Asahi Kasei Exits as China Production Capacity Expansion Forces International Giants Out

Recently, Jilin Petrochemical Acrylonitrile plant 250,000 tons/year MMA (methyl methacrylate)Acrylic acidThe successful full-line integration and one-time startup of the methyl methacrylate (MMA) modification unit marked the increase of the company's total MMA production capacity from 200,000 tons per year to 250,000 tons per year. At the same time, it also signaled the beginning of the commissioning of new chemical units in the acrylonitrile plant series.

The technical accumulation of Jilin Petrochemical's MMA production line can be traced back to 2008 and 2012, when the German Degussa Acetone Cyanohydrin (ACH) process technology was introduced, and two sets of 100,000 tons/year units were established, with a total capacity of 200,000 tons/year. The newly constructed 250,000 tons/year unit was started up in September 2022 and completed handover on April 30, 2025. Its process package preparation and engineering design were independently completed by Global Jilin Company, marking a significant enhancement in the independent capabilities of Chinese enterprises in the core technology field of MMA.

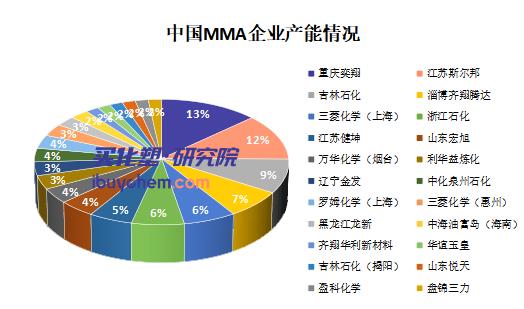

As an important chemical raw material, MMA has extremely wide application scenarios. From polymethyl methacrylate (PMMA) to polyvinyl chloride additives (ACR), from coatings and adhesives to textile printing and dyeing auxiliaries, its downstream applications cover multiple industries such as construction, automotive, and electronics. However, it is precisely this broad demand that has triggered a global capacity race. International giants such as Mitsubishi Chemical, Dow, and Asahi Kasei have long dominated the market, but in recent years, the rise of Chinese companies has been reshaping the landscape—enterprises like Chongqing Yixiang, Jiangsu Sailboat, and Wanhua Chemical are driving China’s MMA production capacity to grow at an average annual rate of 18% through new construction or capacity expansion. In the first half of 2025, with the successive commissioning of Sinochem Quanzhou Petrochemical and Panjin Sanli facilities, the total production capacity will reach 2.8 million tons, representing a year-on-year increase of 7.68%.

Concerns of Overcapacity and Price Wars

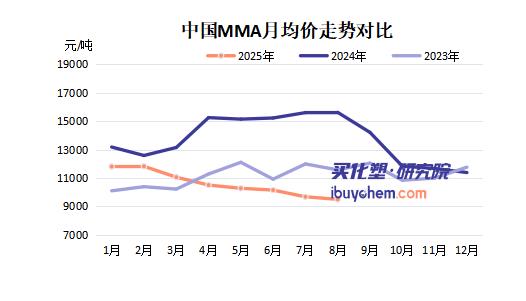

Behind the capacity expansion, the supply-demand imbalance has become increasingly prominent. Although domestic MMA production capacity continues to increase, the recovery of end-user industries such as construction and automobiles remains weak, resulting in lower-than-expected demand growth for major downstream products such as PMMA and ACR. According toBuy Chemicals and PlasticsAccording to research institute data, the average price of MMA in the East China market in the first half of 2025 dropped by 22.37% year-on-year to 10,941 yuan/ton. After July, prices further fell below the 10,000 yuan mark, and by August, the mainstream price in East China had dropped to 9,500 yuan/ton. The continuous price decline has directly squeezed corporate profits, intensifying competition within the industry to a white-hot stage.

This trend has even forced international giants to adjust their strategies. Japan's Asahi Kasei will close its MMA plant in Thailand in November 2024 and announced a complete withdrawal from the MMA business in May 2025, citing "the supply-demand imbalance caused by China's capacity expansion" as the core reason in its public statement. Asahi Kasei's withdrawal both reflects the cost advantage of Chinese companies and exposes the structural risks in the global MMA industry. The rapid deployment of low-cost capacity is reshaping the market landscape, but the demand side has yet to form an effective reception.

Jilin Petrochemical's counter-current expansion is attributed to its synergistic advantage in the industrial chain (relying on acrylonitrile raw material support), while also facing the challenge of overall industry profit decline. The successful operation of Jilin Petrochemical's new MMA facility is a microcosm of the upgrading of China's chemical industry. Under the dual pressures of global competition and overcapacity, how to balance scale expansion and efficiency improvement will be key for enterprises to navigate through the cycle.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track