August PE Operating Rates Climb, HDPE Production Soars 11.68% Month-on-Month

Data source: JLC Network Technology

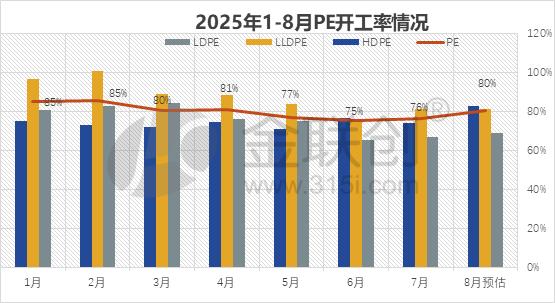

In August 2025, the overall operating rate of China's polyethylene (PE) industry was estimated at 80.44%, further increasing from July. By category, the operating rate for LDPE rose by 1.98 percentage points to 68.77%, mainly supported by the restart of Zhejiang Petrochemical's plant; the operating rate for LLDPE slightly increased by 0.04 percentage points to 81.16%, with stable plant operations; and the operating rate for HDPE significantly increased by 8.65 percentage points to 82.65%, driven by the restart of Lianyungang Petrochemical, the commissioning of Jilin Petrochemical, and the transition of full-density units to significantly boost low-pressure supply.

LDPE production has increased slightly, with differentiation among product types.

In August, both maintenance and restarts of LDPE units coexisted in China, with the estimated output increasing by 2.96% month-on-month. Zhejiang Petrochemical’s high-pressure unit successfully restarted after completing maintenance in late July, effectively compensating for the capacity shortfall caused by the planned maintenance at Shenhua Xinjiang’s unit. In terms of specific product types, LDPE film-grade showed the most significant increase, reaching 15,600 tons. Additionally, heavy-duty packaging material and cable material increased by 5,800 tons and 2,800 tons respectively. Meanwhile, the output of coating material and injection molding material declined to varying degrees, with coating material decreasing by 13,000 tons and LDPE injection molding material dropping by about 4,200 tons.

LLDPE supply tends to stabilize, and metallocene supply increases.

In August, the LLDPE market exhibited the characteristics of "overall stability with structural changes." Although the total production only increased by a mere 0.04% month-on-month, there were significant adjustments among different product categories. During the month, the production of LLDPE film (MI=2, without anti-blocking agent) increased by 56,800 tons, and the production of metallocene polyethylene also increased by 15,500 tons, reflecting the accelerated process of domestic high-end polyolefin products replacing imports. Meanwhile, LLDPE (MI=2, with anti-blocking agent) production decreased by approximately 33,400 tons, other LLDPE (including medium-density film, ultra-low molecular weight polyethylene, C6 linear film, etc.) decreased by about 14,000 tons, LLDPE injection molding decreased by about 13,100 tons, and LLDPE (MI=1) decreased by about 10,800 tons.

HDPE production surges significantly, driven notably by pipes and films.

In August, China's HDPE production saw a month-on-month increase of 11.68%, marking the largest single-month growth this year. This robust growth was primarily attributed to the dual-line restart of the Lianyungang Petrochemical plant, the commissioning of new equipment at Jilin Petrochemical, and the adjustment of some full-density units to produce HDPE. However, Lianyungang Petrochemical has plans for a shutdown during the month, and its subsequent operational status requires continued attention. According to the production scheduling plans by companies at the beginning of the month, the supply increase in HDPE film was the most significant, with a month-on-month increase of approximately 103,700 tons. This was mainly due to the production of this category following the restart of Lianyungang Petrochemical, and both Luqing Petrochemical and Yulong Petrochemical also plan to increase HDPE film production in phases. Additionally, HDPE pipe production increased by about 68,100 tons. Other HDPE (including bottle caps, rotational molding, ultra-high molecular weight, IBC barrels, medical dialysis fluid barrels, fuel tanks, and fiber materials, etc.) increased by about 12,100 tons, HDPE injection molding increased by about 9,300 tons, HDPE wire drawing increased by about 2,200 tons, HDPE cable increased by about 1,100 tons, and HDPE large and medium hollow products increased by about 800 tons. In contrast, the supply of HDPE small hollow products and CPE decreased month-on-month, with HDPE small hollow products decreasing by about 34,600 tons and CPE decreasing by about 21,900 tons.

In August, domestic PE supply in China shows a pattern of "HDPE increase, LDPE stable, LLDPE flat." It is expected that under the loose supply of HDPE, the market will be under pressure, while LDPE prices will remain high and consolidate.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track