August Polyester Monthly ReportCost Supports the Bottom, Demand Determines the Height

Summary of viewpoints:

PX:Despite the current weak downstream demand affecting some PX demand, the new PTA large-scale equipment is being commissioned, and the extension of the China-US tariff negotiations continues. There is a possibility of seasonal recovery for overseas orders in mid-to-late August, and there is still an expectation for a promising polyester market in September and October. Under these conditions, demand may gradually recover. However, PX maintenance facilities are gradually restarting, with an overall upward supply trend. In August, as the supply and demand for PX costs engage in a tug-of-war, PX prices fluctuate around raw material costs, and the PXN price spread remains firm.

PTA:In the short term, crude oil is mainly fluctuating within a range. The PX plant maintenance intensity in August is average, but the pressure on supply and demand inventory accumulation is not significant. The PXN price spread has solid bottom support, and the PTA cost side is relatively resistant to decline. Due to the continued low processing margins and tight raw material supply for some factories, PTA supply in August may decrease month-on-month. The polyester demand is transitioning between peak and off-peak seasons, reducing the downward pressure on polyester loads. Therefore, the PTA supply-demand situation is improving, and the downside space for PTA prices is limited. However, as spot supply is relatively abundant, there is limited room for strengthening the basis.

MEG:In August, the MEG supply and demand structure is expected to shift towards a balanced state, with visible inventory primarily adjusting within a low range. Domestic MEG operating rates remain high, although some co-production units are undergoing production adjustments; on the import side, overseas plants are resuming operations, coupled with a backlog of shipments at ports at the end of July due to weather conditions. On the demand side, order activity is expected to pick up mainly after late August, with overall demand support being average. MEG prices in August are anticipated to fluctuate within a wide range, with visible inventory still at a low level and relatively strong support at the low end during the price correction process.

Risk Points:

Geopolitical events ferment.

Changes in China-U.S. trade negotiations

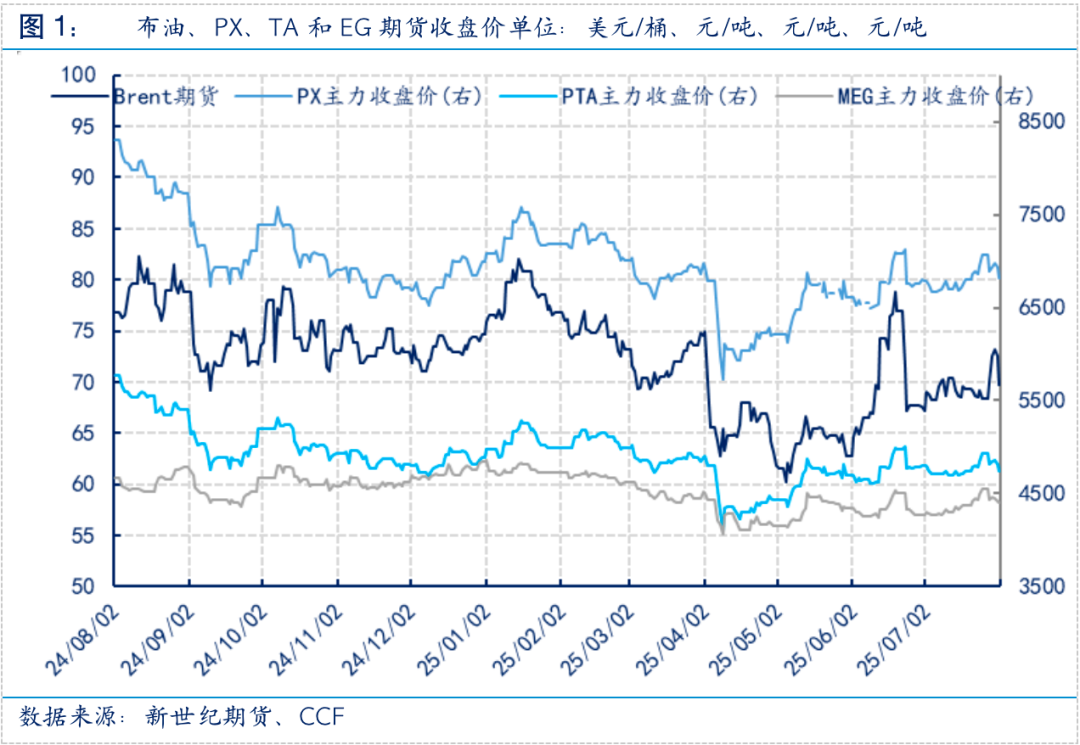

After fluctuating, oil prices rose in July. In the first ten days, the United States extended the deadline for trade negotiations, reducing market concerns over US tariff issues. Additionally, the traditional US consumption peak season continued, supporting the rise in international oil prices. In the middle ten days, the US sanctions plan on Russia would not be implemented in the short term, combined with OPEC+ continuing to increase production, leading to a decline in international oil prices. In the last ten days, the US and the EU reached a new trade agreement, significantly alleviating market worries about tariff issues. Moreover, potential supply risks arose as the US might impose new sanctions on Russia, driving up international oil prices.

In July, oil prices rose. In July, Tianjin Petrochemical underwent maintenance, Fuhai Chuang had two units with a total capacity of 1.6 million tons, Weilian Chemical had one unit with a capacity of 1 million tons, and Fujia Dahua had one unit with a capacity of 700,000 tons continuing maintenance. The downstream PTA load fluctuated little, and there were also new units put into operation, so the PX demand remained relatively stable. PX prices fluctuated with oil prices, with the monthly average price of PXN closing at 266 USD/ton, up 4% month-on-month.

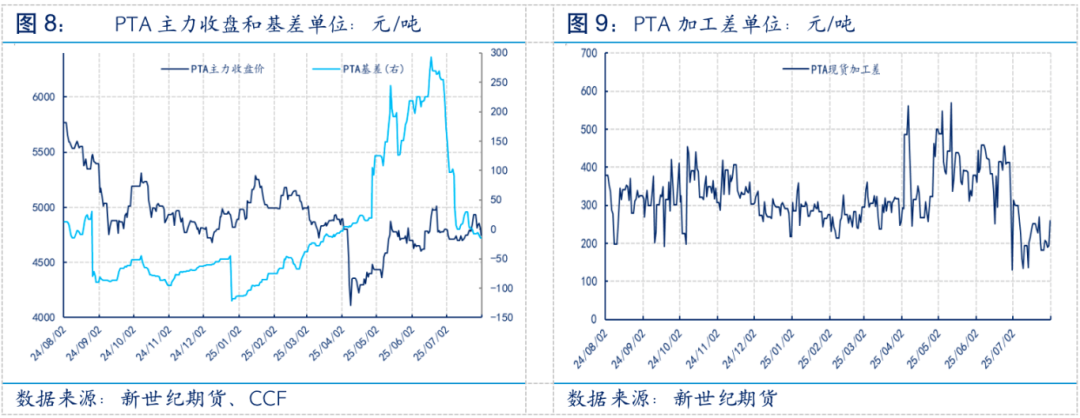

In July, PTA prices rebounded after a decline, and processing margins continued to shrink. In the first half of the month, the macro environment was unfavorable, and there were expectations of increased crude oil production. End-user orders were poor, and polyester planned to reduce its operating rates, leading to a decline in PTA prices. In the second half of the month, market prices gradually rebounded, mainly due to the anti-involution trend boosting commodity sentiment with a macro preference. The announcement of maintenance plans for August indicated an expected easing of supply and demand margins, leading to a corresponding increase in market prices. At the end of the month, concerns about the negative impact of the third round of China-U.S. negotiations, combined with the imminent start-up of new facilities, led the market prices to give back some of their gains and fluctuate.

In July, MEG prices moved upward. At the beginning of the month, prices fluctuated and remained stagnant due to a lackluster fundamental situation. In the middle of the month, prices rebounded slightly, driven by continued low port inventories, with spot prices rising to around 4,400 yuan/ton. From late July, influenced by macro news on anti-involution policies and the phasing out of outdated production capacity, market sentiment improved. The overall chemical sector benefited from this sentiment, and, spurred by a rapid rebound in the ferrous metals sector, MEG prices were also pushed to high levels, followed by a correction from these highs.

PX:

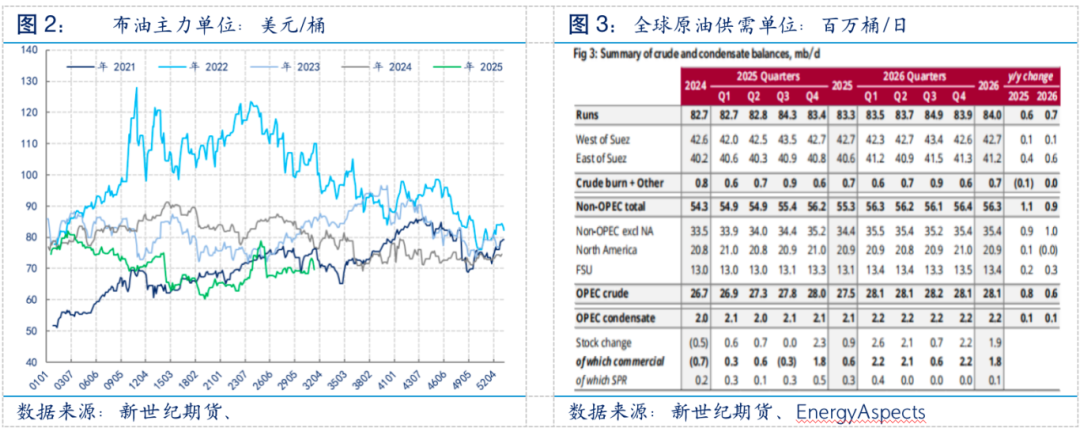

In July, after a period of narrow fluctuations and standoff, oil prices rose as international oil prices were influenced by the macro atmosphere brought about by Trump's tariff negotiations and the impact of geopolitical issues in Russia-Ukraine and the Middle East. At the beginning of the month, the oil price news was generally calm, with a mix of bullish and bearish factors. The OPEC+ accelerated production increase meeting and the resulting news put pressure on oil prices to decline. Additionally, the possibility of the U.S. extending the tariff buffer deadline and the unequal trade agreement reached between the U.S. and Vietnam provided some support to market sentiment. Meanwhile, signs of escalating geopolitical tensions led to a rebound in oil prices, recovering previous losses. Approaching mid-month, geopolitical conflicts pushed oil prices upward, with Israel launching airstrikes on Yemen and Houthi forces attacking merchant ships in the Red Sea, providing support for oil prices due to geopolitical risks. The continued tightening of U.S. sanctions on Iranian oil exports by the Department of Commerce also benefited oil prices. However, on the other hand, OPEC+ continued to accelerate oil production increases, which, even though the current increase is below policy expectations, still exerts pressure on long-term oil prices.

Additionally, investors' concerns about the negative impact of Trump's tariff policies on the global economy have intensified, prompting a downturn in oil prices. In the middle of the month, Trump stated that if Russia and Ukraine could not reach a ceasefire agreement within 50 days, he would impose a 100% tariff on Russia and the countries purchasing its oil. However, since there is still a window of opportunity for negotiations, the short-term risk of disruptions to Russian oil supplies is limited, causing oil prices to fluctuate rapidly. Meanwhile, trends in crude oil demand are diverging, with EIA inventory data showing a much larger-than-expected buildup in gasoline stocks, and poor demand during the peak gasoline consumption season is putting pressure on crude oil prices. However, strong diesel demand in Europe and a significant price increase have boosted market sentiment, causing oil prices to rebound after a decline. Later in the month, macroeconomic sentiment and expectations for oil supply significantly pushed up oil prices. Trump reached trade agreements with several countries, alleviating market concerns. At the same time, Trump shortened the grace period for Russia and warned Iran not to restart its nuclear facilities, or they might be bombed again, providing geopolitical support for a substantial rebound in oil prices.

Recently, the crude oil market surged and then retraced. The U.S. pressure on Russia is still viewed in the context of short-term geopolitical risk events, and there is uncertainty about whether related sanctions will be implemented. The geopolitical sentiment premium in the crude oil market has not been effectively eliminated. Last week's U.S. non-farm payroll data rekindled concerns about a U.S. economic recession, causing a short-term spike in the fear index and leading to a temporary flight to safety in financial markets, impacting U.S. stocks and commodities. In the near term, attention should be paid to further developments in macroeconomic sentiment. OPEC+ maintained high-speed production increases in September, and supply-side pressure will continue to manifest. Combined with a seasonal decline in demand in September, the fundamental pressure in the crude oil market is expected to gradually increase. There is no clear statement on how OPEC+ will adjust its production policy, but regardless, time remains a bearish factor for the crude oil market, and the upside potential for crude oil remains limited. The biggest potential positive for the future oil market comes from the geopolitical level; aside from that, there are no substantial positive drivers.

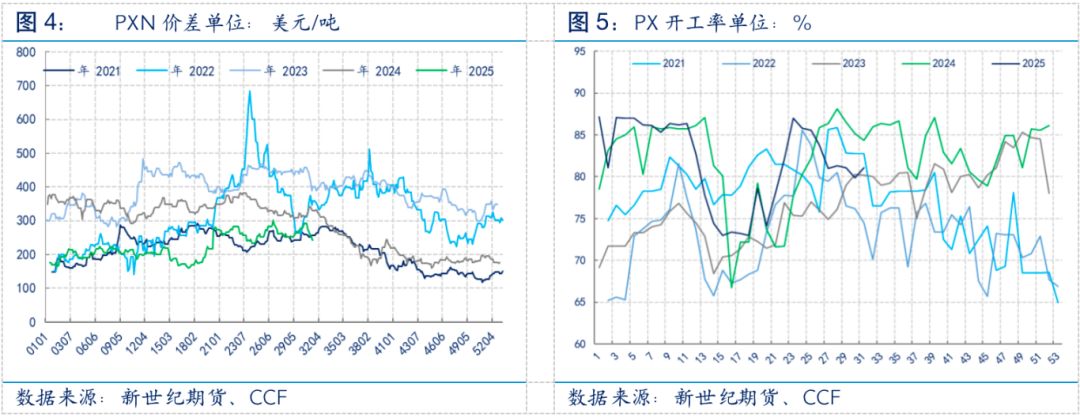

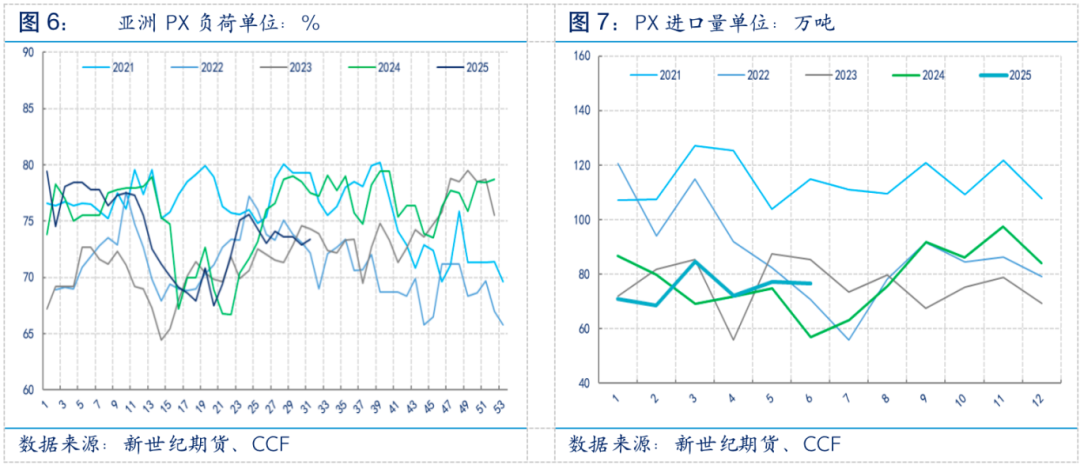

In July, the operating rates of PX units at home and abroad showed divergent trends. Domestic units operated steadily, while overseas units experienced fluctuating increases in load. By the end of the month, the domestic PX operating rate fluctuated narrowly around 80%. Domestically, the only unplanned change was a load decrease at Shenghong Refining due to upstream faults. Overseas units experienced relatively frequent changes, mainly planned, including the restart of SK and Iranian Petrochemical units, the recovery of NSRP load, and maintenance at Thai Petroleum units. Idemitsu in Japan conducted unplanned shutdowns for maintenance on two new units totaling 610,000 tons.

In July, the PX production was 3.13 million tons, a decrease of 100,000 tons compared to June. The reduction in PX production was due to the maintenance of Fuhai Chuang and Fuhai as well as the unplanned reduction in operating rates at Shenghong facilities. The estimated PX import volume in July was around 800,000 tons. On the demand side, the PTA production in July was 6.38 million tons. Based on this calculation, the PX supply-demand balance in July is expected to reduce inventory by approximately 250,000 tons.

Polyester consumption is in the off-season, with polyester and end-use demand performing generally. After a significant compression in PTA plant processing spreads, maintenance of some units has also directly impacted part of PX demand. Therefore, from the demand side, the support for PX is not as strong as in July. However, considering the rigid procurement demand from newly commissioned PTA units and the continued extension of the China-US tariff negotiations, as well as the possibility of seasonal recovery in overseas orders in mid to late August, the "golden September and silver October" period for polyester still holds promising expectations. Demand may gradually recover from the off-season. On the supply side of PX, there are few positive factors; maintenance units are gradually restarting, and multiple new domestic reforming units are increasing, directly or indirectly raising PX supply overall. Therefore, August may see a situation of strong supply and strong demand simultaneously.

PTA:

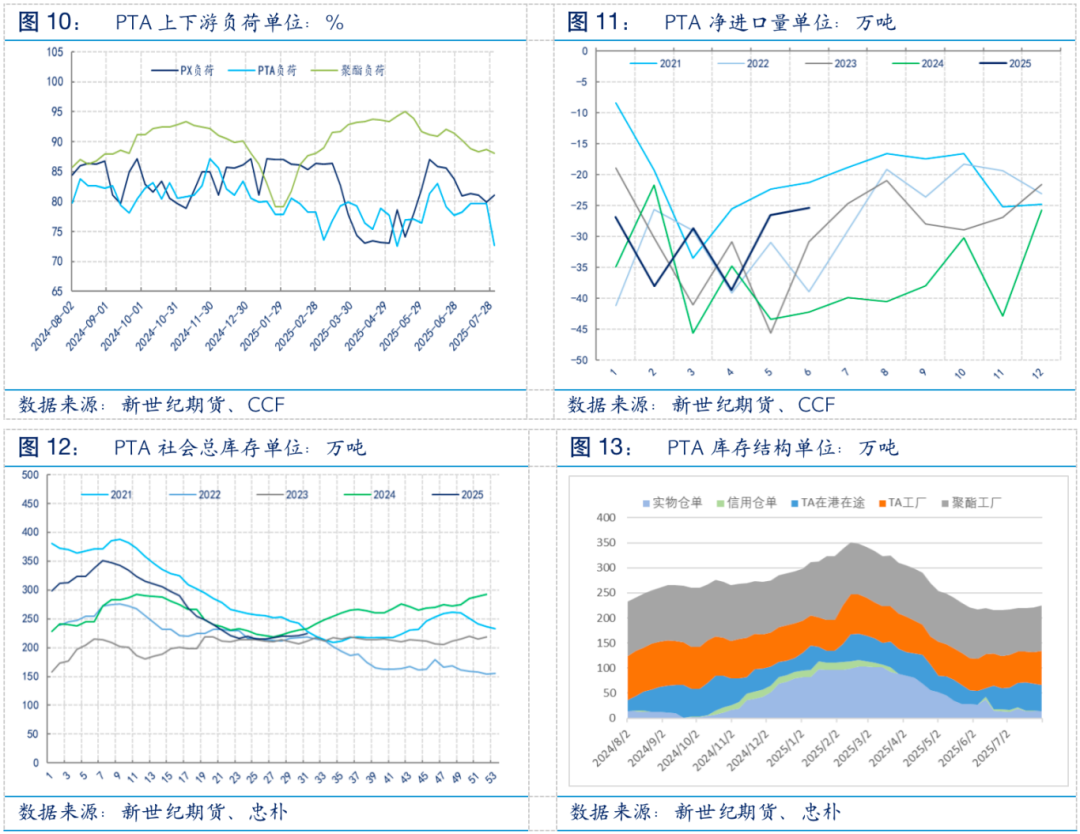

In July, domestic PTA plant maintenance decreased. Except for some long-term shutdowns, the 4.5 million tons PTA plant of Fujian Refining & Chemical and the 2.5 million tons PTA plant of Weilian Chemical were shut down. Yisheng New Materials, Yisheng Dalian, and Yihua slightly reduced their load, while the 1.5 million tons plant of Formosa Chemicals planned an unexpected shutdown. One production line of the new 3.2 million tons PTA plant of Hailun Petrochemical (Sanfangxiang) started production at the end of the month. The total domestic PTA supply in July was 6.38 million tons.

In terms of demand, polyester load slightly declined in July, with polyester load decreasing from just above 90% to around 88%. Polyester production in July was around 6.7 million tons, and the actual PTA consumption was about 5.73 million tons. The operating rates of non-polyester products fell in July, with DOTP load around 50-60%, and PBT and PBAT loads also declining, resulting in PTA demand of approximately 230,000 tons. The price gap between domestic and international markets widened in July, but due to limited overseas demand, export orders were relatively few. However, some previously placed orders were postponed to July shipments, leading to a slight increase in exports from certain suppliers. Shipments to Vietnam decreased month-on-month, while shipments to Turkey and India increased month-on-month. Export volume is expected to be around 280,000 tons. Overall, domestic PTA supply and demand resulted in an inventory build of about 140,000 tons in July.

From the cost perspective, the market has recently been concerned about the potential supply risks posed by the U.S. sanctions against Russia. However, the expectation of OPEC+ maintaining production increases and generally moderate demand has somewhat limited the rise in oil prices. Therefore, short-term fluctuations are expected, and if geopolitical tensions ease, a pullback may occur. In August, maintenance on PX facilities is moderate, and once previously maintained units complete their repairs, they are expected to restart with a slight increase in operating rates. However, the pressure from supply and demand stockpiling is not significant, and the bottom support for PXN is solid, making the PTA cost side relatively resistant to decline. Regarding PTA, the continued low processing margin and tight raw material supply for some factories have led to an increase in PTA facility maintenance plans in August. Even with the production of new PTA units at Sanfangxiang, there is a possibility that older units may shut down, resulting in a month-on-month decrease in supply. The transition period between the off-peak and peak seasons for polyester demand reduces the downward pressure on polyester load, thus improving PTA supply and demand on a month-on-month basis. However, market liquidity is currently abundant, and the extent of PTA processing margin recovery is limited.

MEG:

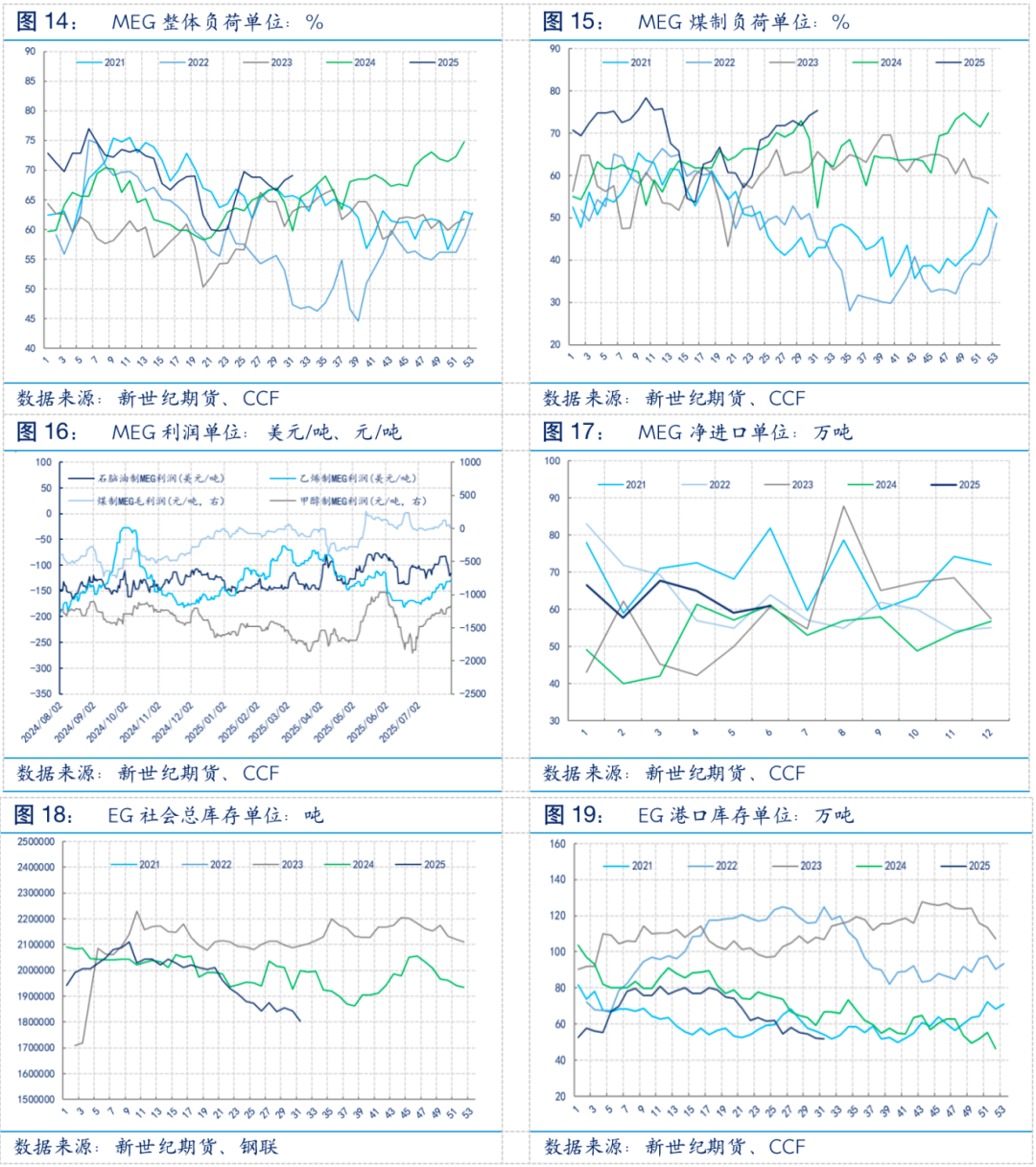

In July, the sentiment in the MEG market was primarily driven by the commodity market, with anti-internal competition continuing to intensify. Coking coal and multiple other commodities hit consecutive daily limit-ups. Under the influence of a warming capital market, buying interest in the MEG market followed suit. Additionally, temporary shutdowns of overseas plants and slow resumption progress led to expectations of reduced supply. As a result, MEG inventory drawdown expanded in July, creating a phase of fundamental resonance.

From the perspective of supply and demand structure, MEG social inventory continued to decline in July, with an overall reduction of around 100,000 tons. In terms of domestic supply, coal-based MEG units operated at high load, resulting in a significant increase in output during the month. By the end of the month, devices at Sinochem and Xinjiang Guanghui resumed operation as scheduled. Among traditional units, Satellite Petrochemical and Zhejiang Petrochemical Phase II #1 were under maintenance, and non-coal-based output remained low. In July, the average operating rate of domestic MEG was about 67.19%, with coal-based MEG units running at 72.41%. Domestic MEG production in July was around 1.665 million tons, an increase of 79,000 tons from the previous month. As for imports, due to typhoon weather at the end of the month, vessel delays were significant, and import volume is expected to remain around 600,000 tons. On the demand side, polyester operating rates remained low in July, with the monthly average load at around 89%, indicating moderate demand support.

In August, the MEG supply-demand structure is shifting towards a broad balance, with apparent inventories expected to remain at low levels and mainly adjust within a low range. Domestically, the restart of Zhejiang Petrochemical Phase II Line 1# has been moderately delayed to around mid-August, which is later than market expectations. With epoxy ethane entering its off-season, some integrated units are adjusting between EO/EG products, resulting in increased MEG operating rates at facilities such as Sanjiang Petrochemical, Yuandong Lian Petrochemical, and Zhenhai Refining & Chemical. Attention should also be paid to the progress of capacity increases at Guanghui and Sinochem units. It is expected that domestic MEG production in August will rise to slightly above 1.76 million tons. On the import front, due to the previous temporary shutdown of Saudi Arabia’s Sharq series units, MEG overseas shipments in July were somewhat reduced. However, by the end of July, weather factors led to an accumulation of delayed vessels at ports. Overall, MEG imports in August are expected to be around 640,000–650,000 tons. From the demand perspective, August remains within the traditional off-season, and effective order activation is expected to be seen after late August. The average polyester operating rate for the month is expected to run around 88.5%, indicating moderate demand support. In addition, supply in the South China market is relatively ample, with some cargoes being shipped to the East China market, and MEG spot liquidity will remain moderately abundant in the future.

The MEG price focus in August is expected to undergo a wide adjustment. Explicit inventory remains at a low level, and during the price correction process, the support at the lower end is relatively strong. Attention should be paid to the cost side and changes in production units.

Downstream:

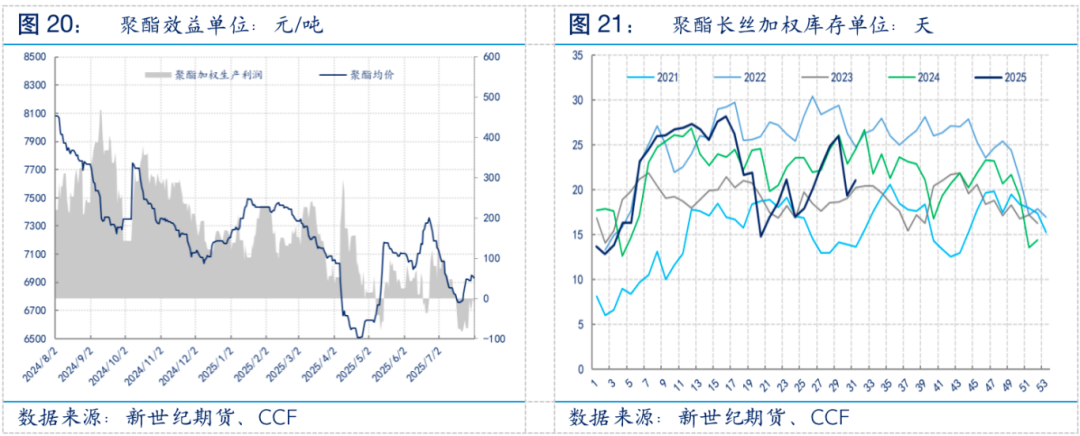

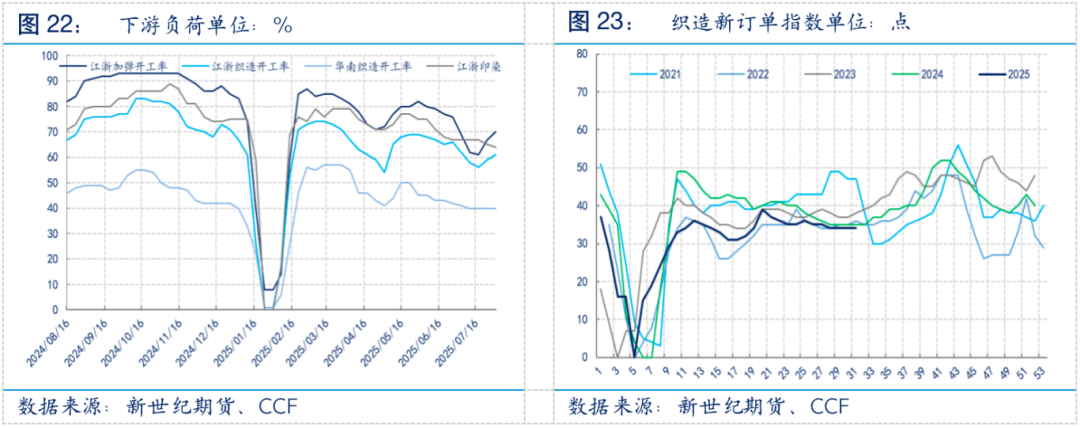

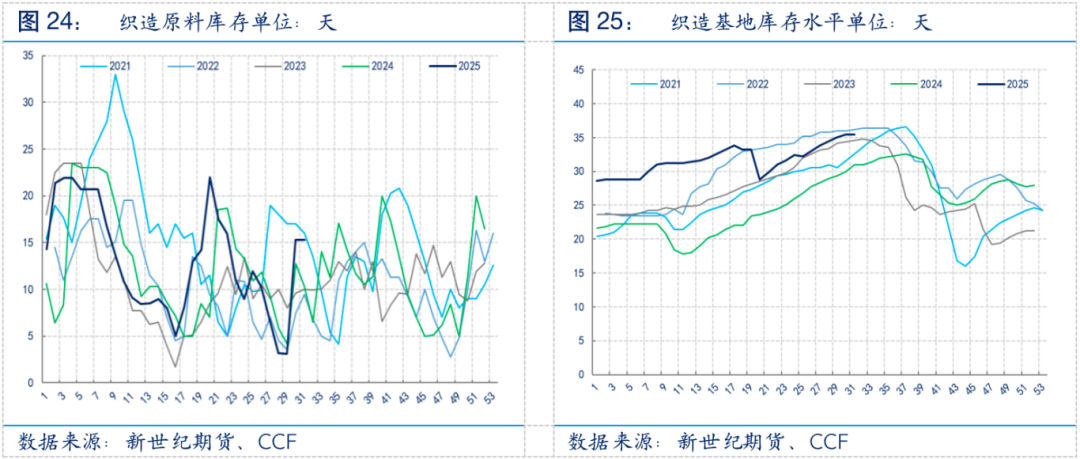

In the first half of July, the market was in an off-season atmosphere, with downstream operations continuing to decline. The intention to purchase raw materials was weak, and inventory levels dropped to relatively low levels around the middle of the month. In the second half of the month, driven by the atmosphere of domestic bulk commodities, raw material prices gradually strengthened. Downstream filament sectors began to initiate concentrated purchasing, and after a surge in production and sales, the equity inventory of factories significantly decreased again. As raw material procurement increased in the weaving sector, downstream operations stopped declining and slightly increased at the end of the month.

In July, with more units undergoing maintenance, polyester operating rates dropped below 90%. During this period, there were both temporary shutdowns due to equipment malfunctions and restarts, but overall operations remained below the 90% level. Generally, the downstream market was in a low season in July, with terminal operating rates continuing to decline and companies showing weak purchasing intentions. It was not until the latter part of the month, when the "anti-involution" sentiment led to a surge in commodity prices, that downstream filament enterprises carried out concentrated restocking, resulting in a moderate stabilization of market operating rates. However, a full recovery in demand still requires further improvement.

Looking ahead, in terms of exports, following the conclusion of the U.S.-China tariff negotiations, U.S. autumn and winter orders are likely to be released in a concentrated manner. On the domestic demand side, efforts are being made to promote relevant positive policies, including the national subsidies in the first half of the year and the recent "anti-involution" trend aimed at boosting market confidence. However, the realization of incremental industrial demand still requires ongoing observation. As domestic and international order demand gradually picks up, the polyester industry may have passed its most difficult period, and the market is expected to experience a moderate recovery in August.

From a timing perspective, the industry is anticipating a seasonal recovery in demand after the second half of August, which will in turn drive a gradual increase in industrial operating rates, a progressive revival of market sentiment, and the gradual realization of end-user inventory reduction. Going forward, the focus will be more on the strength of this recovery and the year-on-year growth situation.

Although current downstream demand is weak, affecting some PX demand, the launch of new large-scale PTA facilities and the continued extension of US-China tariff negotiations should be taken into account. There is also a possibility of seasonal recovery in overseas orders in mid-to-late August, and with the traditionally strong "Golden September and Silver October" period for polyester, there are still expectations for demand recovery. However, as PX maintenance units are gradually restarting, overall supply is increasing. In August, the supply and demand game for PX costs will continue, with PX prices fluctuating around feedstock levels and the PXN spread remaining firm.

In the short term, crude oil is expected to fluctuate within a range. The intensity of PX plant maintenance in August is moderate, but there is not much pressure from inventory buildup in terms of supply and demand. The PXN has solid support at the bottom, making the PTA cost side relatively resilient. Due to persistently low processing margins and some factories facing tight raw material supplies, PTA supply in August may decrease month-on-month. As the polyester industry transitions between peak and off-peak seasons, the downward pressure on polyester operating rates has eased. As a result, PTA supply and demand are expected to improve month-on-month, and the downside space for PTA prices is limited. However, with ample spot supply, there is little room for the basis to strengthen.

In August, the MEG supply-demand structure is shifting towards a wide balance, with visible inventories expected to mainly adjust within a low range. Domestic MEG production remains at a high load, and some joint production facilities are adjusting their production. On the import side, overseas facilities are recovering, and there were many shipments delayed at ports at the end of July due to weather conditions. In terms of demand, orders are expected to start after late August, with generally moderate demand support. The MEG price center in August is expected to adjust within a wide range, with visible inventories still at a low level, providing strong support during the price correction process.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track