August Production Analysis of The Three Major White Goods: Industry Changes Amid Domestic Demand Divergence and Export Pressure

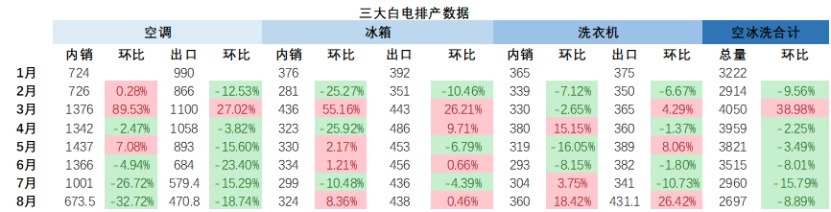

In August 2025, the production data of domestic white goods (air conditioners, refrigerators, washing machines) was recently released by Industry Online.The total scheduled production volume for the three major categories is26.97 million units, down 8.89% month-on-month and 4.9% year-on-year. This data reflects the complex situation of the current white goods market: domestic demand shows a polarized pattern of “two extremes,” while exports continue to face the dual pressures of trade policies and weak global demand.

Air conditioners: Domestic sales are polarized, exports are under pressure.

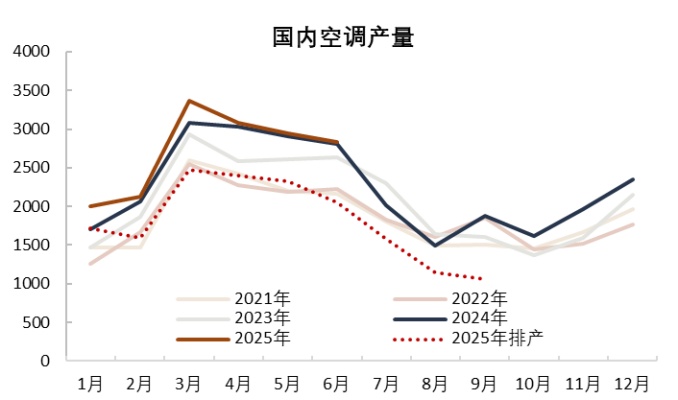

In August, the production of household air conditioners was 11.443 million units, a month-on-month decrease of 27.58%.Compared to the same period last year, production performance has declined. 2.8%. Among them, domestic production scheduling reached 6.735 million units, a sharp month-on-month decline of 32.72%. Although low-penetration markets such as Northeast China experienced significant demand growth due to high temperatures, with Midea air conditioners’ sales in Heilongjiang and Jilin increasing by 356% year-on-year, and Xiaomi air conditioners’ sales in Northeast China reaching 20 times that of the same period last year, sales growth in mature markets such as East China and South China remained steady, reflecting the stage characteristics of the air conditioner domestic market where both existing and new demand coexist. Due to early release of some demand during the June e-commerce promotions, although the high temperatures in July stimulated consumption, domestic production scheduling declined by 22.93% month-on-month. In August, production scheduling decreased by 5.3% year-on-year. Manufacturers have lowered their market expectations for the second half of the year and are cautiously controlling inventory.

ExportsIn August, the scheduled production for household air conditioner exports was 4.708 million units, a month-on-month decline of 18.74%, marking the fifth consecutive month of decline. The downward trend in production is expected to continue in September and October. Since May and June, the export market has shown a clear downward trend, with declines of varying degrees across all continents except Oceania. The implementation of reciprocal tariff policies in multiple countries, the end of restocking by overseas importers, significant inventory pressures in some regions, as well as geopolitical and logistics issues in the Middle East and Southeast Asia, have all contributed to considerable pressure on the export market.

Refrigerators: Domestic Sales Shrink, Export Divergence

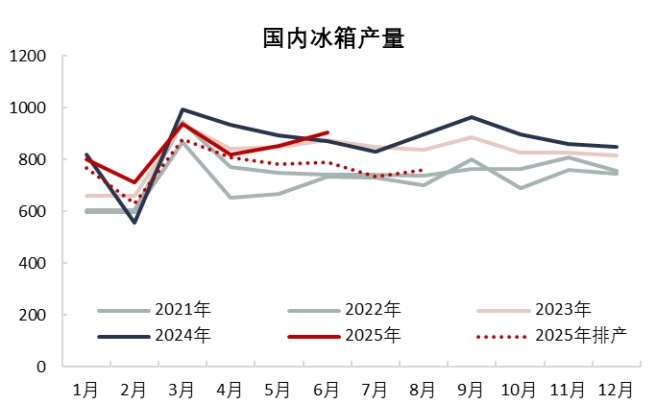

In August, refrigerator production was 7.62 million units, an increase of 3.67% month-on-month.However, compared with the same period last year, production performance has declined. The domestic sales production schedule reached 3.24 million units, an increase of 8.36% month-on-month, but a decrease of 11.5% compared to the same period last year. The early demand pull-forward by the 618 promotional event, coupled with insufficient consumer momentum during the traditional off-season, and extended high-temperature vacations, all contributed to the contraction in domestic refrigerator production schedules year-on-year. In the first half of the year, the refrigerator industry experienced multiple rounds of intense competition and production schedule volatility. In the future, the industry will face challenges such as fragmented channels, diversified demand, product structure upgrades driven by national subsidy policies, and industry adjustments due to the implementation of new energy efficiency standards. The reshuffling process is accelerating, and the reconfiguration of manufacturer structures is intensifying.

Export Production Scheduling 4.38 million units, a slight month-on-month increase, but an 8.3% decrease compared to the same period last year. Affected by the high base number from the same period last year, tariff policies, market demand, and the summer holidays, exports showed differentiation. Traditional European and American markets were weak, exports to the North American market dropped significantly due to tariff impacts, while emerging markets such as Africa and Latin America became the main drivers of export growth. Changes in the U.S. import structure indicate that China’s market share for refrigerators has significantly declined since May. The global tariff environment has become more complex since August, which will further affect the export pattern of refrigerators.

Washing Machines: Domestic Sales Improving, Export Restrictions Persist

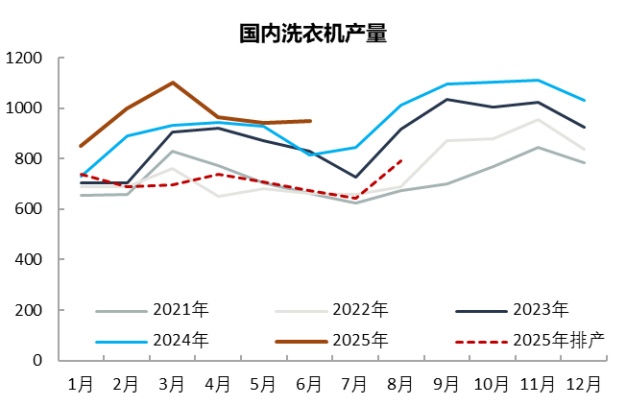

In August, washing machine production was 7.911 million units, an increase of 22.75% month-on-month.Compared to the same period last year, production performance has declined. The domestic sales production plan is 3.6 million units, a month-on-month increase of 18.4%, representing a 6.9% decline compared to the same period last year, showing a good trend with a consecutive month-on-month increase. The expansion of domestic washing machine production capacity, along with a promising performance in the washing and care industry structure, has resulted in an increased proportion of large-capacity and high-priced products. With the support of "national subsidies," the proportion of 12 kg products has increased, and companies are shifting their strategy towards promoting high-end products. The allocation of funds for trade-in programs also significantly boosted the domestic sales production plan in August.

Export Scheduling 4.311 million units, a month-on-month increase of 26.4%, and a slight year-on-year growth of 1.2% compared to the same period last year. In the second half of 2024, washing machine exports will face constraints such as a high base period, trade policies, and technical compliance requirements. The high export base in the second half of 2024 will create pressure, while the U.S. tariff policy on steel household appliances may prompt the EU to follow suit. Additionally, new EU regulations and standards will further increase export barriers.

The production data for white goods in August indicates that the industry is currently experiencing the growing pains of transformation: domestic demand growth relies on dual optimization of regional and product structures, while exports need to cope with significant fluctuations in the trade environment. Against this backdrop, leading companies are seizing opportunities through technological upgrades and global expansion, while small and medium-sized manufacturers may become further marginalized. In the future, policy incentives (such as trade-in programs), upgrades in energy efficiency standards, and the development of emerging markets will become key variables for industry breakthroughs.

Author: Zhuansu Shijie Market Research Expert Zhao Hongyan

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track