“Anti-Involution” Drives China Polyethylene Special Material Production Capacity Upgrade

Since the second half of 2024, under the influence of anti-involution policies, the production capacity of polyethylene specialty materials in China has increased and accelerated its transformation toward high quality. Over the next five years, we expect China's polyethylene industry to overcome the past dilemma of "low-price competition," achieving capacity expansion and product structure optimization.

-

China will accelerate the elimination of outdated production capacity to promote industrial upgrading and structural optimization.

-

Investing in New Areas: Future investments will focus on the high-end new materials sector to enhance product quality and alleviate the pressure of homogenized competition.

The Sixth Meeting of the Central Financial and Economic Affairs Commission held in July clearly required the lawful and regulated governance of enterprises' low-price disorderly competition and promoted the orderly exit of outdated production capacity, providing a policy guideline for the industry to counter "involution."

"Involution-style competition typically refers to enterprises engaging in homogeneous competition through additional capital investment, capacity expansion, price reductions, and other means, ultimately resulting in minimal profits across the entire industry."

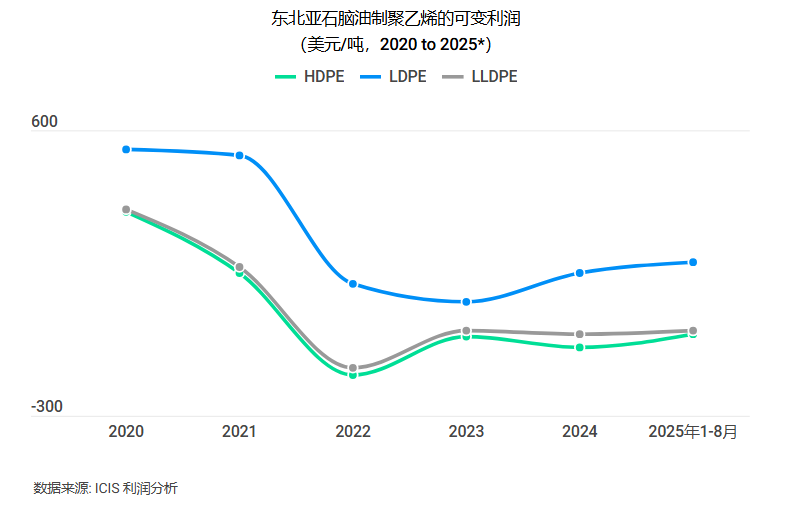

In recent years, with a significant increase in production capacity in China, polyethylene margins in Northeast Asia—especially those for the naphtha-based process—have shrunk considerably. According to the ICIS margin analytics tool, since 2022, the average variable margins for naphtha-based linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE) have remained at low levels, with the exception of low-density polyethylene (LDPE).

The successive commissioning of new production capacities has driven the continuous increase in China's PE output. From January to July 2025, China's PE production (excluding recycled materials) has exceeded 18 million tons, representing a year-on-year growth of over 13%. With new capacities coming online, output continues to rise—monthly production in July 2025 alone surpassed 2.7 million tons. From September to December 2025, China has plans to commission an additional total of 3 million tons/year of PE capacity (including EVA). However, we expect that the commissioning of most of these projects will be delayed.

According to customs data, China still relies on imports for polyethylene (PE), with net imports of PE from January to July 2025 reaching nearly 7.9 million tons, accounting for about 30% of apparent demand.

China's ethylene industry is ushering in a new wave of capacity expansion. As polyethylene (PE) is a major downstream derivative, it is expected to enter an expansion cycle from 2025 to 2030. Therefore, we anticipate that in the next three years, domestic resources will continue to replace imported resources, while more facilities will face shutdowns.

Some general-purpose production capacities have already been shut down due to structural oversupply and thin profit margins. By the end of 2024, approximately 500,000 tons/year of PE capacity in China is expected to be permanently shut down. From 2025 to 2030, China is expected to announce the closure of about 1.9 million tons/year of PE capacity. However, the pressure from continued supply increases and supply-demand imbalance still persists.

Therefore, market participants anticipate that the "anti-involution" policies will accelerate the elimination of inefficient PE production capacity. In 2027-2028, it is expected that more PE capacity in China will be shut down to ease the imbalance between supply and demand in the market. However, the key to resolving this imbalance lies in accelerating technological upgrades and the development of high-end PE products, shifting the focus of China's PE industry from expanding capacity to improving quality.

With the slowdown of economic growth in various regions and globally, as well as the increasing focus on the concept of a circular economy, the use of single-use plastic products has been restricted or banned, leading to a partial substitution of PE demand by other materials. In addition, due to the decline in China’s birth rate, the growth rate of PE demand has shown a slowing trend.

According to our latest forecast in August, China's PE demand is expected to grow by 5% in 2025, significantly lower than the production growth rate.

PE is mainly used in the packaging industry. Currently, the rapid development of leisure economy sectors such as e-commerce, food delivery services, and tourism has driven the demand for flexible packaging, thereby to some extent boosting the growth of PE demand in China.

With the shift in consumer preferences and the increase in health awareness, there is a growing demand for high-performance and aesthetically pleasing packaging in the fields of cosmetics, skincare products, and fresh food preservation. According to data from the National Bureau of Statistics, the total national online retail sales reached 8.68 trillion yuan from January to July this year, representing a year-on-year increase of 9.2%.

In addition, in line with the carbon neutrality goals and industrial structure adjustment guidance issued by the Chinese government at the end of 2023, we anticipate that policy support in industries such as new energy vehicles, photovoltaic power generation, construction, and textiles will continue to drive the demand growth for PE in emerging fields like photovoltaic films, new energy battery films, and high-performance fibers.

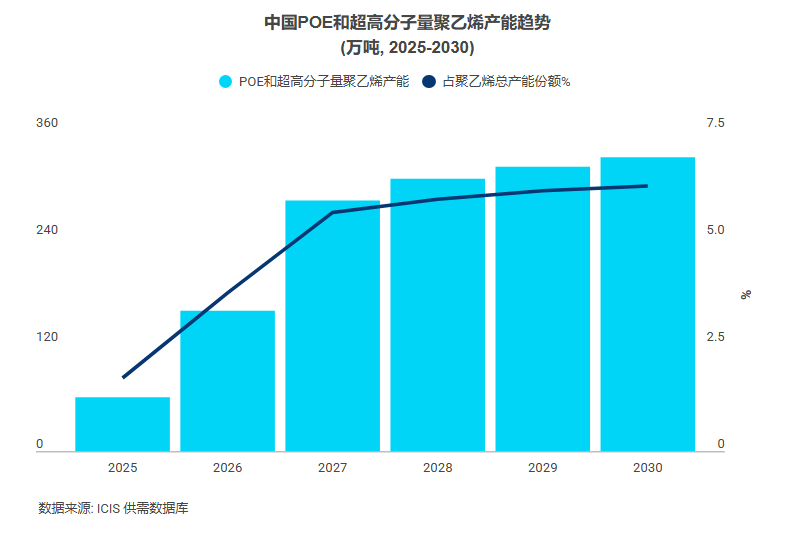

According to ICIS data, by 2030, the production capacity of POE and ultra-high molecular weight PE in China is expected to significantly increase as a proportion of China's total PE production capacity compared to 2025. It is anticipated that with the growth in domestic specialized material output, the influence of Chinese PE products in the international market will also be enhanced. This will further strengthen China's self-sufficiency in PE and lay a foundation for expanding PE product exports.

"Anti-involution" and industry trends are driving structural reforms in China's PE market, accelerating the enhancement of supply-side capabilities. Although there are some challenges in the initial stage, from a long-term perspective, this will promote the market to enter a healthier development phase. The key to improving PE competitiveness lies in technological innovation, product differentiation, and accurately grasping emerging downstream demands.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track