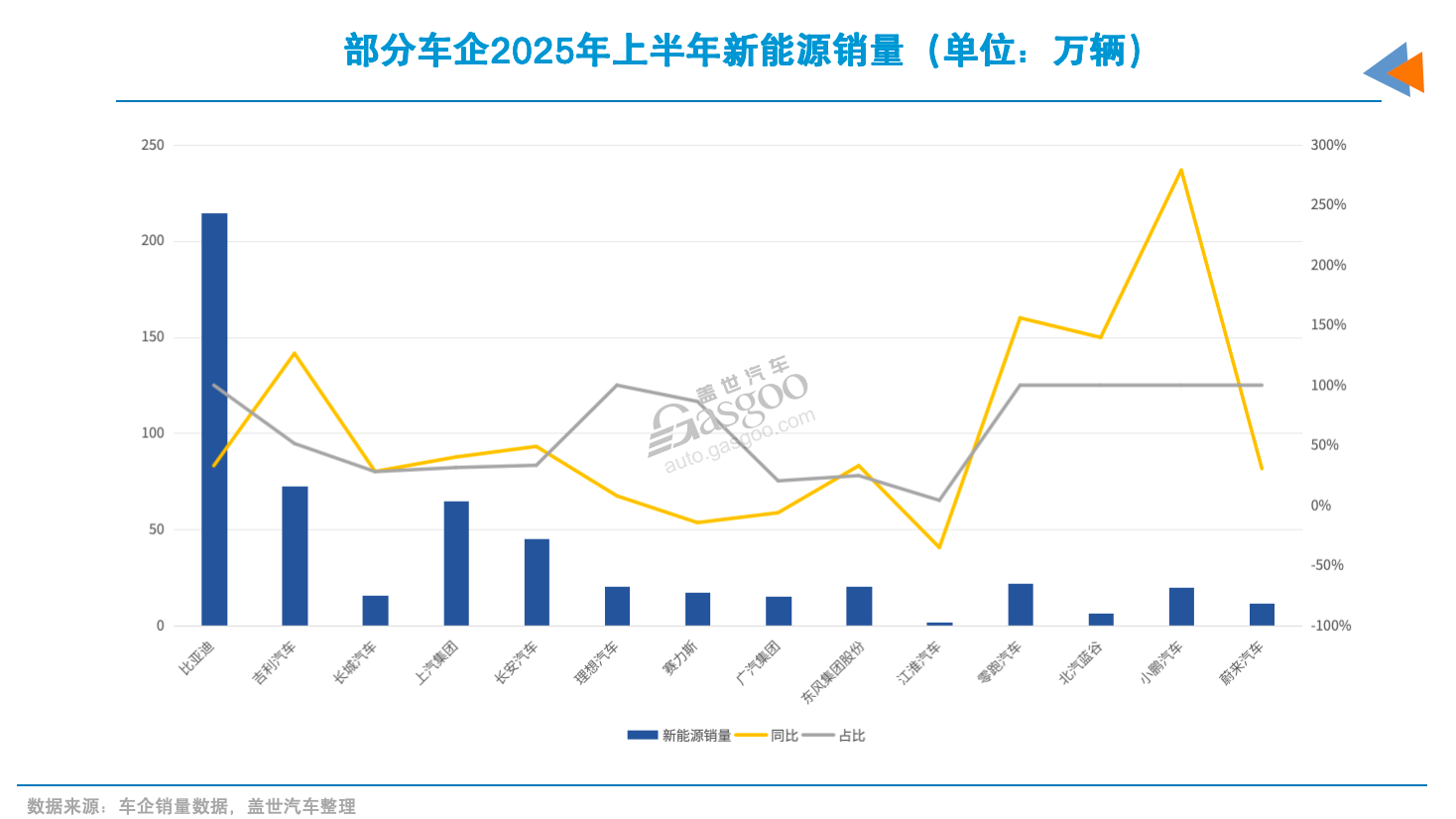

Among many traditional automakers, BYD, Geely, and Seres have taken the lead in breaking through the new energy market with their forward-looking strategic layouts. Their common feature is that the sales volume of new energy vehicles accounts for more than half of their total sales. Coupled with continuous R&D investment and a comprehensive product lineup, they have maintained relatively stable profitability despite the intensifying competition.

BYD continues to play the role of a leader in the new energy industry. In the first half of 2025, it achieved an operating income of 371.3 billion yuan, a year-on-year increase of 23.3%; net profit was 15.51 billion yuan, a year-on-year increase of 13.8%. Corresponding sales were 2.146 million vehicles, maintaining a year-on-year growth rate of 33%. However, due to intensified competition and increased terminal discounts, BYD's net profit declined in the second quarter.

However, the growth of overseas business has to some extent offset the impact of domestic price reductions. In the first half of 2025, BYD's overseas sales reached 470,000 units, doubling compared to the same period last year, driving foreign revenue to increase by 50% year-on-year to 135.4 billion yuan, accounting for 36% of total revenue. China Galaxy Securities analysts believe that the overseas business effectively offsets the domestic promotional pressure, allowing BYD to maintain stable profits while expanding sales.

Geely has also made substantial progress in its transition to new energy. In the first half of the year, its operating revenue reached 150.3 billion yuan, up 26.5% year-on-year; net profit was 9.29 billion yuan, down 13.9% year-on-year. Although Geely’s profitability has come under some pressure during its expansion, it still remains in the leading tier of the industry, with net profit second only to BYD.

This is mainly attributed to the scale effect of its new energy vehicle sales. In the first half of the year, Geely’s sales reached 1.41 million units, a year-on-year increase of 47%. Among them, new energy vehicle sales reached 725,000 units, up 130% year-on-year, with a penetration rate surpassing 50%. This means that the new energy business has already become Geely’s main growth engine.

Zeekr and Galaxy are the key drivers of Geely’s new energy vehicle growth. In the first half of the year, the combined sales of these two brands reached 640,000 units, accounting for 90% of Geely’s total new energy vehicle sales. Guosen Securities pointed out that Geely has rapidly increased the proportion of new energy vehicles through a multi-brand strategy, and has continuously invested in R&D and the launch of new models, which has improved its overall product structure. With the release of scale effects and a decline in expense ratios, Geely’s profitability is expected to gradually improve.

In contrast, Seres has made headway in the high-end electric vehicle market by focusing on the AITO series. In the first half of 2025, its revenue reached 62.4 billion yuan, a slight decrease of 4.1% year-on-year, while sales declined by 15.8% year-on-year to 199,000 units. Despite this, its net profit grew against the trend to 2.94 billion yuan, a significant increase of 81% year-on-year, with net profit reaching as high as 2.2 billion yuan in the second quarter. The gross margin remained at a high level of 29%, ranking first among major car manufacturers.

The slight decline in revenue but significant increase in profit is a result of the sales growth and product structure optimization of the high-end AITO series models. The combined sales of the AITO M8 and M9 models, both priced above 350,000 yuan, reached 104,000 units in the first half of the year, accounting for 60% of the AITO series. The strong sales of high-end models have improved the profit per vehicle, thereby driving an increase in gross profit margin. Currently, new energy vehicles account for 86% of Seres' total sales, positioning it at a leading level in the industry.

Looking at the three traditional automakers with relatively stable profits, their development paths differ, but the logic is consistent: the proportion of new energy business has increased, providing support for their performance.

They are experiencing "fire and ice" extremes.

Traditional car manufacturers with a new energy penetration rate below 35% show varied performance. For most traditional car companies, the sales proportion of new energy vehicles remains around 30%, with limited contribution to profits.

Some industry insiders have analyzed that "the insufficient proportion of new energy vehicles among some traditional automakers has led to significant pressure during the industry's structural adjustment. This is not due to technological shortcomings, but rather because their pace of transformation lags behind market changes." Traditional automakers such as SAIC, GAC, Great Wall, JAC, and JMC are all experiencing the growing pains of electrification transformation.

Guangzhou Automobile Group's situation is particularly typical, with losses continuing to widen since 2024. In the first half of 2025, its operating revenue was 42.61 billion yuan, a year-on-year decrease of 7.9%; the net loss was 2.54 billion yuan, a nearly threefold year-on-year decline. The direct reasons include a decline in demand for fuel vehicles, increased terminal discounts, and an unsmooth transition to new energy. In the joint venture segment, GAC Honda's sales continue to decline, with its net profit turning into a loss of 410 million yuan in the first half of this year. GAC Toyota performed relatively well, contributing more than 3.3 billion yuan in profit in the first half of the year.

Aion, the main force in new energy transition, performed less than ideally, with sales in the first half of the year dropping 14% year-on-year to 109,000 units. The group's total new energy vehicle sales reached only 154,000 units, accounting for 20% of total sales. As its main new energy models are concentrated in the mid- to low-end segment, profitability is limited. Insufficient profit contribution from new energy vehicles and declining profitability in traditional business have directly impacted the financials, putting overall performance under pressure.

JAC Motors faces difficulties similar to those of GAC Group, but with some differences. The similarity lies in the decline of both revenue and net profit. Particularly, the net loss reached 770 million yuan during the reporting period, a deterioration of more than three times year-on-year. New energy vehicle sales amounted to only 13,000 units, accounting for less than 7% of total sales. The difference is that increased spending on the launch of the Zunjie brand, in collaboration with Huawei, has added cost pressure. In the first half of the year, selling and administrative expenses rose to 1.8 billion yuan, further worsening the net profit margin.

In contrast, although Great Wall Motors' new energy vehicle sales reached only 160,000 units, accounting for less than 30%, its performance decline was controllable thanks to high-margin models such as the Tank brand. Its revenue for the first half of the year was 92.33 billion yuan, a year-on-year increase of 1%, while net profit was 6.34 billion yuan, down 10.2% year-on-year.

However, Great Wall Motors saw a significant improvement in its fundamentals in the second quarter, with net profit reaching 4.58 billion yuan, setting a new record high for a single quarter. Some analysts believe that the optimization of its product structure, the high gross profit contribution from SUVs and rugged off-road models, as well as the resilience of its export business, have together formed its risk buffer zone.

SAIC Motor Corporation Limited narrowed the decline in net profit through product structure optimization and improvement in joint ventures. In the first half of 2025, its operating revenue was 299.6 billion yuan, an increase of 5.23% year-on-year; net profit was 6.018 billion yuan, with the year-on-year decline narrowing to 9.21%.

In the new energy sector, SAIC Motor has launched its own new energy brands such as IM Motors and Rising Auto, while also expanding its market coverage through new energy joint venture models under SAIC Volkswagen and SAIC-GM. In the first half of the year, its new energy vehicle sales reached 640,000 units, a year-on-year increase of 40%, accounting for 31% of total sales. Some believe that, relying on its channel network and economies of scale, SAIC Motor can maintain a certain level of competitiveness before the penetration rate of new energy vehicles fully reverses.

Obviously, some traditional automakers are facing a "double-edged" challenge: on one hand, the profitability of fuel vehicles is rapidly declining; on the other hand, new energy vehicles have not yet fully taken on the responsibility of growth. The difference lies in that a few automakers have found a "buffer zone."

In the new forces, NIO should be anxious.

In the camp of 100% electrification new forces, the financial reports for the first half of 2025 may depict a scenario of "NIO's sorrow, while others rejoice."

Leapmotor is undoubtedly enjoying great success, becoming the second new energy vehicle company to achieve profitability after Li Auto. In the first half of 2025, its revenue reached 24.25 billion yuan, a year-on-year increase of 174.2%; net profit was 33 million yuan, marking its first half-year positive turnaround in profitability. In terms of sales, deliveries reached 222,000 vehicles, a year-on-year increase of 156%, ranking first among new energy vehicle companies for several consecutive months.

Leapmotor's profitability inflection point is not accidental but the result of improved channel efficiency and cost structure. According to a report by Yuanta Securities, Leapmotor has achieved a core component self-development ratio exceeding 70%, creating a "high cost-performance" advantage in the 100,000 to 200,000 yuan price range. Meanwhile, the "1+N" model has driven a year-on-year increase of over 50% in single-store efficiency, with coverage in prefecture-level cities expected to reach 90% by the end of the year, thereby expanding sales reach channels.

XPeng Motors is currently in the stage of "accelerating loss reduction." In the first half of the year, revenue reached 34.09 billion yuan, a year-on-year increase of 132.5%; net loss narrowed to 1.14 billion yuan, a year-on-year reduction of 57%; and gross profit margin rose to 16.5%. In the second quarter alone, deliveries reached 103,000 vehicles, a year-on-year increase of 242%, with net loss narrowing to 480 million yuan. The turnaround is attributed to the high gross margin contribution from the facelifted G6 and G9 models, as well as the technology output model in cooperation with Volkswagen.

Currently, the collaboration between XPeng and the Volkswagen Group has expanded from purely electric models to hybrid and fuel vehicle sectors. Kaiyuan Securities believes that this will become a significant point of profit enhancement in the future. Although XPeng is not yet profitable, it has a clear path to reducing losses, and its cash reserve of over 20 billion yuan is sufficient to support continued investment.

As a new entrant, Xiaomi Auto has demonstrated the unique advantages of an ecosystem-based enterprise. Leveraging its smart ecosystem and brand influence, Xiaomi Auto achieved revenues of 39.9 billion yuan from smart electric vehicles and AI-related innovative businesses in the first half of the year, with sales exceeding 150,000 units. Its “hardware + ecosystem” model not only reduces customer acquisition costs but also lays the foundation for future software service charges.

Li Auto's overall performance remained stable. Revenue for the first half of the year was 56.17 billion yuan, a slight decrease of 2% year-on-year, but net profit reached 1.743 billion yuan, an increase of 2.8% year-on-year. Corresponding sales were 203,900 units, an increase of 7.9% year-on-year.

Ideal relies on a "high customer unit price + stable sales volume" model, establishing a relatively clear profit logic among new forces. Its differentiated positioning with extended-range technology has somewhat alleviated the short-term pressure faced by pure electric vehicles due to an imperfect charging network, enabling Ideal to maintain its share in the high-end family SUV market. Although revenue has slightly declined, its ample cash reserves and continuous R&D investment demonstrate strong financial resilience.

In stark contrast, NIO recorded a net loss of 12.03 billion yuan in the first half of the year, an increase of 15.87% year-on-year, with the gross profit margin dropping to 9.1%. NIO's predicament does not lie in sales (114,000 vehicles, a year-on-year increase of 30.6%), but in the sustainability of its business model.

As of August 2025, NIO has built 3,467 battery swap stations nationwide, but this heavy asset model is unlikely to generate positive cash flow in the short term and instead continues to consume its resources.

The deeper issue lies in the mismatch between NIO's market positioning and the competitive landscape. In the high-end market, Tesla and Li Auto have already established relatively strong user loyalty; in the mid-range market, NIO lacks a competitive product lineup. Although the battery swapping model offers differentiated value, in a price war environment, consumers care more about cost-effectiveness than the convenience of recharging.

This year, William Li, the founder of NIO, has repeatedly admitted to facing "significant operational pressures." Recently, the newly launched ES8 is priced nearly 100,000 yuan lower than the current model, and this passive price reduction exposes NIO's difficulties in cost control.

Essentially, this differentiation reflects the characteristic shift of the new energy vehicle industry from an incremental market to a stock market. In the incremental era, various business models had room to survive; in the stock competition era, only enterprises with genuine core competitiveness can prevail.

Why is the differentiation so obvious?

When an industry transitions from a phase of rapid and uncontrolled growth to one of refined and competitive development, companies that can create a closed loop in technology conversion, brand building, and strategic execution gain a first-mover advantage.

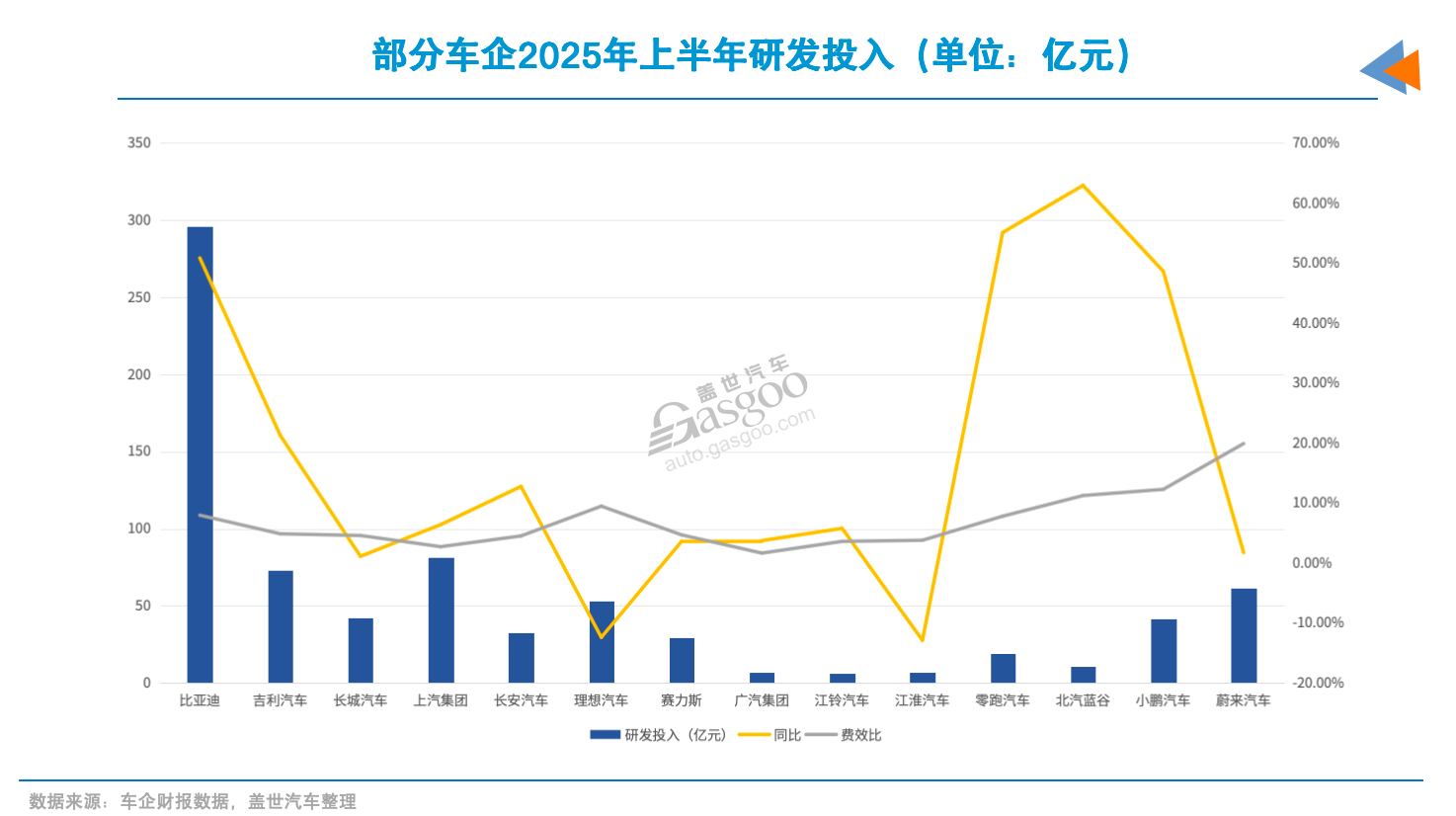

The effectiveness of R&D investment is the first dividing line in performance differentiation. On the surface, almost all car companies are heavily investing in R&D, but the conversion efficiency between input and output varies greatly. BYD’s R&D investment of 29.6 billion yuan appears substantial, but its cost-effectiveness ratio is only 8%. This means that for every 1 yuan invested in R&D, it can generate over 12 yuan in revenue support.

BYD's research and development focuses on core technologies with clear commercialization pathways, such as blade batteries and DM-i hybrid systems. Today, BYD has also become a leader in the democratization of intelligent technology. This not only enhances product competitiveness but, more importantly, reduces costs through vertical integration, forming a positive cycle of "R&D - scale - profitability."

Leapmotor controls costs through "full-domain self-research." With a 70% self-developed rate for core components, Leapmotor has greater flexibility in the price war. Although its 14% gross profit margin is not outstanding, it provides a considerable competitive advantage within the mainstream price range. The essence of this model is to use technological investment to gain cost control, achieving the effect of decreasing marginal costs as scale expands.

In contrast, although NIO invested 6.18 billion yuan in R&D, its cost-effectiveness ratio was as high as 20%. The issue does not lie in NIO's lack of technological innovation, but rather in its choice of business path. While aggressively expanding the battery swapping network creates differentiation in user experience, it faces tremendous pressure from infrastructure investment during commercialization, and the technological advancement has yet to translate into financial advantages.

The ability to command a brand premium has become the second threshold for differentiation. By precisely positioning itself as a "family car," Li Auto has established stable user recognition in the market above 250,000 yuan. Some believe that its 20% gross margin and 11 consecutive quarters of profitability demonstrate the commercial value of its brand premium.

Although Xiaomi Auto has not been in the market for long, it has created highly cost-effective products through deep integration of the supply chain and cost control. At the same time, relying on ecological integration, it has quickly established brand recognition. Driven by multiple factors, Xiaomi Auto has rapidly formed a scale advantage. A gross profit margin of 26.4% indicates that its brand premium capability has begun to emerge.

Differences in the intensity of globalization strategy execution have further amplified the performance divergence among automakers. For example, in just three years, BYD has increased its overseas revenue share to 30%, which not only diversifies the risks of domestic market competition but, more importantly, allows it to achieve higher premium margins in overseas markets. The strategic layouts of Changan Automobile and Great Wall Motors in markets such as Thailand similarly demonstrate the foresight of their strategic execution.

Meanwhile, pursuing high-end positioning has become the foundation for some car manufacturers. Empowered by Huawei’s intelligent technologies, SERES has gained the qualification to compete with traditional luxury brands in the high-end market, allowing its brand premium to be established rapidly.

Great Wall Motors' Tank brand also reflects a high-end value. Through a differentiated positioning as a rugged off-road vehicle, the Tank brand has established a unique brand image in the 200,000 to 500,000 yuan price range. Its vertically segmented strategy allows it to maintain relatively stable profit margins amid price competition, raising the overall profit per vehicle to 11,000 yuan.

In contrast, car companies facing performance difficulties have problems in product positioning and market strategy. For example, NIO's high-end strategy has achieved certain success at the brand level, but its capital-intensive battery swapping model limits the release of its profitability.

An industry insider bluntly stated that the competition in the new energy vehicle sector has entered the second half, where the competition is not just about sales but about who can build a sustainable business model.

In the second half of the year, differentiation will continue.

Recent financial reports over the past two years have clearly demonstrated the importance of the new energy transition. However, due to varying speeds of electrification transformation and intensified market competition, most automakers are likely to continue facing profitability pressures. Looking ahead to the second half of the year, whether automakers can stabilize depends crucially on their ability to alleviate cost pressures and achieve economies of scale in new energy through technology implementation, market expansion, and product structure optimization.

In this context, BYD still demonstrates relative certainty. Although the gross profit margin per vehicle has declined, its overall gross profit margin remains at an above-average industry level due to its scale advantage, supply chain integration, and increased proportion of high-end products. At this rate, its annual sales are expected to reach a new high.

In the context of intense competition in the domestic market, BYD's ability to diversify risks by relying on overseas markets is another major advantage that sets it apart from other automakers. With factories in Brazil, Thailand, and other locations gradually coming into operation, its target of selling 800,000 vehicles overseas this year is not difficult to achieve.

Changan and Geely are both widely regarded as promising. Leveraging its “Hai Na Bai Chuan” (Embracing All Rivers) initiative, Changan’s overseas sales exceeded 300,000 units in the first half of the year, representing a year-on-year increase of 49%, demonstrating its resilience in internationalization. With new energy brands such as Qiyuan, Deepal, and Avatr entering their product cycles, Changan’s sales are expected to maintain an upward trend in the second half of the year.

Geely has increased its overall new energy vehicle (NEV) penetration rate to over 50% through the rapid growth of Zeekr and Galaxy. Institutions generally expect its gross profit margin and profitability to improve in the second half of the year. Based on its market performance in the first half, Geely has raised its annual sales target to 3 million vehicles.

With the large-scale rollout of Hi4 hybrid technology and the continued expansion of the Coffee Intelligence System, Great Wall Motors is expected to achieve breakthroughs in the new energy sector in the second half of the year, thereby improving its performance.

The commonality among the aforementioned automakers is that their new energy vehicle segments have already become, or are in the process of becoming, the core support for their main business. Even though overall profits are under pressure, the fundamentals have certain recovery or even growth potential driven by the expansion of new energy vehicles and product cycles.

In terms of differentiated competition, some automakers such as SERES and Li Auto have demonstrated stronger structural advantages. In the second half of the year, driven by the strong product cycle of the “AITO high-end lineup + first batch delivery of M8 pure electric,” SERES is expected to continue the simultaneous growth in both sales volume and price. Li Auto, relying on its dual-line layout with the L series and i series, is also expected to maintain relatively stable performance in the second half of the year.

It is evident that, amid ongoing price wars, a premiumization strategy can provide some car manufacturers with a profit buffer, becoming an important means to weather industry cycles.

Compared to this, NIO faces greater pressure. Although sales volume increased in the first half of the year, high research and development expenses and the heavy asset burden brought by the battery swapping model have caused its gross profit margin to continue declining, and net losses to further expand. In the short term, even if new models drive sales growth in the second half of the year, there is still considerable uncertainty regarding improvements in its financial performance. Some opinions suggest that NIO may find it difficult to achieve profitability breakeven targets in the fourth quarter of this year.

Overall, in the second half of the year, the performance of car companies is more of a continuation of the structural trends from the first half, rather than an overall improvement. The key variables mainly lie in three aspects:

First, whether R&D investment can truly translate into cost reduction and gross margin improvement. For example, the implementation of BYD’s hybrid and intelligent technologies, as well as XPeng’s progress in assisted driving, will directly impact their profit margins.

Secondly, whether the overseas market can continue to contribute new growth remains to be seen. Some automakers such as BYD, Chery, and SAIC Group have already established a first-mover advantage, while Geely and Great Wall are also rapidly catching up.

Thirdly, whether high-end products can continue to grow in volume remains to be seen, and the performance of Seres and Li Auto is still worth watching.

Against the backdrop of overall industry pressure, differentiated competition strategies and risk resilience are among the key factors determining whether automakers can maintain steady performance in the second half of the year.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track