August Passenger Vehicles: Domestic Brands Compete Overseas, New Forces Surge Ahead, Joint Ventures Fight Back in New Energy

As August came to an end, many car manufacturers took the opportunity to release their performance reports on the first day of September (September 1). Driven by favorable policies and the release of consumer demand, the car market in August showcased numerous highlights. Among them, domestic brands remain the main force in the current market, and some new energy brands have also achieved record-high deliveries. In contrast, only a few luxury and joint venture brands released sales figures, resulting in relatively low visibility.

Overseas is gradually becoming a "new battleground" for independent competition.

In August, BYD, SAIC, and FAW each sold more than or close to 300,000 vehicles, while Geely, Chery, and Changan all exceeded 230,000 units, ranking among the industry's leaders. It is worth noting that with increasing competition in the domestic market, the overseas market is becoming the new focus for independent brands' competition following the new energy sector.

As a leading company in the new energy vehicle industry, BYD's sales in August remained stable at a high level of 370,000 units, with a cumulative sales volume of 2.864 million units from January to August. In comparison, its overseas market sales in August increased by 146.4% year-on-year to 80,000 units, with a cumulative sales volume exceeding 630,000 units in the first eight months. Given BYD's annual sales target of 5.5 million units and 800,000 units overseas, its overall sales target is clearly under pressure, but there is potential for surpassing the target in the overseas market.

SAIC has also placed the overseas market, self-owned brands, and new energy vehicles as the "new troika" for deepening reforms and advancing transformation. In August, SAIC's overseas sales reached 88,000 units, a year-on-year increase of 10.5%; new energy vehicle sales reached 130,000 units, a year-on-year increase of 49.9%; and self-owned brand sales reached 232,000 units, a year-on-year increase of 49.5%, becoming the main pillar of the group.

Certainly, in terms of overseas market strength, Chery is undoubtedly No.1. In August, Chery exported 129,000 vehicles, a year-on-year increase of 32.3%. It not only exceeded 100,000 exports for four consecutive months but also set a new record for single-month exports, continuing to maintain its position as the top Chinese automobile exporter. In the first eight months, Chery's cumulative exports reached 799,000 units, a year-on-year increase of 10.8%. At the same time, Chery also performed well in the new energy sector, with sales in August increasing by 53.1% year-on-year to 71,000 units.

In contrast, Geely's performance in the new energy sector is more impressive. Its new energy vehicle sales in August reached a record high of 147,000 units, a year-on-year increase of 95%; cumulative sales for the first eight months have exceeded one million units. This has made Geely the automaker with new energy vehicle sales second only to BYD, highlighting the gradual emergence of the aggregation effect of Geely's "One Geely" strategy under the "Taizhou Declaration."

In addition, Changan Automobile released its sales figures for the first month after being listed as a new central enterprise on July 29. In August, Changan sold 233,000 vehicles, including 88,000 new energy vehicles and 56,000 overseas sales. Great Wall sold 116,000 vehicles in August, achieving its best-ever August sales performance.

The new forces continue to surge ahead.

New energy vehicle brands continued to show an upward trend in August. Among them, Leapmotor achieved a new monthly sales high for new energy brands with 57,000 units, maintaining its lead in the sector. Meanwhile, HarmonyOS Intelligent Driving sold nearly 50,000 units in August, and XPeng, NIO, and Xiaomi each exceeded 30,000 units.

Thanks to the intensive launch of highly competitive new products such as B01, the new C11/C16/C10, and B10, Leapmotor's sales have been continuously rising this year. At the current growth rate, Leapmotor is expected to challenge the 60,000 monthly sales mark in September. The second-ranking Hongmeng Intelligent Mobility currently mainly relies on the performance of the AITO brand, with August sales reaching 40,012 units, accounting for 90% of Hongmeng Intelligent Mobility's sales. With the gradual market entry of new models like Zhijie, Xiangjie, and Zunjie, Hongmeng Intelligent Mobility may experience a new surge.

Xpeng and NIO both set new sales records in August. Xpeng launched the all-new P7 ahead of the Chengdu Auto Show, and with the new model receiving over 10,000 orders within just seven minutes, its strong momentum is expected to further boost Xpeng’s future sales. For NIO, the main driver of sales growth came from the delivery of its sub-brand, Le Dao’s L90. In its first full month of deliveries, the new vehicle surpassed 10,000 units, ranking among the top in the mid-to-large SUV segment.

Thanks to the large number of orders received when the YU7 was launched, Xiaomi’s sales exceeded 30,000 units for the second consecutive month. As for Li Auto, although it was the only leading new energy brand that did not surpass 30,000 units, its August sales still had highlights. The MEGA model delivered over 3,000 units in that month, becoming the best-selling pure electric MPV. In addition, among new brands from traditional automakers, both Deepal and Aion achieved sales close to 30,000 units in August.

Joint venture counterattack on new energy

Some analysts believe that with the rapid rise of new players, especially the aggressive expansion of high-end new energy vehicles, the former leaders of the luxury car market—Mercedes-Benz, BMW, and Audi (BBA)—have been showing a steady decline in the Chinese market. A recently circulated weekly sales report for the luxury car market also shows that the AITO M8 has topped the list for several consecutive weeks in August.

Although the data source of this ranking cannot be confirmed, the official sales figures released by BBA in China also reflect the difficulties they are currently facing. Data shows that in the first half of this year, Mercedes-Benz, BMW, and Audi delivered 293,200, 318,100, and 288,700 vehicles respectively in China, all experiencing double-digit year-on-year declines.

However, it is worth noting that since the beginning of this year, new models from BBA's all-new electric platforms have been rapidly launching, such as the CLA from Mercedes' MMA platform, the iX3 from BMW's Neue Klasse platform, and the Q6L e-tron from Audi's PPE platform (which was launched in August). Whether the arrival of these new cars can reverse BBA's current downturn in the new energy sector remains to be seen.

Apart from BBA, joint venture brands have also been continuously impacted by domestic brands, including new forces, in recent years. As a result, in the monthly sales "big comparison" on the first day of each month, joint venture brands tend to remain silent. However, as a leader among joint venture brands, FAW-Volkswagen's performance in August is still commendable.

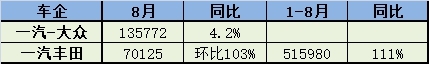

According to the data, FAW-Volkswagen achieved total vehicle sales of 135,800 units (including imported vehicles) in August, a year-on-year increase of 4.2%. Among them, the Volkswagen brand sold 79,000 units, up 1.9% year-on-year; the Audi brand, driven by the momentum of new product launches, recorded sales of 45,800 units (including imported vehicles), ranking first in market share for domestically produced luxury fuel vehicles.

Regarding the Jetta brand, on August 28, FAW Group, Volkswagen Group China, and Chengdu Economic and Technological Development Zone officially signed the "Jetta Business Development Cooperation Agreement" to promote its electrification transformation. This initiative not only inaugurates a new model of government-enterprise joint venture but also will help FAW-Volkswagen accelerate its layout in the entry-level intelligent electric mobility market.

Whether it is the continuous strengthening of traditional independent brands in the new energy and overseas markets, the sustained rise of emerging brands, or the vigorous efforts of joint venture brands, all have injected new vitality into the passenger car market in August. With the arrival of the traditional sales peak season of "Golden September and Silver October," as well as the ongoing implementation of stimulus policies across various regions, future competition in the car market is expected to become more intense, and the market landscape is likely to be further reshaped.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track