Aowei Cloud Network: September Air Conditioner Production Volume Drops Sharply by 12%

1. Market Overview: The Myth of High Growth Ends, Downward Pressure Intensifies

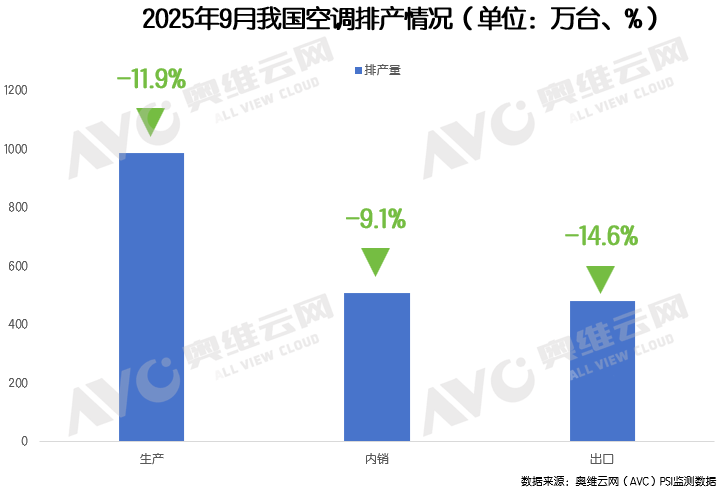

In 2025, the air conditioner market experienced a dramatic turnaround. Driven by sustained high temperatures in June and July, the retail sector saw explosive growth.According to the aggregated data from Aowei Cloud Network, air conditioner retail sales from January to July increased by 16.7% year-on-year, continuing the steady upward trend seen in the first half of the year.However, this "relying on the weather" frenzy came to an abrupt halt in August—the growth rate at the retail end turned negative for the first time. According to weekly data from All View Cloud Network, both online and offline sales declined by 6% and 19% respectively in the first week of August. An even more severe signal came from the production end:According to the latest production scheduling data from Aowei Cloud Network, domestic air conditioner production in September was 5.082 million units, down 9.1% year-on-year, while export production was 4.785 million units, a sharp decline of 14.6%.

2. Domestic Sales Predicament: The Dual Stranglehold of Inventory Pressure and Demand Depletion

1. Inventory devours channel vitality

The significant retail growth in June and July is essentially a concentrated clearance of previous inventories. As of June, the industry's total inventory exceeded 54 million units, with 22.32 million units in factory stock and 31.81 million units in channel stock, far surpassing the healthy level for the industry. High inventory levels directly suppress the willingness of distributors to restock, especially for small and medium-sized distributors who face significant pressure on their cash flow, leading to a substantial decline in channel replenishment enthusiasm.

2. High Base Curse and Demand Exhaustion

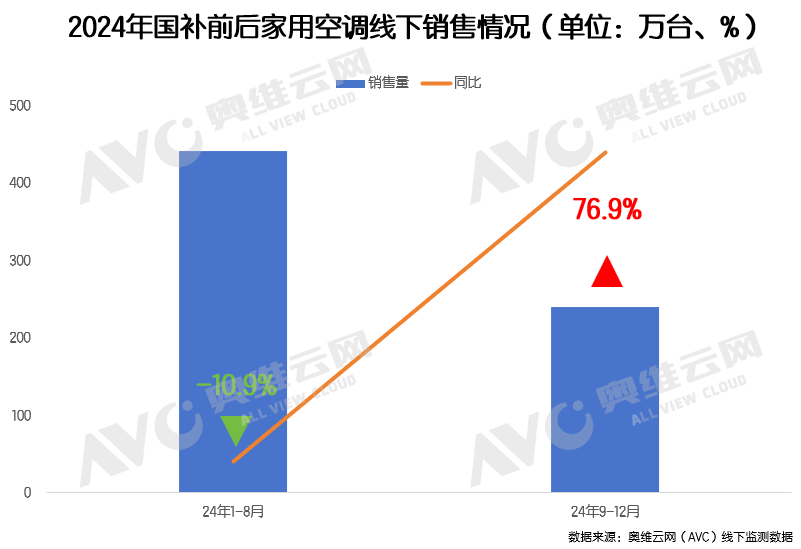

The high base effect formed by the 2024 national subsidy policy is becoming evident. Retail sales from September to December last year surged by 76.9% year-on-year, leading to increased pressure in the second half of this year. Coupled with the previous overdraft in demand, consumer skepticism is prevalent; companies lack confidence in the market for the second half of the year, and the conservative strategies on the production side further exacerbate the situation.

3. Subsidy policies have fallen into an implementation dilemma.

Although the national subsidy policy is still being implemented, feedback from dealers in various regions indicates that its effectiveness on the ground is poor. In some areas, subsidies are distributed in limited quantities and for limited times, resulting in low actual utilization rates, and the policy benefits have not effectively reached the end users. Dealers also face significant financial pressure from advancing funds, which dampens their enthusiasm for promotion. Furthermore, some businesses have adopted a “raise prices first, then subsidize” approach, further diluting the effectiveness of the policy and indirectly suppressing retail activity.

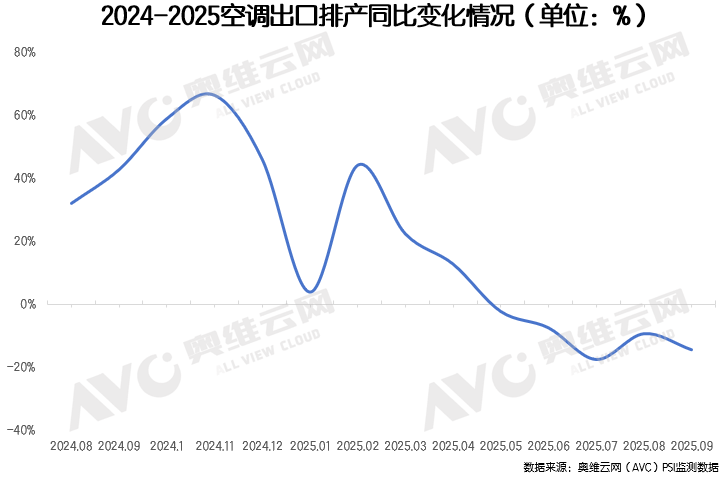

Exports in the cold winter decreased by 14.6% year-on-year.

The overseas market has experienced a year-on-year decline for five consecutive months, mainly due to the end of the global restocking cycle. The overdraft effect caused by early stockpiling in the second half of 2024 will be concentrated and released in 2025. Coupled with the continued tariff issues, the pressure on export costs has not eased, and some orders have been lost to regions like Southeast Asia. Additionally, the European market is affected by competition from local brands and the upgrade of energy efficiency standards, which has weakened the advantages of Chinese products. Although the Southeast Asian market is growing, profit margins are being squeezed by rising costs. In the short term, the downward trend in exports is difficult to change.

5. Conclusion

The decline in production scheduling in September reflects a combination of cyclical adjustment and structural transformation in the air conditioning industry. In the short term, inventory digestion, base effects, and policy implementation issues will continue to suppress the market; in the medium to long term, technological upgrades and the overseas expansion strategy will reshape the competitive landscape. Amid accelerated industry reshuffling, companies with technological advantages and strong channel control are expected to seize opportunities during the adjustment period, accumulating momentum for subsequent recovery.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics